Introduction: Inflows Rebound as Retail Investors Return

After five months of slowing momentum, India’s mutual fund industry made a sharp comeback in June 2025, thanks to robust retail participation and a surge in allocations across asset classes.

Equity mutual fund inflows jumped 24% month-on-month to ₹235.87 billion ($2.75 billion), snapping the persistent downtrend. Investors re-entered not just large-cap and mid-cap funds but also poured money into gold and silver ETFs—a sign of rising risk awareness amid global trade uncertainties.

Adding to this momentum, India’s total mutual fund AUM hit an all-time high of ₹74.41 trillion, further underlining investor trust in domestic markets.

This renewed activity supported the broader market as well. The benchmark Nifty 50 rose 3%, while mid-caps gained 4% and small-caps soared 6.7%, giving investors across categories reasons to stay invested.

Equity Mutual Fund Segments That Outperformed

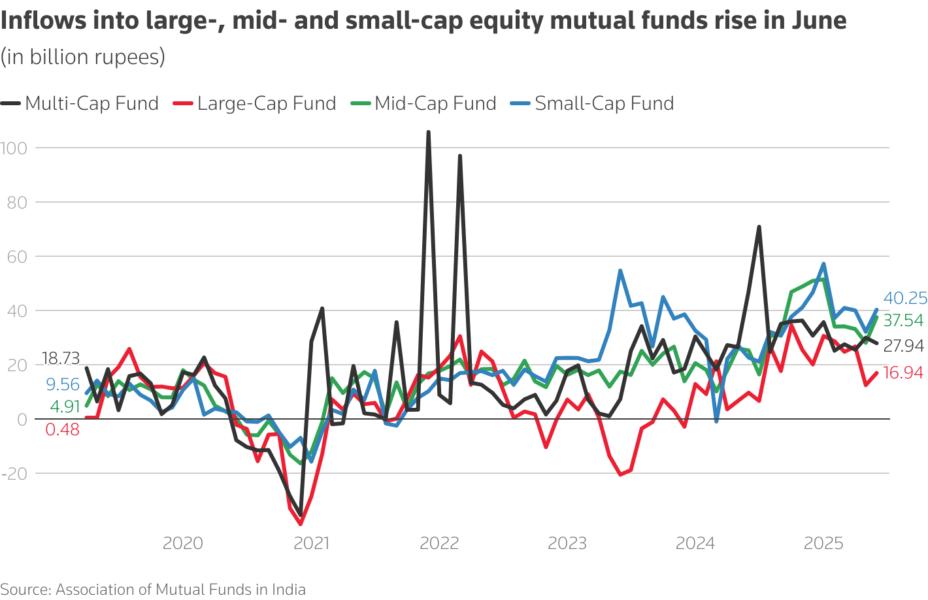

The rebound in June wasn’t limited to overall inflows—all major equity mutual fund categories saw meaningful participation, signaling broad-based investor confidence.

Here’s how the key categories performed:

- Large-cap funds recorded a 36% jump in inflows, reaching ₹16.94 billion.

- Mid-cap funds saw a 34% increase.

- Small-cap funds rose 25%, continuing their strong SIP-led run.

This surge in flows was reflected in market performance too.

While the Nifty 50 gained 3%, the CNX Midcap rose 4%, and the CNX Smallcap delivered a strong 6.7% monthly return—highlighting renewed investor appetite for growth.

The rally in small and mid-caps also signals investor expectations around corporate earnings recovery and continued macroeconomic stability heading into Q2.

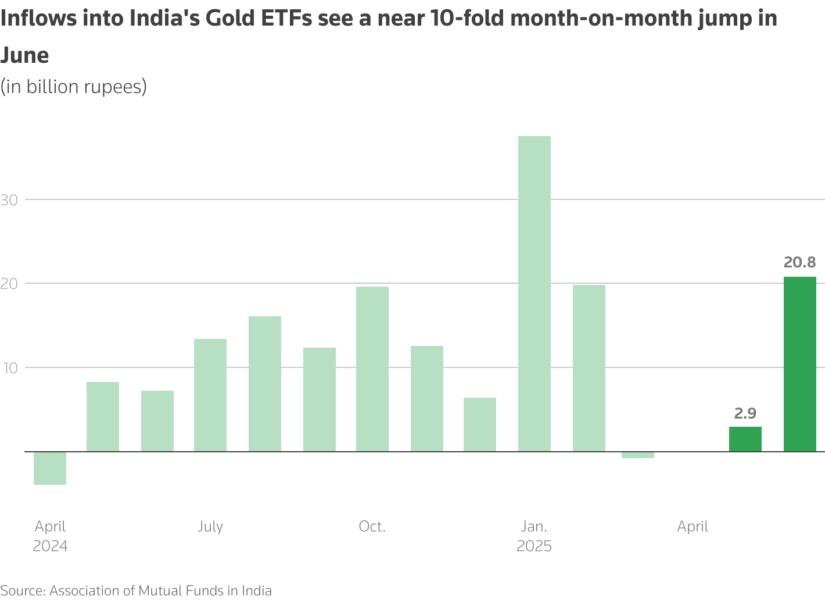

Gold & Silver ETFs See a Surge

As global trade uncertainty and inflation fears persisted, many Indian investors pivoted toward safer, tangible assets—leading to an impressive surge in both gold and silver ETFs.

In June 2025:

- Gold ETF inflows jumped 10x month-on-month, hitting ₹20.81 billion—the highest in five months.

- Silver ETFs also saw strong demand, with inflows rising to ₹20.04 billion, up from ₹8.53 billion in May.

According to Anand Vardarajan, Chief Business Officer at Tata Asset Management, the spike reflects how investors are using precious metals as a hedge—for both diversification and potential returns.

“Rising inflows into Gold ETFs suggest investor interest to seek both diversification and gain from the performance of the precious metal.”

This dual attraction of stability and momentum makes precious metal ETFs an increasingly relevant part of modern mutual fund portfolios.

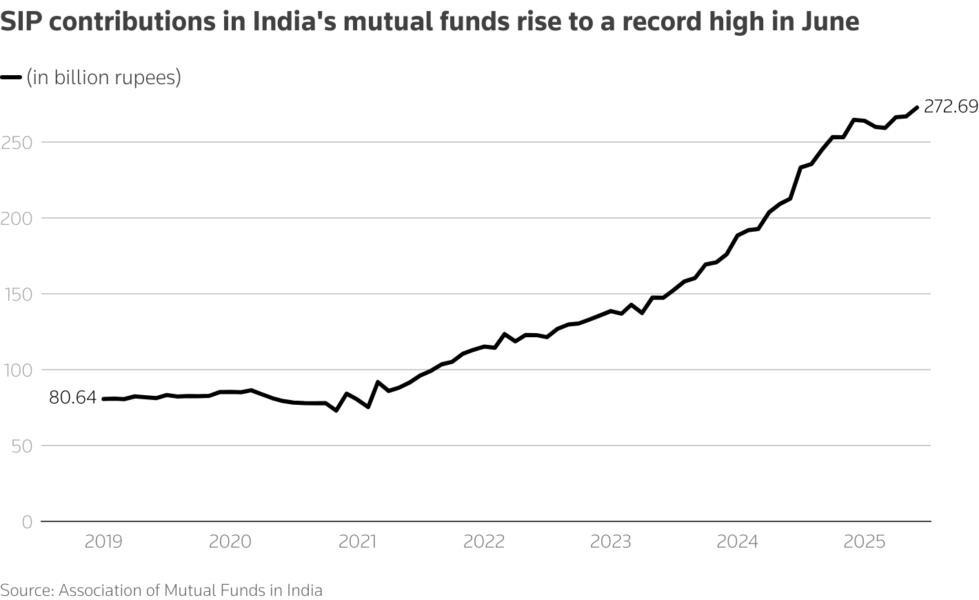

SIP Contributions Hit Record High

While lump-sum investments made a comeback, Systematic Investment Plans (SIPs) continued their consistent upward trajectory—setting new records in June 2025.

- Monthly SIP inflows reached ₹272.69 billion, the highest ever recorded.

- SIP accounts grew to 86.4 million, up from 85.6 million in May, reflecting expanding retail participation.

This milestone signals strong long-term investor confidence in Indian equities—even after recent market corrections. SIPs are not only cushioning volatility but also strengthening the domestic liquidity base, especially amid unpredictable global flows.

“Strong inflows and record SIPs reflect improved sentiment, better valuations post-correction, and the enduring structural confidence in Indian equities.”

— Himanshu Srivastava, Morningstar India

What’s Driving This Investment Momentum?

Several key factors contributed to the sharp rise in mutual fund inflows in June—across both equity and commodity segments. These drivers show how investor behavior is shifting with the market cycle:

1. Better Valuations Post-Correction

After the recent market dip, many sectors became attractively priced. Smart investors used this as a buying opportunity, especially in small- and mid-cap segments.

2. Positive Sentiment Around Earnings

June-quarter results were anticipated to be stable, especially for manufacturing, banking, and FMCG sectors. This optimism attracted new fund flows.

3. Rising Domestic Liquidity

Record SIP contributions and steady inflows show domestic investors are becoming the market’s cushion—insulating against foreign outflows and global volatility.

4. Flight to Safe Assets

Gold and silver ETFs became popular as a hedge against inflation, Geopolitical Tension, global trade tensions, and potential Fed rate moves.

Together, these elements form a powerful narrative: Indian investors are becoming more strategic and less reactive—choosing long-term consistency over short-term noise.

Smart Investor Watchlist: Top Stocks to Track Now

With mutual fund flows bouncing back and SIPs at record highs, it’s clear that investors are repositioning portfolios across market segments. Here are top-performing and high-potential stocks that are quietly gaining traction—many of which align with rising fund inflows:

Segment-Wise Smart Picks

| Segment | Stock Picks | Why Watch |

|---|---|---|

| Large-Cap | HDFC Bank, Infosys | Consistent mutual fund favourites; resilient to macro shifts |

| Mid-Cap | Schaeffler India, Relaxo Footwear | Gaining institutional interest; strong fundamentals |

| Small-Cap | KPI Green Energy, BLS International | Among top holdings in several small-cap funds; high growth outlook |

| Gold Proxy | Hindustan Zinc, Manappuram Finance | Indirect gold plays; benefiting from ETF inflows |

| Silver Proxy | Vedanta, Hindustan Copper | Linked to industrial silver demand; riding commodity rally |

These picks aren’t just trending—they reflect what fund managers are quietly accumulating behind the scenes.

💡 Tip: Cross-reference these with fund factsheets from leading AMCs to spot holding overlaps and gauge sectoral conviction.

Conclusion: Retail Power Is Driving the Market’s Next Move

June 2025 marked a turning point for mutual fund investors in India. After months of muted flows, equity fund allocations surged—driven not by institutions, but by millions of retail investors committing through SIPs and thematic ETFs.

From large-caps to gold, and small-caps to silver—investors are clearly diversifying with intent, using corrections as buying opportunities and turning to safer assets when needed.

The record SIP numbers, the rebound in equity inflows, and the spike in precious metal ETF participation all point to one thing:

👉 Retail sentiment in India remains structurally bullish.

And for smart investors, this momentum presents a clear takeaway:

Follow the money, track fund flows, and stay aligned with segments where mutual fund confidence is growing.

FAQs: Mutual Fund Inflows June 2025

Q1. Why did mutual fund inflows rise in June 2025?

Mutual fund inflows in June 2025 rose due to better equity valuations, improved sentiment around earnings, and increased SIP contributions. Retail participation also surged across equity and commodity funds.

Q2. Which mutual fund segments saw the highest inflows in June 2025?

In June 2025, large-cap mutual funds saw the highest rise in inflows (up 36%), followed by mid-cap (34%) and small-cap funds (25%). Gold and silver ETFs also witnessed strong inflows.

Q3. How much money flowed into gold and silver ETFs in June 2025?

Gold ETFs attracted ₹20.81 billion in June 2025—a tenfold increase from May. Silver ETFs also surged, with ₹20.04 billion in inflows.

Q4. What does the rise in SIP contributions indicate?

The record SIP contributions in June 2025—₹272.69 billion—indicate growing investor discipline, long-term confidence, and increasing participation from retail investors.

Q5. What are some smart stocks to watch based on mutual fund inflows in June 2025?

Based on mutual fund inflows June 2025, smart investors are tracking stocks like HDFC Bank, KPI Green, BLS International, Hindustan Zinc, and Vedanta due to their inclusion in popular fund categories.

Related Articles

India’s $100 Billion Silicon Bet: The Semiconductor Investment Opportunity No One Should Ignore

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh

Rare Earth Magnet Manufacturing Stocks: Catch These Before India’s ₹1,000 Cr Push Lifts Off