Introduction

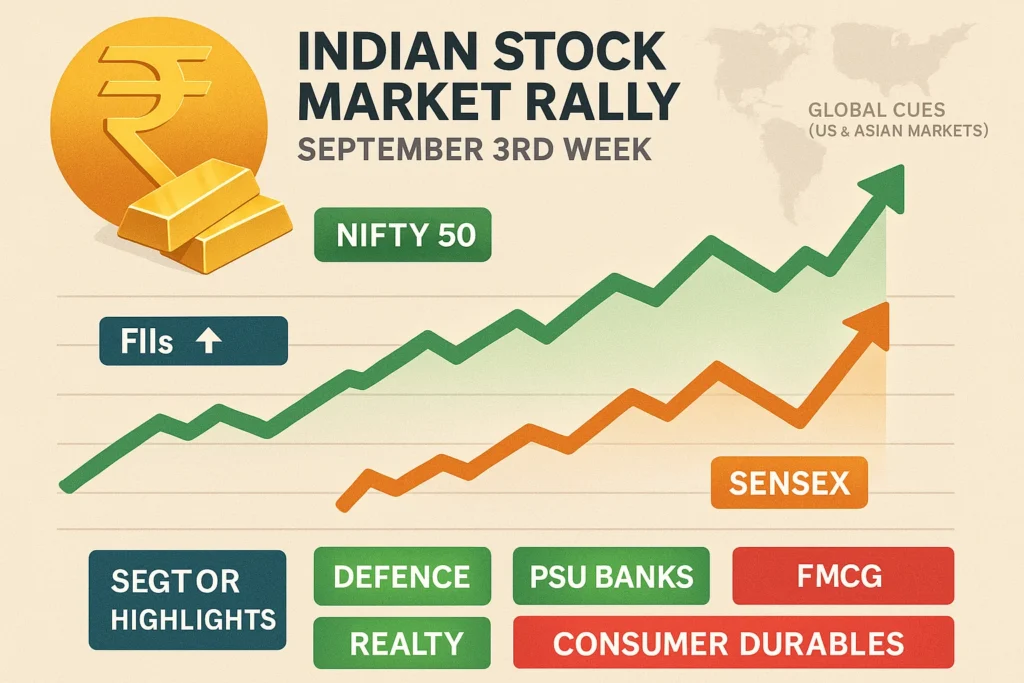

The market update September 3rd week highlights yet another positive streak for Indian equities, marking the third consecutive week of gains. Despite global uncertainties, the Indian stock market showcased resilience, buoyed by supportive macroeconomic indicators, improved foreign inflows, and encouraging signals from global peers. Investor sentiment improved further with India–US trade discussions offering clarity, while global market cues kept momentum intact.

This weekly market update is particularly important because it reflects how domestic markets are syncing with global trends. While the US and Asian indices rallied ahead of the much-anticipated US Federal Reserve policy meeting, Indian indices mirrored the optimism. The stock market update also brings focus on the strengthening midcap and small-cap segments, the renewed participation of FIIs, and sectoral shifts that are reshaping trading sentiment.

Index Performance: Gains Across the Board

Indian benchmark indices closed higher for the second week in a row, with notable support from global cues and sectoral tailwinds. Here’s how the indices fared:

| Index | Closing Level | Weekly Change | % Change |

|---|---|---|---|

| NIFTY 50 | 25,351.35 | +237.90 | +0.95% |

| SENSEX | 82,702.77 | +806.16 | +0.98% |

| Nifty Bank | 55,494.10 | +563.70 | +1.03% |

| Nifty IT | 36,638.15 | +789.40 | +2.20% |

| S&P BSE SmallCap | 54,654.76 | +854.21 | +1.59% |

The market update September 3rd week underlines how broader participation lifted market sentiment. Notably, midcaps and small caps outperformed frontline indices, rising 1.83% and 2.43% respectively. This reflects broad-based buying interest across sectors, supported by improved breadth and healthy liquidity.

Adding to the optimism, the India VIX—an indicator of market volatility—fell by 2.14%, signaling stronger confidence among traders and reduced fear of short-term volatility.

Sectoral Developments: Defence Leads, FMCG Drags

The weekly market update also saw a strong divergence across sectors. While growth-sensitive and policy-driven sectors surged, defensives like FMCG struggled.

Key Gainers:

- Defence: Nifty India Defence surged nearly 8% for the second consecutive week, boosted by policy tailwinds and rising global geopolitical tensions.

- PSU Banks: A robust 4.54% gain on the back of credit growth optimism and favorable valuations.

- Realty: Nifty Realty jumped 4.49%, supported by sustained housing demand and improving affordability metrics.

- Capital Markets & Energy: Gains of 2.72% and 2.64% respectively, backed by strong institutional flows and higher crude oil prices.

Laggards:

- FMCG: Declined 1.21% as high input costs and muted rural demand weighed on sentiment.

- Consumer Durables: Marginal dip of 0.17% despite festive season buildup.

Sector Performance Snapshot

| Top Gainer Sectors | % Change | Top Loser Sectors | % Change |

|---|---|---|---|

| Diversified Consumer Services | +10.35% | FMCG | -1.38% |

| Telecommunications Equipment | +5.79% | Hotels, Restaurants & Tourism | -1.07% |

| Hardware Technology & Equipment | +5.62% | Healthcare | -0.09% |

| General Industrials | +4.17% | Media | -0.06% |

| Utilities | +3.59% | Consumer Durables | -0.02% |

FII & DII Data: FIIs Return to Buying Mode

The stock market update for September 3rd week also shows a significant shift in foreign investor behavior. FIIs, who had been net sellers in recent weeks, turned buyers again—supporting momentum in large-cap as well as broader markets.

FII-DII Activity Table

| Period | FII Net (₹ Cr) | DII Net (₹ Cr) |

|---|---|---|

| Last 30 Days | +134,381.8 | -33,200.7 |

| Last 2 Weeks | +104,233.9 | +129,114.6 |

| Last 1 Week | -1,327.4 | +11,177.3 |

While FIIs displayed a mixed approach this week with slight profit booking towards the end, DIIs continued to be consistent net buyers, reflecting strong domestic liquidity support.

Global Market Update: A New Shock from the US

Global cues shaped much of the weekly market update. US and Asian equities rallied ahead of the Fed policy meeting, which lifted Indian sentiment too. However, a major announcement after markets closed—President Donald Trump’s executive order to raise the H-1B visa application fee to $100,000—sent shockwaves across the global IT industry.

The order, designed to discourage large US companies from relying on foreign talent, could impact India’s IT exporters significantly. The immediate reaction is expected in the upcoming week, with Nifty IT stocks particularly vulnerable.

Global Indices Snapshot

| Index | Last | Change | % Change |

|---|---|---|---|

| Dow 30 | 46,315.30 | +172.85 | +0.37% |

| S&P 500 | 6,664.36 | +32.40 | +0.49% |

| Nasdaq Composite | 22,631.50 | +160.75 | +0.72% |

| FTSE 100 | 9,216.67 | -11.44 | -0.12% |

| CAC 40 | 7,853.59 | -1.02 | -0.01% |

| DAX | 23,639.40 | -35.12 | -0.15% |

| Nikkei 225 | 45,045.80 | -257.62 | -0.57% |

| Hang Seng | 26,545.10 | +0.25 | 0.00% |

| Shanghai Composite | 3,820.09 | -11.57 | -0.30% |

Top Gainers & Losers of the Week

Market leadership continued to shift in the market update September 3rd week, with select midcaps and sector-specific names driving sharp gains.

| Top Gainers | Weekly % Change | LTP (₹) |

|---|---|---|

| Redington | +22.94% | 299.73 |

| Anant Raj | +20.08% | 640.40 |

| Poonawalla Fincorp | +13.84% | 500.25 |

| Netweb Technologies | +12.93% | 3,279.40 |

| Aegis Logistics | +12.72% | 791.55 |

| Top Losers | Weekly % Change | LTP (₹) |

|---|---|---|

| ACME Solar Holdings | -7.47% | 295.00 |

| Cohance Lifesciences | -7.24% | 909.40 |

| IndiaMART InterMESH | -5.04% | 2,469.60 |

| Jubilant Ingrevia | -4.87% | 673.85 |

| JM Financial | -4.65% | 171.60 |

Rupee, Gold & Commodities

The stock market update would be incomplete without assessing currency and commodities.

- Rupee: The Indian rupee slipped to record lows near ₹88.10/$, reflecting pressure from a stronger dollar index and persistent trade imbalances.

- Gold: Gold prices hit fresh record highs, supported by weak US labor market data, geopolitical risks, and a softer dollar.

- Crude Oil: Brent crude edged higher, driven by supply disruptions and geopolitical concerns.

Corporate Actions: Bonus, Rights, and Splits

This week also carried several corporate announcements that may impact trading in coming sessions.

Bonus Announcements: Pidilite, Nazara Technologies, Shilpa Medicare, Time Technoplast among others.

Rights Issues: 3i Infotech, Sunshield Chemicals, Mangalam Industries.

Stock Splits: Adani Power, Nazara Technologies, Paushak, AGI Infra, and more.

These developments can add sectoral and stock-specific volatility in the upcoming week.

Events to Watch Next Week

As we move beyond the market update September 3rd week, investors will be keeping a close eye on upcoming domestic and global triggers. These data points and policy events could guide market direction in the short term and influence sectoral momentum.

Domestic Events

India’s economic calendar includes PMI readings, bank credit and deposit data, and forex reserves—each important for understanding growth momentum and liquidity trends.

Global Events

Globally, investors will track the US Fed policy stance, movement in crude oil prices, and geopolitical updates, all of which could add volatility to the stock market update in the coming week.

| Date | Event | Forecast | Prior |

|---|---|---|---|

| Tuesday, Sept 23 | HSBC Composite PMI Flash | 63.2 | 62.9 |

| HSBC Manufacturing PMI Flash | 59.3 | — | |

| HSBC Services PMI Flash | — | — | |

| Friday, Sept 26 | Bank Loan Growth YoY | 10% | — |

| Deposit Growth YoY | 10.2% | — | |

| Foreign Exchange Reserves | 702.97 B $ | — |

Conclusion: What Lies Ahead?

The market update September 3rd week reflects strength, but uncertainties remain. While the short-term momentum has been driven by FII inflows, broad-based buying, and supportive global cues, fresh challenges such as the US H-1B visa restrictions could weigh on IT stocks in the near term.

For the coming week, markets may remain volatile, with investors weighing domestic PMI data, RBI commentary, and global central bank updates. The weekly market update suggests a cautiously optimistic stance—bullish in the medium term but expecting short-term swings due to global shocks.

In conclusion, this stock market update emphasizes that while the Indian markets are showing remarkable resilience, investors must remain vigilant, diversify holdings, and avoid chasing momentum blindly.

Sources: https://www.screener.in/

https://sgxnifty.org/world-markets/

https://www.equitypandit.com/giftnifty/

https://trendlyne.com/markets-today/

More Articles

NITI Aayog Reports on India’s Hand & Power Tools Sector: 5 Stocks to Watch

India Automotive Sector Stocks – NITI Aayog’s 2030 Vision

India’s Plan to Stop Power Cuts: How It Could Boost These Stocks