Introduction

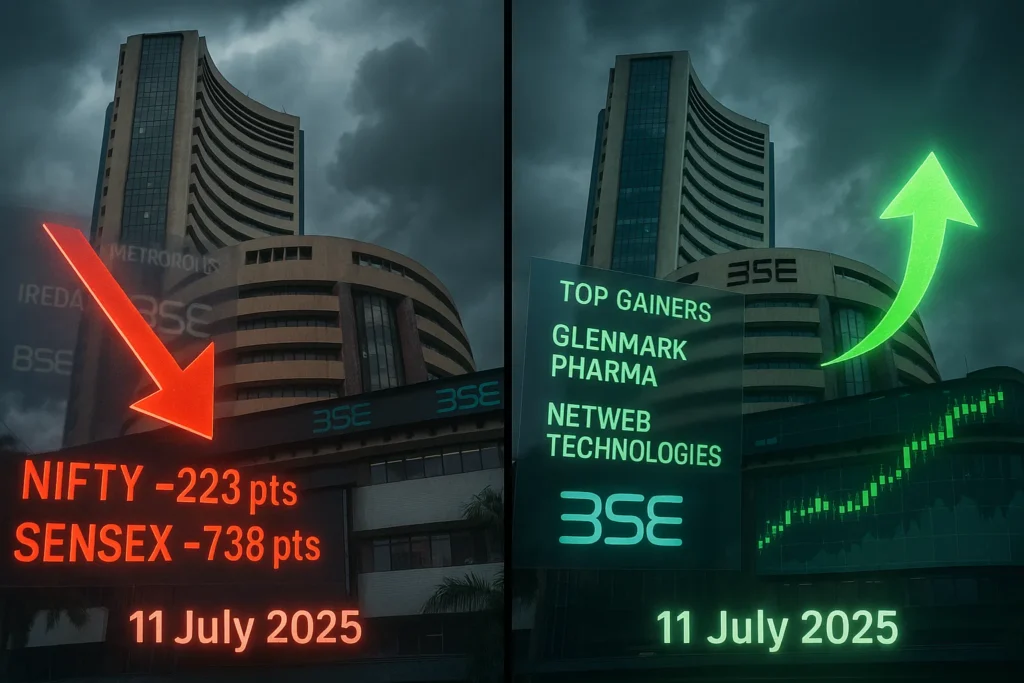

The Market Today 11 July saw sharp selling pressure across the board, with the Sensex plunging 738 points and the Nifty 50 falling below the 25,150 mark. Tech stocks bore the brunt of the correction, led by post-earnings weakness in TCS and rising concerns over global trade friction. Broader indices like the Nifty Smallcap also sank nearly 0.8%, reflecting widespread investor caution.

Let’s take a closer look at today’s stock market summary, the biggest gainers and losers, and why the market remained under pressure.

Market Today 11 July: Summary

| Index | Closing Level | Change | % Change |

|---|---|---|---|

| Nifty 50 | 25,132.10 | –223.15 | –0.88% |

| Sensex | 82,452.65 | –737.63 | –0.89% |

| Nifty Bank | 56,715.10 | –240.90 | –0.42% |

| Nifty IT | 37,638.15 | –738.50 | –1.92% |

| BSE SmallCap | 54,426.99 | –441.70 | –0.81% |

The sharp drop in the Nifty IT index, coupled with extended selling in mid- and small-caps, weighed heavily on market sentiment.

Top Gainers: Market Today 11 July

Despite the broader market correction, a handful of stocks defied the trend and posted strong gains:

🔺 1. Glenmark Pharma – ₹2,181.10 ▲ 14.55%

Shares surged after the company signed a new licensing agreement that promises higher revenue visibility. Pharma sector outperformance also boosted sentiment.

🔺 2. Netweb Technologies – ₹1,947.40 ▲ 7.43%

The stock touched a 10-year high following strong institutional buying and optimism around data center expansion and AI server demand.

🔺 3. Asahi Glass – ₹851.70 ▲ 4.7%

Asahi Glass rallied to a new high on signs of margin expansion and strong domestic demand for architectural and automotive glass products.

🔺 4. Piramal Enterprises – ₹1,217.50 ▲ 4.69%

Piramal gained after management hinted at portfolio restructuring and positive business momentum in its financial services vertical.

🔺 5. Hindustan Unilever (HUL) – ₹2,519.60 ▲ 4.62%

HUL rose on news of a new MD appointment and favorable consumer data, especially in the personal care segment.

Top Losers: Market Today 11 July

Several high-profile stocks saw intense selling, triggered by profit booking, sector-specific concerns, or regulatory developments:

🔻 1. Indian Renewable Energy Development Agency (IREDA) – ₹160.00 ▼ –5.68%

IREDA declined after regulatory approval delays emerged for certain green bond instruments, sparking concerns among investors.

🔻 2. Elecon Engineering – ₹619.30 ▼ –4.53%

Shares fell after the company reported lower-than-expected margin growth. The recent run-up also prompted profit-taking ahead of a board meeting.

🔻 3. Metropolis Healthcare – ₹1,885.30 ▼ –4.53%

This is the second consecutive day of losses for Metropolis, following weak outlook guidance and subdued diagnostic volume growth.

🔻 4. Hitachi Energy – ₹18,700.00 ▼ –3.98%

The stock slipped from recent highs amid global volatility and a dip in large infrastructure orders.

🔻 5. BSE Ltd. – ₹2,371.10 ▼ –3.86%

BSE extended its losses as SEBI’s expanded probe into derivatives trading manipulation continued to spook investors in exchange-related counters.

Gainers & Losers Summary Table

| S.No | Stock Name | Change (%) | LTP (₹) | Sector | Key Trigger |

|---|---|---|---|---|---|

| 1 | Glenmark Pharma | +14.55% | 2,181.10 | Pharmaceuticals | Licensing deal & sector tailwinds |

| 2 | Netweb Technologies | +7.43% | 1,947.40 | Tech Infrastructure | AI/data center expansion |

| 3 | Asahi Glass | +4.70% | 851.70 | Industrial Glass | Demand and margin growth |

| 4 | Piramal Enterprises | +4.69% | 1,217.50 | Financial Services | Portfolio shift speculation |

| 5 | HUL | +4.62% | 2,519.60 | FMCG | New MD, strong sales trends |

| 6 | IREDA | –5.68% | 160.00 | Renewable Energy | Regulatory delays |

| 7 | Elecon Engineering | –4.53% | 619.30 | Capital Goods | Margin miss, board meeting risk |

| 8 | Metropolis Healthcare | –4.53% | 1,885.30 | Healthcare | Weak guidance, volume pressure |

| 9 | Hitachi Energy | –3.98% | 18,700.00 | Industrial Equipment | Order slowdown concerns |

| 10 | BSE | –3.86% | 2,371.10 | Exchange | SEBI investigation overhang |

Why the Market Fell Today

🔻 Weakness in IT Stocks

The Nifty IT index plunged nearly 2%, reflecting the disappointment in TCS’s Q1 results. Investors turned cautious on tech, dragging down the entire pack including Infosys and Wipro.

🔻 SEBI Crackdown Hits Market Confidence

News around SEBI intensifying its probe into options market manipulation at BSE and other brokers added to the nervousness in financial and exchange stocks.

🔻 Global Concerns on Tariffs & Oil

Fresh trade jitters from the U.S. and elevated oil prices amid Middle East tensions sparked concerns over inflation and export pressure, further dampening market mood.

🔻 Broader Profit Booking

After weeks of gains, the smallcap index dropped 0.81%, showing a broader pullback. Investors chose to lock in profits ahead of more Q1 earnings announcements.

Conclusion

The Market Today 11 July delivered a sharp correction, led by IT, energy, and exchange-related stocks. But within the weakness, a few names like Glenmark Pharma and Netweb Technologies stood out, offering glimpses of selective strength.

As macro factors and earnings season play out, traders should brace for continued volatility and position accordingly. Defensive names, high-growth midcaps, and FMCG could offer safer ground amid the turbulence.

Related Articles

Trump’s Tariff Shockwave: How Indian Stocks & Sectors Will Be Hit or Rise

Is Your Broker Safe? How the Jane Street vs SEBI Scandal Shook Indian Markets

Trump’s Big Beautiful Bill: Impact on Indian Stock Market and Key Stocks to Watch