Market Outlook 6 October

Good morning and welcome to your Market Outlook 6 October Edition.

After seven consecutive days of weakness, Indian markets finally found their footing on Friday with a modest rebound. The NIFTY 50 closed at 24,888.70 (+0.21%), while the SENSEX ended at 81,196.33 (+0.26%). Banking stocks provided some lift, with Nifty Bank gaining 0.44% to 55,592.00. Broader markets outperformed as S&P BSE SmallCap jumped over 1%, and Nifty IT managed to close slightly higher at 33,940.40 (+0.10%).

However, early cues from the global front hint at a cautious start to the week. The Gift Nifty is trading at -0.09%, suggesting a flat to mild negative opening for today.

In this newsletter, we bring you technical views, key news, IPO updates, and stocks to watch for today.

Index Outlook – Market Outlook 6 October

According to Equitypandit analysis, Indian indices have shifted into a more positive zone after Friday’s rebound. Both NIFTY and SENSEX have entered a bullish territory, while Bank Nifty continues to hold strength. Here’s a detailed view for today’s session:

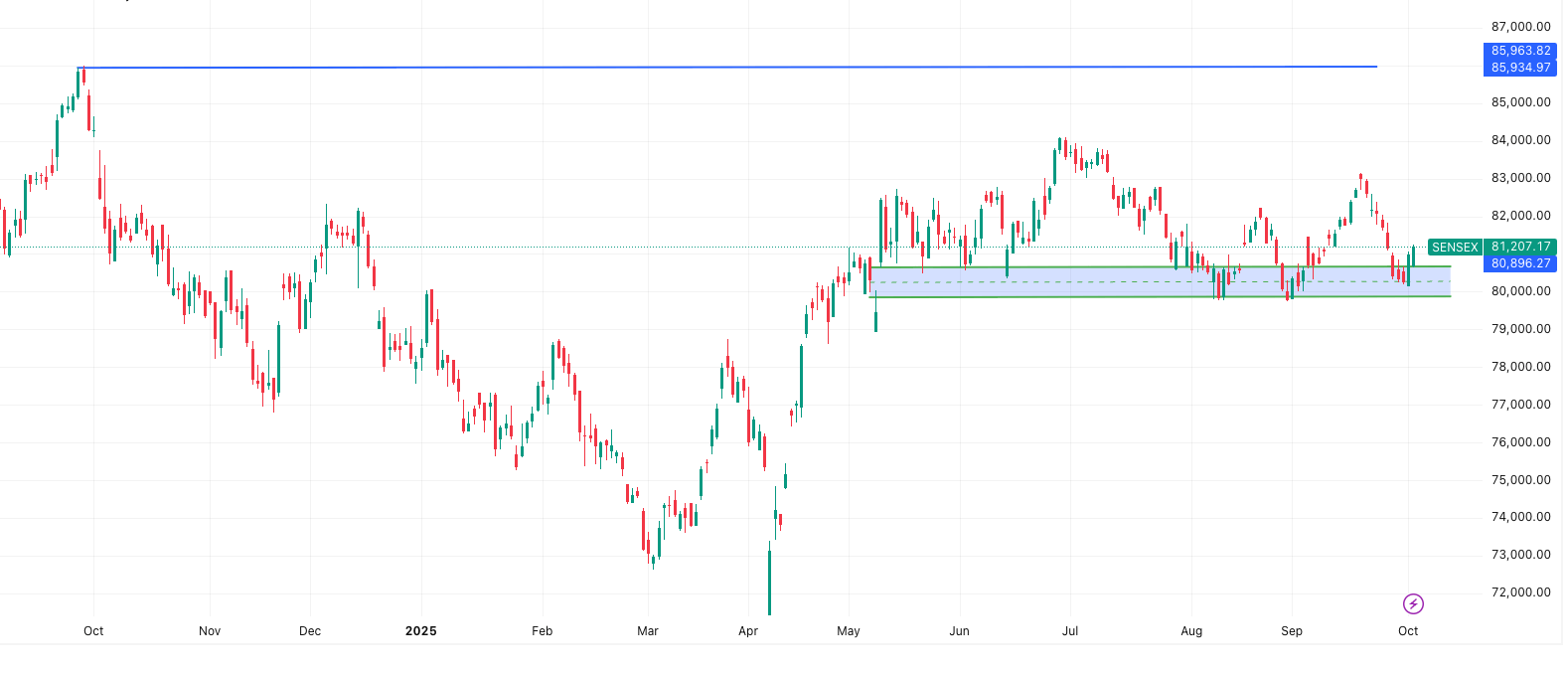

SENSEX Outlook

The SENSEX (81,207) has entered a positive trend in the last trading session. Traders can consider holding long positions with a daily closing stoploss at 80,335. The index would remain strong as long as it sustains above this level.

- Support Levels: 80,820 – 80,434 – 80,218

- Resistance Levels: 81,423 – 81,639 – 82,025

- Tentative Range: 81,818 – 80,595

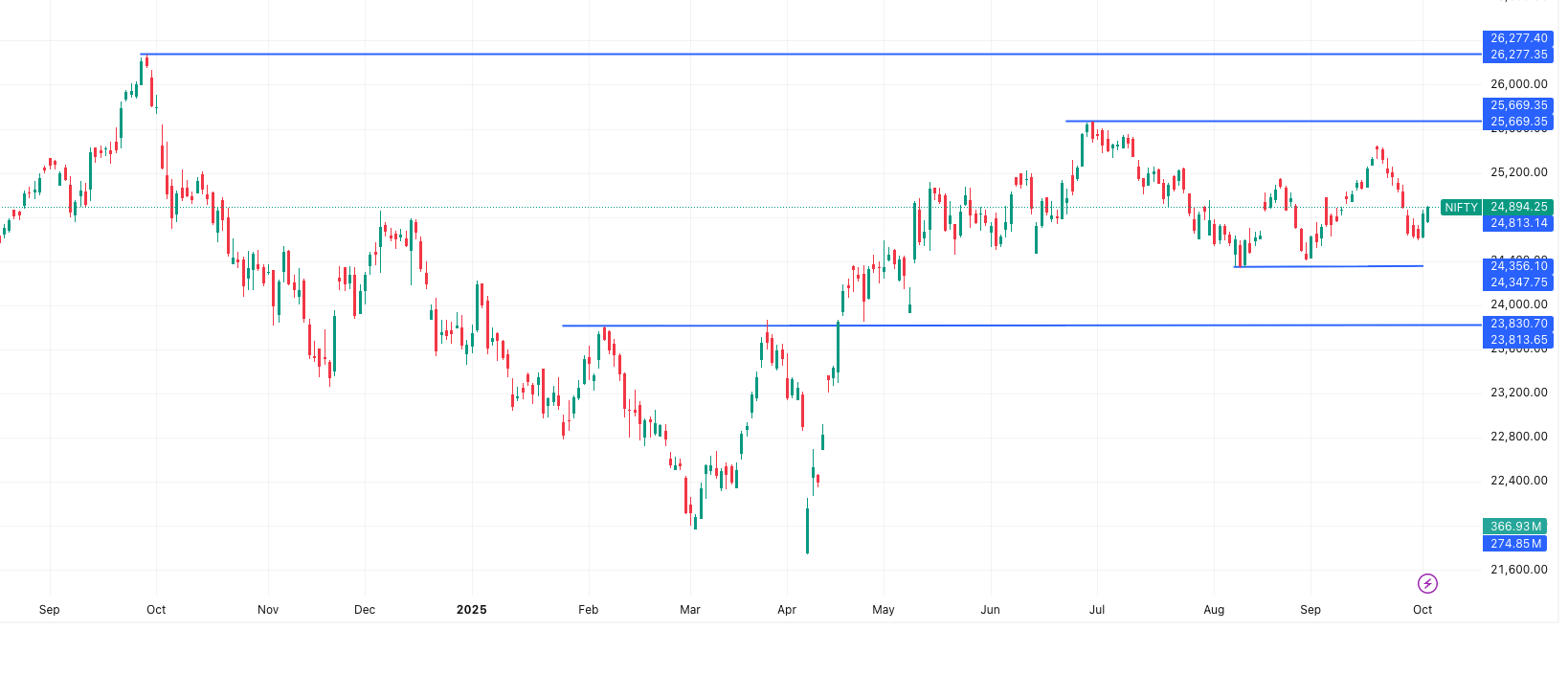

NIFTY Outlook

The NIFTY (24,894) is also in a positive trend. If you are holding long positions, continue to ride the momentum with a daily closing stoploss of 24,646. A fresh short position may only be initiated if Nifty closes below this critical level.

- Support Levels: 24,793 – 24,692 – 24,636

- Resistance Levels: 24,950 – 25,006 – 25,107

- Tentative Range: 25,075 – 24,713

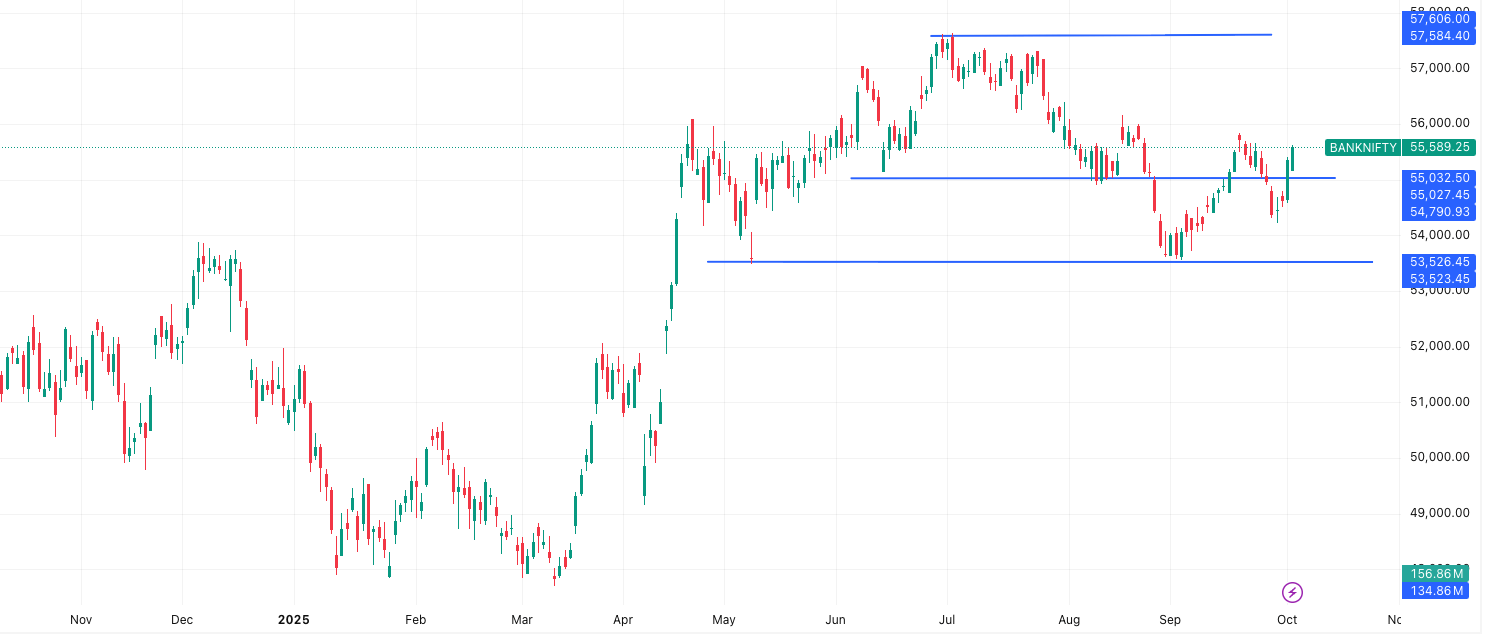

Bank Nifty Outlook

The Bank Nifty (55,589) remains in a positive trend. Long positions should be maintained with a daily closing stoploss at 54,922. Only a close below this level may open the door for weakness.

- Support Levels: 55,305 – 55,021 – 54,866

- Resistance Levels: 55,745 – 55,900 – 56,184

- Tentative Range: 56,059 – 55,118

👉 With all three major indices in the green zone, today’s session may witness selective strength in large-cap banks and frontline IT stocks, though broader market participation will be key to sustaining the upmove.

News & Stocks – Market Outlook 6 October

Indian markets step into the new week with key policy decisions, sectoral developments, and global cues that could set the tone for near-term sentiment. Here are the important updates and their potential stock market impact:

1. India Semiconductor Mission (ISM) 2.0

The government is preparing to launch ISM 2.0 with a stronger focus on semiconductor fabs, advanced packaging, and design-led manufacturing. The Design Linked Incentive (DLI) scheme will be revamped to provide capital support and scaling opportunities for fabless companies. This move is aligned with India’s ambition to reduce dependence on chip imports and strengthen domestic electronics manufacturing.

Stocks in focus: Dixon Technologies, Vedanta, Tata Elxsi

2. Forex Reserves Decline

India’s forex reserves fell by $2.33 billion to $700.23 billion in the week ended September 26. The decline was mainly due to lower foreign currency assets, though gold reserves increased by $2.23 billion and offered partial support. While RBI maintains adequate reserves to manage currency volatility, the dip signals capital outflows and higher dollar demand.

Stocks in focus: HDFC Bank, ICICI Bank, SBI

3. Delhi Excise Policy Review

The Delhi government is reviewing its liquor excise duty and MRP structure, which has remained unchanged for nearly 10 years. A possible revision may boost state revenues and reshape the retail liquor business in the NCR region. Higher duties could impact consumption patterns but also strengthen state finances.

Stocks in focus: United Spirits, Radico Khaitan, United Breweries

4. Push for Solar Energy in Delhi

Delhi will install solar panels across 1,000 government buildings, expected to generate 55 MW of renewable power and reduce annual electricity costs by over ₹50 crore. The move is also aimed at cutting carbon emissions and promoting sustainable energy. This will create business opportunities for solar energy companies.

Stocks in focus: Tata Power, Adani Green, Sterling & Wilson Solar

5. Defence Procurement – S-400 and S-500 Systems

India is in talks with Russia for additional S-400 missile systems and potential acquisition of the more advanced S-500, after the successful deployment of S-400 in “Operation Sindoor.” This reflects India’s increasing focus on strengthening air defence capabilities. Defence sector remains in spotlight as Goldman Sachs also maintained a positive outlook on Indian defence companies.

Stocks in focus: Azad Engineering, PTC Industries, HAL, BEL

6. China’s $1 Trillion Investment Pitch

China is reportedly offering a $1 trillion investment package to the US in exchange for easing restrictions on technology access and trade barriers. If negotiations progress, this could reshape global trade flows and impact Indian exporters, particularly in steel, IT services, and energy. The development will be closely watched as it could influence global commodity and currency markets.

Stocks in focus: Tata Steel, Infosys, Reliance

7. Rajasthan Pharma Probe

The Rajasthan government has suspended drugs from Kaysons Pharma after suspected child deaths linked to contaminated cough syrup. This has raised concerns about stricter quality checks and regulatory scrutiny in the pharma industry. While the action is company-specific, it raises broader compliance risks for the entire sector.

Stocks in focus: Sun Pharma, Cipla, Dr. Reddy’s

8. J&K Tobacco Ban

The Kathua district administration has banned the sale of smokeless tobacco product Cool Lip due to health concerns, particularly its rising usage among children and youth. This reflects an increasing trend of stricter regulations in the tobacco sector.

Stocks in focus: ITC, Godfrey Phillips

9. Isabgol GST Confusion

Uncertainty over GST classification of Isabgol (psyllium husk) has forced processors to stop purchases from October 6. This has directly impacted farmers in Gujarat and risks disrupting exports worth over ₹3,500 crore annually. Unless clarity emerges, the supply chain could face significant stress.

Stocks in focus: Dabur, Patanjali Foods

This mix of domestic policy moves, regulatory changes, and international trade signals will guide investor sentiment today. Defence, green energy, pharma, liquor, and financial sectors remain in sharp focus.

IPO Updates – Market Outlook 6 October

Mainboard IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP / Listing Gain |

|---|---|---|---|---|

| Rubicon Research | 9-Oct | 13-Oct | 16-Oct | ₹42 (8.66%) |

| LG Electronics | 7-Oct | 9-Oct | 14-Oct | ₹210 (18.42%) |

| Tata Capital | 6-Oct | 8-Oct | 13-Oct | ₹10 (3.07%) |

| WeWork India | 3-Oct | 7-Oct | 10-Oct | ₹5 (0.77%) |

| Advance Agrolife | 30-Sep | 3-Oct | 8-Oct | ₹14.5 (14.50%) |

| Om Freight | 29-Sep | 3-Oct | 8-Oct | ₹2 (1.48%) |

Takeaway:

LG Electronics IPO is commanding the strongest grey market buzz with ~18% listing gain expected, followed by Advance Agrolife (~15%). Tata Capital shows moderate strength, while WeWork India looks muted with under 1% GMP.

SME IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP / Listing Gain |

|---|---|---|---|---|

| DSM Fresh Foods | 26-Sep | 6-Oct | 9-Oct | – |

| Valplast Technologies | 30-Sep | 3-Oct | 8-Oct | – |

| Infinity Infoway | 30-Sep | 3-Oct | 8-Oct | ₹50 (32.26%) |

| Zelio E-Mobility | 30-Sep | 3-Oct | 8-Oct | – |

| Sheel Biotech | 30-Sep | 3-Oct | 8-Oct | ₹8 (12.70%) |

| Munish Forge | 30-Sep | 3-Oct | 8-Oct | – |

| Suba Hotels | 29-Sep | 1-Oct | 7-Oct | ₹8 (7.21%) |

| KVS Castings | 26-Sep | 30-Sep | 6-Oct | – |

| Rukmani Devi Garg Agro | 26-Sep | 30-Sep | 6-Oct | ₹21 (21.21%) |

Takeaway:

Among SME IPOs, Infinity Infoway shines with a stellar 32% GMP, while Rukmani Devi Garg Agro and Sheel Biotech also show double-digit listing gains. Others like DSM Fresh Foods, Valplast, and Zelio E-Mobility remain flat with no GMP traction yet.

Stocks in Radar – Market Outlook 6 October

Jyoti CNC Automation Ltd. (CMP: ₹914 | Target: ₹1,005 | Upside: 10%)

Research Source: SBI Securities | NSE: JYOTICNC | BSE: 544081

Business Overview:

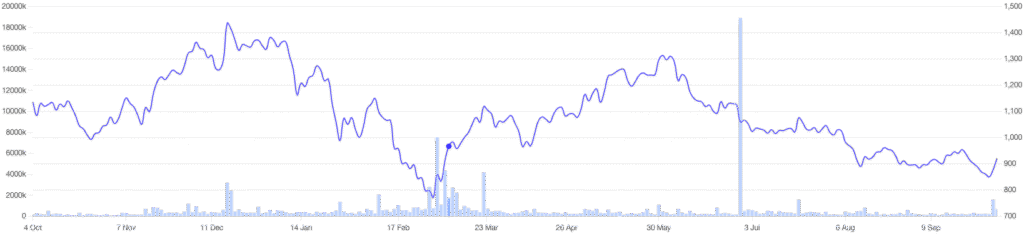

Jyoti CNC Automation Ltd. is one of the world’s leading vertically integrated manufacturers of CNC (Computer Numerical Control) machines, with a robust portfolio of 200+ variants including CNC Turning Centres, 5-Axis Machining Centres, and Multi-Tasking Machines. The company operates three manufacturing facilities—two in Rajkot, India, and one in Strasbourg, France—delivering over 1.35 lakh machines worldwide. With more than three decades of industry experience, it enjoys a 10% share in the domestic CNC machine market.

Financials & Market Standing:

- Market Cap: ₹20,520 Cr

- Promoter Holding: 62.6% (Pledge 4.1%)

- Avg. Volume (5D/30D): 1.8 Mn / 1.9 Mn

- Delivery Volume: ~1 Mn, indicating strong investor participation

Investment Drivers:

- Capacity Expansion: Increased FY24 installed capacity from 4,400 units to 6,000 units. New Rajkot expansion to add another 10,000 machines annually in the next two years, targeting entry-level and EMS demand.

- Industrial Tailwinds: Rising demand from EVs, semiconductors, EMS, aerospace, and defence industries. India’s EMS alone may require 1,00,000 CNC machines in 5 years.

- Growth Momentum: Delivered ~40% CAGR during FY23–FY25 with margins at 26–27%. Strong growth outlook supported by secular industry trends.

- Valuation: Trades at a premium P/E (FY26E: 43.2x, FY27E: 33.7x) but supported by robust earnings visibility.

Outlook (SBI Securities View):

- Accumulation Range: ₹905–₹922

- Target Price: ₹1,005

- Duration: 6–12 Months

- Upside Potential: ~10%

- The stock looks attractive for accumulation due to industry tailwinds, ongoing expansion, and strong financial trajectory, though investors should monitor risks like raw material volatility and sector slowdown.

Risks to Watch:

- Industrial slowdown impacting demand

- Dependence on limited high-growth sectors (EV, EMS, Defence)

- Raw material price fluctuations

In short: Jyoti CNC Automation is a fundamental long-term growth play with near-term 10% upside potential. Backed by capacity expansion and demand from sunrise industries, it remains a strong candidate in the Market Outlook 6 October radar.

Conclusion – Market Outlook 6 October

Indian markets ended the last session on a positive note after a prolonged seven-day losing streak, with both Sensex and Nifty entering a positive trend according to Equitypandit analysis. The rebound was supported by selective buying in banking, small-cap, and IT counters, while global cues remain mixed as investors watch U.S. interest rate trajectory and crude price movements.

As we step into the new week, the short-term outlook suggests cautious optimism. Technical levels indicate that Nifty and Sensex will remain strong above their key support zones, while Bank Nifty is also holding steady, hinting at resilience in the financial space. However, volatility cannot be ruled out as global macroeconomic data and commodity price movements unfold.

On the stock-picking front, Jyoti CNC Automation stands out as a strong candidate on the radar, with robust capacity expansion, sectoral tailwinds, and steady financial growth providing confidence for accumulation.

Key Takeaway: Traders can look for selective long opportunities with strict stop-loss levels, while investors may continue to accumulate quality stocks with strong growth potential. Staying disciplined with support and resistance levels will be crucial in navigating market swings this week.

Related Articles

Read Our All Newsletter On Pre-Market Analysis

Tata Capital IPO 2025: Expert Analysis on a High-Growth Investment Opportunity