Intro – Market Outlook 2nd September

Good morning and welcome to your Market Outlook 2nd September Edition.

The Indian market started September on a bullish note, shrugging off tariff concerns and gaining momentum from the positive vibes around the SCO Summit. Investors remained upbeat as global sentiment improved and domestic buying supported the rally.

On Monday’s last trading day, benchmark indices ended higher — with Nifty 50 jumping 199 points to close at 24,626 and Sensex advancing 567 points to 80,377. The uptrend was powered by strong moves in IT, banking, and small-cap stocks, showing broad-based market participation.

- Nifty Bank: 53,993 (+337 pts | +0.63%)

- Nifty IT: 35,751 (+570 pts | +1.62%)

- S&P BSE SmallCap: 52,261 (+812 pts | +1.58%)

In this pre-market newsletter for Market Outlook 2nd September, we decode key levels, major news, IPO updates, and stocks on the radar to prepare you for the trading day ahead.

Index Technical View – Market Outlook 2nd September

According to Equity Pandit analysis, Indian markets are currently in a cautious to negative phase. The indices are hovering near their critical support levels, which means traders need to remain disciplined and avoid aggressive fresh buying until clear breakouts are seen. Short positions should be protected with strict stoplosses, while fresh long opportunities will only emerge if indices manage to close above their immediate resistance.

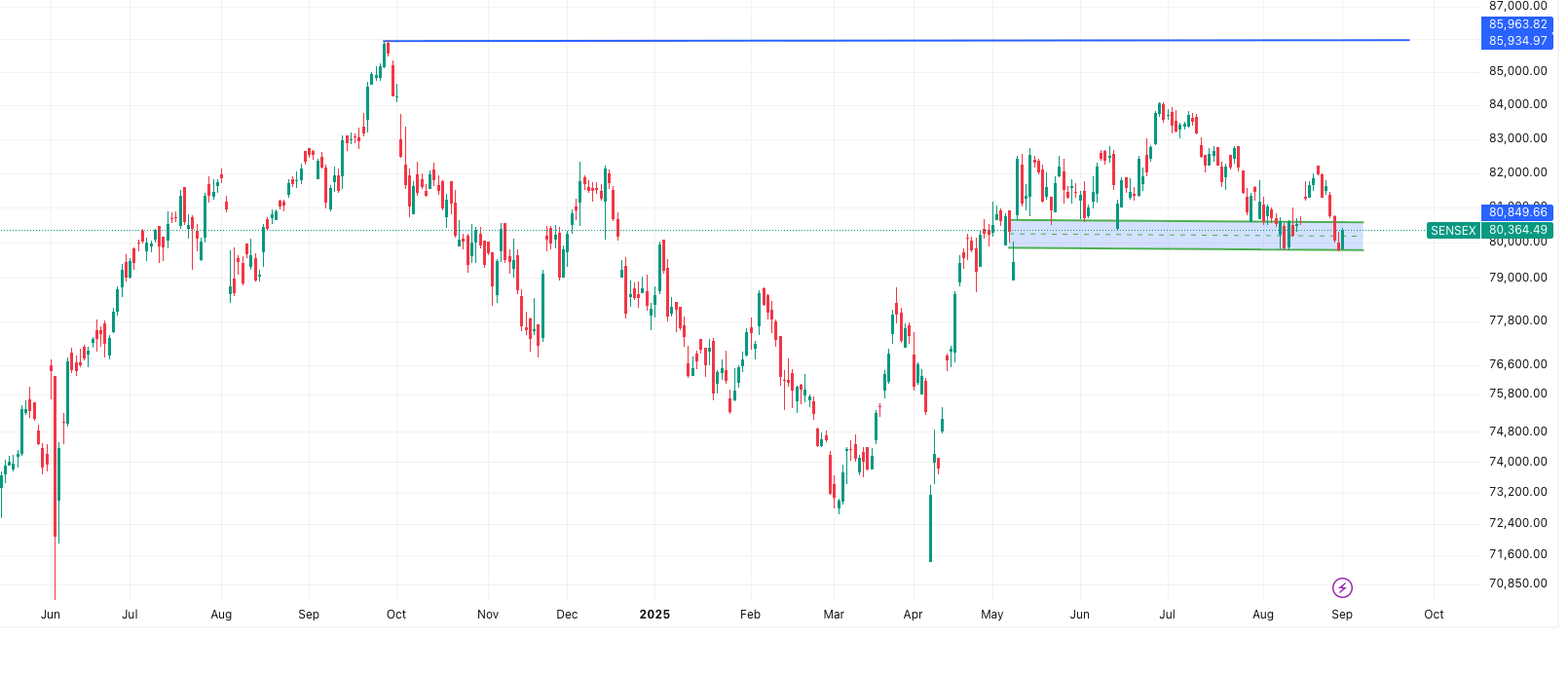

SENSEX (80,364)

SENSEX is trading under pressure and continues to remain in a negative trend. The index has shown resilience near 80,000 levels, but buyers need a decisive close above 80,684 to confirm bullish reversal. Until then, the sentiment will stay weak.

- Support: 79,986 • 79,608 • 79,398

- Resistance: 80,575 • 80,785 • 81,163

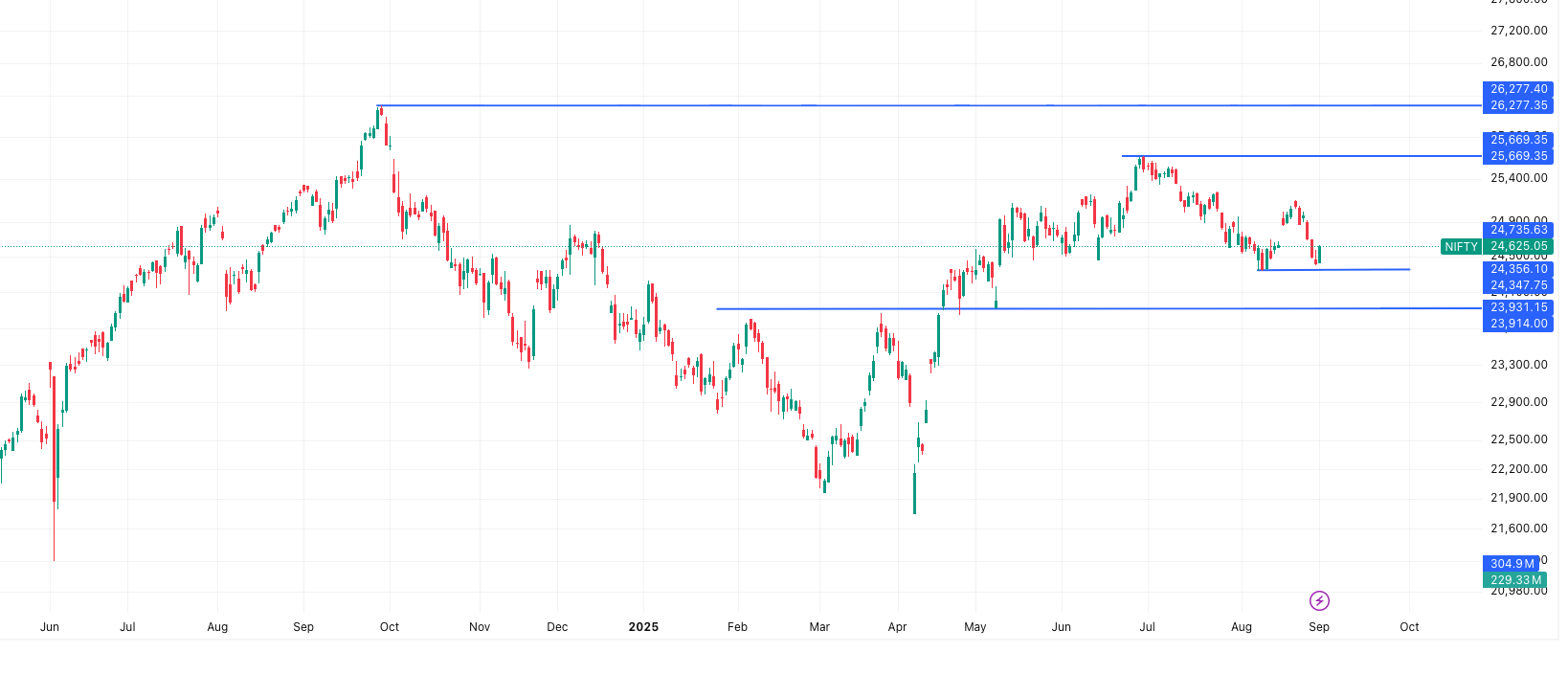

NIFTY (24,625)

Nifty is also reflecting a weak undertone and is unable to sustain above resistance levels. The index is consolidating with a bearish bias, and traders holding short positions can continue with a protective stoploss. A move above 24,689 will be the trigger point for fresh long positions.

- Support: 24,493 • 24,362 • 24,290

- Resistance: 24,696 • 24,767 • 24,899

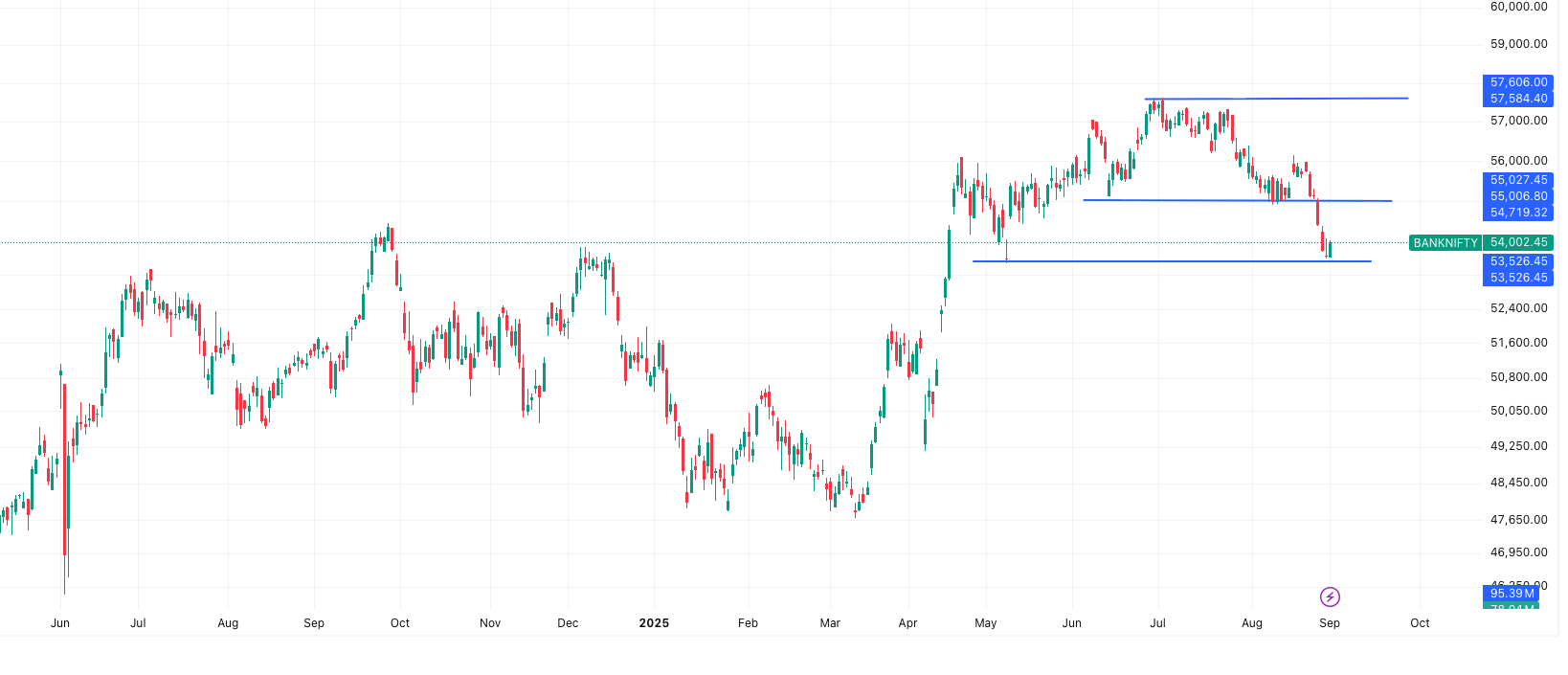

BANK NIFTY (54,002)

Bank Nifty is struggling to hold higher levels and remains in a negative trajectory. The banking index is underperforming slightly compared to broader indices. Fresh strength will only come if it closes above 54,346, while further weakness could be seen if support levels give way.

- Support: 53,762 • 53,521 • 53,384

- Resistance: 54,139 • 54,277 • 54,517

👉 Overall, the Market Outlook 2nd September signals that indices are trapped in a consolidation zone with a negative tilt. Traders should stay cautious and align trades with the support–resistance framework provided by Equity Pandit.

News & Impact Stocks – Market Outlook 2nd September

1️⃣ Cement Industry GST Impact

India’s cement industry may see a boost as GST cuts are expected to make premium and Category A cement more affordable. Category A, currently ~40% of volumes, could rise to 55–60% by FY30. Brokerage reports highlight likely pre-GST price hikes of ₹20–30 per bag across regions, while Category C players continue losing market share.

Impact Stocks:

- Ultratech & Ambuja – Higher demand for premium products like Weather Plus & ACC Gold.

- Shree Cement – Narrowing price gap with Category A, improving brand-led realisations.

- Dalmia Bharat & Nuvoco – Support from pre-GST price hikes.

- Ramco Cements – Gains market share as Category C weakens.

2️⃣ BHEL Fined for Governance Lapses

BHEL disclosed that both NSE and BSE imposed fines of ₹5.36 lakh each for not meeting SEBI norms on independent directors. The company has sought a waiver, citing that appointments are made by the government.

Impact Stocks:

- BHEL – Short-term sentiment negative due to governance non-compliance; waiver decision awaited.

3️⃣ Ashok Leyland EV Battery Push

Ashok Leyland announced a long-term exclusive partnership with China’s CALB Group, committing ₹5,000 crore over 7–10 years to localize EV battery production. The plan includes R&D in battery materials, recycling, and storage systems.

Impact Stocks:

- Ashok Leyland – Positive, long-term EV growth driver.

- Switch Mobility (subsidiary) – Gains from secure EV battery supply chain.

- Auto Ancillaries (Amara Raja, Exide) – Could face competitive pressure.

4️⃣ Coal India Faces SEBI Fine, Production Dip

Coal India was fined ₹10.72 lakh (₹5.36 lakh each by NSE & BSE) for non-compliance with SEBI’s board independence rules. Additionally, production fell 6% YoY to 229.8 MT in April–July due to monsoon disruptions.

Impact Stocks:

- Coal India – Negative sentiment from regulatory fine and production decline.

- Power Producers – Risk of tight coal supply if production drop continues.

5️⃣ Zomato Commission Model Under Review

Zomato (Eternal Ltd.) is reportedly considering easing its commission model (currently 10–28%) to provide relief to restaurants, amid industry concerns over margins. Discussions are ongoing, though no decision has been finalized.

Impact Stocks:

- Zomato – Potential margin pressure, but stronger restaurant relations may boost order volumes.

- Restaurant Chains (Jubilant FoodWorks, Devyani International) – Positive if commissions reduce.

- Swiggy – Could face pressure to align pricing.

👉 Overall, the Market Outlook 2nd September highlights cement demand uplift, regulatory headwinds for PSUs, and strong EV push from Ashok Leyland, while consumption-linked platforms like Zomato are adjusting for long-term sustainability.

Stocks For Market Outlook 2nd September

| News | Impact Stocks | Sentiment |

|---|---|---|

| GST cuts & pre-GST price hikes to boost premium cement demand | Ultratech, Ambuja, Shree Cement, Dalmia Bharat, Nuvoco, Ramco Cements | Positive for leaders, Negative for weaker players |

| NSE & BSE fines BHEL ₹5.36 lakh each over governance non-compliance | BHEL | Negative (short-term) |

| Ashok Leyland–CALB ₹5,000 cr partnership to localize EV batteries | Ashok Leyland, Switch Mobility, Auto Ancillaries (Exide, Amara Raja) | Positive for Leyland, Pressure on battery peers |

| Coal India fined by SEBI; Q1 production down 6% YoY due to rains | Coal India, Power Producers | Negative |

| Zomato may ease commission rates (10–28%) for restaurants | Zomato, Jubilant FoodWorks, Devyani International, Swiggy | Mixed – margin hit but better volumes, Positive for restaurant chains |

IPO Update – Market Outlook 2nd September

The IPO market continues to remain active with both mainboard and SME issues drawing mixed investor responses. While some offerings are enjoying strong oversubscription and steady grey market premiums (GMPs), others are still struggling to attract demand.

Mainboard IPOs

| IPO Name | Open | Close | Listing | Subscription | GMP (Est. Listing Gain) |

|---|---|---|---|---|---|

| Amanta Healthcare | 1-Sep | 3-Sep | 9-Sep | 4.62x | ₹25 (≈19.8%) |

| Vikran Engineering | 26-Aug | 29-Aug | 3-Sep | 24.87x | ₹4 (≈4.1%) |

| Anlon Healthcare | 26-Aug | 29-Aug | 3-Sep | 7.12x | ₹2 (≈2.2%) |

Among mainboard IPOs, Vikran Engineering clearly stood out with massive 24.87x subscription, reflecting strong investor appetite despite a relatively low GMP. Amanta Healthcare is showing healthy subscription with a decent ₹25 GMP, suggesting potential listing gains. Anlon Healthcare, while subscribed moderately, is showing limited GMP traction.

SME IPOs

| IPO Name | Open | Close | Listing | Subscription | GMP (Est. Listing Gain) |

|---|---|---|---|---|---|

| Rachit Prints (BSE SME) | 1-Sep | 3-Sep | 8-Sep | 0.52x | ₹13 (≈8.7%) |

| Snehaa Organics (NSE SME) | 29-Aug | 2-Sep | 5-Sep | 7.75x | ₹20 (≈16.4%) |

| Sugs Lloyd (BSE SME) | 29-Aug | 2-Sep | 5-Sep | 1.15x | ₹– (0%) |

| Abril Paper Tech (BSE SME) | 29-Aug | 2-Sep | 5-Sep | 2.26x | ₹5 (≈8.2%) |

In the SME space, demand has been uneven. Snehaa Organics led the pack with a solid 7.75x subscription and a healthy ₹20 GMP, making it the highlight among SMEs. Rachit Prints and Abril Paper Tech are showing moderate traction, while Sugs Lloyd is seeing lukewarm investor interest with almost no GMP activity.

Takeaway: Overall, mainboard IPOs are showing strong resilience with selective opportunities for listing gains, while the SME segment remains polarized—some issues attracting heavy interest while others struggle to gain momentum.

Stock on Radar – Market Outlook 2nd September

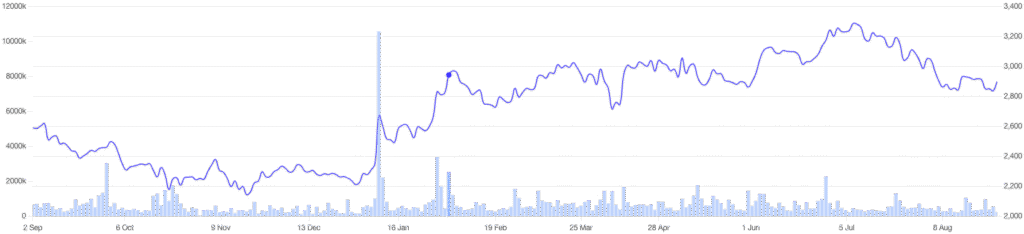

SRF Ltd (CMP: ₹2,836 | Target Price: ₹3,650 | Upside: +29%)

Motilal Oswal Research has placed SRF Ltd firmly on the radar with a BUY rating and a target price of ₹3,650, signaling nearly 29% upside from current levels. The brokerage highlights SRF’s strong positioning in the global refrigerants and specialty chemicals space, backed by regulatory tailwinds and expanding margins.

Why SRF is in Focus?

- Kigali Agreement Catalyst: India, as part of Article 5 Group 2 countries, will need to freeze HFC consumption by CY2028. This global regulatory shift directly benefits SRF, a leader in refrigerants.

- Asia at the Core: With Asia consuming the bulk of refrigerants, SRF is strategically positioned to tap rising demand.

- Future-Ready Portfolio: Heavy investments in Hydrofluoroolefins (HFOs) ensure SRF stays ahead of the curve even after HFC phase-out.

- Diversified Strength: Beyond refrigerants, SRF’s chemicals, packaging films, and technical textiles segments create a strong multi-engine growth model.

Financial Snapshot (Motilal Oswal Estimates FY25–27E)

- Revenue Growth: From ₹146.9B → ₹196.5B (16% CAGR)

- EBITDA Growth: From ₹28.4B → ₹48.0B (30% CAGR)

- PAT Growth: From ₹13.7B → ₹27.5B (42% CAGR)

- EBITDA Margin Expansion: 19.3% → 24.4%

- RoE Improvement: 11.4% → 18.0%

Motilal Oswal’s Take

“SRF is not a typical cyclical chemical company—it is a structural growth story supported by global regulatory tailwinds and strong financial visibility,” notes Motilal Oswal. The brokerage maintains a BUY rating with a SoTP-based TP of ₹3,650, highlighting earnings compounding and margin expansion as key drivers.

Conclusion – Market Outlook 2nd September

As we step into today’s trade, the market is carrying forward a positive undertone from Monday, supported by global cues like the SCO Summit optimism and resilience against tariff concerns. Broader participation from IT, banking, and smallcaps is also adding strength to the momentum.

On the IPO front, activity remains buzzing with healthy demand in Amanta Healthcare, Snehaa Organics, and select SME names—indicating that investor appetite is still strong in the primary market.

Meanwhile, Motilal Oswal’s bullish call on SRF Ltd highlights how regulatory tailwinds and structural growth themes can offer high-conviction opportunities even in a volatile environment.

Overall, the market setup looks constructive in the near term. However, traders should keep an eye on support and resistance levels shared by Equity Pandit, while investors can focus on quality names with clear growth visibility.

Let’s see if Nifty can build further on this momentum today and extend the rally beyond crucial resistance.

More Articles

5 Unique & Underrated Business Model Stocks in India You Shouldn’t Ignore

Luxury Housing Boom: Real Estate Stocks to Watch in 2025

Golden Crossover vs Death Crossover: How to Use These Powerful Chart Signals