Market Outlook 29 September — Intro

Good morning and welcome to your Market Outlook 29 September Edition.

Wishing you and your family a very Happy Durga Puja! After a festive weekend break, traders return to a market clouded by global uncertainties and tariff-led concerns. The spotlight for the Market Outlook 29 September remains firmly on U.S. trade policy and its ripple effects on Indian equities.

On Friday, September 26, 2025, sentiment turned sharply negative after former U.S. President Donald J. Trump announced a 100% tariff on all branded and patented pharmaceutical imports into the U.S., effective October 1, 2025. While Indian pharma firms with U.S. manufacturing presence may escape the brunt, exporters relying solely on India-based facilities are expected to feel the heat. Unsurprisingly, the Nifty Pharma index tumbled nearly 2%.

The sell-off wasn’t limited to pharma — IT stocks cracked 2.31%, dragged down by renewed visa concerns, while SmallCaps slumped 1.98% on heavy profit booking. Broader indices mirrored the weakness as foreign outflows and sectoral headwinds weighed.

Here’s how the markets closed on Friday:

- NIFTY 50: 24,663.90 ▼ -226.95 (-0.91%)

- SENSEX: 80,493.62 ▼ -666.06 (-0.82%)

- Nifty Bank: 54,406.90 ▼ -569.30 (-1.04%)

- Nifty IT: 33,750.80 ▼ -797.50 (-2.31%)

- S&P BSE SmallCap: 52,316.46 ▼ -1,056.42 (-1.98%)

As we dive into the Market Outlook 29 September, investors will be closely tracking global policy cues, institutional flows, and the tariff implementation timeline to gauge near-term direction.

In this newsletter, we bring you technical views, key news, IPO updates, and stocks to watch for today.

Market Outlook 29 September — Index Technical View

As part of this Market Outlook 29 September, let’s break down the technical landscape for the benchmark indices based on EquityPandit analysis. The broader market mood remains cautious after Friday’s global shocker, and price action suggests a negative bias across SENSEX, NIFTY, and BANKNIFTY. Here’s the detailed outlook:

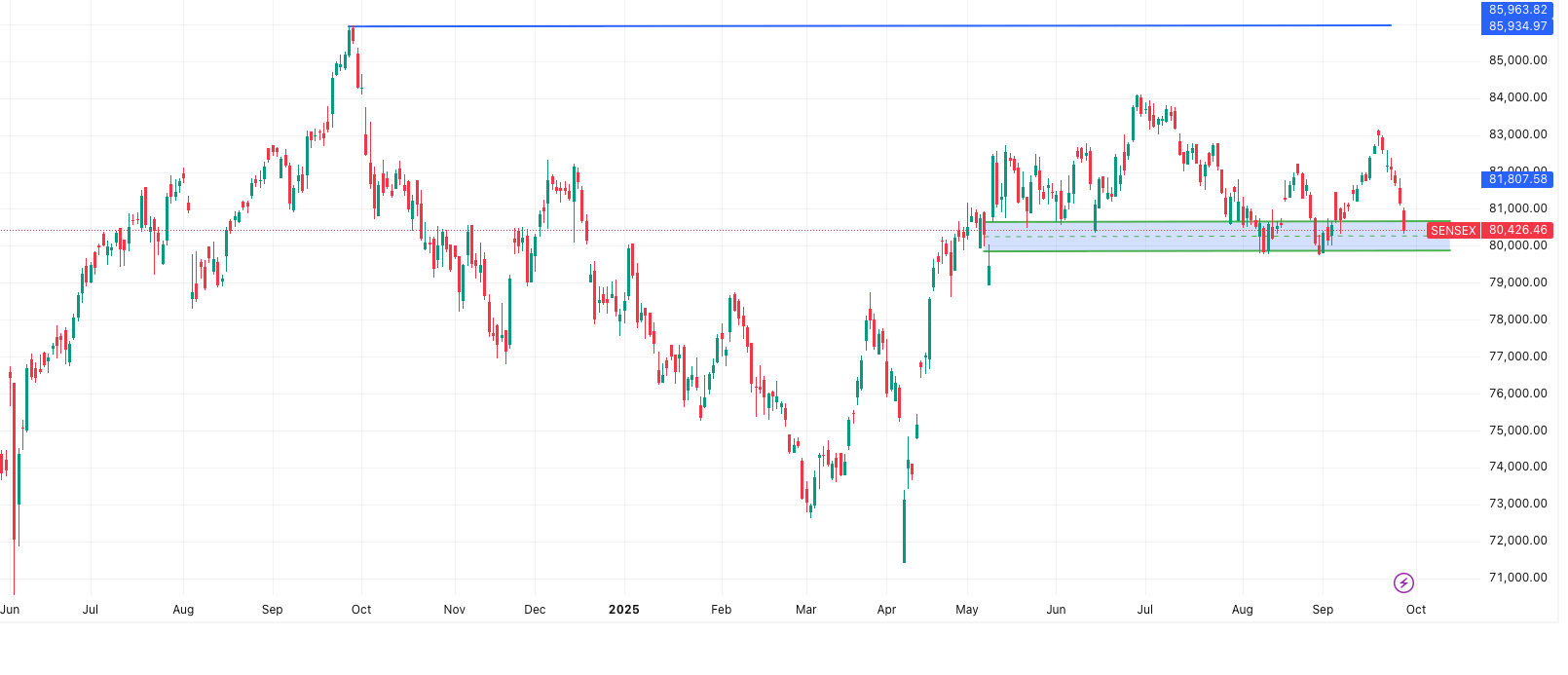

SENSEX Outlook

Current Level: 80,426

SENSEX continues to trade in a negative trend. Traders holding short positions may continue to hold with a daily closing stoploss of 81,275. A shift in sentiment will only come if SENSEX closes above 81,275, which could trigger fresh long entries.

- Support Levels:

- 80,162

- 79,897

- 79,461

- Resistance Levels:

- 80,862

- 81,298

- 81,563

- Tentative Range: 81,023 – 79,829

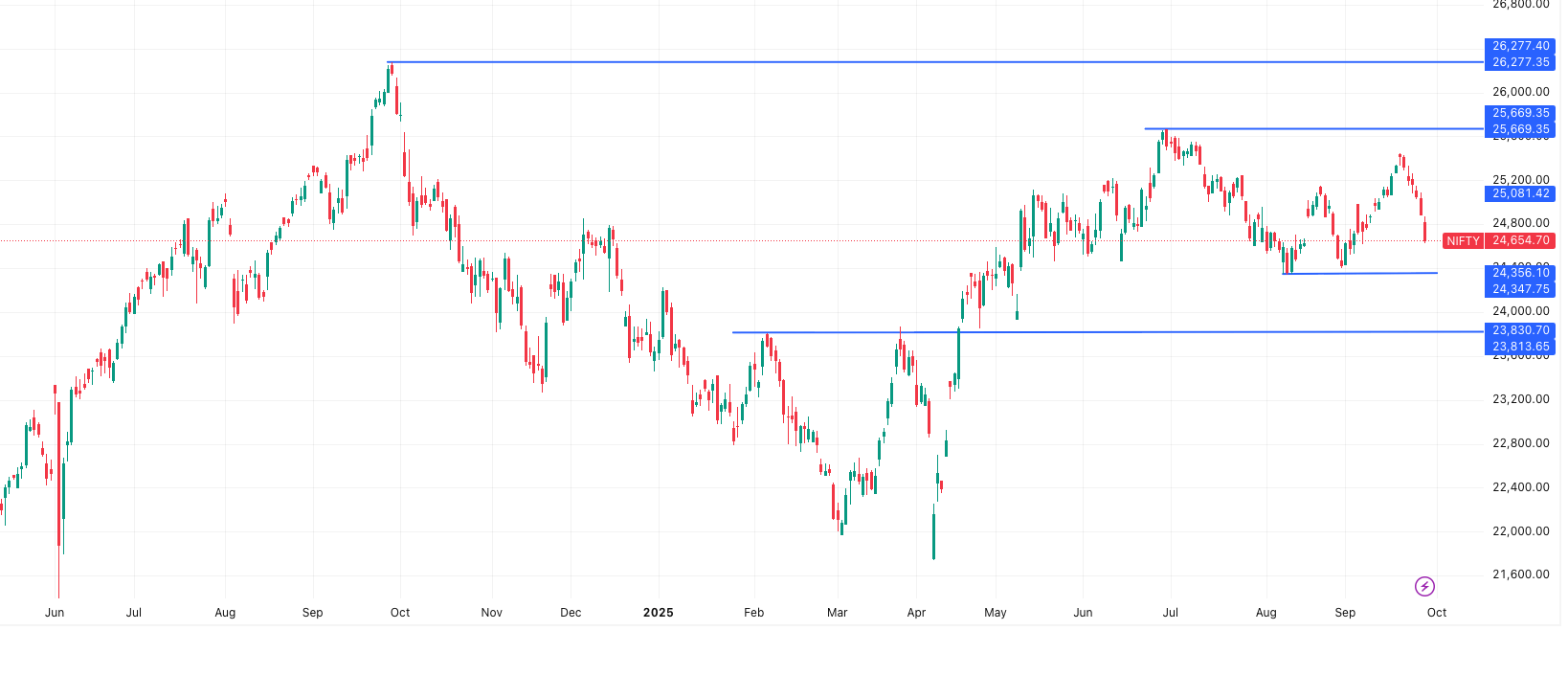

NIFTY Outlook

Current Level: 24,655

NIFTY too remains in a downtrend. Shorts can be maintained with a stoploss at 24,925. A reversal signal emerges only if the index manages to close above 24,925. For now, pressure remains intact.

- Support Levels:

- 24,567

- 24,478

- 24,327

- Resistance Levels:

- 24,806

- 24,957

- 25,045

- Tentative Range: 24,833 – 24,476

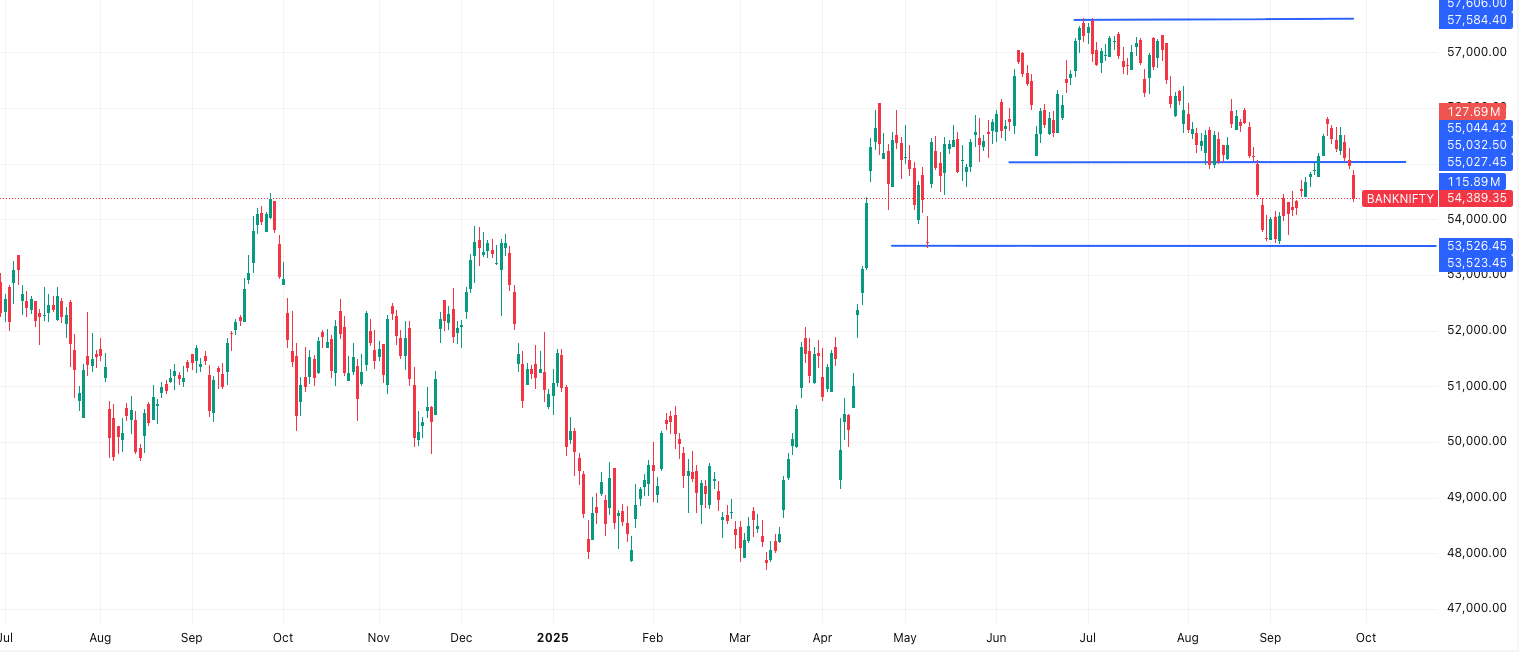

BANKNIFTY Outlook

Current Level: 54,389

Banking index is mirroring the weakness in broader markets. Shorts remain valid with a stoploss at 55,052. Momentum will only shift if BANKNIFTY closes above 55,052. Until then, financials could continue to stay under pressure.

- Support Levels:

- 54,168

- 53,946

- 53,582

- Resistance Levels:

- 54,754

- 55,118

- 55,340

- Tentative Range: 54,843 – 53,935

In summary, the Market Outlook 29 September points towards sustained caution with all three indices in negative zones. For traders, stoploss discipline will be crucial, while investors may prefer to stay on the sidelines until clarity emerges on global policy shifts.

Market Outlook 29 September — News & Stocks

In this Market Outlook 29 September, the spotlight is on some of the biggest developments across corporate India, global markets, and policy shifts. Each headline not only reflects the evolving business environment but also ties back to stock-specific action that traders and investors will be watching closely today.

IRFC Expands Infra Financing with ₹12,640 Cr Loan

Indian Railways Finance Corp. (IRFC) has sanctioned a massive ₹12,640 crore term loan to Chhattisgarh State Power Generation Co. for a 2×660 MW Super Critical Thermal Power Project in Korba (West). This deal underscores IRFC’s growing role as a diversified infra financier beyond just railways. The stock has already been buzzing, and investors will track if the momentum sustains.

- Stock in Focus: IRFC

BMW Recall Hits 3.3 Lakh Vehicles Globally

German auto giant BMW AG is recalling 331,000 vehicles globally over a defect in starter motors that could cause fires. With nearly 195,000 cars affected in the U.S. alone, this is a costly setback for the company after last year’s large-scale recall. Investors in Indian auto ancillary suppliers tied to BMW may also keep a close watch.

- Stock in Focus: BMW suppliers (Auto Ancillaries theme)- BMW has a 50:50 joint venture with Tata Technologies called BMW TechWorks India, which is focused on developing automotive software.

HDFC Bank Faces Regulatory Action in Dubai

The Dubai Financial Services Authority (DFSA) has barred HDFC Bank’s DIFC branch from onboarding new clients or promoting financial services. This action follows complaints of misuse of deposits by NRIs. While existing customers remain unaffected, sentiment could stay weak around HDFC Bank until clarity emerges.

- Stock in Focus: HDFC Bank

VIP Industries Promoters Cut Stake by 6.2%

Promoters of VIP Industries offloaded 88.40 lakh shares worth ₹343 crore, reducing their holding from 51.7% to 45.5%. Private equity firm Multiples Equity and Samvibhag Securities scooped up a chunk of the shares. The stock fell 4% post-sale, but long-term re-rating hopes remain as professional investors step in.

- Stock in Focus: VIP Industries

RBI Strengthens Digital Lending Rules

The RBI’s Digital Lending Directions, 2025 have tightened compliance norms, extended coverage to All India Financial Institutions, and mandated stricter reporting of Digital Lending Apps (DLAs). This will enhance borrower transparency and reduce systemic risks but could increase compliance costs for fintechs.

- Stock in Focus: Fintech & NBFC players

Visa Fee Shock from U.S.

The Finance Ministry’s August Economic Outlook has warned that the U.S. move to impose a $100,000 one-time fee on H-1B visas poses risks to India’s services exports and remittances. IT companies may face medium-term headwinds as reduced mobility dents client delivery models.

- Stock in Focus: Infosys, TCS, Wipro, HCLTech

BSNL Launches Indigenous 4G Stack

In a milestone for Indian telecom, PM Narendra Modi inaugurated BSNL’s indigenous 4G stack and commissioned 97,500 new towers built with homegrown technology at a cost of ₹37,000 crore. The rollout paves the way for a 5G upgrade and boosts India’s self-reliance push.

- Stock in Focus: BSNL project-linked telecom equipment makers

₹60,000 Crore Development Push from Odisha

PM Modi also unveiled development projects worth ₹60,000 crore, spanning railways, IIT expansions, telecom, and infrastructure. The move signals a strong policy-driven capex cycle that can benefit multiple industrial and infra-linked stocks.

- Stocks in Focus: L&T, IRFC, PSU Infra Companies

In short, the Market Outlook 29 September shows a day filled with stock-moving news — from IRFC’s big loan deal to HDFC Bank’s Dubai troubles, BMW’s recall to BSNL’s indigenous telecom push. Traders can expect sector-specific action in infra, banks, autos, IT, and telecom.

IPO Update – Market Outlook 29 September

Mainboard IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| Tata Capital IPO | 6-Oct | 8-Oct | 13-Oct | ₹24 (0.00%) |

| Advance Agrolife IPO | 30-Sep | 3-Oct | 8-Oct | ₹10 (10.00%) |

| Om Freight Forwarders IPO | 29-Sep | 3-Oct | 8-Oct | ₹11 (8.15%) |

| Fabtech Technologies IPO | 29-Sep | 1-Oct | 7-Oct | ₹35 (18.32%) |

| Glottis IPO | 29-Sep | 1-Oct | 7-Oct | ₹10 (7.75%) |

| Pace Digitek IPO | 26-Sep | 30-Sep | 6-Oct | ₹30 (13.70%) |

| TruAlt Bioenergy IPO | 25-Sep | 29-Sep | 3-Oct | ₹100 (20.16%) |

| Jinkushal Industries IPO | 25-Sep | 29-Sep | 3-Oct | ₹17 (14.05%) |

| Epack Prefab Technologies IPO | 24-Sep | 26-Sep | 1-Oct | — |

| BMW Ventures IPO | 24-Sep | 26-Sep | 1-Oct | ₹2 (2.02%) |

| Jain Resource Recycling IPO | 24-Sep | 26-Sep | 1-Oct | ₹8 (3.45%) |

| Solarworld Energy Solutions IPO | 23-Sep | 25-Sep | 30-Sep | ₹43 (12.25%) |

| Jaro Institute IPO | 23-Sep | 25-Sep | 30-Sep | ₹57 (6.40%) |

| Seshaasai Technologies IPO | 23-Sep | 25-Sep | 30-Sep | ₹46 (10.87%) |

| Anand Rathi Share IPO | 23-Sep | 25-Sep | 30-Sep | ₹32 (7.73%) |

| Ganesh Consumer Products IPO | 22-Sep | 24-Sep | 29-Sep | -₹1 (-0.31%) |

| Atlanta Electricals IPO | 22-Sep | 24-Sep | 29-Sep | ₹112 (14.85%) |

SME IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| Infinity Infoway | 30-Sep | 3-Oct | 8-Oct | ₹21 (13.55%) |

| Valplast Technologies | 30-Sep | 3-Oct | 8-Oct | ₹3 (5.56%) |

| Sheel Biotech | 30-Sep | 3-Oct | 8-Oct | ₹5 (7.94%) |

| Suba Hotels | 29-Sep | 1-Oct | 7-Oct | ₹7 (6.31%) |

| Gujarat Peanut | 25-Sep | 29-Sep | 3-Oct | ₹7 (8.75%) |

| Chatterbox Technologies | 25-Sep | 29-Sep | 3-Oct | ₹20 (17.39%) |

| Justo Realfintech | 24-Sep | 26-Sep | 1-Oct | ₹4 (3.15%) |

| Praruh Technologies | 24-Sep | 26-Sep | 1-Oct | — |

| Systematic Industries | 24-Sep | 26-Sep | 1-Oct | ₹10 (5.13%) |

| Gurunanak Agriculture | 24-Sep | 26-Sep | 1-Oct | — |

| Ecoline Exim | 23-Sep | 25-Sep | 30-Sep | ₹3 (2.13%) |

| True Colors | 23-Sep | 25-Sep | 30-Sep | ₹9 (4.71%) |

| Matrix Geo Solutions | 23-Sep | 25-Sep | 30-Sep | ₹3 (2.88%) |

| Aptus Pharma | 23-Sep | 25-Sep | 30-Sep | ₹4 (5.71%) |

| BharatRohan Airborne Innovations | 23-Sep | 25-Sep | 30-Sep | ₹5 (5.88%) |

| Prime Cable Industries | 22-Sep | 24-Sep | 29-Sep | ₹3 (3.61%) |

Key highlight: Atlanta Electricals IPO & TruAlt Bioenergy IPO showing strongest listing gains potential among active IPOs.

Stock in Radar – Market Outlook 29 September

Godrej Agrovet (GOAGRO)

- CMP: ₹688

- Target Price: ₹980

- Upside: ~42%

- Recommendation: BUY (ICICI Securities)

Business Overview

Godrej Agrovet (GOAGRO) operates across animal feed, dairy, crop protection, and vegetable oils. Over the last 12–18 months, the company has shown a steady recovery, supported by margin expansion and product diversification.

Key Growth Drivers

- Astec/CDMO revival – Weakness has likely bottomed out; strong demand pipeline ahead.

- Favorable monsoon & reservoirs – Strong planting season to boost crop protection and agro-chemicals.

- Animal feed & vegetable oils – Expansion and new Palm Kernel Oil (PKO) facility to support ~10% CAGR.

- Branded products push – Value-added dairy products (VAP) and processed foods gaining traction.

- GST relief – Lower GST on agrochemicals and farm inputs to cut farmer costs by 7–13%, driving demand.

Financials & Valuation

- FY25 witnessed margin improvement despite muted volume growth.

- EPS growth of 26% expected over FY26–28E, with RoE/ROCE expansion of 600–700bps.

- Stock trades at the lower end of its 5-year valuation band, offering attractive entry levels.

- ICICI Securities’ SoTP-based valuation assigns a target price of ₹980, implying a 42% upside.

Key Risks

- Weak monsoon or adverse weather.

- Rising competitive pressures or raw material costs.

- Lower-than-expected offtake of new products.

- Disease outbreaks affecting poultry segment.

Bottom Line: With strong multi-pronged growth drivers, government policy tailwinds, and favorable valuations, Godrej Agrovet stands out as a high-conviction BUY for medium to long-term investors.

Conclusion – Market Outlook 29 September

As we step into a festive week marked by Durga Puja, the market mood is anything but celebratory. Global tremors from Trump’s 100% pharma tariff shock continue to weigh on sentiment, while IT and Realty remain under pressure. With SENSEX, NIFTY, and BANKNIFTY all locked in a negative trend, traders need to stay cautious and respect support–resistance levels closely.

That said, opportunities still exist for stock pickers. Godrej Agrovet has emerged as a standout candidate in our Stock in Radar section, with a potential 42% upside backed by structural growth drivers. Investors would do well to keep such fundamentally strong plays on their radar even during volatile times.

As always, discipline is key:

- Traders should stick to stop-loss levels and ride momentum.

- Investors should focus on sectors with structural growth and policy tailwinds.

In this newsletter, we brought you technical views, key news, IPO updates, and stocks to watch for today.

Related Articles

Pharma Tariff Effect – 100% Tariff Creates Big Risks & Hidden Opportunities

Trump’s Tariff Shockwave: How Indian Stocks & Sectors Will Be Hit or Rise