Market Outlook 26 September – Intro

Good morning and welcome to your Market Outlook 26 September Edition.

The Indian markets extended losses on Wednesday, dragged down by persistent foreign fund outflows, renewed U.S. visa policy concerns, and sectoral pressure in IT and Realty. The Nifty 50 slipped 162 points (0.65%) to close at 24,894.80, while the Sensex fell 521 points (0.64%) to end at 81,194.99.

Banking shares showed relative resilience with Nifty Bank easing just 0.30% to 54,954.15, but IT stocks faced sharp selling, with the Nifty IT index tumbling 1.10%. The broader market also struggled as the BSE SmallCap index declined 0.77%, reflecting cautious investor sentiment.

In this newsletter, we bring you technical views, key news, IPO updates, and stocks to watch for today.

Index Technical View – Market Outlook 26 September

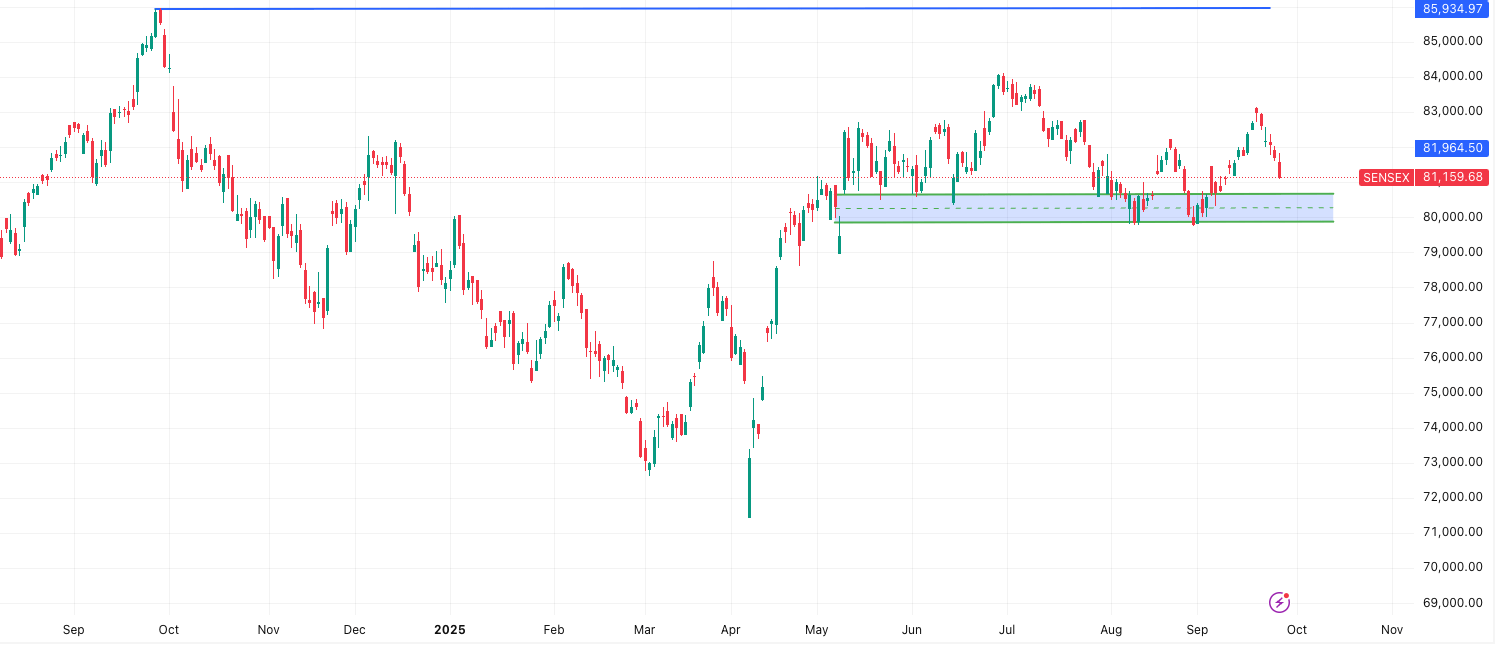

SENSEX Outlook 26 September

The Sensex closed at 81,160, extending its decline as selling pressure persisted across IT and Realty counters. Equitypandit’s analysis indicates that the index remains in a negative trend, with weak global cues and foreign fund outflows adding to the cautious sentiment.

If you are holding short positions, it is advisable to continue with a stoploss at 82,030 on a daily closing basis. Fresh buying interest could return only if the Sensex manages to close above this crucial level. Until then, traders should remain cautious as volatility is likely to stay elevated.

- Support: 80,888 – 80,617 – 80,140

- Resistance: 81,636 – 82,112 – 82,384

The broader picture suggests the index could trade in a tentative range between 80,580 and 81,739, and any decisive breakout beyond these levels may set the next directional move.

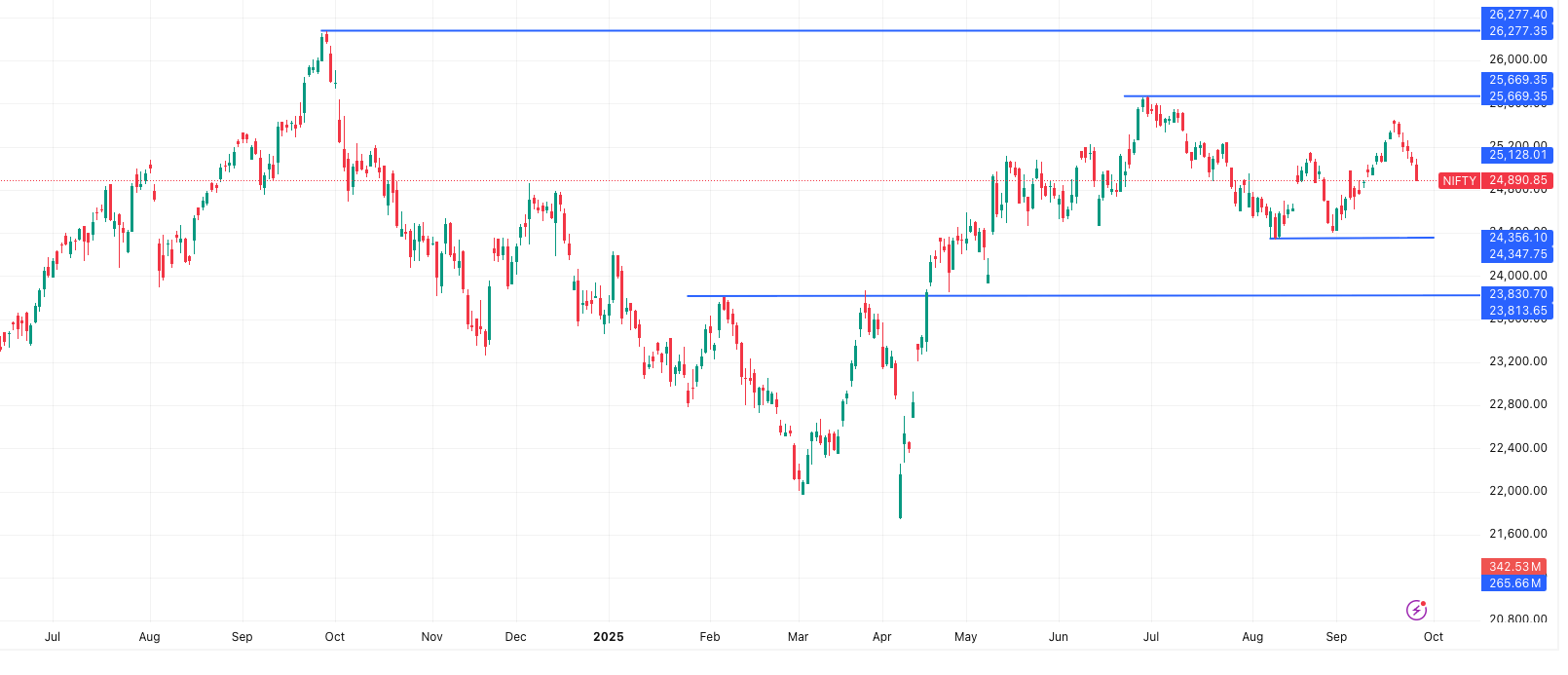

NIFTY Outlook 26 September

The Nifty 50 ended at 24,891, losing 162 points, and confirmed a continuation of its negative bias. Persistent foreign fund withdrawals and sharp declines in IT heavyweights dragged the benchmark lower.

As per technical signals, traders holding shorts should keep positions intact with a stoploss at 25,151. Any fresh long entry will be valid only if Nifty closes above 25,151, which could indicate a trend reversal.

- Support: 24,815 – 24,740 – 24,601

- Resistance: 25,030 – 25,168 – 25,244

The index is expected to remain volatile within a range of 24,718 to 25,062, with downside risks dominating unless strong institutional buying emerges.

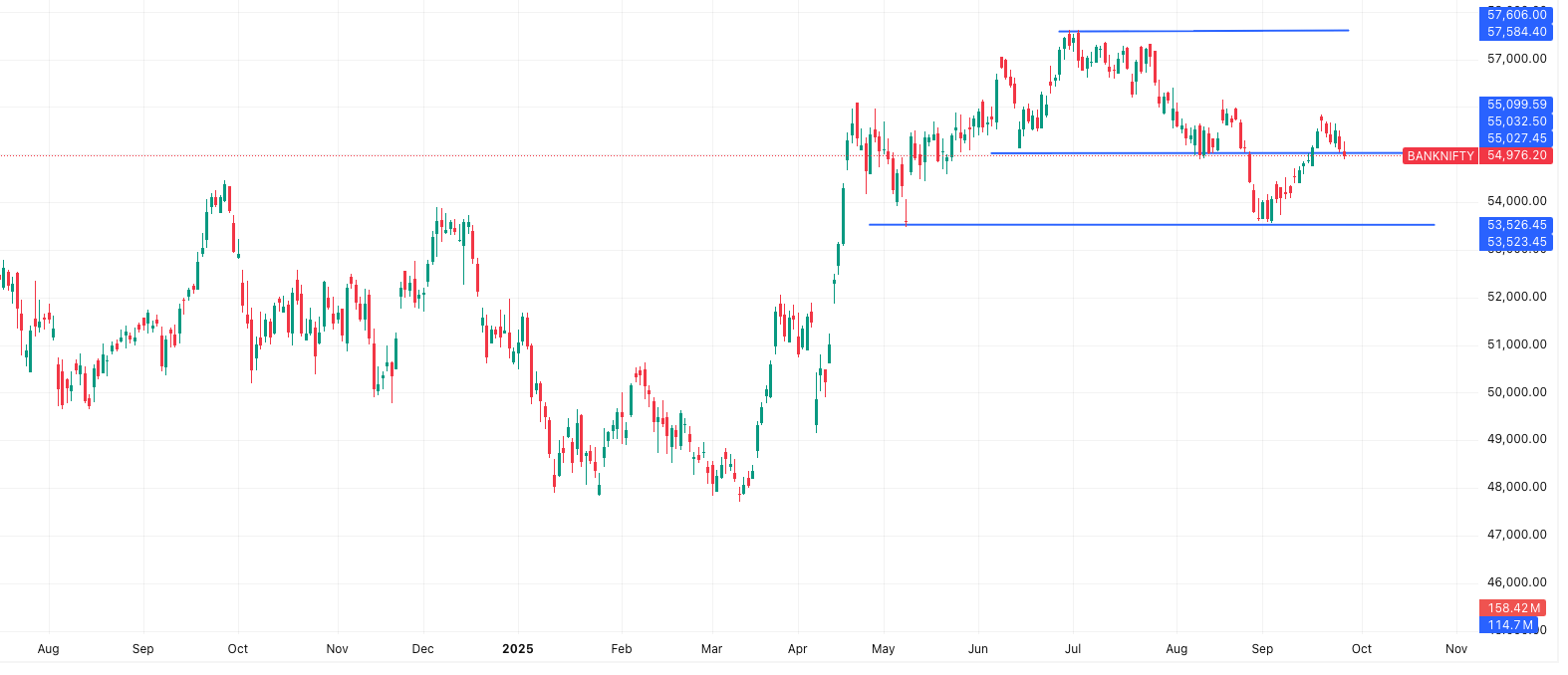

BANKNIFTY Outlook 26 September

The Bank Nifty closed at 54,976, showing relative resilience compared to the broader market but still ending in the red. The index has entered a negative trend, though selling pressure was less aggressive than in IT and Realty.

Equitypandit suggests that traders can continue to hold short positions with a stoploss at 55,511. For bullish momentum to return, Bank Nifty must close convincingly above this mark, which would bring stability to financial counters.

- Support: 54,827 – 54,679 – 54,454

- Resistance: 55,201 – 55,425 – 55,574

The banking index is expected to oscillate in the range of 54,538 to 55,413, and traders should watch for breakouts at these levels to identify fresh trends.

News & Stocks – Market Outlook 26 September

India–US Relations & Quad Summit Updates

Diplomatic momentum between Prime Minister Narendra Modi and US President Donald Trump is gaining pace. A senior US State Department official highlighted the leaders’ “very, very positive” relationship, with planning already underway for the next Quad Summit — expected either later in 2025 or early 2026, with India as host.

Talks between the two nations have been described as “incredibly productive,” despite differences on issues like Russian oil imports and trade disputes. The US has already imposed 50% tariffs on Indian imports as a penalty for continued crude purchases from Russia, while also revoking India’s exemptions on Iran’s Chabahar Port projects.

At the same time, visa concerns remain a point of friction, with a $100,000 H-1B visa fee on new applicants raising industry costs. However, US officials insist the fee will target fraud, not genuine applicants. Despite turbulence, the US continues to underline India as a “critical partner” in the Indo-Pacific, pointing to stronger defence and energy cooperation ahead.

Stock To Watch Today:

- IT Sector: Infosys, TCS, Wipro, HCL Tech (H-1B visa fee hikes add cost pressure).

- Oil & Gas: Reliance Industries, ONGC (tariff impact on Russian crude).

- Defence & Infra: HAL, BEL, L&T (defence cooperation + Quad).

US–India Energy Trade & Cooperation

US Energy Secretary Chris Wright praised India as an “awesome ally” and a “dynamic society” with rapidly growing energy demand. He confirmed Washington’s intent to expand cooperation in natural gas, coal, nuclear power, and clean fuels, despite tensions over Russian crude.

Wright noted that while Russian oil imports are a sticking point, India’s growing energy needs make it a key partner. He specifically pointed to India’s progress in LPG and clean cooking fuels, where New Delhi has become a “star performer.”

The big picture: The US wants to deepen energy exports to India, balancing its strategic stance on Russia with commercial gains in the Indian energy market.

Stock To Watch Today:

- Energy & Oil Marketing: ONGC, GAIL, IOC, BPCL, HPCL (gas & oil trade).

- Power & Renewables: NTPC, Adani Green, Tata Power (clean energy cooperation).

- Nuclear Tech Suppliers: NPCIL-linked contractors, L&T (nuclear infra build).

India–US Trade Talks & Tariffs

Trade negotiations between India and the US have restarted after disruptions caused by 50% tariffs on Indian goods, including penalties for Russian crude imports. Both countries are now aiming for a comprehensive goods-and-services trade deal, though progress may be slow given friction over energy purchases.

According to reports, American negotiators view Indian investment in the US positively, and both sides are working towards shaping a balanced deal that addresses strategic as well as commercial interests.

The tariff issue remains a headwind, but the continuation of talks signals that both governments are keen to avoid prolonged disruption.

Stock To Watch Today:

- Export-driven IT & Pharma: Infosys, TCS, Dr. Reddy’s, Sun Pharma (sensitive to tariff changes).

- Textiles & Manufacturing: Welspun India, Page Industries, Bharat Forge (trade exposure).

- Energy Players: Reliance, ONGC (tariffs linked to crude imports).

Swiggy’s Rs 2,400 Cr Rapido Exit

Food delivery giant Swiggy Ltd. will raise Rs 2,400 crore by selling its stake in Rapido. This boosts its cash reserves to Rs 7,750 crore, giving it runway for about eight quarters, but still far behind rival Eternal Ltd. (Zomato) which holds Rs 18,860 crore in cash.

Swiggy has faced concerns over cash burn, with losses driven by expansion into non-core verticals like Swiggy Scenes and Snacc. The company is also losing ground in quick commerce, with Blinkit (Eternal-owned) opening stores at a much faster pace.

To streamline operations, Swiggy is restructuring Instamart into a step-down subsidiary, enabling potential fundraising at the vertical level. Analysts believe this could unlock value but caution that its financial health remains weaker than Zomato’s.

Stock To Watch Today:

- Zomato (Eternal Ltd.): Strengthened market leadership, treasury advantage.

- Swiggy IPO-bound: Valuation reset risk, investor watch on cash discipline.

- Amazon & Flipkart (private arms): Rising quick commerce rivalry.

Indian Hotels – Taj Bandstand Revival

Indian Hotels Company Ltd. (IHCL), the Tata Group hospitality arm, has received final approvals to commence work on the Taj Bandstand project at Bandra, Mumbai. The Rs 2,500 crore project will deliver a 330-room luxury hotel and 85 serviced apartments by 2029.

The redevelopment of the iconic Sea Rock Hotel site has faced delays since the 1993 terror attack and subsequent litigation. Now, with clearances in place, construction will begin under ELEL Hotels and Investment Ltd., IHCL’s wholly owned subsidiary.

The project cements Mumbai as the city with the highest number of Taj properties, strengthening IHCL’s premium hospitality portfolio.

Stock To Watch Today:

- Indian Hotels (IHCL): Long-term value unlock, brand reinforcement.

- Construction & Realty: L&T, Oberoi Realty (infra synergies).

Hindustan Zinc’s Expansion Push

Hindustan Zinc Ltd. (HZL) announced plans to double its annual metal production to 2 million tonnes within 3–5 years, backed by a Rs 30,000–35,000 crore capex program.

The company holds reserves of 450 million tonnes of ore (~30 million tonnes of metal equivalent), enough to sustain this scale-up. HZL will boost mining efficiency by 30%, supported by an Australian consultant, and expand mines both horizontally and in depth.

The company’s strong balance sheet, with an estimated Rs 10,000 crore annual PAT, ensures no need for external debt funding. Orders for smelters, concentrators, and mine expansions will be placed by Nov 2025.

Stock To Watch Today:

- Hindustan Zinc: Strong growth visibility, capex-driven volume expansion.

- Vedanta Ltd.: Parent company benefits from HZL’s profitability.

- Mining Contractors & Infra: L&T, Tata Projects (mining infrastructure).

IPO Update — Market Outlook 26 September

The IPO market continues to stay active, with several mainboard and SME issues progressing through their timelines. In this Market Outlook 26 September, we highlight the latest GMP trends along with subscription and listing schedules so that investors can stay prepared.

Mainboard IPOs

| IPO Name | GMP (Listing gain) | Open Date | Close Date | Listing Date |

|---|---|---|---|---|

| Om Freight Forwarders | ₹11 (8.15%) | 29-Sep | 03-Oct | 08-Oct |

| Fabtech Technologies | ₹10 (5.24%) | 29-Sep | 01-Oct | 07-Oct |

| Pace Digitek | ₹20 (9.13%) | 26-Sep | 30-Sep | 06-Oct |

| TruAlt Bioenergy | ₹75 (15.12%) | 25-Sep | 29-Sep | 03-Oct |

| Jinkushal Industries | ₹21 (17.36%) | 25-Sep | 29-Sep | 03-Oct |

| Epack Prefab Technologies | ₹15 (7.35%) | 24-Sep | 26-Sep | 01-Oct |

| BMW Ventures | ₹8 (8.08%) | 24-Sep | 26-Sep | 01-Oct |

| Jain Resource Recycling | ₹17 (7.33%) | 24-Sep | 26-Sep | 01-Oct |

| Jaro Institute | ₹71 (7.98%) | 23-Sep | 25-Sep | 30-Sep |

| Anand Rathi Share | ₹31 (7.49%) | 23-Sep | 25-Sep | 30-Sep |

| Seshaasai Technologies | ₹56 (13.24%) | 23-Sep | 25-Sep | 30-Sep |

| Solarworld Energy Solutions | ₹52 (14.81%) | 23-Sep | 25-Sep | 30-Sep |

| Atlanta Electricals | ₹95 (12.60%) | 22-Sep | 24-Sep | 29-Sep |

| Ganesh Consumer Products | ₹2 (0.62%) | 22-Sep | 24-Sep | 29-Sep |

| Saatvik Green Energy (Allotted) | ₹6 (1.29%) | 19-Sep | 23-Sep | 26-Sep |

👉 IPO listing today: Saatvik Green Energy makes its debut on the bourses on 26 September.

SME IPOs

| IPO Name | GMP (Listing gain) | Open Date | Close Date | Listing Date |

|---|---|---|---|---|

| Riddhi Display Equipments | ₹1 (1.00%) | 25-Sep | — | — |

| Valplast Technologies | ₹3 (5.56%) | 30-Sep | 03-Oct | 08-Oct |

| Rukmani Devi Garg Agro Impex | ₹14 (14.14%) | 26-Sep | 30-Sep | 06-Oct |

| Gujarat Peanut | ₹7 (8.75%) | 25-Sep | 29-Sep | 03-Oct |

| Chatterbox Technologies | ₹22 (19.13%) | 25-Sep | 29-Sep | 03-Oct |

| Justo Realfintech | ₹8 (6.30%) | 24-Sep | 26-Sep | 01-Oct |

| Systematic Industries | ₹20 (10.26%) | 24-Sep | 26-Sep | 01-Oct |

| Praruh Technologies | ₹3 (4.76%) | 24-Sep | 26-Sep | 01-Oct |

| Gurunanak Agriculture | — | 24-Sep | 26-Sep | 01-Oct |

| BharatRohan Airborne Innovations | ₹8 (9.41%) | 23-Sep | 25-Sep | 30-Sep |

| Aptus Pharma | ₹4 (5.71%) | 23-Sep | 25-Sep | 30-Sep |

| Matrix Geo Solutions | ₹6 (5.77%) | 23-Sep | 25-Sep | 30-Sep |

| True Colors | ₹42 (21.99%) | 23-Sep | 25-Sep | 30-Sep |

| Ecoline Exim | ₹9 (6.38%) | 23-Sep | 25-Sep | 30-Sep |

| Prime Cable Industries | ₹3 (3.61%) | 22-Sep | 24-Sep | 29-Sep |

👉 No SME IPO is scheduled to list on 26 September.

Overall, the IPO calendar in this Market Outlook 26 September highlights a packed pipeline, with Saatvik Green Energy’s listing being the key event of the day. Investors should track opening trades and GMP performance closely for cues on broader IPO sentiment.

Stocks in Radar – Market Outlook 26 September

Minda Corporation Ltd. (NSE: MINDACORP | BSE: 538962)

CMP: ₹576 | Target: ₹640 | Upside: 11.1% | Duration: 6–12 Months

Research Source: SBI Securities (SSL Research, ACE Equity)

Business Overview

Minda Corporation Ltd. (MCL), the flagship company of Spark Minda, is one of India’s leading automotive component manufacturers with strong domestic presence and global reach. Its diversified product portfolio spans advanced electronics, mechatronics, die casting, electrical information systems, and interior plastics. These products cater to two-wheelers, three-wheelers, passenger and commercial vehicles, off-roaders, and the aftermarket segment.

Financials & Strategic Moves

- Market Cap: ₹13,775 crore

- Promoter Holding: 64.8% (0% pledged)

- Average Volumes: 4.7L/3.7L (5D/30D)

- Delivery Volumes: 2.3L/2.0L (5D/30D)

Key financial highlights:

- Revenue target of ₹17,500 crore by FY30 (3.5x growth).

- EBITDA margin expected to rise from 11.4% in FY25 to 12.5%+ by FY30.

- Debt/Equity ratio to decline from 0.6x in FY25 to 0.3x by FY30.

Growth Drivers

- Premiumization of portfolio: Entry into smart locks, EV high-voltage harness systems, ADAS, onboard chargers, and more.

- Strategic partnership with Flash Electronics: 49% stake acquisition adds global R&D and EV systems pipeline.

- Industry tailwinds: GST rationalization, policy support, and strong demand recovery boosting auto sector growth.

Outlook

With strong fundamentals, a visionary growth plan (Vision 2030), and multiple industry tailwinds, Minda Corporation is well-positioned to deliver value. At current valuation (46.6x/33.4x FY26E/FY27E earnings), the stock offers attractive upside. Investors can accumulate in the ₹570–582 range for medium-term gains.

In the context of Market Outlook 26 September, SBI Securities has highlighted Minda Corporation as a strong candidate to watch, thanks to its strategic EV push, new product launches, and steady financial performance. This stock stands out as one of the key opportunities in today’s edition of Market Outlook 26 September.

Conclusion

The Market Outlook 26 September edition paints an interesting picture for investors and traders. While global market trends, crude oil movement, and foreign fund flows will continue to drive short-term sentiment, India’s structural story remains strong. Sectors like auto, banking, and capital goods are showing resilience, and selective opportunities are emerging even in a cautious market setup.

Today’s listings and IPO activity add an extra layer of excitement to the markets, offering fresh options for investors to track. Meanwhile, our stock pick – Minda Corporation Ltd. – stands out with its robust business model, strong industry tailwinds, and ambitious Vision 2030 roadmap, making it a compelling name to watch in the auto ancillary space.

Overall, this Market Outlook 26 September edition encourages participants to stay disciplined, track technical levels closely, and keep an eye on key news developments. Opportunities are plenty – but the winners will be those who combine patience with smart stock selection.

In this newsletter, we bring you technical views, key news, IPO updates, and stocks to watch for today.

Related Articles

India’s $40 Billion Spending Wave: What’s Powering the Next Consumption Boom?

Battery Energy Storage in India: The $32 Billion Opportunity Powering the Green Shift

Power Sector Boom in India: Stocks to Watch and Why It’s Just Beginning

Vehicle-to-Grid (V2G) Technology: How India Is Gearing Up and 5 Stocks to Watch