Introduction – Market Outlook 24 September

Good morning and welcome to your Market Outlook 24 September Edition.

The Indian equity market closed on a mixed note on Tuesday. The Nifty 50 slipped 29.65 points to 25,172.70 while the Sensex dipped 10.25 points to end at 82,149.72, both settling flat after intraday volatility. The pressure came largely from IT stocks, with the Nifty IT index losing 200 points (-0.56%). On the other hand, banking stocks provided resilience, as the Nifty Bank advanced 269 points (0.49%), helping the market trim deeper losses.

Broader markets remained weak, with the S&P BSE SmallCap index falling 189 points (-0.35%), signaling cautious sentiment among retail investors. Overall, the session reflected a tug-of-war between banking strength and IT weakness, keeping the indices range-bound.

That sets the tone for today’s session—let’s dive deeper into key technical levels, stock-specific news, IPO updates, and stocks on our radar in this newsletter.

Index Technical View – Market Outlook 24 September

According to EquityPandit’s analysis, Indian equities are starting the week on a cautious note. Both Sensex and Nifty are trading under pressure, while Bank Nifty continues to hold ground in positive territory. Traders should remain watchful of key support and resistance levels as markets may witness range-bound moves with sector-specific action.

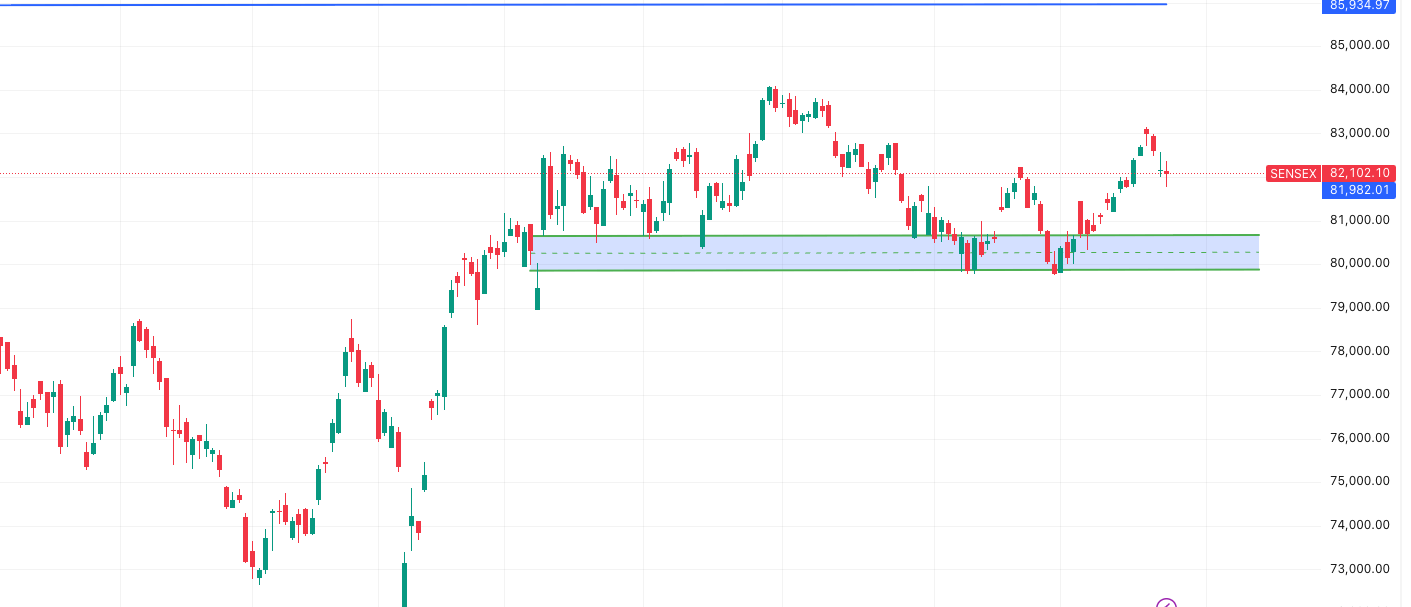

Sensex (82,102) – Negative Trend

The Sensex is still in a downward phase. Short positions can be carried with a closing stoploss at 82,619. Fresh buying is only advisable if the index closes above this level.

- Support Levels: 81,796 – 81,489 – 81,202

- Resistance Levels: 82,389 – 82,677 – 82,983

- Tentative Range: 82,673 – 81,530

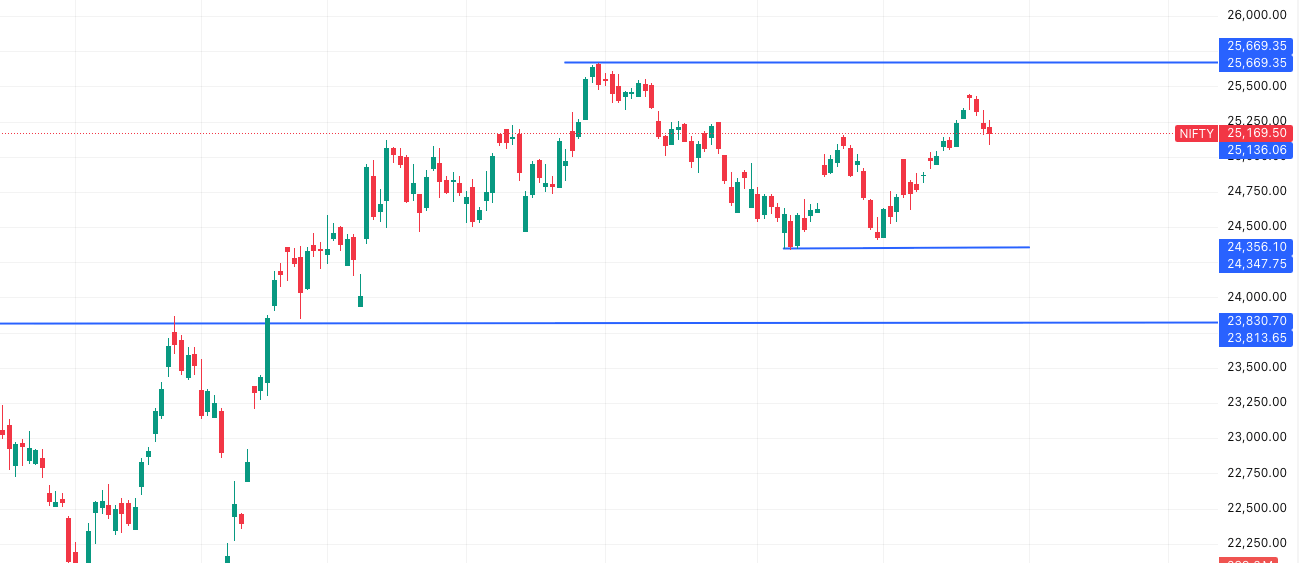

Nifty 50 (25,170) – Negative Trend

Nifty remains weak, and traders should maintain shorts with a stoploss at 25,334. A decisive close above 25,334 could shift momentum positively.

- Support Levels: 25,082 – 24,995 – 24,905

- Resistance Levels: 25,259 – 25,349 – 25,437

- Tentative Range: 25,340 – 24,998

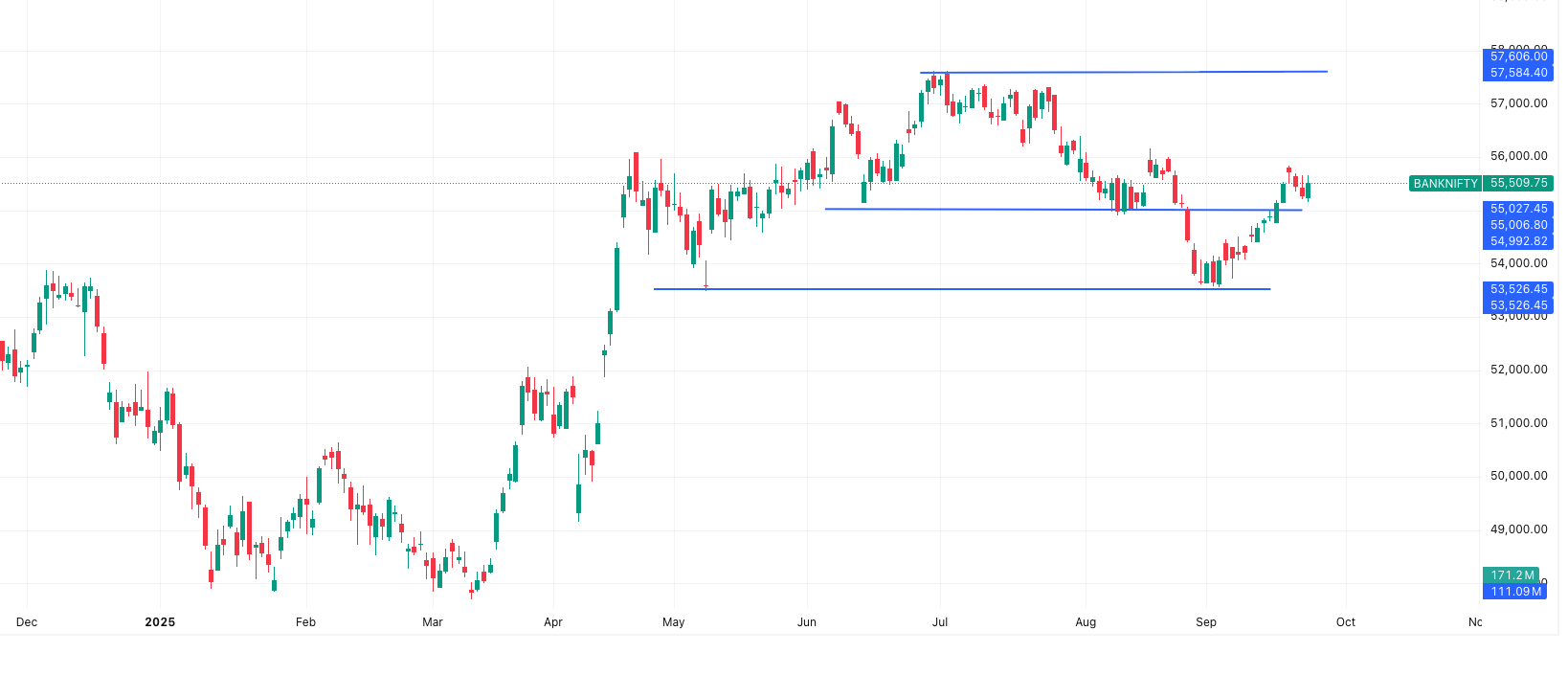

Bank Nifty (55,510) – Positive Trend

Bank Nifty shows relative strength and continues to provide stability. Long positions can be held with a stoploss at 55,253, while fresh shorts should only be considered below this mark.

- Support Levels: 55,225 – 54,941 – 54,722

- Resistance Levels: 55,728 – 55,947 – 56,231

- Tentative Range: 55,949 – 55,069

Overall, Market Outlook 24 September suggests that broader indices may trade cautiously, with Bank Nifty acting as a key driver to balance weakness in Nifty and Sensex.

News & Stocks – Market Outlook 24 September

The markets today are likely to react to a mix of global trade tensions, domestic policy developments, sectoral outlooks, and fresh IPO buzz. Here’s a deeper look into the headlines that matter:

India’s Growth Outlook Reaffirmed

S&P Global Ratings has reaffirmed India’s GDP forecast at 6.5% for FY26, supported by robust domestic demand, a generally benign monsoon, GST and income tax cuts, and a pickup in government spending. The rating agency noted that India’s economy expanded 7.8% in Q1 FY26, and momentum is expected to remain strong despite global headwinds. On inflation, S&P revised its forecast lower to 3.2%, thanks to falling food prices, and now expects the RBI to cut policy rates by 25 bps this year to further stimulate growth.

👉 Stocks to watch: Banking majors like HDFC Bank, ICICI Bank, and consumption-focused plays such as HUL, ITC, Avenue Supermarts could benefit from sustained domestic demand.

$125 Million ADB Loan to Boost Assam Infra

The Government of India signed a $125 million loan pact with the Asian Development Bank (ADB) to strengthen infrastructure in Assam. The funds will be directed towards building six water treatment plants with a capacity of 72 million litres per day, 800 km of water pipelines, and storm water management systems across six districts. The project is expected to benefit 3.6 lakh residents while enhancing climate resilience.

👉 Stocks to watch: Infra and utilities players like L&T, NCC, NBCC, and utilities companies operating in the Northeast may see positive sentiment.

Medicap Healthcare Files ₹240 Cr IPO

Vadodara-based Medicap Healthcare Ltd. has filed its draft papers with SEBI to raise ₹240 crore via IPO. The fresh issue proceeds will be used to install new injection moulding machines to boost capacity by nearly 966 million units annually, repay debt, and fund subsidiary KASR Healthcare. Financially, the company has shown strong growth with FY25 revenue at ₹108.3 Cr (up 51% in 2 years) and PAT at ₹26.6 Cr (up 80% in 2 years). However, risks remain with high dependency on Euro Head caps and operations concentrated in a single facility.

👉 Stocks to watch: While Medicap itself is unlisted, peers like Essel Propack, Uflex, and packaging material suppliers could see sympathy moves.

Copper Demand – A Multi-Bagger Theme?

Analyst Ambareesh Baliga believes copper could be the new “gold”, thanks to rising demand from AI, data centres, EVs, and renewable energy. Hindustan Copper recently announced plans to ramp up production from 3.47 MTPA to 12.2 MTPA by FY31, sparking investor optimism. The stock has already surged 26% in the past month, but analysts believe it may still deliver multi-bagger returns over 2–3 years.

👉 Stocks to watch: Hindustan Copper, Vedanta, Hindalco could all ride the copper demand boom.

Power Sector – CLSA’s Revised Targets

Brokerage firm CLSA has turned positive on select utilities. It upgraded Tata Power to “Hold” with a price target of ₹369, while raising targets for SJVN (₹90) and JSW Energy (₹486). Analysts see better opportunities in regulated utilities like NTPC, NHPC, and CESC, particularly with NTPC set to launch its $6B nuclear project later this month.

👉 Stocks to watch: Tata Power, NTPC, NHPC, SJVN, CESC, JSW Energy.

PMI Data Signals Strong Momentum

The HSBC Flash India Composite Output Index for September came in at 61.9, slightly lower than August’s 63.2, but still among the best readings in two years. Manufacturing PMI eased to 58.5 and Services PMI to 61.6, indicating slower but still solid expansion. Export orders have softened due to higher US tariffs, but lower GST rates and rising domestic orders have offset the weakness.

👉 Stocks to watch: Manufacturing-heavy midcaps, service exporters, and FMCG names that benefit from domestic demand resilience.

Defence Sector Outlook Positive

A report by Crisil Ratings projects 16–18% revenue growth for private defence companies in FY26, with order books expected to swell to ₹55,000 Cr by FY26 from ₹40,000 Cr in FY25. Operating margins are expected to remain in the 18–19% range, driven by government capex and initiatives like the Atmanirbhar Bharat and the ₹4 Trillion Sudarshan Chakra Project.

👉 Stocks to watch: Bharat Dynamics, HAL, Data Patterns, BEL, Paras Defence, MTAR Tech.

In short, today’s Market Outlook 24 September is shaped by strong domestic fundamentals, fresh infra push in Assam, IPO activity, sectoral outlooks in copper, power, and defence, and robust PMI data despite global trade challenges.

Mainboard IPOs – Market Outlook 24 September

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| Om Freight Forwarders | 29-Sep | 3-Oct | 8-Oct | ₹10 (7.41%) |

| Pace Digitek | 26-Sep | 30-Sep | 6-Oct | ₹25 (11.42%) |

| Jinkushal Industries | 25-Sep | 29-Sep | 3-Oct | ₹51 (42.15%) |

| TruAlt Bioenergy | 25-Sep | 29-Sep | 3-Oct | ₹58 (11.69%) |

| Jain Resource Recycling | 24-Sep | 26-Sep | 1-Oct | ₹25 (10.78%) |

| Epack Prefab Technologies | 24-Sep | 26-Sep | 1-Oct | ₹14 (6.86%) |

| Jaro Institute | 23-Sep | 25-Sep | 30-Sep | ₹123 (13.82%) |

| Seshaasai Technologies | 23-Sep | 25-Sep | 30-Sep | ₹75 (17.73%) |

| Anand Rathi Share | 23-Sep | 25-Sep | 30-Sep | ₹35 (8.45%) |

| Solarworld Energy Solutions | 23-Sep | 25-Sep | 30-Sep | ₹65 (18.52%) |

| Atlanta Electricals | 22-Sep | 24-Sep | 29-Sep | ₹110 (14.59%) |

| Ganesh Consumer Products | 22-Sep | 24-Sep | 29-Sep | ₹10 (3.11%) |

Quick Insight: Top GMP for Mainboard IPOs – Jinkushal Industries at 42%, Atlanta Electricals at 14.6%, Seshaasai Technologies at 17.7%.

SME IPOs – Market Outlook 24 September

| IPO Name | Open Date | Close Date | Listing Date | GMP (Est. Listing Gain) |

|---|---|---|---|---|

| Chatterbox Technologies | 25-Sep | 29-Sep | 3-Oct | ₹33 (28.70%) |

| Riddhi Display Equipments | 24-Sep | 26-Sep | 1-Oct | ₹4 (4.00%) |

| Systematic Industries | 24-Sep | 26-Sep | 1-Oct | ₹15 (7.69%) |

| Justo Realfintech | 24-Sep | 26-Sep | 1-Oct | ₹11 (8.66%) |

| BharatRohan Airborne Innovations | 23-Sep | 25-Sep | 30-Sep | ₹10 (11.76%) |

| Aptus Pharma | 23-Sep | 25-Sep | 30-Sep | ₹7 (10.00%) |

| Matrix Geo Solutions | 23-Sep | 25-Sep | 30-Sep | ₹10 (9.62%) |

| True Colors | 23-Sep | 25-Sep | 30-Sep | ₹45 (23.56%) |

| Ecoline Exim | 23-Sep | 25-Sep | 30-Sep | ₹15 (10.64%) |

| Prime Cable Industries | 22-Sep | 24-Sep | 29-Sep | ₹6 (7.23%) |

| JD Cables | 18-Sep | 22-Sep | 25-Sep | ₹43 (28.29%) |

Quick Insight: Top GMP for SME IPOs – JD Cables at 28.3%, Chatterbox Technologies at 28.7%, True Colors at 23.6%.

Stock In Radar – Market Outlook 24 September

AGI Greenpac Ltd (AGI) – BUY

CMP: ₹860 | Target Price (Sep-26E): ₹1,520 | Upside: 81%

Analyst Recommendation: BUY | Research House: Emkay Research

Company Overview:

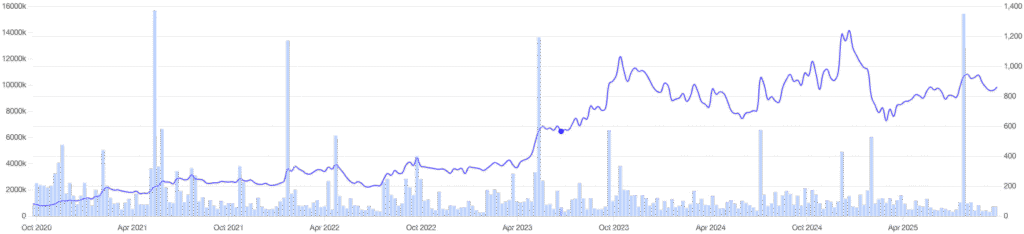

AGI Greenpac is a leading player in the Indian container glass (CG) industry with over 20% market share. The company has demonstrated resilience in a cyclical industry, outperforming peers even during periods of demand volatility, overcapacity, and energy cost spikes. With a focus on innovation, cost efficiency, and disciplined capital allocation, AGI has maintained strong growth metrics over the last decade.

Growth Strategy & Capex Plans:

- Expanding glass production capacity by 30% to ~2,600 tonnes per day (tpd) by FY27 with a new ₹7bn plant in Madhya Pradesh.

- Diversifying into the aluminium can segment, targeting 1.6 billion units capacity by CY30, supported by ₹10bn capex.

- Existing PET bottle and caps business expected to grow in double digits, adding to revenue diversification.

- Focused capex strategy ensures long-term sustainable growth while improving operational efficiency.

Financial Performance & Projections:

- Revenue CAGR (FY25–28E): 17% → ₹25,288 mn (FY25) to ₹40,981 mn (FY28E)

- EBITDA CAGR (FY25–28E): 20% → ₹6,139 mn (FY25) to ₹10,647 mn (FY28E)

- APAT CAGR (FY25–28E): 29% → ₹2,923 mn (FY25) to ₹6,234 mn (FY28E)

- EBITDA margin expected to expand from 24.3% (FY25) to 26% (FY28E) due to benign input costs and specialty glass ramp-up.

- RoE improving from 16.5% (FY25) to 20.4% (FY28E), RoIC from 14.3% → 24.4%.

- Valuation remains attractive: <9x FY28E EPS of ₹96.4, providing strong upside potential.

Sector Outlook:

- Indian CG sector remains stable with projected volume growth of 4–5% CAGR and value growth of 8–9% CAGR.

- Demand driven by key user industries: Alcoholic Beverages, F&B, and Pharmaceutical packaging.

- Input costs (soda ash, energy) expected to remain under control, supporting steady margins.

Investment Thesis:

- Proven track record navigating cyclical challenges and expanding market share.

- Strategic diversification into aluminium cans and PET bottles positions AGI for long-term growth.

- Strong capex plans and operational efficiency improvements enhance earnings visibility.

- Attractive risk-reward ratio with 81% upside potential from CMP.

Conclusion – Market Outlook 24 September

The Indian equity market is set to open with cautious optimism amid mixed global cues and domestic developments. While short-term headwinds such as global trade tensions and tariff-related concerns persist, strong domestic demand, robust corporate earnings, and government-backed infrastructure initiatives continue to provide stability.

Key sectors to watch today include container glass, renewable energy, power utilities, and defence, where structural growth trends and strategic expansions are driving long-term value. Additionally, several IPOs opening and closing this week could influence market sentiment and create trading opportunities for both retail and institutional investors.

Investors are advised to monitor crucial support and resistance levels for Nifty, Bank Nifty, and Sensex, while selectively exploring high-conviction stocks like AGI Greenpac, which offer both growth and long-term potential. A balanced approach combining trend-following strategies with selective stock-picking remains prudent in the current market scenario.

Stay informed, watch the market closely, and align trades with your risk tolerance.

More Articles

When to Sell Mutual Funds: 5 Proven Exit Strategies

The Hidden Multibagger Stock: 5 Positive Triggers That Make Suven Life Sciences a Game-Changer

The Indian Retirement Savings Crisis: 5 Reasons EPF and PPF Won’t Be Enough