Market Outlook 1st September – Intro

Good morning and welcome to your Market Outlook 1st September Edition.

The week wrapped up with a subdued session as Indian equities faced the weight of weak global cues, persistent FII outflows, and sectoral volatility. After a flat start, benchmark indices drifted lower, mirroring cautious investor sentiment.

- Nifty 50 closed at 24,424.30, down 76.60 points (0.31%)

- Sensex ended at 79,871.24, losing 209.33 points (0.26%)

- Bank Nifty slipped 0.24%

- Nifty IT tumbled 0.86%

- S&P BSE SmallCap fell 0.28%

The pressure came largely from IT and banking stocks, while midcaps and select pockets showed some resilience. Yet, the broader mood stayed cautious.

As we step into a new trading month, Market Outlook 1st September turns the spotlight on global economic data, oil price trends, and institutional flows. After August’s soft close, the Market Outlook 1st September also signals a period of heightened volatility but fresh opportunities, especially for short-term traders eyeing sector rotations.

Index Outlook – Market Outlook 1st September

The Indian market sentiment continues to stay weak, with global cues and foreign outflows dragging indices lower. According to EquityPandit Analysis, all major benchmarks — Sensex, Nifty, and Bank Nifty — are in a negative trend, and traders are advised to remain cautious with a short bias until key resistance levels are crossed.

🔹 Sensex (79,871)

According to EquityPandit Analysis, the Sensex is trading in a negative zone. Short positions can be held with a strict stoploss at higher resistance, while fresh longs should only be taken if the index closes above 80,684.

- Support Levels: 79,597 – 79,385 – 79,028

- Resistance Levels: 80,166 – 80,523 – 80,735

- Tentative Range: 80,473 – 79,145

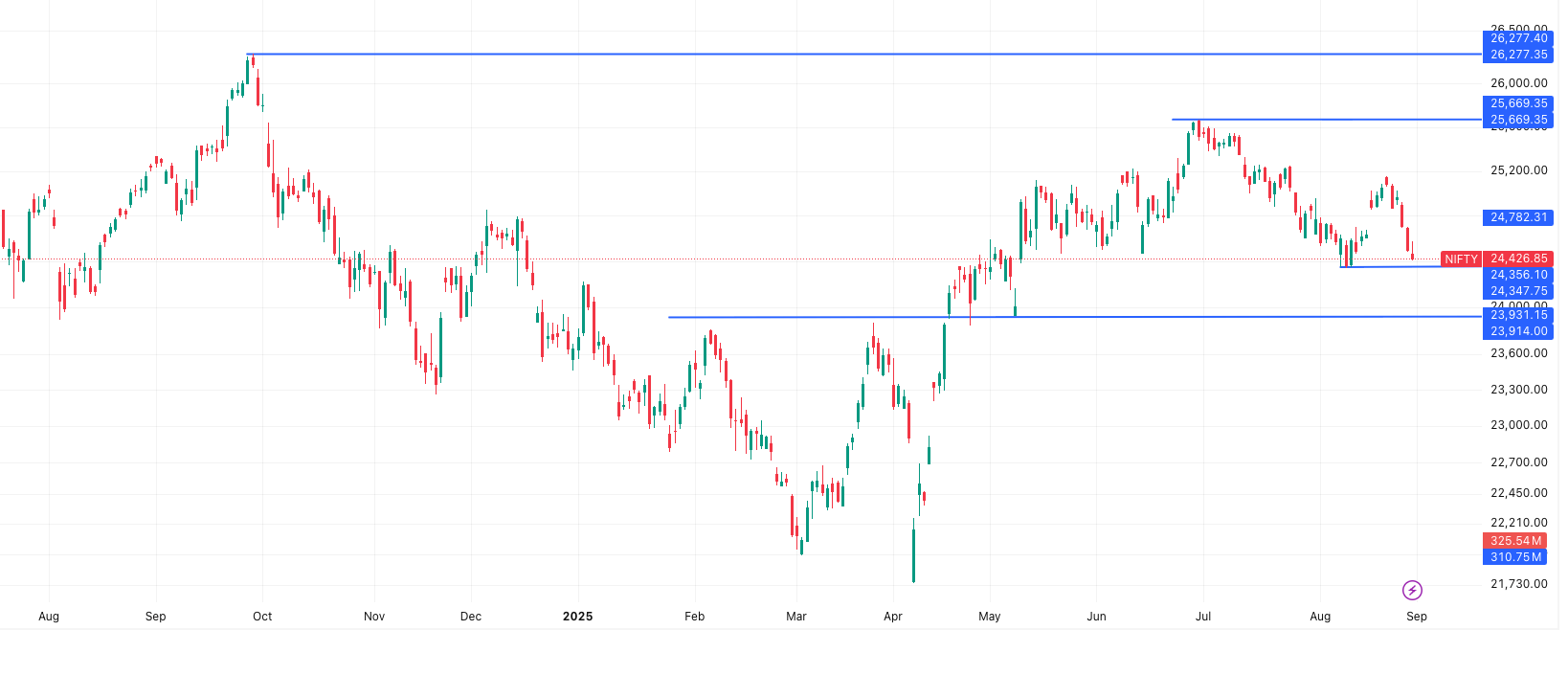

🔹 Nifty 50 (24,427)

As per EquityPandit Analysis, Nifty also remains in a bearish mode, showing weak sentiment with repeated support testing. Fresh upside trades will be safe only above a close of 24,689, while short positions remain favorable until then.

- Support Levels: 24,364 – 24,300 – 24,196

- Resistance Levels: 24,531 – 24,636 – 24,699

- Tentative Range: 24,629 – 24,223

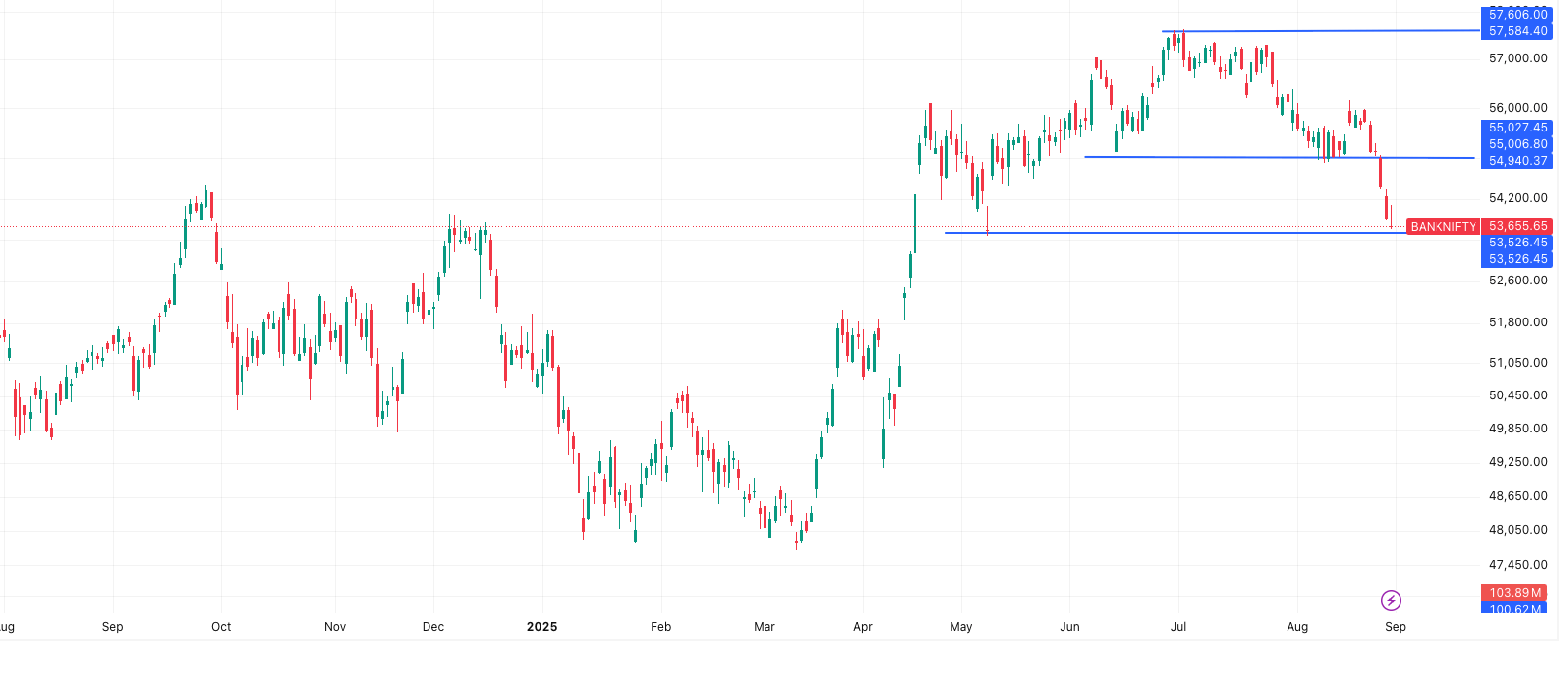

🔹 Bank Nifty (53,656)

EquityPandit Analysis suggests Bank Nifty continues in a negative trend with weakness in leading bank stocks. Shorts are active and should be maintained with stoplosses in place. New long positions are advised only above a decisive close of 54,360.

- Support Levels: 53,479 – 53,303 – 53,000

- Resistance Levels: 53,959 – 54,262 – 54,439

- Tentative Range: 54,169 – 53,141

Takeaway for Market Outlook 1st September:

According to EquityPandit Analysis, all three indices — Sensex, Nifty, and Bank Nifty — are in a negative trend. The overall structure suggests traders should stay cautious, stick to short positions, and only look for fresh longs if key resistance levels are breached.

News & Stocks That Might Impact – Market Outlook 1st September

A quick roundup of fresh developments that could move markets today. Below each news item I explain the key facts in plain language and list stocks that may react — with a short note on why.

India–Japan Summit 2025 — $68bn investment push

The news: India and Japan announced a joint commitment of $68 billion over the next decade focused on clean energy, infrastructure, semiconductors, AI and talent exchange. The summit also renewed backing for projects such as high-speed rail and joint supply-chain initiatives for critical minerals and batteries.

Why it matters: Large, multi-year capital inflows plus technology partnerships can lift capex, exports and domestic manufacturing across several sectors.

Stocks that might react:

- Adani Green, Tata Power — clean-energy projects and financing could accelerate renewables capacity and order pipelines.

- L&T, IRCON, Texmaco — big infra and rail contracts (including bullet train work) boost order visibility and execution backlog.

- Dixon Technologies, Vedanta (semiconductor initiatives) — companies in electronics/semiconductor supply chains stand to gain from localization and tech partnerships.

- Select engineering & component makers — beneficiaries of expanded supply-chain investments.

Emami to accelerate overseas push

The news: Emami plans to enter new overseas markets to accelerate international growth; its international business has grown at ~11% CAGR over five years. Management says health & wellness remains a focus.

Why it matters: Faster international expansion could raise revenue visibility and improve margins over time.

Stocks that might react:

- Emami — direct beneficiary from faster overseas rollouts and better top-line mix.

- Dabur, Marico, Himalaya — peers in health & wellness and consumer staples may see re-rating or stock comparisons.

Adani Power wins LoA for 800 MW plant in MP

The news: Adani Power received a Letter of Award to supply power from a new 800 MW ultra-supercritical plant in Anuppur (MP). Project CAPEX ~₹10,500 crore; tariff ~₹5.838 / kWh; commissioning within 54 months.

Why it matters: Adds a large contracted order to Adani Power’s pipeline and supports medium-term revenue visibility for the group’s power business.

Stocks that might react:

- Adani Power — direct impact from new long-dated supply contract and secured off-take.

- Adani Enterprises / Adani group suppliers — downstream infra and fuel linkages could see sentiment benefit.

Zydus Wellness acquires Comfort Click (UK) for GBP 239m

The news: Zydus Wellness’ UK arm agreed to buy Comfort Click Ltd for GBP 239 million (~₹2,846 crore). Comfort Click is a digital VMS (vitamins, minerals & supplements) business with strong European & U.S. traction and high growth.

Why it matters: Marks Zydus’ first major overseas acquisition and expands its digital + VMS footprint, adding recurring revenue and cross-sell opportunities.

Stocks that might react:

- Zydus Wellness (ZWL) — direct strategic and revenue upside; watch integration execution.

- Dabur, Emami, Marico — comparable consumer/wellness plays may see sentiment movement as global M&A picks up.

Aurobindo / Apitoria — USFDA inspection yields 5 observations (Form 483)

The news: The FDA inspected Apitoria Pharma (Aurobindo subsidiary) and issued a Form 483 with five procedural observations; no data-integrity issues reported. Company will respond within timelines.

Why it matters: Form 483s are routine but can cause short-term caution until responses and remediation are accepted by regulators.

Stocks that might react:

- Aurobindo Pharma — stock may see volatility; focus on management response and remediation timelines.

- Sun Pharma, Dr. Reddy’s, Cipla — sector re-rating risk/reward could shift on renewed regulatory attention across peers.

Textile exporters get export-obligation relief under QCO

The news: Export obligation period for imports covered by mandatory Quality Control Orders (QCO) under the Advance Authorisation scheme has been extended from 6 months to 18 months. This applies to polyester fibre/yarn and similar inputs.

Why it matters: Longer timelines ease working-capital pressure for exporters and allow better inventory/pricing strategies.

Stocks that might react:

- Arvind, Welspun India, Vardhman Textiles — exporters of textiles and fabric may see margin relief and improved operational flexibility.

- Export-oriented smallcaps in textiles — could benefit from eased compliance and reduced cost strain.

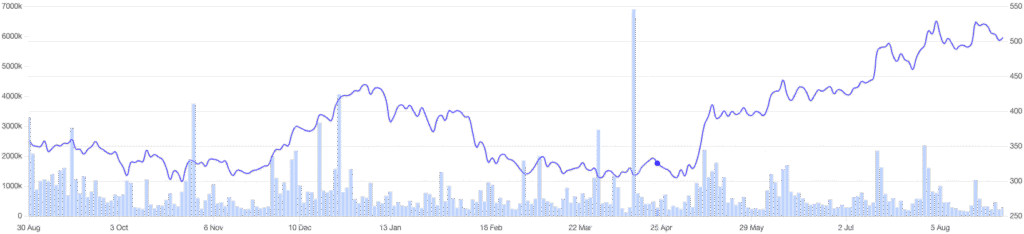

RBI credit data — lending trends cooling, personal loans rising

The news: Bank credit growth slowed to 9.9% (June 2025) from 15% a year ago; industrial credit growth is 7.6% (vs 11.3% prior). Personal loans now make up ~32% of total credit. Share of loans with rates <9% rose to 54.1%. Public sector banks posted ~11% credit growth; private banks ~8.3%.

Why it matters: Overall credit deceleration and a tilt toward retail/personal loans change earnings composition and risk profiles across banks.

Stocks that might react:

- SBI, Bank of Baroda, PNB — PSBs showing relatively stronger credit growth may attract flows.

- HDFC Bank, ICICI Bank, Kotak Mahindra — private banks could see mixed reactions as industrial lending cools but retail lending stays robust.

- NBFCs / housing finance names — monitor for changes in deposit flows, borrowing costs and retail demand.

Bottom line for Market Outlook 1st September: big macro headlines (India–Japan $68bn), large corporate orders and strategic M&A are the primary drivers today. Track the infra, energy, consumer-wellness, pharma and banking names listed above for stock-specific moves.

News & Stocks – Summary Table

| News | Key Data (Simplified) | Stocks to Watch |

|---|---|---|

| India–Japan Summit – $68bn investment push | $68bn in infra, clean energy, semiconductors, AI over 10 years | Adani Green, Tata Power, L&T, IRCON, Dixon Tech, Vedanta |

| Emami’s overseas push | International business grew ~11% CAGR; new markets planned | Emami, Dabur, Marico |

| Adani Power wins 800 MW project (MP) | ₹10,500 cr CAPEX, 54 months, tariff ₹5.838/kWh | Adani Power, Adani Enterprises |

| Zydus Wellness acquires Comfort Click (UK) | GBP 239m (~₹2,846 cr), VMS & digital wellness focus | Zydus Wellness, Dabur, Marico |

| Aurobindo (Apitoria) USFDA inspection | Form 483 issued, 5 observations, no data-integrity issues | Aurobindo Pharma, Sun Pharma, Dr. Reddy’s, Cipla |

| Textile exporters get relief (QCO extension) | Export obligation extended from 6 to 18 months | Arvind, Welspun India, Vardhman Textiles |

| RBI credit data update | Credit growth slows to 9.9%; personal loans = 32% of total | SBI, BoB, PNB, HDFC Bank, ICICI Bank, NBFCs |

IPO Updates – Market Outlook 1st September

Mainboard IPOs

| IPO Name | Open | Close | Listing | Subscription | GMP (Est. Listing Gain) |

|---|---|---|---|---|---|

| Amanta Healthcare | 1-Sep | 3-Sep | 9-Sep | – | ₹25 (~19.8%) |

| Vikran Engineering | 26-Aug | 29-Aug | 3-Sep | 24.87x | ₹6 (~6.2%) |

| Anlon Healthcare | 26-Aug | 29-Aug | 3-Sep | 7.12x | ₹2 (~2.2%) |

Quick Take:

Vikran Engineering stands out with a massive 24.87x subscription, while Amanta Healthcare opens today with decent grey market buzz.

SME IPOs

| IPO Name | Open | Close | Listing | Subscription | GMP (Est. Listing Gain) |

|---|---|---|---|---|---|

| Snehaa Organics (NSE SME) | 29-Aug | 2-Sep | 5-Sep | 1.95x | ₹30.5 (~25%) |

| Sugs Lloyd (BSE SME) | 29-Aug | 2-Sep | 5-Sep | 0.93x | ₹10 (~8.1%) |

| Abril Paper Tech (BSE SME) | 29-Aug | 2-Sep | 5-Sep | 1.35x | ₹5.5 (~9%) |

| Oval Projects Engineering (BSE SME) | 28-Aug | 1-Sep | 4-Sep | 0.68x | – |

Quick Take:

Snehaa Organics is the star of SME space with strong GMP signals, while Sugs Lloyd and Abril Paper Tech show moderate traction. Oval Projects, however, looks subdued with weak subscription.

Stock in Radar – Market Outlook 1st September

Allied Blenders and Distillers (ABDL)

CMP: ₹512 | Target Price: ₹600 | Upside: 17%

Call: BUY (Maintain) | ICICI Securities Research

Business Overview

Allied Blenders and Distillers (ABDL) is one of India’s largest spirits companies with a strong presence across multiple price points. Its flagship brand, Officer’s Choice, is a leader in the mass premium segment, delivering healthy margins due to an optimized state mix. However, the company is now shifting its strategic focus towards the high-margin Premium & Above (P&A) segment, which currently contributes ~40% of its portfolio but is targeted to scale up to 50% by FY28.

To accelerate this premiumisation journey, ABDL has:

- Launched ICONiQ White and refreshed Sterling Reserve B7 to capture consumer interest.

- Built a dedicated 50-member team to scale up super-premium and luxury offerings.

- Set a clear roadmap for backward integration (expected completion by FY27), which should improve gross margins by ~300 bps.

The company’s strategy is well-aligned with rising consumer preferences for premium liquor variants, which although just 10% of industry volumes, contribute a massive 42% of profits. This focus on premiumisation, coupled with operational improvements, is expected to drive steady revenue growth, margin expansion, and stronger ROCE in the coming years.

Financial Snapshot (INR Mn)

| Year | Revenue | EBITDA | EBITDA % | Net Profit | EPS (₹) | RoCE % |

|---|---|---|---|---|---|---|

| FY24A | 32,977 | 2,421 | 7.3% | 68 | 0.3 | 2.2 |

| FY25A | 34,918 | 4,306 | 12.3% | 1,948 | 7.0 | 14.7 |

| FY26E | 39,818 | 5,183 | 13.0% | 2,541 | 9.1 | 12.9 |

| FY27E | 44,200 | 6,036 | 13.7% | 3,182 | 11.4 | 13.8 |

Outlook

- Growth Drivers: Premiumisation push, strong Officer’s Choice margins, new product launches, and backward integration benefits.

- Risks: Tax hikes in key states, consumer downtrading, raw material inflation, and regulatory bans.

Verdict: With ambitious FY28 targets and a sharper focus on premiumisation, ABDL looks well-positioned to deliver double-digit growth and margin expansion. BUY maintained with TP ₹600.

Conclusion – Market Outlook 1st September

As we step into September 2025, the market landscape is setting up for a dynamic month ahead. With indices showing resilience near key support zones, selective stock action, and a buzzing IPO pipeline, opportunities are lining up for both traders and investors.

The Market Outlook 1st September highlights that while short-term volatility may persist due to global cues and sector-specific pressures, the long-term structure remains positive. Investors should focus on quality names, ride the premiumisation trends in consumer businesses like ABDL, and keep an eye on fresh IPO listings that could offer strong listing gains.

In summary, the new month begins with cautious optimism, and a well-placed strategy of stock-specific bets, disciplined levels, and smart IPO participation could make September a rewarding ride.

More Articles

When to Sell Mutual Funds: 5 Proven Exit Strategies

The Hidden Multibagger Stock: 5 Positive Triggers That Make Suven Life Sciences a Game-Changer

The Indian Retirement Savings Crisis: 5 Reasons EPF and PPF Won’t Be Enough