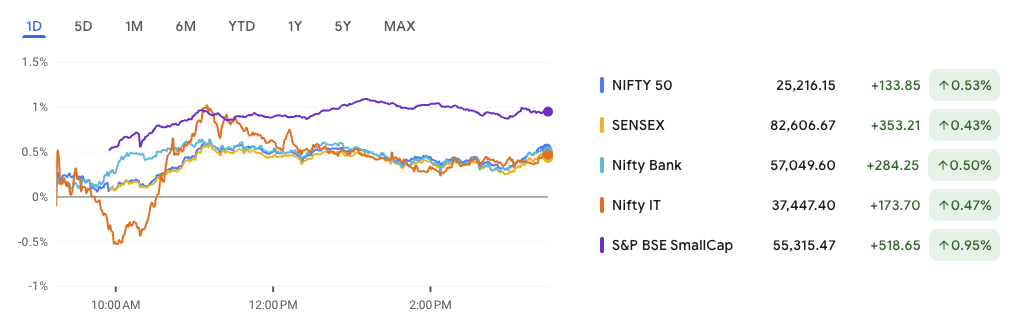

Market Outlook 16 July: Nifty Rises 0.53%, Smallcaps Lead the Charge

Indian stock markets ended Tuesday, 15 July, on a firm note, with benchmark indices posting healthy gains across sectors. The Nifty 50 closed at 25,216.15, up 0.53%, while the Sensex advanced 0.43% to settle at 82,606.67.

The broader market showed stronger momentum, with the BSE SmallCap index rising 0.95%, outperforming the benchmarks. Gains were led by buying in financials, IT, and auto sectors. The Nifty Bank climbed 0.50%, and the Nifty IT index rose 0.47%, indicating widespread participation.

As we move into Wednesday, 16 July, market sentiment remains positive, but traders are watching key resistance zones closely.

In this edition of our daily newsletter, we cover:

- Nifty Technical Outlook: Key chart levels, trend signals, and what to expect next

- Top News and Impacted Stocks: Blinkit’s model overhaul, Tata Steel’s green transformation, and IPO filings

- IPO Tracker: Latest GMPs, subscriptions, and listing gains from SME and mainboard IPOs

- Smallcap of the Day: A fundamentally strong company showing breakout potential

- Technical Stock Watch: A swing trade candidate with bullish confirmation and favorable risk-reward setup

Let’s look at what’s shaping the market ahead of Wednesday’s session.

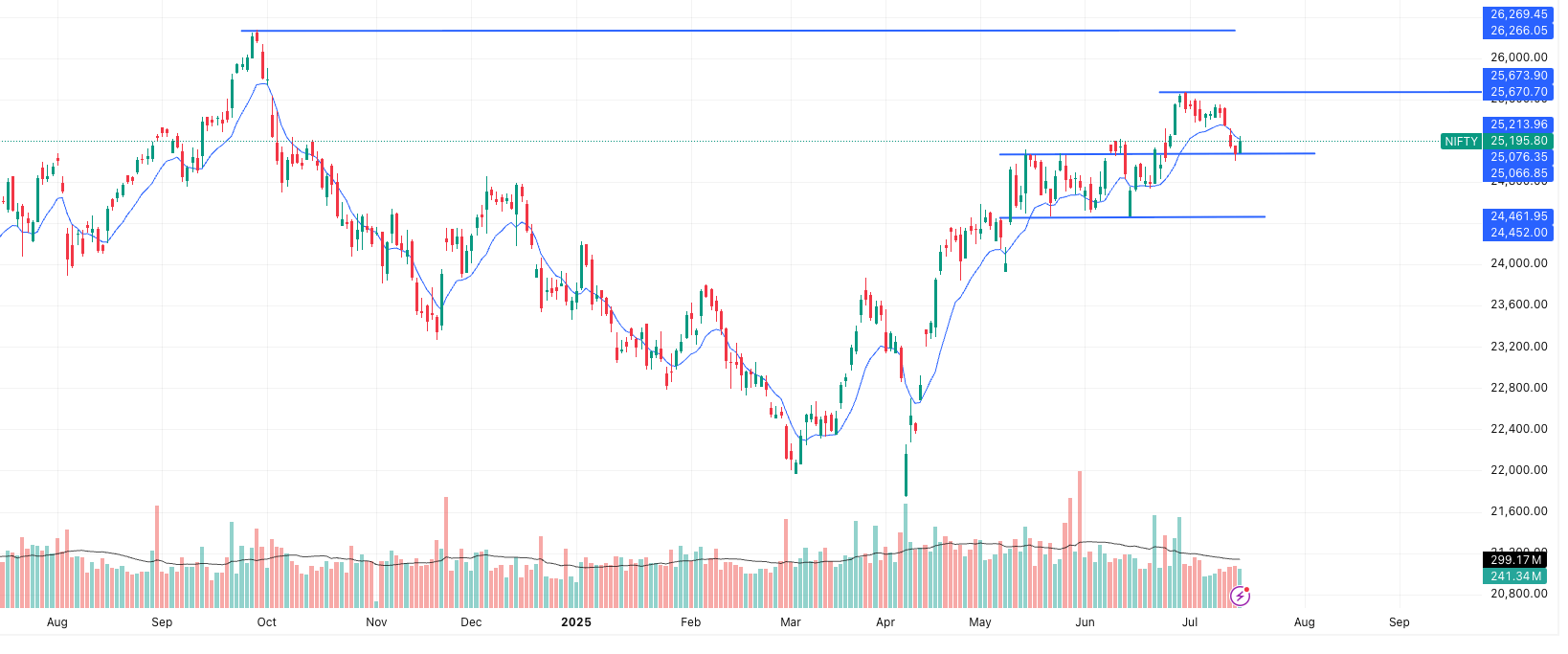

Nifty Technical Outlook – Market Outlook 16 July

In the Market Outlook 16 July, Nifty 50 finds itself at a critical juncture. The index closed at ₹25,195.80, slightly below its 9-day Exponential Moving Average (EMA) of ₹25,213.96, signaling caution in the short term. Volume levels were lower than average, suggesting that traders are waiting for a clear direction before committing heavily.

Recently, Nifty attempted to break above the resistance at ₹25,670 but failed, forming a short-term consolidation or rising wedge pattern just beneath this level.

Key Support and Resistance Zones

| Type | Zone (₹) | Description |

|---|---|---|

| Resistance 1 | 25,670–25,674 | Immediate resistance zone (recent swing high) |

| Resistance 2 | 26,266–26,270 | All-time high zone |

| Support 1 | 25,065–25,076 | Crucial near-term horizontal support |

| Support 2 | 24,452–24,462 | Major swing support (former breakout zone) |

Price Action Insights

- The index has slipped below the short-term moving average, which may indicate temporary weakness or indecision.

- A breakout above ₹25,670 could restart bullish momentum, while a breakdown below ₹25,065 might trigger a deeper correction.

- The zone near ₹25,065 is now acting as a make-or-break support for bulls.

What to Expect Next – Market Outlook 16 July

Bullish Scenario:

- If Nifty holds above ₹25,065 and breaks ₹25,670 with strong volume, we may see a move toward:

- Target 1: ₹26,270

- Target 2: ₹26,500+

- This would confirm a new breakout and continuation of the uptrend.

Bearish Scenario:

- A breakdown below ₹25,065 could lead to a correction toward:

- Target 1: ₹24,450 (gap-fill zone)

- Target 2: ₹24,000 (50 EMA support)

- Volume confirmation will be key for this move to sustain.

Strategy Summary

| Factor | Signal |

|---|---|

| Trend | Sideways to mildly bullish |

| Momentum | Weakening |

| Support | ₹25,065 |

| Resistance | ₹25,670 |

| Bias | Neutral |

| Strategy | Buy on breakout above ₹25,670, sell below ₹25,065 |

Final Word – Market Outlook 16 July

For traders eyeing the Market Outlook 16 July, Nifty’s behavior around ₹25,065–₹25,670 will be crucial. A move above the resistance could fuel another leg of rally, but failure to hold the support might invite a deeper pullback. Until a clear breakout or breakdown occurs, caution remains the best approach.

News & Impacted Stocks – Market Outlook 16 July

As we look at the Market Outlook 16 July, several industry developments and stock-specific updates are likely to influence market sentiment going forward. From auto sector headwinds to PSU banks lending trends and strategic corporate moves, here’s a comprehensive roundup of the latest news and impacted stocks.

Auto Sector Sees Mixed Q1 Performance – Stocks React Accordingly

The Indian auto industry delivered mixed results in Q1 FY26, with overall domestic sales declining by 5.1% YoY to 60.75 lakh units. While Utility Vehicles (UVs) remained a bright spot, growing 3.8% and claiming 66% of the PV segment, segments like Passenger Cars (-11.2%), Two-Wheelers (-6.2%), and Commercial Vehicles (-0.6%) dragged the numbers.

Impacted Stocks:

| Stock | CMP (15 July) | Change | Outlook |

|---|---|---|---|

| Maruti Suzuki | ₹12,829 | -0.7% | Weak PV sales drag |

| M&M | ₹2,813 | +0.9% | UV-led strength aids |

| TVS Motor | ₹2,310 | +1.2% | Strong export support |

| Bajaj Auto | ₹9,855 | -0.5% | Cautious on 2W segment |

| Bharat Forge | ₹1,434 | -1.1% | CV volume concern |

Auto stocks may remain rangebound as investors await festive season cues and further clarity on rural demand revival.

M&M Finance Allots ₹100 Cr NCDs at 7.05%

Mahindra & Mahindra Financial Services has raised ₹100.01 crore via listed NCDs with a fixed 7.05% coupon. While this strengthens liquidity, the stock closed at ₹265.85 on 15 July, down 0.86%, and has underperformed over the last year (-9.8%).

Investor Takeaway: Despite healthy fundraising, cautious sentiment persists around NBFCs amid high interest rate cycles.

CONCOR Signs Global Logistics Pact with Dubai’s RHS Group

Container Corporation of India (CONCOR) inked an MoU with Rais Hassan Saadi (RHS) to expand international logistics reach and multimodal connectivity. The stock rose 0.56% to ₹619 on July 15.

Investor Takeaway: This strategic alliance could enhance CONCOR’s global freight presence and long-term volumes, especially in light of India’s export-driven ambitions.

PSBs Expand Sub-Prime MSME Lending Backed by Govt Guarantees

Public sector banks are aggressively lending to sub-prime and new-to-credit MSMEs, backed by schemes like ECLGS and CGFMU. As of March 2025, 30.3% of PSBs’ MSME books were sub-prime, versus 18% for private banks.

Why It Matters:

- Positive: Supports financial inclusion and rural credit flow.

- Risks: NPA rates under CGFMU (9.9%) and ECLGS (6.4%) still remain a concern.

Impacted Stocks:

- PSU Banks (BOB, PNB, SBI) may see increased MSME lending activity.

- Private banks may maintain a conservative credit stance.

Indira IVF to Revive ₹3,500 Cr IPO – EQT to Exit

Indira IVF, backed by EQT, is planning to relaunch its IPO with a ₹3,500 crore offer, purely as an offer for sale. The previous filing was withdrawn earlier due to regulatory concerns around its biopic release. The move signals a thaw in the IPO pipeline.

Related Stock: Watch for movement in IIFL Securities (₹329.95, +1.14%) which may play a role in the issue management.

Indowind Energy to Raise ₹50 Cr via Rights Issue

Indowind Energy approved filing a Draft Letter of Offer for a ₹50 crore rights issue, aiming to improve its capital structure. Stock closed flat at ₹19.61.

Investor Note: Keep watch as pricing, ratio, and record date are announced. The issue aims to support renewable growth initiatives.

Summary – Market Outlook 16 July: Sector Pulse & Key Watchlist

| Sector | Key Development | Watchlist Stocks |

|---|---|---|

| Auto | Mixed Q1 performance; UVs strong | M&M, Maruti, TVS, Bajaj Auto, Bharat Forge |

| NBFC | Fundraising via NCDs | M&M Financial Services |

| Logistics | Global expansion deal | CONCOR |

| Banking (PSU) | Rising MSME lending with govt backing | SBI, BOB, PNB |

| Healthcare/IPO | Indira IVF revives ₹3,500 Cr listing plan | IIFL Securities |

| Renewables | Rights issue to boost capital | Indowind Energy |

Stocks on Technical Radar – Market Outlook 16 July

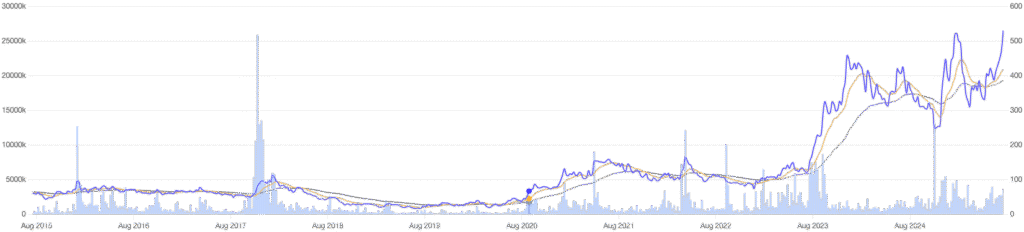

Swan Energy Ltd – Ascending Triangle Breakout in Play

Current Market Price (CMP): ₹502.25

Volume: 30.39 million (highest in months)

9 EMA: ₹446.31 (price significantly above EMA)

Market Outlook 16 July highlights Swan Energy as a strong technical breakout candidate. The stock has surged with high volume, breaking out of a long-standing consolidation phase, making it one of the top momentum setups this week.

Chart and Pattern Analysis

Technical Pattern: Ascending Triangle

Breakout Level: ₹476–₹478

Breakout Confirmation: Strong green candle with institutional volume

Swan Energy had been forming higher lows for over four months, meeting resistance near ₹478. The breakout is confirmed by a surge above resistance with strong volume — a classic sign of trend continuation and bullish strength.

Key Support and Resistance Levels

| Type | Price Zone (₹) | Description |

|---|---|---|

| Resistance 1 | 502 | CMP – currently being tested |

| Resistance 2 | 694–695 | Next major swing high from October 2023 |

| Support 1 | 476–478 | Recent breakout zone – now acting as support |

| Support 2 | 446–450 | 9 EMA and triangle base zone |

| Support 3 | 427 | Horizontal support from April swing low |

Short-Term Trading Outlook (1–7 Days)

- Bias: Strongly Bullish

- Target Range: ₹520–₹545

- Stop Loss: ₹474

- Entry Strategy:

- Enter on a minor pullback toward ₹495–₹500

- Or above ₹505 on breakout continuation

Rationale: Momentum and volume both support further upside. Price is comfortably above all key averages, and the breakout level is well-defended.

Swing Trading Outlook (1–3 Weeks)

- Bias: Bullish Continuation

- Target 1: ₹545

- Target 2: ₹585–₹600

- Target 3: ₹694 (prior swing high)

- Swing Stop Loss: ₹446

Rationale: The setup aligns with a classic breakout structure — long consolidation, strong candle, and heavy volume. There’s potential for a multi-leg rally toward historical highs if broader market sentiment remains favorable.

Volume Analysis

- Today’s volume is 8 times the 20-day average

- Strong volume indicates institutional buying interest

- A breakout on such volume often leads to sustained momentum unless broader indices reverse sharply

Summary – Swan Energy Technical Setup

| Factor | Signal |

|---|---|

| Trend | Bullish |

| Pattern | Ascending Triangle Breakout |

| Volume Confirmation | Yes |

| Short-Term Bias | Bullish |

| Swing Bias | Strong Bullish |

| Entry Zone | ₹495–₹510 |

| SL (short-term) | ₹474 |

| SL (swing) | ₹446 |

| Targets (swing) | ₹545, ₹600, ₹694 |

Final Take – Market Outlook 16 July

With the broader market showing signs of consolidation, Swan Energy stands out as a high-conviction technical breakout. Traders should keep this stock on their radar for both short-term and swing opportunities, with clearly defined risk-reward parameters and volume-backed strength.

IPO Update – Market Outlook 16 July

As the Market Outlook for 16 July reflects bullish undertones across major indices, the IPO space remains active with strong participation in SME counters and selective momentum in mainboard issues. Here’s a breakdown of notable IPOs currently in focus, segregated by Mainboard and SME IPOs, with updated GMPs and subscription data.

Mainboard IPOs

| IPO Name | GMP | Subscription | Price (₹) | Issue Size (Cr) | Lot Size | Listing Date | GMP % Gain |

|---|---|---|---|---|---|---|---|

| Anthem Biosciences | ₹133 | 3.33x | ₹570 | ₹3,395.00 Cr | 26 | 21-Jul | 23.33% |

| Smartworks Coworking | ₹17 | 13.92x | ₹407 | ₹582.56 Cr | 36 | 17-Jul | 4.18% |

SME IPOs

| IPO Name | GMP | Subscription | Price (₹) | Issue Size (Cr) | Lot Size | Listing Date | GMP % Gain |

|---|---|---|---|---|---|---|---|

| Spunweb Nonwoven | ₹42 | 42.88x | ₹96 | ₹57.89 Cr | 1,200 | 21-Jul | 43.75% |

| Asston Pharmaceuticals | ₹30 | 186.55x | ₹123 | ₹26.17 Cr | 1,000 | 16-Jul | 24.39% |

| CFF Fluid Control | ₹25 | 8.45x | ₹585 | ₹83.19 Cr | 200 | 16-Jul | 4.27% |

IPOs Opening Soon

| IPO Name | Price Band | Issue Size | Open Date | Close Date | Listing Date |

|---|---|---|---|---|---|

| Monika Alcobev | ₹400 | ₹153.68 Cr | 16-Jul | 18-Jul | 23-Jul |

| PropShare Titania | ₹1.6 lakh | ₹473.00 Cr | 21-Jul | 25-Jul | 4-Aug |

| Savy Infra | ₹1,200 | ₹66.47 Cr | 21-Jul | 23-Jul | 28-Jul |

Key Observations – Market Outlook 16 July

- Anthem Biosciences leads the mainboard segment with a ₹133 GMP and 23.33% estimated listing gain — fueled by strong fundamentals and moderate oversubscription.

- Spunweb Nonwoven and Asston Pharmaceuticals dominate the SME space with high oversubscription and double-digit GMP gains.

- Monika Alcobev’s IPO opens today (16 July) and is closely watched due to its mid-sized issue and liquor sector exposure.

Small Cap of the Day – Ashapura Minechem Ltd

Stock Price: ₹532

Market Cap: ₹5,075 Cr Sector: Industrial Minerals & Commodities

About the Company

Ashapura Minechem Ltd., established in 1982, is a leading Indian player in the mining and minerals space. The company offers integrated solutions across several industrial chains — from energy and steel to ceramics and chemicals. It operates across India and 7 international markets, with a strong export footprint and diversified customer base.

Product Portfolio

Ashapura specializes in multi-mineral solutions, offering value-added and niche products across seven core verticals:

- Industrial Functional Minerals

- Refractory & White Performance Materials

- Hydrocarbon Exploration Additives

- Adsorbents & Refined Mineral Solutions

- Construction and Chemical Materials

Key Financials & Metrics

| Metric | Value |

|---|---|

| Stock P/E | 17.6 |

| Book Value | ₹130 |

| Price to Book | 4.09× |

| ROCE | 17.1% |

| ROE | 26.6% |

| Net Profit Margin | 7.31% |

| EPS Growth (3Y CAGR) | 56.9% |

| Operating Profit | ₹370 Cr |

| Profit After Tax | ₹289 Cr |

| Sales (FY) | ₹2,739 Cr |

| Debt-to-Equity Ratio | 0.94 |

| Cash & Equivalents | ₹122 Cr |

| Intrinsic Value (Est.) | ₹717 |

| Pledged Shares | 0% |

Investment Outlook – Market Outlook 16 July

Ashapura Minechem is riding strong tailwinds from the global demand recovery in industrial minerals, and its diversified portfolio offers a hedge across cyclical industries. Its robust ROE of 26.6%, strong earnings CAGR, and relatively low debt make it a promising small-cap candidate for long-term investors.

The recent 9.34% price surge on 15 July and breakout toward ₹532 signals technical strength. With an intrinsic value estimate near ₹717, the stock still offers upside potential.

Final Word

Backed by consistent earnings growth, international expansion, and a strong moat in niche industrial minerals, Ashapura Minechem is a standout in today’s Market Outlook 16 July. It could be a valuable addition to small-cap portfolios focused on real assets, industrials, and export-driven themes.

Conclusion – Market Outlook 16 July

The broader market maintained its bullish stance on July 15, with Nifty 50 closing above 25,200 and Smallcap indices outperforming. As we head into Wednesday, the technical setup for Nifty remains range-bound between 25,065–25,670, demanding caution and confirmation from traders.

Meanwhile, the IPO market continues to show strength, especially in the SME segment, where listings like Spunweb Nonwoven and Anthem Biosciences are generating strong interest. On the technical front, Swan Energy has emerged with a high-conviction breakout setup, while Ashapura Minechem leads the small-cap momentum with solid fundamentals and strong price action.

In summary, the Market Outlook for 16 July suggests:

- Stay stock-specific, especially in small and midcaps showing breakout or turnaround setups.

- Track key Nifty levels for confirmation before entering index trades.

- Watch for fresh momentum in the IPO market and upcoming listings.

- Keep a close eye on stocks with institutional volume spikes and favorable risk-reward setups.

The trend remains cautiously bullish, but the market now demands selective conviction and disciplined entries.

Related Articles

Best Ad Tech Stock: India’s Emerging Digital Goldmine for Investors

NABFID Infrastructure Lending Stocks: Impact on Infra Companies & Market Outlook

Retail Inflation Crashes to 2.10% in June 2025: What It Means for Consumers, RBI & Stocks