Market Outlook 16 September – Intro

Good morning and welcome to your Market Outlook 16 September Edition. The market enters the week on a mixed footing as India’s latest macro data delivers both comfort and caution.

On the brighter side, August trade data highlighted improving resilience. Exports rose 6.7% YoY to $35.10 billion, while imports declined 10% YoY to $61.59 billion, sharply narrowing the trade deficit by 25.7% YoY to $26.59 billion. This points to stronger domestic demand and a healthier external balance.

However, inflation ticked higher. WPI inflation climbed back into positive territory at 0.52% in August (vs -0.58% in July). While food inflation was modest at 0.21%, it reversed from July’s steep decline, hinting at emerging price pressures.

Equities reflected this cautious mood on Friday. Nifty 50 slipped 0.18% to 25,068, Sensex fell 0.12% to 81,810, while Nifty Bank managed a gain of 0.08% at 54,853. Broader markets stayed strong with BSE SmallCap up 0.71%.

👉 In today’s newsletter, you will get the Index Technical View, Key News & Stocks, IPO Updates, and a Stock on Radar to help navigate the session ahead.

Index Outlook – Market Outlook 16 September

Indian indices are holding firm in a positive trajectory, but traders need to stay alert as benchmarks hover near crucial resistance zones. According to EquityPandit analysis, the overall setup suggests a cautiously bullish bias with strict stoploss management. Let’s break it down:

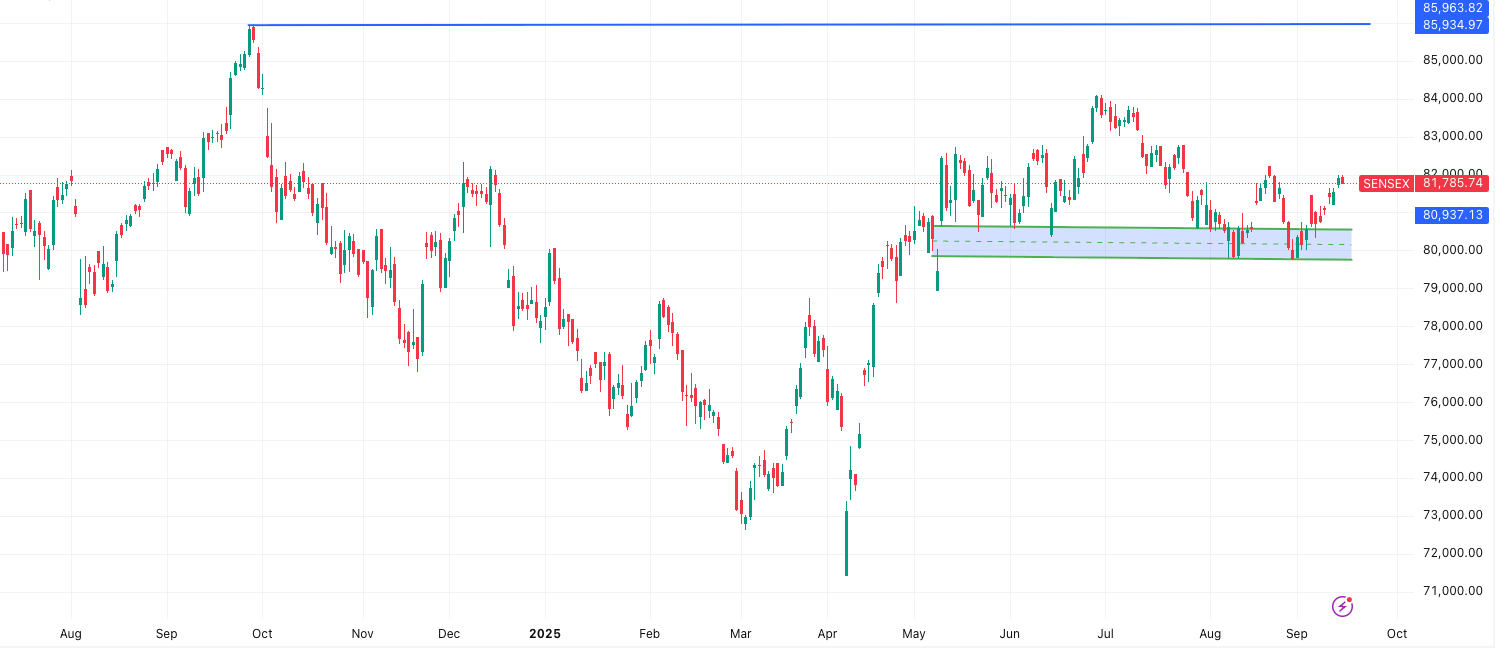

Sensex Outlook

The Sensex closed at 81,786, extending its upward momentum for another session. Bulls remain in control, but the index is approaching heavy resistance levels where some profit booking may emerge.

- Support: 81,687 – 81,589 – 81,434

- Resistance: 81,941 – 82,097 – 82,195

- Tentative Range: 81,197 – 82,373

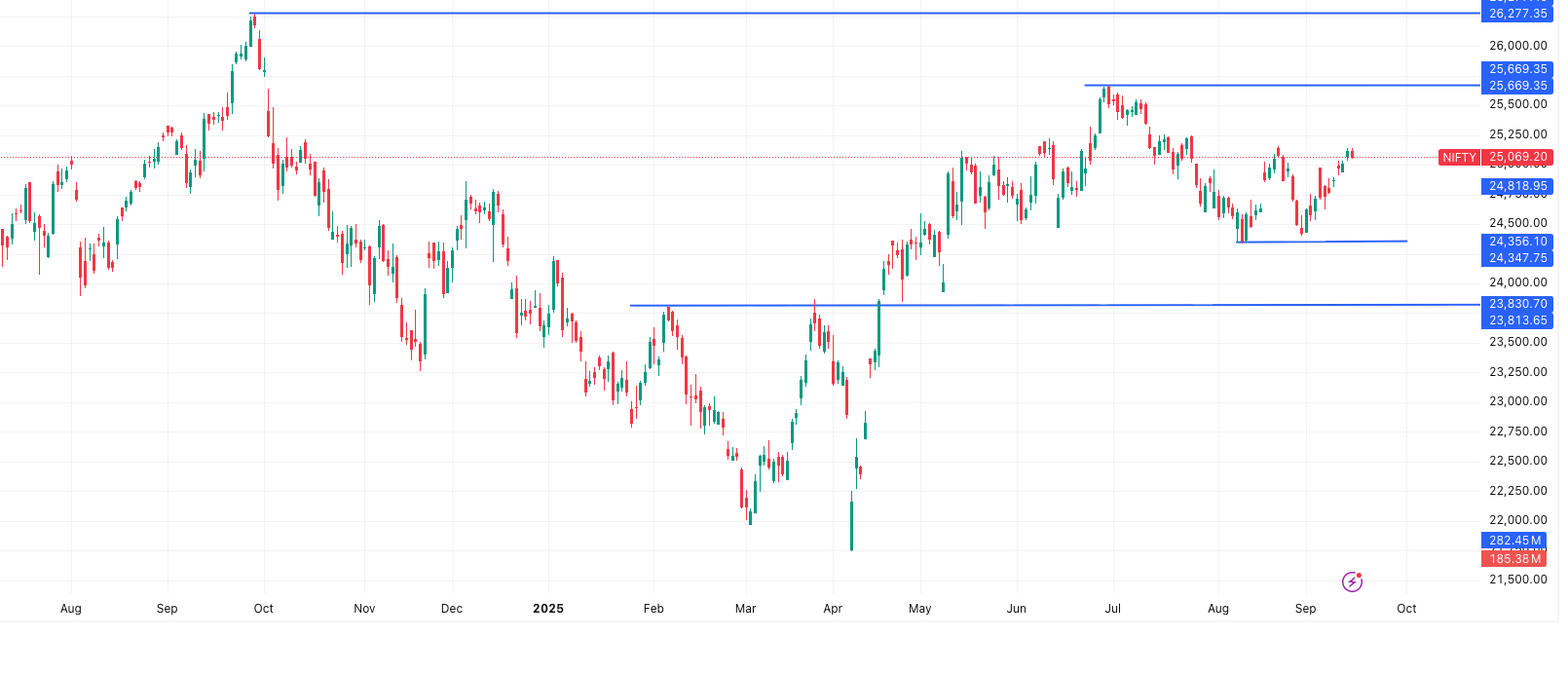

Nifty 50 Outlook

At 25,069, the Nifty 50 remains in positive trend, supported by strength in banks and select heavyweights. A sustained move above 25,122 could trigger fresh buying, while a break below 24,927 may weaken the momentum.

- Support: 25,032 – 24,996 – 24,943

- Resistance: 25,122 – 25,175 – 25,212

- Tentative Range: 24,889 – 25,248

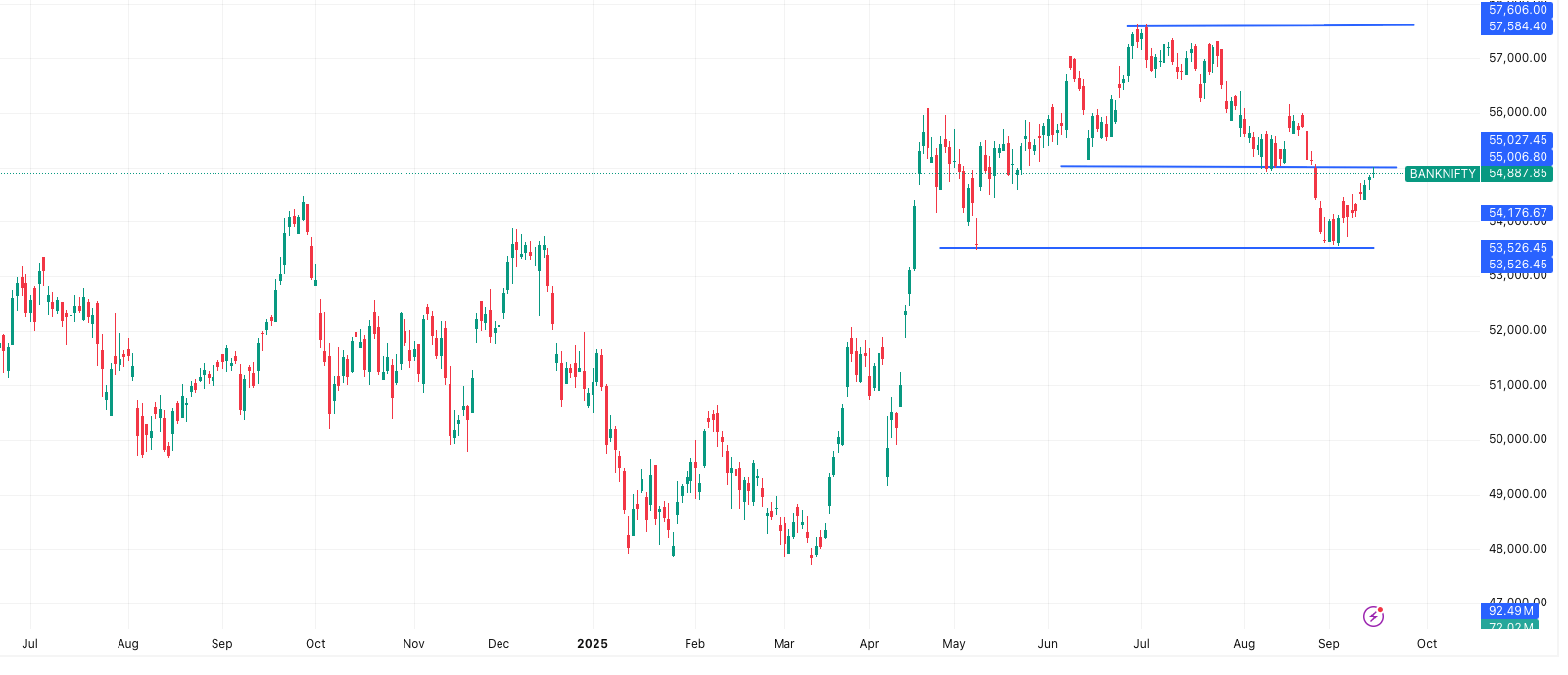

Bank Nifty Outlook

The Bank Nifty ended at 54,888, and financials continue to provide stability to the market. With resistance just above 55,000, traders should closely watch this zone for signs of breakout or reversal.

- Support: 54,791 – 54,693 – 54,579

- Resistance: 55,002 – 55,116 – 55,213

- Tentative Range: 54,435 – 55,340

In summary, the Market Outlook 16 September signals that momentum remains positive across benchmarks, but the battle at resistance levels will define whether indices can extend their winning streak or pause for consolidation.

News & Stocks – Market Outlook 16 September

The markets opened the week with plenty of stock-specific action, as companies across sectors unveiled new strategies, faced governance concerns, and struck big-ticket deals. Let’s look at the key developments that shaped sentiment:

Thomas Cook India – Digital Leap with TC Pay

Thomas Cook India launched its new forex app, TC Pay, available for both Android and iOS users. The app offers end-to-end digital forex solutions—reloading forex cards, buying/selling currency, and international remittances—all in one place. With mobile-based remittances now accounting for 60% of global transfers, the move strengthens Thomas Cook’s digital-first journey.

Market Impact: Shares traded with mild optimism, reflecting investor confidence in the company’s digital strategy.

KRBL – Governance Concerns Drag Stock

KRBL Ltd. plunged nearly 10% after independent director Anil Kumar Chaudhary resigned, citing corporate governance issues. The board has announced the appointment of an independent third-party firm to review the concerns raised.

Market Impact: The sharp fall underscores investor unease around transparency and governance practices.

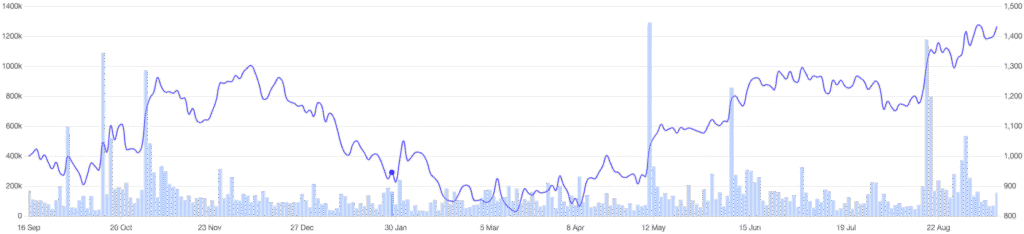

Zerodha – Weekly Options in Spotlight

Nithin Kamath, CEO of Zerodha, raised red flags about the future of weekly options, saying he “would not be surprised if they were banned completely.” He highlighted that most brokers rely heavily on trader activity and regulatory risk poses the biggest challenge to the broking industry.

Market Impact: While Zerodha is unlisted, Kamath’s comments sparked debate in the trading community, with concerns about liquidity and broker earnings if regulatory restrictions tighten.

Muthoot Finance – Raises $600 Million via ECB

Muthoot Finance successfully raised $600 million through international bond markets under its $2 billion GMTN program. The funds will fuel lending growth, especially in its gold loan business.

Market Impact: The issuance saw strong global demand, reinforcing investor faith in Muthoot’s governance and growth trajectory.

Edible Oil Imports – Policy Shifts Change Mix

India’s vegetable oil imports surged 7% YoY in August to 16.77 lakh tonnes. However, refined palmolein imports fell sharply due to higher duties, shifting demand back to crude oil.

Market Impact: The move supports India’s domestic refining industry but keeps importers cautious about policy-driven volatility.

Shakti Pumps – ₹1,037 Cr Solar Order Boost

Shakti Pumps bagged a massive ₹1,037 crore order from MSEDCL to install 34,720 off-grid solar water pumps under PM-KUSUM B and state schemes. Installations must be completed within 60 days per order.

Market Impact: Shares surged as the order strengthens the company’s order book and positions it as a key player in agricultural solar solutions.

In summary, the Market Outlook 16 September brings a mix of digital innovation (Thomas Cook), corporate governance challenges (KRBL), regulatory uncertainty (Zerodha), and growth enablers (Muthoot & Shakti Pumps). These stories are likely to influence investor mood in the coming sessions.

IPO Update – Market Outlook 16 September

The IPO market continues to buzz with activity, with both mainboard and SME listings drawing strong investor interest. While some issues are still open for subscription, others are heading towards listing with hefty grey market premiums (GMP). Let’s take a closer look:

Mainboard IPOs in Focus

| IPO Name | Open Date | Close Date | Listing Date | GMP (₹) |

|---|---|---|---|---|

| Ivalue Infosolutions | 18-Sep | 22-Sep | 25-Sep | — |

| VMS TMT | 17-Sep | 19-Sep | 24-Sep | 23 (23.23%) |

| Euro Pratik Sales | 16-Sep | 18-Sep | 23-Sep | — |

| Shringar House of Mangalsutra | 10-Sep | 12-Sep | 17-Sep | 31 (18.79%) |

| Urban Co. | 10-Sep | 12-Sep | 17-Sep | 54 (52.43%) |

| Dev Accelerator | 10-Sep | 12-Sep | 17-Sep | 8 (13.11%) |

SME IPOs in Action

| IPO Name | Open Date | Close Date | Listing Date | GMP (₹) |

|---|---|---|---|---|

| JD Cables | 18-Sep | 22-Sep | 25-Sep | 26 (17.11%) |

| Sampat Aluminium | 17-Sep | 19-Sep | 24-Sep | 18 (15.00%) |

| TechD Cybersecurity | 15-Sep | 17-Sep | 22-Sep | 160 (82.90%) |

| L.T. Elevator | 12-Sep | 16-Sep | 19-Sep | 25 (32.05%) |

| Airfloa Rail Technology | 11-Sep | 15-Sep | 18-Sep | 175 (125.00%) |

| Jay Ambe Supermarkets | 10-Sep | 12-Sep | 17-Sep | 8 (10.26%) |

| Galaxy Medicare | 10-Sep | 12-Sep | 17-Sep | — |

| Nilachal Carbo Metalicks | 8-Sep | 11-Sep | 16-Sep | — |

| Krupalu Metals | 8-Sep | 11-Sep | 16-Sep | — |

| Taurian MPS | 9-Sep | 11-Sep | 16-Sep | 14 (8.19%) |

| Karbonsteel Engineering | 9-Sep | 11-Sep | 16-Sep | 23 (14.47%) |

The Market Outlook 16 September suggests a strong appetite in SME IPOs, with names like Airfloa Rail Technology and TechD Cybersecurity commanding hefty GMPs. Meanwhile, mainboard IPOs like VMS TMT are generating steady traction as investors eye their listings.

Stocks in Radar – Market Outlook 16 September

SJS Enterprises Limited (SJS) – Driving Growth with Aesthetic Excellence

📌 CMP: ₹1,400–1,430

🎯 Target Price: ₹1,750 (Upside ~20%)

📑 Research by: Anand Rathi

SJS Enterprises is making waves in the decorative aesthetics industry, positioning itself as a design-to-delivery solutions provider. With strong roots in India and a growing global presence, the company is set to capture the next leg of growth through premiumization, strategic acquisitions, and relentless innovation.

Business Overview

- Market Leadership: Over 30 years of expertise in industrial graphics printing and advanced aesthetic parts.

- Diverse Portfolio: From decals, appliques, and 3D badges to chrome-plated parts and in-mould decorative technologies.

- Global Reach: Manufacturing bases in Bengaluru, Pune, Gurugram with support across Europe, North America, and ASEAN.

- Blue-Chip Clientele: Trusted by Hero MotoCorp, Bajaj, TVS, Ola, Samsung, Whirlpool, Dixon, and many more.

Growth Drivers

- Premiumization Trend – Rising demand for advanced aesthetic solutions in passenger vehicles & appliances.

- Strategic Acquisitions – SJS Decoplast (chrome products) and Walter Pack India (IMD, IML, IMF expertise) add depth and technology leadership.

- Expanding Distribution – Strengthening ties with Tier-1 auto OEMs and consumer appliance giants.

- R&D Edge – Investments in futuristic design, materials, and printing technologies driving customer stickiness.

Financial Highlights (₹ mn)

| Particulars | FY24 | FY25 | FY26E | FY27E |

|---|---|---|---|---|

| Net Sales | 6,278 | 7,605 | 9,126 | 11,161 |

| EBITDA | 1,525 | 1,958 | 2,391 | 3,013 |

| EBITDA Margin | 24.3% | 25.7% | 26.2% | 27.0% |

| PAT | 854 | 1,188 | 1,458 | 1,852 |

| EPS (₹) | 27.2 | 37.9 | 46.5 | 59.1 |

Strong earnings growth, rising margins, and improving return ratios highlight the company’s resilience.

Outlook

With premiumization in automobiles, increasing global demand for high-quality decorative components, and successful acquisitions, SJS Enterprises is poised for robust long-term growth. At CMP ₹1,400–1,430, the stock offers attractive upside potential with a target price of ₹1,750, backed by Anand Rathi’s BUY recommendation.

Verdict: A strong contender in today’s Market Outlook 16 September, SJS Enterprises deserves a place on your radar for its innovation, global expansion, and financial strength.

Conclusion

As we wrap up today’s edition of Market Outlook 16 September, the overall market mood remains constructive with positive undertones. On the index front, Nifty continues to trade above key support levels of 25,050–25,100, while facing resistance near 25,350–25,400. For Bank Nifty, strong buying interest is visible around 54,400–54,500, whereas upside hurdles remain near 55,000–55,200. This range-bound yet optimistic setup suggests that any dip towards support zones could offer attractive entry opportunities for traders.

On the news front, the sharp WPI inflation decline and August trade data improvement have reinforced confidence in India’s macroeconomic stability. Cooling inflation and narrowing trade deficit support the case for sustained FII inflows, which can act as a key driver for market resilience in the near term.

The IPO space is also buzzing with activity, with SME listings and upcoming issues like TechD Cybersecurity drawing strong investor interest. This reflects the appetite for new-age businesses and diversified opportunities in primary markets.

In our Stocks in Radar section, we highlighted SJS Enterprises Limited (SJS), a leading decorative aesthetics solutions provider, backed by strong financials, premiumization-led growth strategy, and marquee clientele across automotive and consumer appliances. With a target price of ₹1,750, analysts remain optimistic about its ability to capture expanding global opportunities and drive long-term shareholder value.

To sum it up — the week ahead presents a healthy mix of stability and opportunities. Traders should watch index levels closely for range-bound plays, while investors can look at select quality stocks like SJS for medium- to long-term gains. IPO watchers too will have plenty to stay engaged with.

In today’s newsletter, you received a comprehensive index outlook, critical news updates, IPO buzz, and an in-depth analysis of SJS Enterprises — giving you a well-rounded view to approach the market with confidence.

Related Articles

Read Our All Newsletter On Pre-Market Analysis

SEBI New IPO Rules Unlock 2 Historic IPOs – Jio & NSE to Deliver Huge Investor Gains

TechD Cybersecurity SME IPO 2025: Mega Listing Gain Ahead? Price, GMP, Financials & Full Details