Market Outlook 12 September

Good morning and welcome to your Market Outlook 12 September edition.

Indian equities carried forward their cautious optimism on Tuesday, with the Nifty 50 managing to stay above the 25,000 mark. The index inched higher by 29 points, while the Sensex added 107 points, reflecting a steady but selective buying interest. The momentum was largely driven by banking and financials, while IT stocks dragged the market lower after recent outperformance.

The Bank Nifty closed with a 0.20% gain, highlighting sustained interest in financial majors, whereas Nifty IT slipped 0.40%, indicating a sectoral rotation at play. Smallcaps too managed to end flat-to-positive, suggesting that retail participation continues to remain active even as large caps consolidate.

Global cues were mixed, with traders watching developments in the U.S. ahead of key macro data releases and the upcoming Federal Reserve policy outlook. At home, investors are closely tracking liquidity trends, corporate updates, and fresh IPO buzz to gauge the next leg of movement.

Overall, the market seems to be in a consolidation mode with a positive bias, awaiting strong triggers to break decisively on either side.

In today’s newsletter, you’ll get a quick technical view of key indices, the latest stock-specific news, fresh IPO highlights, and our stock on radar for short-term opportunity.

Index Outlook– Market Outlook 12 September

According to EquityPandit analysis, the Indian indices are holding firm in a positive trend, with both NIFTY and SENSEX sustaining above crucial support levels. Let’s break down the technical view:

SENSEX Outlook

The SENSEX (81,549) is trading with a constructive bias. Traders with existing long positions should continue holding with a daily closing stoploss at 80,827. A breakdown below this level could invite short-term weakness.

- Support Levels: 81,296 – 81,044 – 80,871

- Resistance Levels: 81,722 – 81,895 – 82,147

- Tentative Range: 80,922 – 82,175

➡️ As long as SENSEX sustains above 81,296, the upside potential towards 82,000+ remains intact.

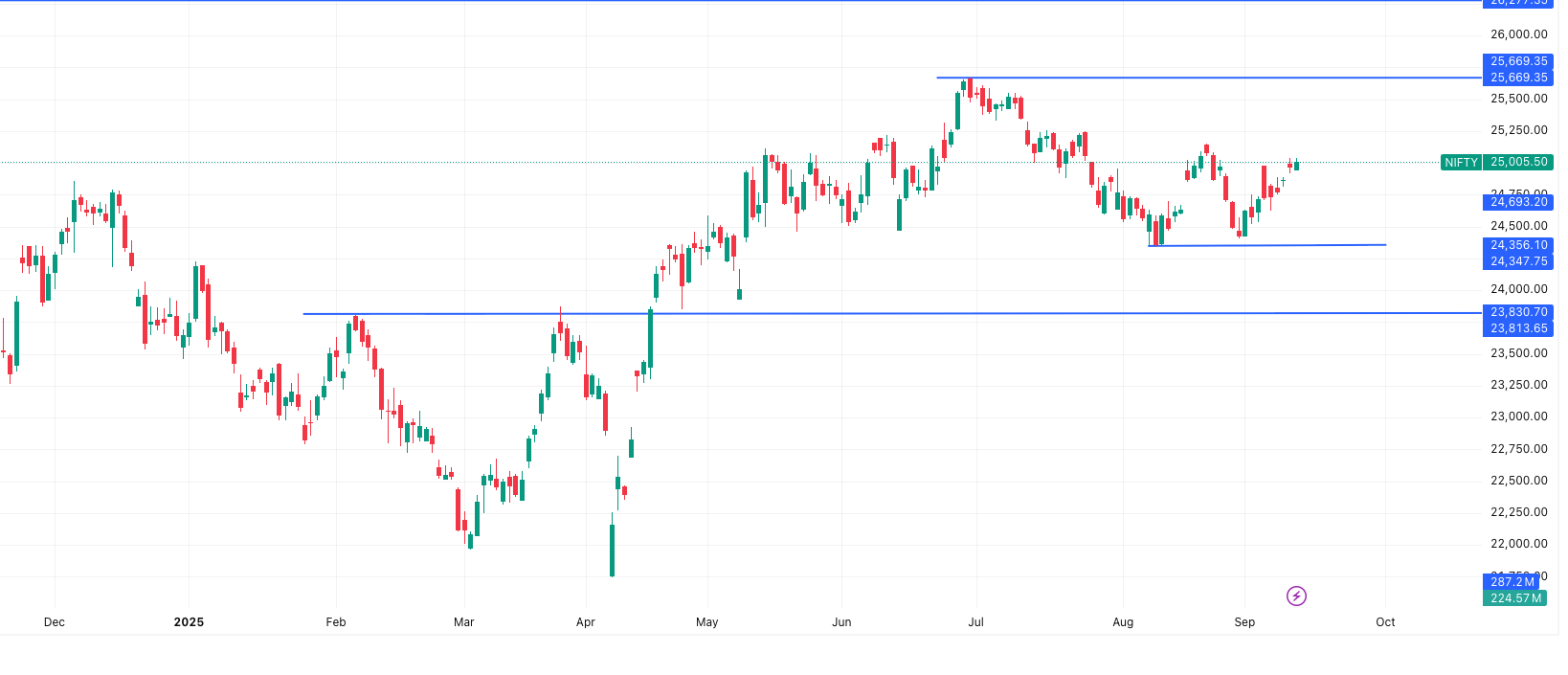

NIFTY Outlook

The NIFTY (25,006) continues its positive momentum, consolidating above the 25,000 mark. Long positions can be maintained with a stoploss at 24,807.

- Support Levels: 24,951 – 24,897 – 24,854

- Resistance Levels: 25,048 – 25,091 – 25,146

- Tentative Range: 24,815 – 25,195

➡️ Sustained trade above 24,950 keeps the index in a steady uptrend, with room to test the 25,100–25,150 zone.

BANK NIFTY Outlook

The Bank Nifty (54,670) has shown renewed strength and remains in a positive setup. Traders can hold long positions with a stoploss at 54,109.

- Support Levels: 54,462 – 54,255 – 54,107

- Resistance Levels: 54,817 – 54,965 – 55,172

- Tentative Range: 54,183 – 55,155

➡️ The momentum in banking stocks suggests that a breakout above 55,000 could fuel further upside.

Overall View:

The Market Outlook 12 September indicates that all three major indices — SENSEX, NIFTY, and Bank Nifty — are aligned in a positive trajectory. With banking and large-cap strength providing stability, the near-term bias stays bullish, provided key support zones are respected.

News & Stocks That Might Impact – Market Outlook 12 September

Insolation Energy Secures ₹143.2 Crore Solar Module Order

Insolation Energy Ltd. (NSE: INSOLATION) announced that its wholly-owned subsidiary, Insolation Green Energy Pvt. Ltd., has bagged a major order worth ₹143.20 crore from Zetwerk Manufacturing Businesses Pvt. Ltd. for supply of solar modules in FY26.

Additionally, the company incorporated nine new SPVs dedicated to solar power projects, ranging from design and supply to commissioning and O&M of solar systems.

Stock Impact: The order strengthens revenue visibility and growth prospects in renewables. Positive for Insolation Energy.

Oil India Forms JV with Rajasthan Rajya Vidyut for Renewables

Oil India Ltd. (NSE: OIL, BSE: 533106) has approved setting up a 50:50 joint venture with Rajasthan Rajya Vidyut Utpadan Nigam Ltd. (RRVUNL) to expand in solar and wind projects. The company will also transfer its existing renewable energy assets to a new subsidiary, OIL Green Energy Ltd.

This move aligns with India’s clean energy transition and could diversify Oil India’s revenue beyond hydrocarbons.

Stock Impact: Long-term positive for Oil India as it builds a renewable energy portfolio; short-term stock reaction may depend on crude & gas trends.

Kalpataru Projects Bags ₹2,720 Crore Orders Across T&D & Buildings

Kalpataru Projects International Ltd. (KPIL, NSE: KPIL), along with subsidiaries, has won orders worth ₹2,720 crore in Power Transmission & Distribution (T&D) and Buildings & Factories (B&F).

With this, KPIL’s FY26 order intake has reached ₹12,620 crore, ensuring strong revenue visibility. The company has a global footprint in 75 countries and continues to expand its leadership in infra projects.

Stock Impact: Robust order book supports growth outlook; positive for KPIL and sentiment across infra & EPC stocks.

Tega Industries in $1.5 Billion U.S. Mining Deal

Tega Industries Ltd. (NSE: TEGNA) announced a $1.5 billion acquisition of U.S.-based Molycop, in consortium with Apollo Global. Tega will own a 77% stake, while Apollo will hold 23%.

This is the biggest U.S. deal by an Indian company in three years, giving Tega access to 26 manufacturing sites globally. However, the market reacted cautiously as concerns emerged over Molycop’s $1 billion debt and potential equity dilution for Tega.

Stock Impact: Stock may stay volatile in near-term due to funding risks, but strategically positive for long-term global expansion.

Ai.tech Becomes Fastest Unicorn – Hurun India Report

The ASK Private Wealth Hurun India Unicorn Report 2025 highlighted that India now has 73 unicorns, with Ai.tech becoming the fastest startup to hit $1 billion valuation. Other names like Navi, Rapido, and Juspay also joined the unicorn club.

However, the Online Gaming Bill of 2025 impacted companies like Dream11 & Gameskraft, causing them to lose unicorn status.

Stock Impact: Positive sentiment for listed startup ecosystem plays like Zomato, Paytm, and Nazara Tech, while RMG sector may remain under pressure.

GST Rate Cuts to Boost Housing & MSMEs

The Ministry of Mines confirmed that the GST Council’s 56th meeting decided to reduce GST on several key commodities from 12% to 5%.

This includes granite, marble, sand lime bricks, brass utensils, and aluminium household items. The move is expected to:

- Lower costs for the housing & construction sector

- Boost affordability for low-income households

- Support MSMEs in expanding market demand

📈 Stock Impact: Positive for housing material companies (Kajaria Ceramics, Somany, Orient Bell, Pokarna, Asian Granito) and MSME-driven manufacturing stocks.

Takeaway – Market Outlook 12 September:

The day is lined with renewable energy expansion (Insolation, Oil India), infra order wins (Kalpataru), mega global deals (Tega), startup milestones, and GST-driven policy reforms. Expect stock-specific action in Insolation, Oil India, KPIL, Tega Industries, and housing-material players.

IPO in Radar – Market Outlook 12 September

Mainboard IPOs

| IPO Name | Open | Close | Listing | GMP (Listing Gain %) |

|---|---|---|---|---|

| VMS TMT IPO | 17-Sep | 19-Sep | 24-Sep | ₹– (NA) |

| Euro Pratik Sales IPO | 16-Sep | 18-Sep | 23-Sep | ₹– (0.00%) |

| Dev Accelerator IPO | 10-Sep | 12-Sep | 17-Sep | ₹7 (11.48%) |

| Shringar House of Mangalsutra IPO | 10-Sep | 12-Sep | 17-Sep | ₹30 (18.18%) |

| Urban Co. IPO | 10-Sep | 12-Sep | 17-Sep | ₹38 (36.89%) |

SME IPOs

| IPO Name | Open | Close | Listing | GMP (Listing Gain %) |

|---|---|---|---|---|

| Sampat Aluminium | 17-Sep | 19-Sep | 24-Sep | ₹– (0.00%) |

| TechD Cybersecurity Ltd. | 15-Sep | 17-Sep | 22-Sep | ₹158 (81.87%) |

| Airfloa Rail Technology | 11-Sep | 15-Sep | 18-Sep | ₹166 (118.57%) |

| Galaxy Medicare | 10-Sep | 12-Sep | 17-Sep | ₹5 (9.26%) |

| Jay Ambe Supermarkets | 10-Sep | 12-Sep | 17-Sep | ₹15 (19.23%) |

| Taurian MPS | 9-Sep | 11-Sep | 16-Sep | ₹5 (2.92%) |

| Krupalu Metals | 8-Sep | 11-Sep | 16-Sep | ₹– (0.00%) |

| Nilachal Carbo Metalicks | 8-Sep | 11-Sep | 16-Sep | ₹4 (4.71%) |

| Karbonsteel Engineering | 9-Sep | 11-Sep | 16-Sep | ₹21 (13.21%) |

| Vashishtha Luxury Fashion | 5-Sep | 10-Sep | 15-Sep | ₹– (0.00%) |

| Austere Systems | 3-Sep | 9-Sep | 12-Sep | ₹32 (58.18%) |

| Vigor Plast | 4-Sep | 9-Sep | 12-Sep | ₹– (0.00%) |

| Sharvaya Metals | 4-Sep | 9-Sep | 12-Sep | ₹– (0.00%) |

Top 3 Hot IPO Picks

- Urban Co. IPO – Mainboard star! GMP at ₹38 signals ~37% listing gain, strong subscription demand.

- TechD Cybersecurity IPO – SME gem in IT security, commanding ₹158 GMP (huge 82% premium).

- Airfloa Rail Technology IPO – Rail-tech play with impressive traction, GMP ₹166 (massive 119% upside).

Stock in Radar – ACME Solar Holdings

CMP: ₹300 | Target (TP): ₹380 | Upside: 26% | Call: BUY (Dolat Capital)

Why this matters for Market Outlook 12 September

ACMESOLA is a high-conviction renewable-energy pick as India scales green capacity. The company is transitioning from utility-scale solar to higher-yield, dispatchable renewable formats (FDRE / Hybrid) and battery storage — a mix that should lift realised CUF, average tariffs and cash flows over FY26–FY28.

Quick snapshot

- Operational capacity: 2.9 GW (current) → ~7 GW by FY29E (pipeline)

- Long-term goal: 10 GW contracted by 2030

- Key levers: FDRE / Hybrid mix, early BESS rollout, softening solar & battery costs, QIP funding

- Valuation basis: DCF-based TP ₹380 (≈10x FY28E EV/EBITDA)

Investment thesis — the drivers

- FDRE / Hybrid tilt = higher CUF & premium tariffs.

- FDRE CUF ~50% vs solar ~28%; Hybrid CUF ~36%.

- Pipeline mix (post-FY29 commissioning): Solar ~49%, FDRE ~38%, Hybrid ~11%, Wind ~2%.

- FDRE realised tariff ~₹4.5/kWh (premium vs solar ~₹3.0/kWh), driving stronger revenue per MW.

- BESS rollout unlocks merchant arbitrage.

- Orders for 5.2 GWh of batteries; ~2.5 GWh to be installed by end-2025.

- Conservative spread assumption (≈₹2/kWh) could lift revenue by ~5%/9%/5% in FY26/FY27/FY28 respectively.

- Falling equipment costs boost returns.

- Solar module prices down ~40% and battery prices down ~65% over ~2 years.

- A $10/kWh fall in battery cost → ~3.5% capex reduction; 10% fall in module price → ~5% capex reduction for FDRE.

- Strong growth visibility & margins.

- Management / research build shows Revenue / EBITDA / PAT CAGR at ~66% / 68% / 78% (FY25–28E).

- High operating leverage expected: EBITDA margin ~90% forecasted (FY26–FY30E).

Financial snapshot (company / research estimates)

| Metric | FY25A | FY26E | FY27E | FY28E |

|---|---|---|---|---|

| Revenue (₹ bn) | 14 | 23 | 42 | 65 |

| EBITDA (₹ bn) | 12 | 21 | 38 | 59 |

| EBITDA margin (%) | 87.9 | 89.1 | 91.0 | 90.9 |

| PAT (₹ bn) | 3 | 5 | 6 | 14 |

| EPS (₹) | 4.1 | 7.7 | 10.5 | 23.3 |

| PER (x) | 72.4 | 38.8 | 28.5 | 12.9 |

Valuation & risk

- Valuation: DCF → TP ₹380/share (WACC ~7.5%, terminal growth 4%); implied EV/EBITDA ~10x FY28E.

- Why BUY: Strong commissioned pipeline, FDRE/hybrid premium, battery-led revenue upside and improving return ratios (RoE → ~22% by FY28E).

- Key risks: execution delays on FDRE/hybrid projects, slower-than-expected battery deployments, capex funding / dilution risk, and regulatory changes affecting tariffs or RPOs.

Bottom line

ACMESOLA is a growth-at-scale play on India’s green transition — combining high-quality contracted capacity, margin-accretive project mix and optionality from BESS trading. We initiate coverage with a BUY and TP ₹380, making it a leading stock to watch in today’s Market Outlook 12 September.

Conclusion – Market Outlook 12 September

The Indian markets closed marginally higher on 11 September, with NIFTY at 25,002.85 (+0.12%) and SENSEX at 81,532.17 (+0.13%), showing cautious optimism.

For Market Outlook 12 September, investors should focus on upcoming IPO listings, including Dev Accelerator, Urban Co., and TechD Cybersecurity, which could influence early market sentiment. In stocks, ACME Solar Holdings stands out as a fundamentally strong green energy play, with potential gains from strategic capacity expansion and falling project costs.

Corporate developments, including renewable energy orders, strategic joint ventures, and GST reforms, are likely to impact sectors such as energy, industrials, and housing.

✅ Key takeaway: Position cautiously, monitor IPO trends and sector-specific developments, and focus on fundamentally strong stocks like ACME Solar Holdings for selective opportunities today.

Related Articles

Read Our All Newsletter On Pre-Market Analysis

Systematic Withdrawal Plan 2025 – 7 Powerful Benefits

Best IPOs in 2025: Top 10 Stocks That Doubled Investors’ Money