Introduction: Why Gold Still Shines as an Investment

Gold has always held a special place in Indian households—not just as an ornament, but as a symbol of wealth and financial security. From festivals to weddings, gold is both a cultural and economic asset. But beyond tradition, there are solid financial reasons to invest in gold in 2025.

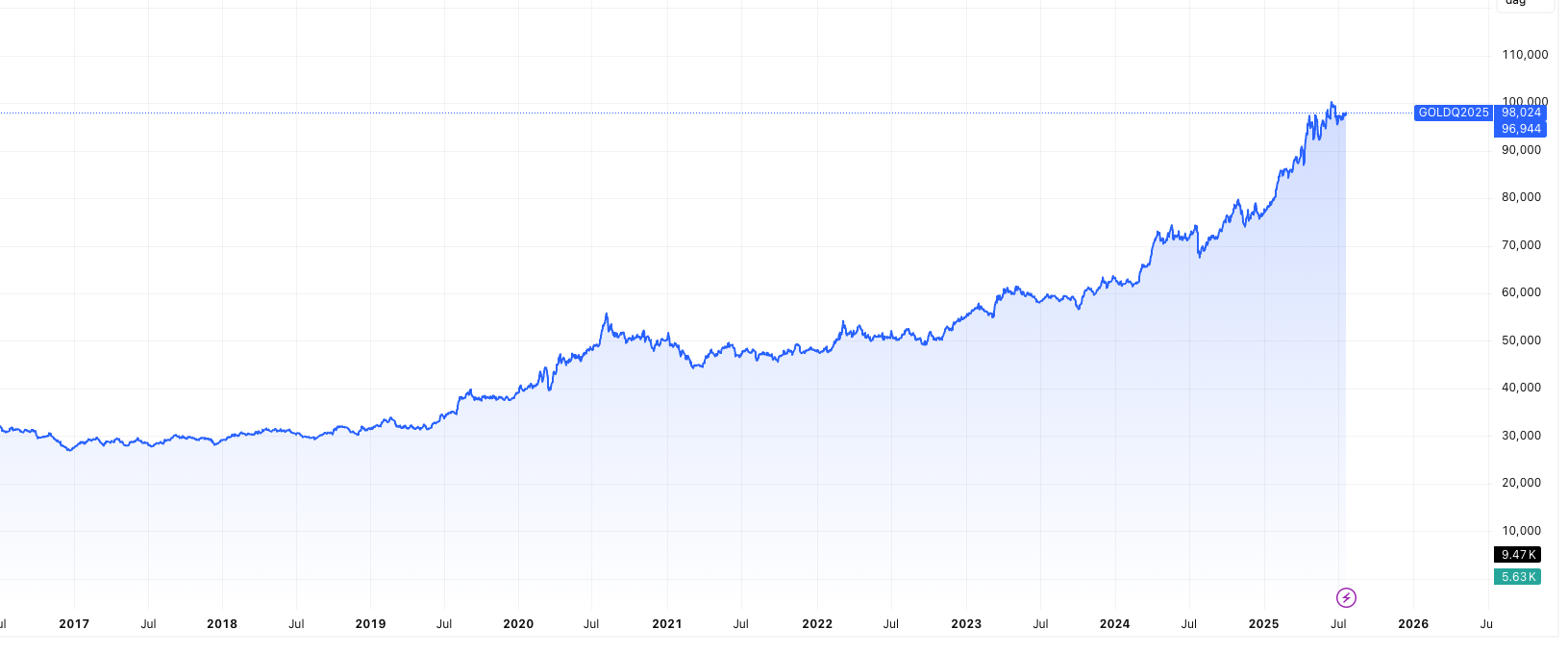

With gold prices hovering around ₹1 lakh per 10 grams, the yellow metal has proven its long-term value. In fact, during times of inflation, currency depreciation, or stock market volatility, gold tends to outperform, offering investors a stable store of value.

Today, gold is no longer just about physical jewelry or coins. Investors now have access to modern options like gold ETFs, digital gold, mutual funds, and until recently, Sovereign Gold Bonds (SGBs). However, the government discontinued the issuance of new SGBs in July 2025, which was once a preferred route for tax-efficient gold investing.

So, if you’re planning to invest in gold, this blog will walk you through a step-by-step guide—from choosing the right format to understanding the risks and taxes involved. Whether you’re a first-time investor or looking to diversify your portfolio, this guide will help you navigate your options in a post-SGB landscape.

Why Invest in Gold?

Gold isn’t just a glittering metal—it’s a time-tested financial asset. Whether you’re a conservative saver or an aggressive investor, there are strong reasons to invest in gold as part of a well-balanced portfolio.

1. Hedge Against Inflation

When inflation eats into the value of money, gold tends to hold (or even grow) in value. Over the last decade, gold has outpaced inflation, making it an effective hedge.

2. Safe Haven During Market Uncertainty

During geopolitical tensions, economic slowdowns, or market crashes, investors flock to gold. For instance, gold prices surged in 2020 during the pandemic and again in 2023 amid global banking concerns.

3. Currency Depreciation Protection

When the rupee weakens against the US dollar, gold prices in India tend to rise. That makes gold a smart way to protect your wealth against currency risk.

4. Portfolio Diversification

Gold has a low correlation with equities and bonds. Including even 5–10% gold in your portfolio can help reduce overall risk and improve long-term returns.

5. Strong Demand in India

India remains the world’s second-largest consumer of gold. Cultural demand during festivals and weddings keeps domestic prices resilient.

6. Liquidity and Accessibility

Most gold investments—especially digital forms—can be easily bought, sold, or pledged. They’re also now more accessible to younger investors thanks to mobile apps and online platforms.

In short, whether you’re looking for safety, diversification, or long-term appreciation, there are several compelling reasons to invest in gold—even more so when gold is trading around ₹1 lakh per 10 grams in 2025.

How to Invest in Gold: Step-by-Step Guide for 2025

Thinking about adding gold to your investment portfolio? Here’s a step-by-step guide on how to invest in gold the smart way—especially now that traditional options like Sovereign Gold Bonds (SGBs) have been discontinued.

Step 1: Decide Your Purpose

Ask yourself:

- Are you looking for short-term gains or long-term wealth protection?

- Do you want to hedge against inflation or simply diversify?

Your purpose will determine the best format to invest in—physical gold, digital gold, or gold-backed financial products.

Step 2: Choose the Right Format to Invest in Gold

Here are your main options:

| Format | Description | Ideal For |

|---|---|---|

| Physical Gold (jewelry, coins, bars) | Tangible, traditional form | Cultural occasions, gifts |

| Digital Gold (via apps like PhonePe, Paytm, Groww) | Buy as low as ₹1 worth, stored in secure vaults | Small-ticket, first-time investors |

| Gold ETFs (via demat account) | Exchange-traded funds backed by gold | Stock market investors |

| Gold Mutual Funds | Invest in gold indirectly via fund houses | Hands-off investors |

| Sovereign Gold Bonds (SGBs) | Govt bonds offering 2.5% annual interest + gold price | Currently discontinued (as of July 2025) |

Step 3: Check Charges & Tax Rules

Each format comes with different costs and tax rules:

- Jewelry involves making charges (8–25%) and GST.

- Digital Gold may include platform fees.

- ETFs charge annual expense ratios.

- Capital gains taxes differ: Physical gold held over 3 years gets LTCG benefit; ETFs and funds after 3 years also enjoy indexation.

Pro Tip: Previously, SGBs were tax-free on maturity, but new issues have now been stopped.

Step 4: Choose a Trusted Platform

- For digital gold: Go with SEBI-registered partners (e.g., Groww, Paytm).

- For ETFs & gold mutual funds: Use your demat or broker account.

- For coins/bars: Buy from reputed jewelers, banks, or MMTC-PAMP.

Step 5: Start Small and Track Performance

Gold doesn’t need a lump sum investment. You can begin with as little as ₹100 in digital gold or SIPs in gold mutual funds.

Make sure to review:

- Market trends (like current ₹1 lakh per 10g rate),

- Dollar-rupee movements,

- Global interest rate cycles.

This helps you time your entry and balance your portfolio better.

Gold Investment Options Compared: Pros & Cons

Before you invest in gold, it’s important to understand which format suits your financial goals. Here’s a quick comparison of the most popular options in 2025, especially since SGBs are no longer being issued:

| Option | Pros | Cons | Taxation |

|---|---|---|---|

| Physical Gold | Tangible, easy to buy; culturally preferred | Making charges, purity risk, storage hassles | LTCG after 3 years (20% + indexation) |

| Digital Gold | Buy/sell instantly, low entry point, stored safely | Not regulated by SEBI/RBI; short-term investment tool | Taxed like physical gold |

| Gold ETFs | Traded like stocks, no storage issues, SEBI-regulated | Requires demat account, brokerage fees | LTCG after 3 years (20% + indexation) |

| Gold Mutual Funds | No demat needed, SIP available, diversified | Expense ratio ~0.5%-1%, indirect exposure to gold | Similar to debt mutual funds (with indexation) |

| SGBs (Discontinued) | Government-backed, 2.5% interest, tax-free on maturity (8 years) | No new issuance since July 2025; existing bonds locked till expiry | Tax-free on maturity; interest is taxable annually |

Key Update on Sovereign Gold Bonds (SGBs)

As of July 2025, the government has discontinued fresh issues of SGBs. This removes one of the most tax-efficient and secure ways to invest in gold. Investors with existing SGBs can continue holding them, but new buyers will have to look for alternatives like digital gold or ETFs.

Risks You Should Know Before You Invest in Gold

While gold is often seen as a “safe” investment, it’s not without risks. Before you invest in gold, be sure to understand these potential downsides:

1. Price Volatility

Gold prices can fluctuate sharply due to global events, interest rates, or central bank policies. For instance, while gold is near ₹1 lakh per 10 grams in 2025, past corrections have wiped out double-digit gains in months.

2. No Regular Income

Unlike stocks or bonds, gold doesn’t generate interest or dividends. The only return comes from price appreciation—except in the case of SGBs, which offered 2.5% interest (but are now discontinued).

3. Storage and Security Issues (Physical Gold)

If you’re holding gold jewellery or coins, you’ll need a secure place to store them. Theft and purity concerns are common issues, especially with unverified sellers.

4. Liquidity Concerns (SGBs and Funds)

SGBs are listed on exchanges but may suffer from poor liquidity. Some gold mutual funds and ETFs may also have redemption limits during times of stress.

5. Tax Implications

Short-term gains from selling gold (before 3 years) are taxed at slab rates. Only SGBs offered tax-free returns after 8 years—but with that option now closed for new investors, taxation becomes a more important consideration.

Taxation on Gold Investments in India (2025)

When you invest in gold, understanding how it’s taxed is crucial to calculating your true returns. Here’s how each gold format is taxed under current Indian tax laws:

1. Physical Gold & Digital Gold

- Short-Term Capital Gains (STCG): If sold within 3 years, gains are added to your income and taxed as per your slab rate.

- Long-Term Capital Gains (LTCG): If held for more than 3 years, taxed at 20% with indexation (adjusts purchase price for inflation).

2. Gold ETFs & Mutual Funds

- ETFs are treated just like physical gold for tax purposes.

- Gold Mutual Funds (FoFs) are taxed as debt funds:

- If sold before 3 years: taxed as per slab rate.

- After 3 years: taxed at 20% with indexation.

3. Sovereign Gold Bonds (SGBs)

- Interest (2.5% annually): Taxable under “Income from Other Sources”.

- Capital Gains on Maturity (after 8 years): Completely tax-free.

- Early Redemption/Sale (after 5 years or on exchanges): Gains are taxed like LTCG — 20% with indexation.

Note: With the SGB scheme discontinued in July 2025, this tax-free maturity benefit is no longer available to new investors.

Conclusion: Should You Invest in Gold in 2025?

With gold prices nearing ₹1 lakh per 10 grams, many investors are wondering if it’s still the right time to invest in gold. The answer depends on your financial goals.

Gold remains a powerful hedge against inflation, currency depreciation, and geopolitical risk. In 2025, with the discontinuation of Sovereign Gold Bonds (SGBs), investors must explore other routes like gold ETFs, digital gold, and gold mutual funds to build exposure.

However, gold should not be your primary investment. Experts recommend allocating 5–15% of your portfolio to gold, primarily for diversification. Use online platforms, regulated apps, and trusted mutual funds for transparency and ease.

✅ Gold is still a smart investment in 2025—if used wisely and strategically as part of a diversified portfolio.

Now that you understand the how, where, and why of investing in gold, you can confidently take the next step toward protecting your wealth.

FAQs on How to Invest in Gold

1. What is the best way to invest in gold in 2025?

The best ways in 2025 include gold ETFs, mutual funds, and digital gold. Sovereign Gold Bonds (SGBs) were a top option but have been discontinued recently.

2. Is it safe to invest in digital gold?

Yes, digital gold is safe if bought through RBI-regulated platforms or apps partnered with MMTC-PAMP, SafeGold, or Augmont. Always verify the platform’s credibility.

3. Can I still invest in Sovereign Gold Bonds (SGBs)?

No, as of July 2025, the Government has discontinued the SGB scheme for new investors. Existing bondholders can still hold or trade them.

4. How much gold should I have in my investment portfolio?

Experts suggest allocating 5–15% of your portfolio to gold for diversification and inflation protection.

5. Is gold taxed in India?

Yes. Physical and digital gold are taxed at 20% (with indexation) after 3 years. SGBs were tax-free on maturity, but that option is no longer open to new buyers.

6. Which is better—gold ETFs or gold mutual funds?

Gold ETFs are more cost-efficient and liquid. Mutual funds are better if you prefer SIPs and professional management. Both are taxed similarly.

7. Why are gold prices so high in 2025?

Gold prices have surged due to global economic uncertainty, high inflation, and rising central bank demand.

Related Articles

Gold and Silver at ₹95,000: What History Tells Us About What’s Next

Gold vs Silver vs Sensex: Who Made You Richer?

Will Gold Price Hit ₹1 Lakh This Year? Or Is a Crash Coming?