Introduction:

The Indogulf IPO opens for subscription on June 26, 2025, and plans to raise ₹200 crore through a combination of a fresh issue and an offer for sale. Indogulf Cropsciences Limited, a leading agrochemical company in India, is entering the capital markets to fund its growth and reduce debt.

Founded in 1993, the company manufactures crop protection chemicals, plant nutrients, and biological products for sustainable farming. It runs four production facilities across Haryana and Jammu & Kashmir and has a presence in 22 states and 3 Union Territories. In addition, it exports to over 30 countries, supported by a strong network of 5,700+ distributors.

The IPO price band is fixed at ₹105 to ₹111 per share, and the listing will take place on both BSE and NSE. The fresh issue will raise ₹160 crore, while the offer for sale will offload shares worth ₹40 crore. Indogulf plans to use the funds for working capital, partial debt repayment, and to set up a new dry flowable plant in Haryana.

However, while the company shows stable growth and industry experience, potential investors should also consider risks like moderate profit margins, rising input costs, and competition from global players.

In this blog, we break down the IPO structure, financials, business model, and investment outlook to help you decide if the Indogulf IPO deserves a spot in your portfolio.

Indogulf IPO Details

The Indogulf Cropsciences IPO will open on June 26, 2025, and close on June 30, 2025. The company aims to raise a total of ₹200 crore through this public issue.

The IPO comprises:

- A fresh issue of 1.44 crore shares, worth ₹160 crore

- An offer for sale (OFS) of 36.03 lakh shares, worth ₹40 crore

Investors can bid within the price band of ₹105 to ₹111 per share. The minimum lot size for retail investors is 135 shares, requiring an investment of around ₹14,985 at the upper end of the band.

For HNIs:

- sNII (small non-institutional investors) must apply for a minimum of 14 lots (1,890 shares)

- bNII (big non-institutional investors) must apply for at least 67 lots (9,045 shares)

Here’s a quick snapshot:

| IPO Details | Information |

|---|---|

| IPO Open Date | June 26, 2025 |

| IPO Close Date | June 30, 2025 |

| Allotment Finalisation | July 1, 2025 |

| Listing Date (Tentative) | July 3, 2025 |

| Issue Type | Book Building |

| Listing Exchange | BSE and NSE |

| Face Value | ₹10 per share |

| Price Band | ₹105 – ₹111 per share |

| Lot Size | 135 shares |

| Retail Investment (Min) | ₹14,985 (at ₹111) |

| Total Issue Size | 1.80 crore shares (₹200 crore) |

| Fresh Issue Size | 1.44 crore shares (₹160 crore) |

| Offer for Sale | 36.03 lakh shares (₹40 crore) |

| Book-Running Lead Manager | Systematix Corporate Services Ltd. |

| Registrar | Bigshare Services Pvt Ltd |

As per SEBI rules, at least 35% of the net offer is reserved for retail investors, 15% for non-institutional investors (NII), and up to 50% for qualified institutional buyers (QIBs).

Investors must confirm UPI mandates before 5 PM on June 30, 2025, to ensure their bids are valid.

Objectives of the Indogulf IPO

Indogulf Cropsciences plans to use the IPO proceeds to strengthen its operations, reduce debt, and fund future growth. The total fresh issue component of ₹160 crore will be strategically allocated across four key areas.

Here’s a breakdown of the objectives:

- Working Capital Needs – ₹65 crore

The company will allocate the largest portion of the proceeds to meet its day-to-day operational expenses. This includes funding raw material purchases, trade receivables, and other short-term financial needs. The goal is to support business expansion and ensure smooth production and distribution. - Debt Repayment – ₹34.12 crore

Indogulf plans to reduce its debt burden by repaying certain outstanding borrowings. This move is expected to improve the company’s balance sheet, lower interest costs, and enhance overall financial health. - New Manufacturing Facility – ₹14 crore

The company will invest in setting up a dry flowable (DF) formulation plant at Barwasni in Sonipat, Haryana. This facility will enhance its product capabilities and support future innovation in agrochemical formulations. - General Corporate Purposes

The remaining funds will be used for general business needs. These may include brand-building, administrative costs, or potential strategic initiatives.

This clear allocation of funds signals the company’s focus on operational efficiency, capacity building, and debt reduction — all of which can add long-term value for shareholders.

Company Overview: Inside Indogulf Cropsciences

Indogulf Cropsciences Limited is a homegrown agrochemical manufacturer that has been operating since 1993. The company focuses on improving crop productivity through its three core verticals: crop protection, plant nutrients, and biologicals.

Over the past three decades, Indogulf has built a strong foundation in the Indian agri-input market and is now expanding its global footprint. It exports products to over 34 countries and has earned the “Two Star Export House” recognition from the Government of India. The company also operates two international subsidiaries—Indogulf Cropsciences Australia Pty Ltd and Abhiprakash Globus Private Limited—to boost overseas registrations and market access.

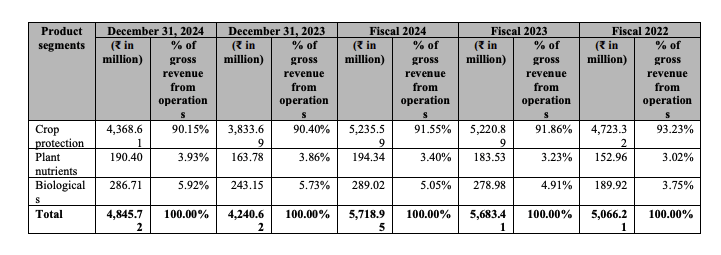

Key Business Segments

- Crop Protection (Over 90% of revenue)

This is Indogulf’s largest business line. It includes insecticides, fungicides, herbicides, and plant growth regulators. These are available in various advanced formulations such as WDG, SC, CS, ULV, EW, SG, and FS.

Some of its popular brands include:- Farrate (Lambda Cyhalothrin 5% EC)

- Dominator (Emamectin Benzoate 5% SG)

- Corsa-808 (Profenofos + Cypermethrin)

- Alkazar (Tembotrione 34.4% SC)

- Bound Off (Glyphosate 41% SL)

- Biologicals (5–6% of revenue)

These products promote sustainable agriculture by improving soil health, boosting plant stress resistance, and enhancing nutrient absorption. Key bio-stimulant brands include:- Breeza (seaweed)

- Apache (humate)

- Root-o-Max Gold (mycorrhiza)

- Empire (combinations)

- Plant Nutrients (Around 3–4% of revenue)

Indogulf also produces a variety of soil-enhancing fertilizers and deficiency correctors. Notable brands include Picaso Gold, Jagromin-99, Zinc Super+, and Zinc Super Gold.

Modern Manufacturing and Customization

The company runs four ISO-certified facilities across Haryana and Jammu & Kashmir, covering around 20 acres. These units offer backward-integrated and flexible manufacturing, which enables Indogulf to deliver tailored formulations through contract manufacturing services.

Long-Term Clients and Suppliers

Indogulf supplies products to major domestic and international brands, including:

- Crystal Crop Protection Ltd.

- Krishi Rasayan Exports

- Parijat Industries

- Asasiat for Development of Agric & Trade Co. (UAE)

Its supplier network includes reputed names such as:

- Coromandel International

- GSP Crop Science

- MaxxGro Agrology

- Chinese partners like Dagro Chemical and Hubei Benxing

Technical Innovation

Indogulf was one of the first indigenous manufacturers of Pyrazosulfuron Ethyl Technical with 97% purity, and also started Spiromesifen Technical manufacturing in 2019 with 96.5% purity. These achievements reflect the company’s focus on technical innovation and self-reliance.

Financial Performance: Steady Growth with Margins in Check

Indogulf Cropsciences has delivered consistent growth across revenue and profitability over the past three fiscal years and the recent nine-month period ending December 31, 2024. The company’s financials reflect operational stability, improved efficiency, and moderate but improving profit margins.

Revenue and Profit Growth

The company’s revenue from operations rose from ₹4,872 million in FY22 to ₹5,522 million in FY24, marking a steady increase. In the nine months ended December 31, 2024, Indogulf clocked ₹4,642 million in revenue, up 12.3% from the same period the previous year.

On the bottom line, profit after tax (PAT) rose to ₹282.33 million in FY24 from ₹224.23 million in FY23. The PAT margin improved to 5.11% in FY24, compared to 4.08% in FY23. In the latest nine-month period, PAT stood at ₹216.77 million, already surpassing the FY23 full-year figure, reflecting stronger operational performance.

Key Profitability Metrics

| Metric | FY2024 | FY2023 | FY2022 | 9M FY24 | 9M FY23 |

|---|---|---|---|---|---|

| Revenue (₹ Mn) | 5,522.34 | 5,496.56 | 4,872.10 | 4,641.88 | 4,134.00 |

| EBITDA (₹ Mn) | 557.44 | 490.40 | 472.43 | 447.77 | 340.11 |

| EBITDA Margin (%) | 10.09% | 8.92% | 9.70% | 9.65% | 8.23% |

| PAT (₹ Mn) | 282.33 | 224.23 | 263.63 | 216.77 | 152.91 |

| PAT Margin (%) | 5.11% | 4.08% | 5.41% | 4.67% | 3.70% |

These figures indicate stable profit margins and a healthy recovery in FY24, despite broader headwinds in the agrochemical sector.

Operational Efficiency

Indogulf has gradually improved operational efficiency, with metrics showing a strong balance between growth and cost control.

- Inventory turnover ratio was 2.02x in FY24, slightly lower than previous years but consistent with sector norms.

- Fixed asset turnover declined to 7.83x in FY24 from 7.21x in FY22, indicating continued investments in capacity.

- The working capital requirement grew from ₹1,151.89 million in FY22 to ₹1,710.45 million in FY24, reflecting business expansion.

Leverage and Return Ratios

Indogulf has managed its debt reasonably well. The debt-equity ratio came down to 0.67x in FY24, from a peak of 0.93x in FY23. This reduction reflects efforts to deleverage, a key objective of the IPO.

Return ratios also highlight healthy value creation:

- Return on Net Worth (RoNW) improved to 12.19% in FY24 from 11.03% in FY23.

- Return on Capital Employed (ROCE) rose to 11.93%, up from 10.12% a year earlier.

These returns indicate efficient capital utilization and underline the company’s earnings potential.

Bottom Line: Indogulf’s financials show steady topline growth, improving profitability, and prudent capital management. While margins are moderate, the company’s improving EBITDA and PAT indicate growing strength in operations—making the Indogulf IPO worth considering for investors looking at the agrochemical space.

Valuation and Peer Comparison: Where Does Indogulf Stand?

The valuation of Indogulf Cropsciences appears moderately priced when compared with listed peers in the agrochemical and plant nutrient space. While it may not lead the pack on every metric, it strikes a balance between profitability and valuation — especially for investors seeking exposure to mid-cap agri-input companies.

IPO Valuation Snapshot

At the upper end of the price band (₹111), Indogulf commands a P/E ratio of ~9.25x based on FY24 earnings (EPS ₹12) and a Price-to-Book (P/BV) ratio of ~1.13x, considering a NAV of ₹97.98. These multiples indicate a reasonable valuation, especially in comparison to industry standards.

Peer Comparison Table

| Company | EPS (₹) | NAV (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|

| Indogulf Cropsciences (IPO) | 12.00 | 97.98 | ~9.25 | 12.19% | ~1.13 |

| Aries Agro Ltd. | 14.94 | 200.20 | 17.47 | 7.07% | 1.21 |

| Basant Agro Tech | 0.43 | 19.22 | 44.58 | 2.27% | 0.95 |

| Best Agrolife Ltd. | 44.94 | 273.64 | 12.23 | 16.42% | — |

| Bhagiradha Chemicals | 17.50 | 397.59 | 101.81 | 4.40% | 4.06 |

| Heranba Industries | 8.72 | 213.19 | 35.34 | 4.04% | 1.33 |

| India Pesticides Ltd. | 5.24 | 7.17 | 41.62 | 72.90% | 213.43 |

| Dharmaj Crop Guard Ltd. | 13.13 | 106.33 | 18.02 | 12.35% | 2.10 |

Analysis

- At ~9.25x P/E, Indogulf is more attractively priced than most peers, especially those with higher P/E ratios like Bhagiradha (101x) or India Pesticides (41x).

- It also offers decent profitability, with RoNW of 12.19%, close to Dharmaj Crop Guard (12.35%) and ahead of players like Heranba (4.04%).

- The company’s P/BV ratio of 1.13 indicates fair pricing against its book value, especially when compared to highly priced peers like India Pesticides.

Although Indogulf doesn’t boast the highest EPS or NAV, it balances value, returns, and stability, making it a compelling mid-tier agrochemical IPO.

Verdict: Indogulf’s valuations suggest a fairly priced offer in a sector that typically commands premium multiples. Investors looking for growth potential without overpaying may find the Indogulf IPO a worthwhile consideration — especially given its strong distribution, steady financials, and improving margins.

Investment Verdict: Should You Subscribe to the Indogulf IPO?

The Indogulf IPO offers a compelling mix of steady financial performance, sectoral relevance, and a reasonable valuation. With India’s agriculture sector seeing ongoing reforms and rising demand for crop protection and bio-based solutions, Indogulf appears well-positioned for both near-term traction and long-term growth.

Short-Term View: Listing Gains Possible, but Moderation Likely

From a short-term perspective, investors can expect moderate listing gains, especially if overall market sentiment remains supportive. Here’s why:

- The IPO is reasonably priced at ~9.25x P/E, leaving room for upside without overvaluation.

- The agrochemical theme continues to attract investor interest, driven by seasonal demand and government-backed agri initiatives.

- However, lack of marquee anchor investors and the absence of a big IPO buzz may limit explosive debut-day rallies.

Verdict: A listing gain of 5–15% appears possible if the subscription numbers are strong and the broader market holds steady.

Long-Term View: A Steady Compounder with Margin Expansion Potential

For long-term investors, Indogulf offers a play on India’s evolving agricultural ecosystem. Here’s what works in its favor:

- Diversified product portfolio across crop protection, nutrients, and biologicals

- Export footprint in 34+ countries and status as a Two Star Export House

- Strong promoter background and long-standing client relationships

- Focus on innovation, like high-purity technicals and new manufacturing capacity (DF plant)

That said, long-term gains will depend on:

- How effectively the company scales its export vertical

- Margin sustainability amid volatile input costs

- Its ability to maintain debt levels post-IPO

Verdict: Indogulf has the potential to become a mid-cap compounder over the next 3–5 years, especially if it executes well on R&D, exports, and capacity expansion.

Allotment Strategy: How to Maximise Your Chances

Given the IPO’s attractive pricing and moderate size, oversubscription in the retail category is likely, though not extreme.

Here’s how you can improve your allotment chances:

- Apply at the cut-off price (₹111) to stay eligible in case of high demand.

- Submit multiple applications through different PANs within your family (only if applicable and legal).

- Avoid applying for more than 1 lot per retail PAN, as allotment in oversubscribed IPOs is usually done via lottery.

- Confirm your UPI mandate before 5 PM on June 30, the last day of subscription, to avoid rejection.

Final Word

The Indogulf IPO brings a mix of fundamentals and reasonable valuation in a sector with long-term structural tailwinds. It might not deliver flashy debut gains, but it offers a stable, growth-oriented investment for those who believe in India’s agricultural transformation.

✅ Short-term investors can expect modest gains

✅ Long-term investors may benefit from sustained margin expansion and export growth

✅ Apply with a disciplined allotment strategy to increase chances of participation

💼 Invest in the Indogulf IPO seamlessly with Angel One! Open a free Demat account today and apply in just a few clicks. 📲 Start Now

Quick FAQs on Indogulf IPO

What is the Indogulf IPO date?

It opens on June 26, 2025, and closes on June 30, 2025.

What is the IPO price band?

The price band is set at ₹105 to ₹111 per share.

What is the minimum investment amount?

Retail investors need to invest at least ₹14,985 (1 lot = 135 shares).

How much of the issue is fresh shares?

₹160 crore is a fresh issue, and ₹40 crore is offer for sale.

When is the allotment expected?

Allotment is likely on July 1, 2025.

When will Indogulf list on the stock exchange?

The tentative listing date is July 3, 2025, on BSE and NSE.

Is Indogulf a profitable company?

Yes, it reported a PAT of ₹282.33 crore in FY24 with a 5.11% PAT margin.

What is the P/E ratio of the IPO?

The IPO is priced at ~9.25x FY24 earnings, making it attractively valued.

What is the company’s core business?

Indogulf manufactures crop protection products, plant nutrients, and biologicals.

Can I apply via Angel One?

Yes! You can apply easily through the Angel One platform or mobile app.

Related Articles

How Micro Factors Impact the Stock Market: A Deep Dive into India’s Sectoral Shifts