The term “biotech” might sound like something that belongs in a sci-fi movie or a lab in Silicon Valley—but make no mistake, the Indian biotechnology sector is rapidly becoming one of the most exciting investment frontiers in the country. Behind its lab coats and microscopes lies a booming economy, a dynamic startup culture, and the kind of government backing that could put rocket fuel under its growth.

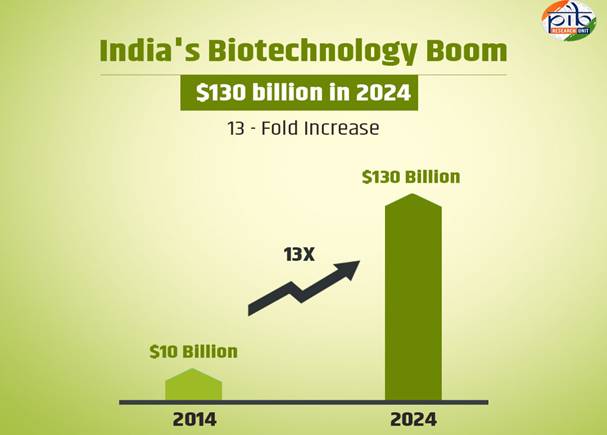

In just a decade, India’s BioEconomy has grown from a modest $10 billion in 2014 to $130 billion in 2024. And the projection? A jaw-dropping $300 billion by 2030. That’s not just growth—that’s a transformation.

But what’s powering this surge? Let’s decode it.

The Three Pillars Fueling India’s Biotech Boom

1. A Population That Needs More Than Band-Aids

India’s rising burden of chronic illnesses isn’t just a public health issue—it’s also a powerful market force. With 72 million diabetes cases and an ever-growing number of cardiovascular disorders, there’s an urgent demand for advanced diagnostics, precision medicine, and gene-based therapies. This isn’t a market luxury—it’s a healthcare necessity.

2. Government: From Bystander to Biotech Cheerleader

In 2023 alone, the Department of Biotechnology allocated $1.9 billion to life sciences R&D. That’s not pocket change. And with World Bank backing the National Biopharma Mission with another $250 million, global confidence is clearly high.

The BIO-E3 policy—a shiny new initiative—signals further regulatory and financial support for everything from biopharma to agri-biotech. Government intent is clear: India won’t just import innovation; it will create it.

3. Global Tailwinds

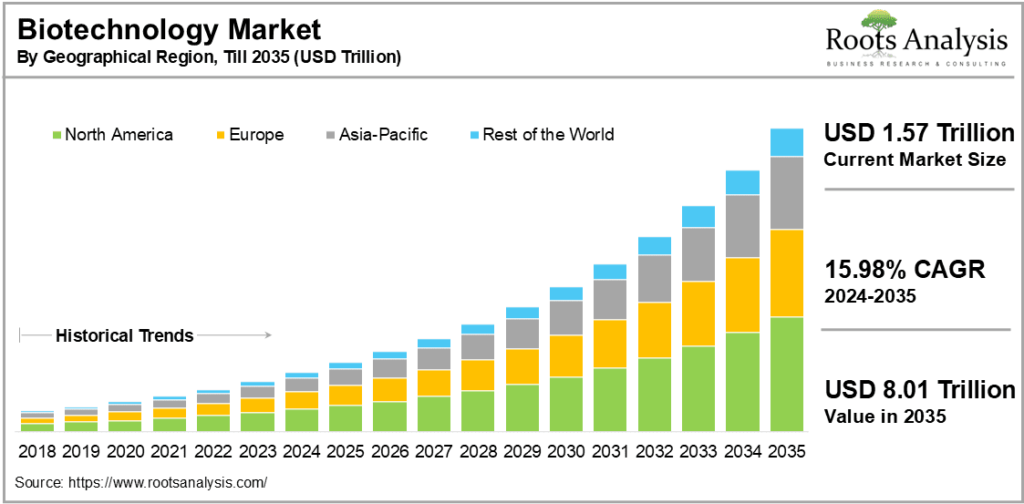

Worldwide, the biotechnology market is valued at over $1.57 trillion in 2024, expected to grow at nearly 16% CAGR over the next decade. India, with its talent, infrastructure, and cost advantage, is perfectly placed to grab a bigger piece of that pie.

Diving Deeper: Where the Real Action Is

The Indian biotechnology sector isn’t a single monolith. It’s an ecosystem of sub-sectors, each with its own growth curve, risk profile, and innovation pipeline. Let’s zoom into three of the hottest spaces:

💡 Gene Editing: From Sci-Fi to Startup

Gene editing might sound like something out of a Marvel origin story—but it’s very real, and very investable.

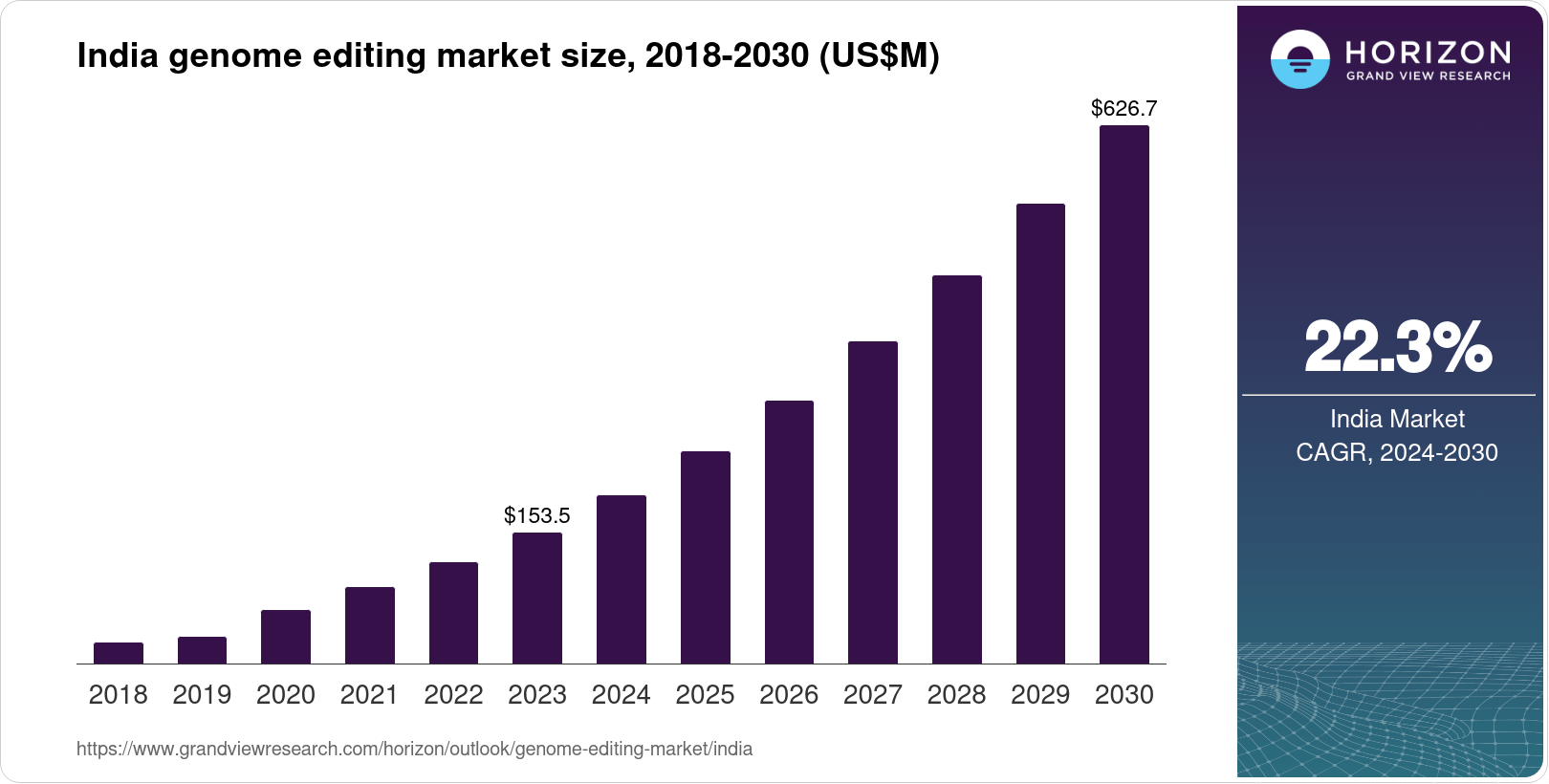

India’s gene editing market is currently pegged at $153 billion, largely driven by CRISPR tech, genomics startups, and personalized treatments. While global estimates suggest the genome editing market could touch $626.7 billion by 2030, India’s push for precision medicine and rare disease treatment gives this sector serious legs.

Leading the charge? Companies like Dr. Reddy’s, Sun Pharma, Biocon, Zydus Cadila, and Reliance Life Sciences—all investing heavily in R&D, collaborations, and next-gen therapies.

🧬 Personalized Medicine: Because “One-Size-Fits-All” is Out

Personalized medicine is no longer the future—it’s the now. With genomic research, digital health data, and AI diagnostics, treatments are being tailored to individuals, not masses.

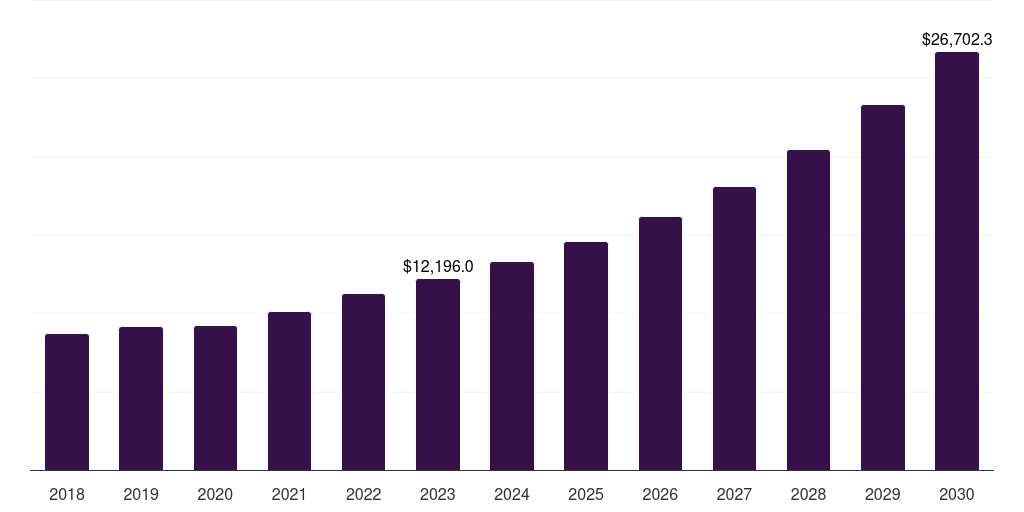

India’s personalized medicine market was valued at USD 12,196.0 million in 2023, and it’s expected to Double by 2035. Whether you’re battling cancer, diabetes, or mental health disorders, customized therapies are taking center stage.

This growth is supported by over 500 biotech startups in India that focus on genetic testing, wellness, diagnostics, and therapeutics. Products in personalized nutrition are already big earners, but PM Therapeutics—personalized medicines tailored to disease biology—are the fastest-growing category.

💉 Biopharmaceuticals: India’s Global Flex

India already supplies 60% of the world’s vaccines. Let that sink in. It also houses the second-largest number of USFDA-approved plants outside the U.S.

That’s not just impressive—it’s strategic. In a world still recovering from COVID-19, India’s biopharma dominance matters more than ever. And with biosimilars and novel biologics gaining ground, the biopharma sector is no longer about “low-cost generics”—it’s about innovation, IP, and global collaboration.

India’s Biotech Sub-Sector Snapshot

| Sub-Sector | 2023 Market Size | 2030 Projection | Key Players |

|---|---|---|---|

| Gene Editing | $153 billion (India) | $626.7 billion globally by 2030 | Sun Pharma, Dr. Reddy’s, Biocon |

| Personalized Medicine | USD 12,196.0 million | USD 26,700 million by 2030 | MedGenome, Mapmygenome |

| Biopharmaceuticals | Part of $151B BioEconomy | $300B BioEconomy by 2030 | Biocon, Serum Institute, Zydus |

Meet the Biotech Trailblazers

Some of India’s most ambitious biotech firms are already shaping the global narrative:

- Biocon – Known for its affordable biosimilars and partnerships in oncology and diabetes.

- Bharat Biotech – Behind COVAXIN and a range of life-saving vaccines.

- Serum Institute of India – The world’s largest vaccine manufacturer. Enough said.

- Zydus Lifesciences – Innovator of ZyCoV-D, the world’s first DNA-based COVID vaccine.

- MedGenome – India’s leader in genetic diagnostics, focused on precision health.

- Reliance Life Sciences – Actively investing in gene therapy and stem cell innovation.

- Intas Pharmaceuticals – Major player in biosimilars, especially for autoimmune disorders.

And let’s not forget rising stars like Pandorum Technologies, Sea6 Energy, and Oncostem Diagnostics—all tackling niche areas like regenerative medicine, seaweed-based biofuels, and AI-powered cancer diagnostics.

Why Investors Should Be Paying Attention

Let’s be clear: biotech is not a get-rich-quick game. It’s capital-intensive, long-term, and often highly regulated. But when it works? It’s transformative. And in India, the signs are lining up beautifully:

- Surging domestic demand

- Global market alignment

- Government and World Bank support

- Startup ecosystem thriving

- Infrastructure and talent already in place

In short, the Indian biotechnology sector is no longer just a space to watch—it’s a space to act in.

Final Word: Don’t Miss the Biotech Boom

The world’s next big medical breakthrough might come not from Boston or Berlin—but from Bengaluru or Hyderabad. Whether it’s gene editing, vaccines, or personalized nutrition, India is building not just for itself—but for the world.

If you’re an investor, startup founder, researcher, or even a curious reader—this is one sector that deserves your attention, your capital, and maybe even your next career move.

Ready to invest in India’s next big growth story?

Open your free Demat account with Angel One today and start tracking high-potential biotech stocks, from Biocon to Zydus, with smart insights and research tools.

FAQs

1. What is the Indian biotechnology sector?

It’s a rapidly growing industry focusing on innovations in medicine, genetics, vaccines, and biosciences.

2. How big is India’s biotech market today?

As of 2024, it stands at $130 billion, with projections to reach $300 billion by 2030.

3. What’s driving the growth of biotech in India?

Rising healthcare needs, government funding, global collaborations, and a strong startup ecosystem.

4. Which areas within biotech are growing fastest?

Gene editing, personalized medicine, and biopharmaceuticals.

5. Who are the top biotech companies in India?

Biocon, Serum Institute, Bharat Biotech, Zydus Lifesciences, MedGenome, and Reliance Life Sciences.

6. What is the government doing to support biotech?

Policies like BIO-E3, the National Biopharma Mission, and a $1.9B R&D push in 2023.

7. What is gene editing, and why is India investing in it?

It’s a technology to alter DNA; India is investing due to its potential in rare disease treatment and precision medicine.

8. Is personalized medicine being used in India?

Yes, particularly in oncology, cardiology, psychiatry, and diabetes care.

9. How can investors benefit from this sector?

By investing in listed biotech firms or upcoming IPOs and tracking market trends via research platforms like Angel One.

10. Is this a short-term trend or a long-term opportunity?

It’s a long-term, high-growth opportunity with global relevance and domestic impact.

Related Articles

Oil Prices Plummet: A Boon for the Indian Stock Market