Introduction

Imagine this: you’ve invested in SIPs through multiple apps, made a few lump sum investments years ago, inherited a folio from a relative, and dabbled in a sector fund someone recommended. Months or even years later, you suddenly wonder — “Where are all my mutual funds?” or “How to Track All Mutual Fund Investments Using PAN”

It’s a common scenario in today’s scattered investment landscape.

But here’s the good news: you don’t need to visit every platform or dig through years of emails to find your portfolio. If you’ve linked your investments correctly, your PAN (Permanent Account Number) is all you need to access your entire mutual fund universe.

In this blog, we’ll explain how to track all mutual fund investments using PAN, how to fix missing folios, and how to reclaim old or forgotten investments using SEBI’s new tools. We’ll walk you through the steps on MF Central — a centralised, SEBI-registered portal built just for this.

Why Use PAN to Track All Mutual Fund Investments?

Your PAN is not just a tax identification number. In the mutual fund world, it serves as a universal identifier that links all your holdings across various Asset Management Companies (AMCs), platforms, and folios.

Here’s why tracking mutual fund investments with PAN is so useful:

- You can view your entire portfolio across AMCs in one place

- It simplifies tax filing and capital gains reporting

- It eliminates the risk of missing or forgetting folios

- It reduces dependence on apps or brokers

- It allows you to monitor SIPs, dividends, and redemptions seamlessly

All this is possible because of the Consolidated Account Statement (CAS) — a unified report of your mutual fund transactions linked to your PAN.

Where to Go: Trusted Platforms for PAN-Based Tracking

Several SEBI-approved platforms allow you to track your mutual fund investments using PAN. These include:

- MF Central

- CAMS Online

- KFintech

- NSDL CAS Portal

- CDSL CAS Portal

Each of these portals accesses your holdings through RTAs (Registrar and Transfer Agents) and delivers a unified view. For this blog, we’ll show you how to use MF Central, which is co-developed by both CAMS and KFintech and covers nearly all AMCs in India.

Step-by-Step: How to Track Mutual Fund Investments Using PAN via MF Central

If you’re accessing your mutual fund portfolio through MF Central, follow these steps to create an account and track all your investments using your PAN number:

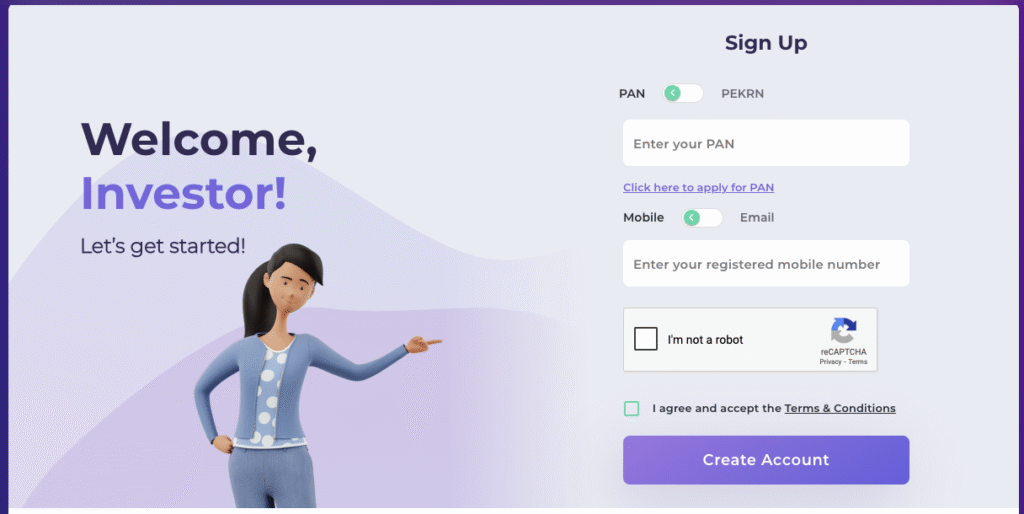

Step 1: Go to the MF Central Website & Click on Sign Up

- Visit www.mfcentral.com

- On the Sign Up page, choose

PAN(default selected). - Enter your PAN number and registered mobile number (linked to your mutual fund folios).

- Select the checkbox for Terms & Conditions.

- Complete the CAPTCHA and click Create Account.

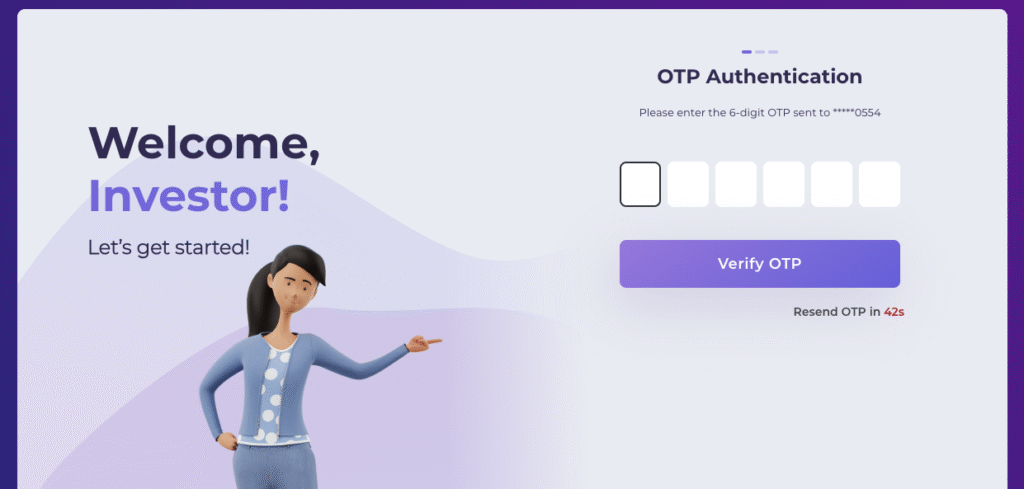

Step 2: OTP Authentication

- You’ll receive a 6-digit OTP on your registered mobile.

- Enter the OTP in the given boxes and click Verify OTP.

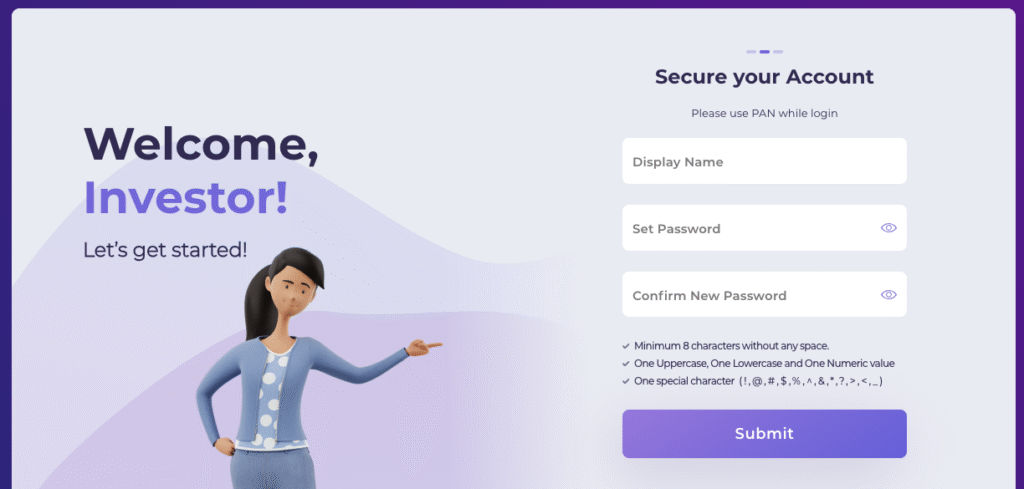

Step 3: Set Display Name and Create Password

- Choose a Display Name.

- Set a strong password:

- Minimum 8 characters

- 1 uppercase, 1 lowercase, 1 number

- 1 special character (e.g.,

@,#,$, etc.)

- Confirm the password and click Submit.

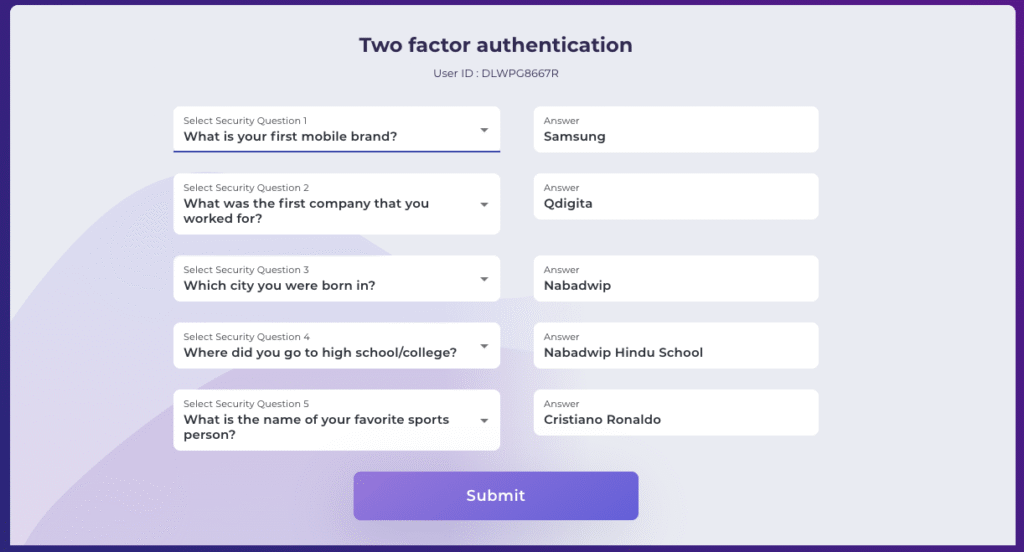

Step 4: Set Up Two-Factor Authentication (Security Questions)

- Select 5 security questions from the dropdowns.

- Enter your unique answers for each.

- Click Submit.

Logging into MF Central

After registration, here’s how to access your dashboard:

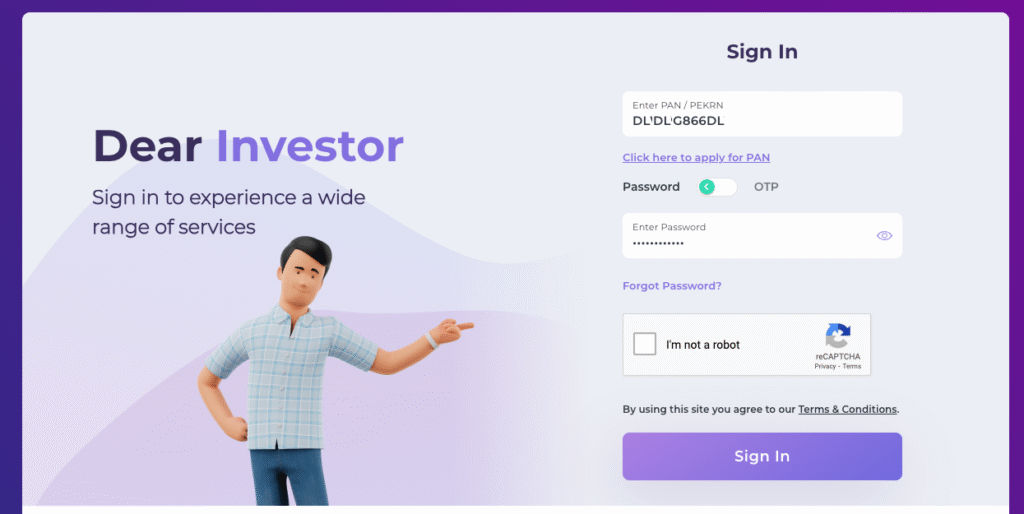

Step 5: Sign In to MF Central

- Go to the Sign In page.

- Enter your PAN and newly created password.

- Complete the CAPTCHA and click Sign In.

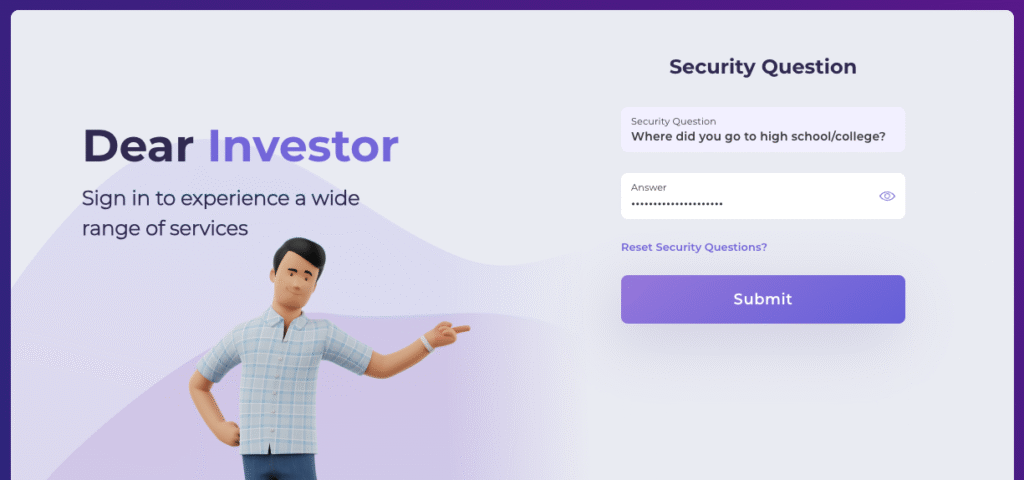

Step 6: Answer a Security Question

- Upon login, you’ll be prompted to answer one of your saved security questions for verification.

- Enter the correct answer and click Submit.

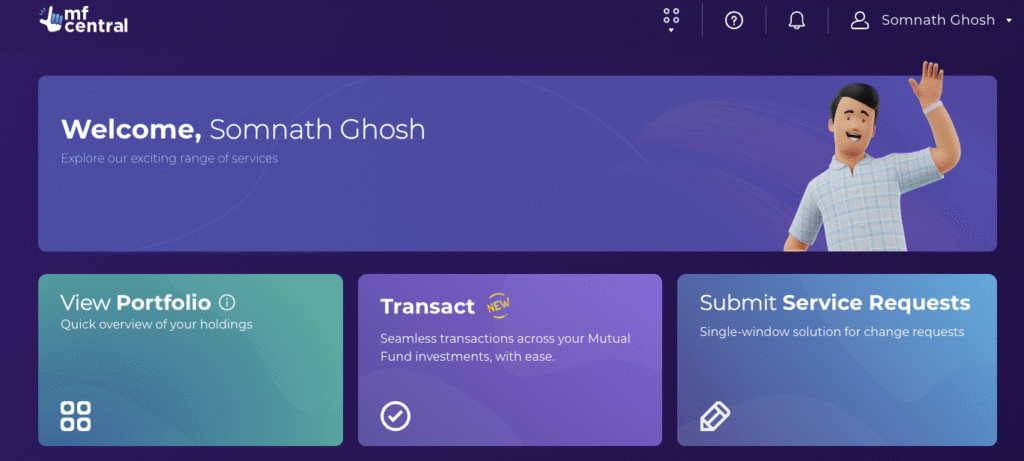

Access Your Portfolio

- After successful login, your dashboard appears.

- Click on “View Portfolio” to check your mutual fund holdings.

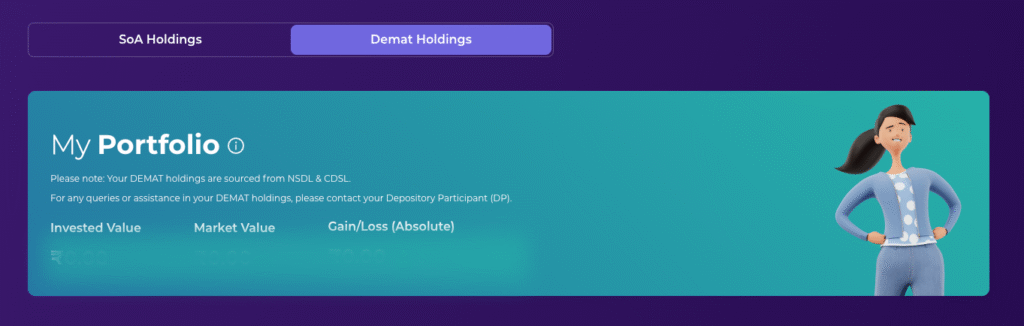

- You can switch between SoA Holdings and Demat Holdings.

Notes:

- For zero values, ensure your mobile number is linked to all your folios.

- SoA Holdings shows investments held in statement (non-demat) mode.

- Demat Holdings reflect mutual fund units held in your demat account via NSDL/CDSL.

What Is CAS and Why Is It Useful?

The Consolidated Account Statement (CAS) is a report that compiles all mutual fund transactions across all AMCs and schemes under a PAN. It’s sent monthly by email if there’s a transaction in that month, or you can request it on-demand through portals like MF Central.

Your CAS includes:

- Complete transaction history

- Valuation of each scheme

- SIPs, redemptions, and dividends

- Expense ratios and exit loads

- Tax-related capital gain summaries

This gives you a 360° view of your mutual fund portfolio in one document.

What If Some Investments Are Missing?

If you notice that certain investments aren’t showing up in your CAS, don’t panic. Here are the most common reasons and fixes:

1. Different PAN used:

If someone else (like a spouse or parent) invested using their PAN, it won’t show up under yours.

2. KYC not completed:

Your folio may not be linked properly if your KYC (Know Your Customer) is incomplete. You can fix this online through CAMS or KFintech.

3. Wrong or missing email/mobile:

Older or offline investments may not have an email or phone number registered. You can update your contact details via the AMC or registrar.

Once your PAN and KYC are correctly linked, those investments will reflect in your CAS going forward.

Reclaim Forgotten or Inherited Mutual Funds via MITRA

In March 2024, SEBI launched the MITRA platform (Mutual fund Investment Tracing and Reclaim Application) — a game-changing tool for recovering unclaimed or lost mutual fund units.

This platform is useful if you:

- Inherited investments but don’t know the folio numbers

- Lost track of units purchased long ago

- Made offline investments before digital platforms existed

- Have no email/mobile registered with the AMC

How to Use MITRA:

- Visit the MITRA section on SEBI’s investor portal

- Enter your PAN and Date of Birth

- The system will show any dormant or forgotten units across AMCs

- Submit verification documents and initiate a reclaim

It’s a major step toward investor protection and transparency.

Tips to Keep Your Mutual Fund Portfolio Clean

To avoid tracking issues in the future, here are a few simple habits:

- Always invest using the same PAN

- Update KYC regularly

- Use a consistent email and mobile number across platforms

- Avoid creating new folios with each investment — use existing ones

- Check your CAS monthly or quarterly

- Use MF Central or CAS for tracking instead of juggling multiple apps

Final Thoughts

In 2025, tracking your mutual fund portfolio is easier than ever — thanks to digital reforms, PAN-based mapping, and centralised tools like MF Central.

How to track all mutual fund investments using PAN is no longer a question for financial experts alone. Whether you’re just starting out or have years of investments behind you, using your PAN to monitor holdings gives you visibility, control, and peace of mind.

It helps uncover forgotten investments, streamline capital gains reporting, and prevents duplication. Most importantly, it empowers you to focus on decisions rather than paperwork.

So log in, enter your PAN, and take control of your financial journey — one dashboard at a time.

Frequently Asked Questions (FAQs)

1. What is MF Central?

MF Central is a unified platform launched by CAMS and KFintech—India’s two major mutual fund registrars. It allows investors to track, transact, and manage mutual fund investments across all AMCs from one place using just their PAN and registered mobile/email.

2. Can I use my PAN to check all mutual fund investments?

Yes, PAN is the key identifier for mutual fund folios in India. If your PAN is linked to your mutual fund investments, you can use it on MF Central to view your entire portfolio across AMCs.

3. Is MF Central free to use?

Absolutely. MF Central is a free service for investors. You don’t need to pay anything to track, manage, or submit service requests related to your mutual fund investments.

4. What if my mobile number is not linked to all folios?

If your mobile number isn’t linked to a folio, MF Central may not be able to fetch it. You can use MF Central’s ‘Service Requests’ feature to update or link your mobile number to such folios.

5. What is the difference between SoA Holdings and Demat Holdings in MF Central?

- SoA Holdings (Statement of Account): These are mutual funds held in non-demat (physical/online folio) format.

- Demat Holdings: These are mutual fund units held through your demat account (e.g., NSDL/CDSL).

MF Central shows both tabs so you can track all investments regardless of the format.

6. Is it mandatory to set up security questions during MF Central registration?

Yes. As part of two-factor authentication, you are required to select and answer five security questions. These help verify your identity during login or password recovery.

7. Can I log in with an email instead of a mobile number?

Yes, MF Central allows login either via a registered mobile number or email ID, as long as it is linked to your mutual fund folios.

8. Can I make mutual fund transactions through MF Central?

Yes, apart from tracking holdings, MF Central also allows transactions such as purchases, redemptions, switches, and submitting service requests—making it a complete MF management tool.

9. What should I do if my portfolio shows ₹0 in MF Central?

If your investments don’t show up:

- Ensure your PAN and mobile/email are correctly linked to all folios.

- If still not visible, raise a service request through the portal or contact the respective RTA (CAMS/KFintech).

10. Is MF Central safe and secure?

Yes, MF Central uses industry-standard encryption, OTP verification, two-factor authentication, and secure password protocols to ensure your data stays protected.

Related Articles:

How to Transfer Shares Between Demat Accounts Online: A Complete Guide

What Happens to Your Shares and Mutual Fund After Death? Transmission Process Explained

Best Stock Broker in India: How to Choose Best Broker in 2025

More Articles

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)

The 15-15-15 Rule: Why the ₹1 Crore SIP Dream Needs a Reality Check

How to Transfer Shares to Family from One Demat to Another (2025 Guide)