HDFC Bank Shareholders—Your Exclusive IPO Opportunity Is Here!

HDB Financial Services IPO, the long-awaited public issue from HDFC Bank’s NBFC arm, opens on June 25. Backed by India’s largest private sector bank, HDB Financial is stepping into the public market with a huge ₹12,500 crore issue.

If you hold shares in HDFC Bank, you’re likely eligible for a special quota. That means early access to one of India’s most-watched IPOs this year.

HDB Financial runs a massive branch network with 1,700+ locations and offers everything from retail loans to BPO services. With solid profits and strong return ratios, it’s one of the most valuable unlisted NBFCs in the country.

This IPO could unlock serious value—not just for HDFC Bank, but for smart investors like you.

In this review, we break down the company’s business, financials, risks, peer comparison, and the best way to approach allotment strategy for the HDB Financial Services IPO.

HDB Financial Services IPO Details

| Particulars | Details |

|---|---|

| IPO Size | ₹12,500 crore (₹2,500 Cr Fresh + ₹10,000 Cr OFS) |

| IPO Date | June 25, 2025 to June 27, 2025 |

| Listing Date | Tentatively July 2, 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹700 to ₹740 per share |

| Lot Size | ₹12,500.00 Cr |

| Issue Type | Bookbuilding IPO |

| Listing At | BSE and NSE |

| Pre-Issue Shares | 79,39,63,540 |

| Post-Issue Share Holdings | 74.19% |

| Promoter | HDFC Bank Limited |

| Registrar | MUFG Intime India Pvt Ltd (Link Intime) |

Objects of the Issue: Why HDB Financial Services Is Raising Capital

The ₹12,500 crore IPO of HDB Financial Services comprises a ₹2,500 crore fresh issue and a ₹10,000 crore offer for sale (OFS) by parent company HDFC Bank.

Fresh Issue (₹2,500 Cr): Capital for Growth

The proceeds from the fresh issue will be used for:

1. Strengthening Tier-I Capital Base

The company aims to augment its Tier-I capital to support business expansion, ensure regulatory compliance under the NBFC-UL framework, and maintain a healthy capital adequacy ratio.

2. Onward Lending & Loan Book Expansion

A significant portion of the capital will fuel onward lending, helping HDB scale its loan book across key verticals—Enterprise Lending, Asset Finance, and Consumer Finance.

3. Enhancing Balance Sheet Resilience

The capital infusion will improve the company’s debt-to-equity profile, ensuring better solvency metrics and a cushion against future credit cycles or macroeconomic shocks.

💡 Note: HDB is expected to continue its capex-light model by focusing more on technology and distribution partnerships rather than heavy infrastructure spends.

Offer for Sale (₹10,000 Cr): HDFC Bank’s Stake Sale

In the offer for sale, existing shareholder HDFC Bank will sell a portion of its stake in HDB Financial Services. This will:

- Help unlock value for HDFC Bank, aiding capital efficiency after the HDFC-HDFC Bank merger.

- Increase public float and market visibility for HDB Financial post-listing.

- Provide a partial exit route to HDFC Bank without diluting HDB’s core operational strength.

👀 Important: The OFS proceeds will not go to HDB Financial Services. Only the fresh issue capital will be utilized for company operations.

Strategic Outcome of the IPO

- Post-IPO, HDB will have stronger capital reserves to fund high-yield, retail-focused NBFC lending.

- The IPO also sets the stage for future credit rating upgrades, enhanced investor trust, and greater autonomy from the parent institution.

Business Overview of HDB Financial Services

HDB Financial Services Ltd., a subsidiary of HDFC Bank, stands out as one of India’s top retail-focused NBFCs. According to CRISIL, it ranks among the leading NBFCs by total gross loan book. Categorized as an Upper Layer NBFC (NBFC-UL) by the RBI, HDB operates a robust, diversified lending platform.

Growth at a Glance

Between March 2022 and September 2024, HDB’s total gross loans grew at a CAGR of 20.93%, reaching ₹98,620 crore. Its AUM hit ₹90,230 crore by March 2024, and PAT surged to ₹2,460 crore in FY24, a CAGR of 55.98% over two years. These numbers highlight not just growth, but scalability with profitability.

Lending Model and Portfolio

HDB’s offerings are structured across three verticals:

- Enterprise Lending (39.85%) – Loans to MSMEs, both secured and unsecured.

- Asset Finance (37.36%) – Funding for income-generating vehicles and equipment.

- Consumer Finance (22.79%) – Personal loans and consumer durable financing.

Additionally, HDB provides BPO services, including collections and back-office operations, mainly to its parent HDFC Bank. It also distributes insurance products to lending customers.

Distribution Reach

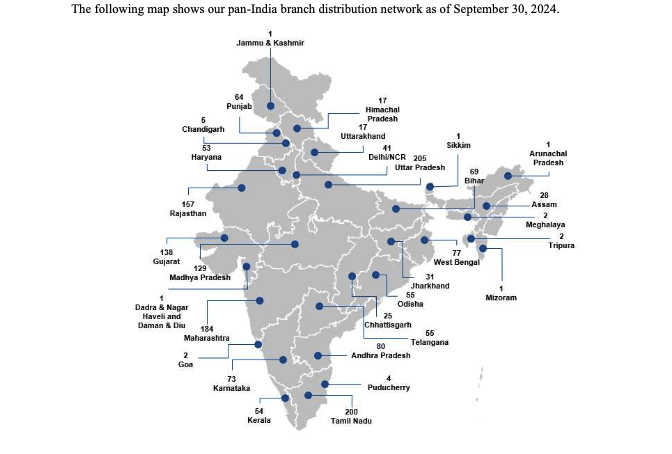

What sets HDB apart is its “phygital” model—a fusion of digital channels with physical presence. As of September 30, 2024, it had:

- 1,772 branches across 1,162 towns

- Over 80% branches outside India’s top 20 cities

- Partnerships with 80+ OEMs

- Access to 1.4 lakh+ retailers and dealers

This omnichannel setup enables deep market penetration, especially in underbanked regions.

Risk Management and Underwriting

To maintain quality, HDB uses a hybrid credit model:

- Centralized credit for smaller, short-tenure consumer loans

- Localized underwriting for larger, longer-tenure enterprise and asset finance loans

The loan book is highly granular—no single borrower accounts for more than 0.36% of total gross loans. Moreover, secured loans form 71.08% of the portfolio, keeping risk in check.

Asset Quality & Credit Efficiency

Despite rapid growth, HDB’s GNPA stood at 2.10% and NNPA at 0.83% as of Sep 2024. It maintains a Provisioning Coverage Ratio of 66.82%, one of the highest in the industry. Notably, credit costs remain low at 1.79% (annualized for H1FY25).

Strategic Edge from HDFC Bank

While HDB operates independently across sourcing, underwriting, and operations, it still benefits immensely from HDFC Bank’s brand, governance discipline, and market trust. This balance allows HDB to build an identity while enjoying the halo effect of its parent.

Who They Serve

HDB primarily targets low-to-middle income households, including:

- Salaried individuals

- Self-employed borrowers

- Small business owners and entrepreneurs

Their average ticket size is just ₹1.45 lakh—underscoring a focus on high-volume, low-risk lending.

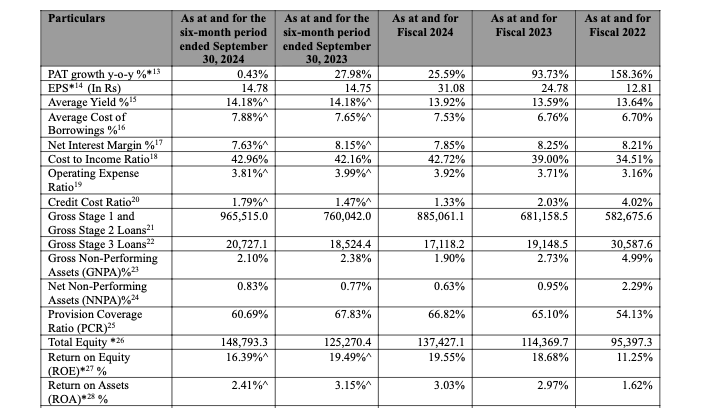

Financial Performance of HDB Financial Services

HDB Financial Services has shown strong and consistent growth across key financial metrics over the past three years. The company’s performance reflects its robust business model, disciplined risk management, and deep market reach.

Consolidated Financial Summary (₹ in Crores)

| Period Ended | Sep 30, 2024 | Mar 31, 2024 | Mar 31, 2023 | Mar 31, 2022 |

|---|---|---|---|---|

| Total Assets | 1,01,960.35 | 92,556.51 | 70,050.39 | 62,025.94 |

| Revenue | 7,890.63 | 14,171.12 | 12,402.88 | 11,306.29 |

| Profit After Tax | 1,172.70 | 2,460.84 | 1,959.35 | 1,011.40 |

| Net Worth | 14,879.33 | 13,742.71 | 11,436.97 | 9,539.73 |

| Total Borrowings | 82,681.10 | 74,330.67 | 54,865.31 | 48,973.08 |

Key Financial Ratios

| Metric | Value |

|---|---|

| Return on Equity (ROE) | 19.55% |

| Debt-to-Equity Ratio | 5.81x |

| Credit Cost Ratio | 1.79% (annualized for H1FY25) |

| Gross NPA (GNPA) | 2.10% |

| Net NPA (NNPA) | 0.83% |

| Provision Coverage Ratio | 66.82% |

Financial Highlights

- High Profitability: PAT doubled in two years, growing at a CAGR of 55.98% from FY22 to FY24.

- Strong Return Metrics: ROE of 19.55% places HDB among the top NBFCs in terms of shareholder returns.

- Asset Quality Under Control: Despite lending to underbanked segments, the company has maintained a GNPA under 2.5%.

- Efficient Leverage: With a debt-to-equity ratio of 5.81, HDB is optimally leveraged for growth without excessive risk.

Valuation & Peer Comparison: HDB Financial Services IPO

HDB Financial Services operates in India’s fast-growing NBFC sector, focusing primarily on retail lending. While it doesn’t have a perfect listed peer, investors often benchmark it against large and mid-cap diversified NBFCs such as Bajaj Finance, Cholamandalam, and Shriram Finance.

Peer Group Snapshot

| Company Name | EPS (₹) | NAV/Share (₹) | P/E (x) | P/BV Ratio |

|---|---|---|---|---|

| HDB Financial Services Ltd (at ₹700–₹740) | 27.41 (Post IPO) | 173.30 | 25.53–27.10 | 4.04–4.27 |

| Bajaj Finance Ltd | 236.89 | 1,239.00 | 29.80 | 5.85 |

| Sundaram Finance Ltd | 130.31 | 997.10 | 36.20 | 4.14 |

| L&T Finance Ltd | 9.34 | 94.20 | 15.50 | 1.68 |

| Mahindra & Mahindra Financial Services Ltd | 15.66 | 161.30 | 17.80 | – |

| Cholamandalam Investment & Finance Co. Ltd | 41.17 | 233.10 | 31.50 | 4.96 |

| Shriram Finance Ltd | 196.32 | 1,302.50 | 16.70 | 1.81 |

What the Numbers Suggest

- Earnings Strength: Post-IPO EPS of ₹27.41 reflects HDB’s solid profitability, placing it in line with mid-cap NBFCs while still below Bajaj Finance in sheer scale.

- Asset Efficiency: With a NAV per share of ₹173.30 and ROE of 19.55%, HDB exhibits strong capital efficiency and return metrics—among the highest in the NBFC space.

- Valuation Range: At a P/E of 25.53–27.10 and P/BV of 4.04–4.27, HDB is priced below Bajaj Finance but close to Cholamandalam and Sundaram, signaling a valuation balance between premium positioning and investor opportunity.

Investor Takeaway

The HDB Financial IPO appears reasonably valued when weighed against its fundamentals and peer group:

✅ Backed by HDFC Bank’s strong parentage and governance

✅ High RoE and low NPAs

✅ Granular loan book and conservative provisioning approach

✅ Positioned below Bajaj Finance but comfortably in line with high-quality peers

If sentiment holds and the current GMP stays hot, HDB Financial could offer both listing pop potential and long-term compounder qualities.

Strengths & 🚫 Risks: HDB Financial Services IPO

Understanding the strengths and risks of HDB Financial Services will help investors assess both short-term potential and long-term viability.

Key Strengths

1. Backed by HDFC Bank – India’s Top Private Lender

HDB Financial is a subsidiary of HDFC Bank, which owns a 94.3% stake. The backing of such a strong parent adds credibility, ensures governance strength, and boosts investor trust.

2. Robust and Diversified Loan Book

As of September 30, 2024, HDB’s Total Gross Loans stood at ₹98,620 crore, with a CAGR of 20.93% over 2.5 years. It operates across three verticals—Enterprise Lending, Asset Finance, and Consumer Finance—ensuring segment diversification and revenue stability.

3. Strong Profitability Metrics

The company posted a PAT of ₹2,460.84 crore in FY24, growing at a CAGR of 55.98% since FY22. Its Return on Average Equity (RoAE) is 19.55%, among the highest in the NBFC space.

4. Wide Reach with “Phygital” Model

With 1,772 branches across 1,162 towns, and over 140,000 distribution touchpoints, HDB has built a powerful hybrid (physical + digital) distribution model that penetrates underserved and underbanked markets.

5. Strong Asset Quality

HDB boasts GNPA of 2.10% and NNPA of 0.83%, along with Credit Costs of 1.79%, which is commendable in the retail NBFC segment. Provisioning coverage stood at 66.82%—a sign of conservative and prudent risk management.

6. Highly Granular Book

No single customer accounts for more than 0.36% of its total loan book. This granularity significantly reduces concentration risk.

Key Risks

1. Valuation Could Be Rich

Depending on the final IPO pricing, the implied P/E may appear elevated compared to listed NBFCs like L&T Finance or Shriram Finance. This could limit listing-day upside.

2. High Leverage Ratio

As of September 2024, HDB’s Debt-to-Equity ratio was 5.81, which is typical for NBFCs but still demands attention during tightening interest rate cycles or liquidity crunches.

3. Competitive Market

HDB competes with industry giants like Bajaj Finance, Cholamandalam, and M&M Financial, which already enjoy brand recall, digital platforms, and pricing power.

4. No Separate Promoter Quota (Yet)

Unlike some strategic subsidiaries, HDB does not currently offer a separate HDFC Bank shareholder quota. Unless this is announced later, retail demand might face pressure from oversubscription.

5. Regulatory Oversight as NBFC-UL

Being classified as an Upper Layer NBFC by the RBI, HDB must comply with tighter capital norms and governance standards, which could constrain rapid expansion or increase compliance costs.

Final Thoughts on Risk-Reward

If priced attractively, HDB Financial Services IPO could be a high-demand offer due to its parentage, strong fundamentals, and scalable distribution engine. But investors should weigh the valuation against peers and stay alert for updates on institutional demand and pricing before committing.

Grey Market Premium (GMP) & Listing Outlook: HDB Financial IPO

With its strong parentage under HDFC Bank and robust financial metrics, the HDB Financial IPO is already generating buzz. The grey market has responded enthusiastically now that the price band is known.

GMP Trend (As of June 20, 2025)

| GMP Date | IPO Price | GMP | Estimated Listing Price | Estimated Profit | Last Updated |

|---|---|---|---|---|---|

| 20-Jun-2025 | ₹740.00 | ₹83 | ₹823 (11.22%) | ₹1,660 | 20-Jun-2025 08:57 AM |

| 19-Jun-2025 | ₹740.00 | ₹83 | ₹823 (11.22%) | ₹1,660 | 19-Jun-2025 |

💬 Current GMP: ₹83

This translates to an estimated listing gain of ~11.2%, indicating sustained interest even after the pricing was revealed.

Mumbai Roadshow Buzz Adds Fire to Sentiment

According to sources, HDB Financial is conducting a high-profile IPO roadshow in Mumbai next week. This event is aimed at attracting institutional interest and could further uplift sentiment and QIB demand.

What Does This Mean for Investors?

1. Strong QIB Interest Incoming?

The Mumbai roadshow could lead to more aggressive bidding by qualified institutional buyers—historically a reliable sign of healthy listing-day performance.

2. GMP Holding Post-Price Band

Despite price band revelation, GMP staying at ₹83 suggests sustained bullishness. This is a strong signal for retail and HNI applicants looking for listing pop.

3. Valuation Matters

At a P/E of ~27–28x, HDB is moderately priced—especially when compared to Bajaj Finance (P/E ~30x) and Cholamandalam (P/E ~31.5x). If subscription builds up, momentum could snowball into strong listing performance.

Important: Treat GMP as Sentiment Only

While grey market premium gives a pulse on investor enthusiasm, it is not a guarantee of listing-day profits. Always base your decision on:

- Final-day subscription trends across QIB, HNI, and Retail

- Valuation comfort

- Business fundamentals

Conclusion: Should You Apply for the HDB Financial Services IPO?

The HDB Financial IPO represents more than just a listing—it’s a rare opportunity to invest in a profitable HDFC Group company, operating in India’s booming NBFC segment. With strong financials, parental backing from HDFC Bank, and a proven omnichannel distribution network, HDB Financial Services is well-positioned to scale its already dominant retail lending franchise.

However, with the issue size pegged at ₹12,500 crore and valuations yet to be disclosed, the ultimate verdict will depend on pricing comfort and market conditions closer to the listing.

Short-Term View: Momentum-Backed Gains Likely

With early GMP crossing ₹100 and a highly anticipated Mumbai roadshow on the cards, sentiment is clearly strong. If the IPO is priced reasonably compared to peers like Chola or L&T Finance, listing gains appear likely. But if valuations come in stretched, the upside may shrink, especially in a choppy market.

✅ Good for listing gains if GMP sustains and QIB demand is strong.

Long-Term View: Strong Business, But Watch Valuation & Execution

HDB’s fundamentals are compelling:

- RoE of 19.55%

- Asset quality with GNPA at 2.1%

- AUM CAGR of 21.18% (FY22–FY24)

- Pan-India footprint with 1,700+ branches

Backed by HDFC Bank, HDB offers exposure to India’s credit growth story—especially in the underserved segment. But long-term success depends on pricing discipline, sustained asset quality, and steady net interest margins (NIMs) as competition intensifies in the NBFC space.

🔍 Best suited for patient investors with a 3–5 year horizon.

Allotment Strategy: If You Get Allotted—or Not

If Allotted:

- Short-term investors can consider partial profit-booking on listing if GMP holds.

- Long-term investors may hold for compounding returns, especially in a declining interest rate cycle.

If Not Allotted:

- Track post-listing price trends. If it lists flat or dips slightly due to valuation concerns, consider entering gradually via SIP-style buying.

- A strong HDFC-backed NBFC like HDB doesn’t come often—don’t ignore it just due to IPO miss.

Frequently Asked Questions (FAQs) – HDB Financial Services IPO

1. What does HDB Financial Services do?

HDB Financial Services is an NBFC focused on retail lending through three segments—Enterprise Lending, Asset Finance, and Consumer Finance. It is a subsidiary of HDFC Bank.

2. Who is the promoter of this IPO?

HDFC Bank is the sole promoter and owns a 94.36% stake in HDB Financial Services before the IPO.

3. What is the size and structure of the IPO?

The IPO totals ₹12,500 crore: ₹2,500 crore is fresh issue and ₹10,000 crore is an Offer for Sale (OFS) by HDFC Bank.

4. What are the IPO dates?

The IPO opens on June 25, 2025, and closes on June 27, 2025.

5. Is there a reservation for HDFC Bank shareholders?

As of now, no shareholder quota has been confirmed for HDFC Bank shareholders.

6. What are the key financials of HDB Financial?

FY24 PAT: ₹2,460.84 Cr | RoE: 19.55% | Debt/Equity: 5.81 | GNPA: 2.10% | NNPA: 0.83%

7. How extensive is their branch network?

HDB has 1,772 branches in 1,162 towns across 31 states and UTs—over 80% are outside the top 20 cities.

8. Will the IPO be listed on NSE and BSE?

Yes, HDB Financial shares will be listed on both NSE and BSE. Tentative listing date: July 2, 2025.

9. What will the company do with the IPO proceeds?

The fresh issue proceeds will strengthen its Tier-I capital base and support lending growth.

10. Is this IPO suitable for listing gains or long-term investment?

It may offer potential for both. GMP activity hints at strong short-term interest, while fundamentals support long-term growth.

Related Articles

How Micro Factors Impact the Stock Market: A Deep Dive into India’s Sectoral Shifts