Introduction

The promise made by Prime Minister Narendra Modi on Independence Day has now transformed into a landmark policy move that is reshaping the Indian economy. Finance Minister Nirmala Sitharaman has announced a sweeping Goods and Services Tax (GST) reform worth ₹48,000 crore in revenue implications, a change that experts are calling a “consumption revival bombshell.”

The immediate effect on the stock market was dramatic: the Sensex surged nearly 900 points, while the Nifty jumped 1%, eyeing a breakout above the crucial 25,000 mark.

This sharp rally is the market’s way of celebrating the reform. But for investors, the real question is: What is the GST Impact On Stock Market and which GST Impact Stocks should you track?

This blog gives you a complete breakdown — how GST restructuring works, why it’s a game-changer for consumption, and which stocks stand to benefit the most from this structural shift.

Understanding the GST Overhaul

India’s earlier GST framework was criticized for being complicated and inefficient, with a confusing four-slab system (5%, 12%, 18%, 28%) that often led to distortions in pricing. The government has now simplified this architecture in a way that directly favors consumers.

- The four-slab structure has been rationalized.

- Products previously taxed at 28% have moved down to 18%, while many under 12% have moved down to 5%.

- The new structure ensures lower prices, higher affordability, and stronger demand.

Dr. VK Vijayakumar of Geojit Investments summed it up well:

“The revolutionary GST reform has come better than expected, benefitting a wide spectrum of sectors. The ultimate beneficiary is the Indian consumer. This boost to consumption in an economy already in growth momentum could surprise on the upside.”

Here’s a simple table to understand the changes:

| Category / Sector | Old GST Rate | New GST Rate | Impact |

|---|---|---|---|

| Two-wheelers (<350cc) | 28% | 18% | Affordability boost for mass market |

| Small Cars | 28% | 18% | Lower EMIs, higher urban demand |

| SUVs (incl. cess) | ~50% | 40% | Big win for SUV-focused companies |

| Tractors & Agri Machinery | 12% | 5% | Strong rural demand support |

| Food items (biscuits, chocolates, noodles, juices, ice cream, cheese) | 18%/12% | 5% | Big relief for FMCG sector |

| Personal Care (soaps, shampoo, toothpaste, hair oil) | 18% | 5% | Rural and urban demand revival |

| Cement | 28% | 18% | Volume growth + margin headroom |

| White Goods (appliances, electronics) | 18% | 12–18% | Increased affordability during festive season |

This reform is being seen not as a temporary stimulus but as a structural shift that can unlock consumption-led growth for years.

Sector-Wise GST Impact On Stock Market

Automobiles: The Biggest Winner

The automobile sector is at the center of the GST Impact On Stock Market. Tax cuts in this category are substantial and directly affect affordability.

- Two-wheelers (<350cc) GST cut from 28% to 18%.

- Small cars GST cut from 28% to 18%.

- SUVs overall tax cut from 50% (incl. cess) to 40%.

- Tractors and agri-machinery cut from 12% to 5%.

This creates both rural and urban demand momentum. According to Emkay Global, “such sharp reduction directly lowers acquisition costs for farmers and boosts affordability,” making M&M and Escorts major rural beneficiaries.

Stocks to Watch (GST Impact Stocks in Automobiles):

- Mahindra & Mahindra (M&M): Dual benefit from SUVs and tractors.

- Maruti Suzuki: Expected surge in small car sales.

- Bajaj Auto, Hero MotoCorp, TVS: Two-wheeler affordability revival.

- Eicher Motors: Premium motorcycles to benefit from reduced pricing gap.

Auto analysts project a 5–10% boost in demand across categories. No wonder auto stocks were the day’s biggest gainers, with M&M rallying 6% and others like TVS, Bajaj Auto, and Hero Moto up 1–2%.

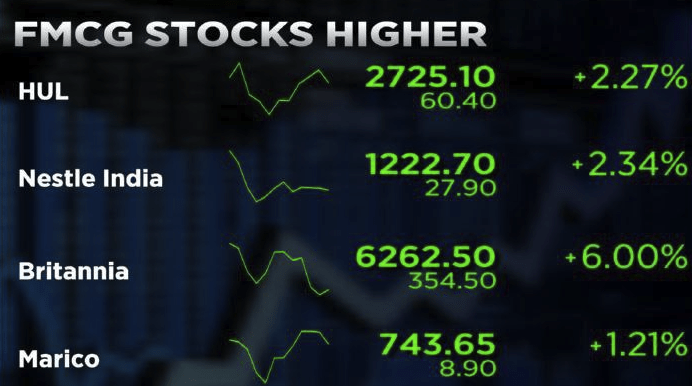

FMCG: The Surprise Beneficiary

The GST impact on FMCG was broader than expected and largely unanticipated, making it the second biggest winner of the reforms.

- Food items such as biscuits, instant noodles, chocolates, ice cream, fruit juices, sauces, and cheese now attract only 5% GST (down from 12–18%).

- Essential personal care items like shampoo, soaps, toothpaste, and hair oil have also moved to 5%.

This is a game-changer for volume growth, particularly in rural markets where affordability is critical. Lower taxes mean consumers will have more disposable income for packaged foods and daily essentials.

Stocks to Watch (GST Impact Stocks in FMCG):

- Nestlé, Britannia, Colgate: Direct gains from packaged food and personal care.

- HUL, Dabur, Marico, GCPL, Patanjali: Broad product portfolio benefits.

Jefferies highlighted that this reform was “largely unanticipated” and “positive for consumer staples companies.” FMCG is now entering a renewed growth phase.

Cement: A Long-Awaited Relief

For years, the cement industry has struggled under a 28% GST rate. The new reform reduces this burden to 18%, finally bringing relief to both producers and consumers.

Why this matters:

- Demand revival in housing and infrastructure.

- Headroom for companies to raise prices.

- High profit leverage (a 1% price increase can lift profits by 4–5%).

Stocks to Watch (GST Impact Stocks in Cement):

- UltraTech Cement, Shree Cement, ACC, Ambuja Cement.

These companies stand to gain both from higher sales volumes and margin expansion, making cement one of the most attractive GST impact plays.

Consumer Durables & White Goods

Though not as headline-grabbing as autos or FMCG, white goods and appliances also stand to benefit.

- Lower GST makes big-ticket items like refrigerators, washing machines, and air conditioners more affordable.

- Festive season discounts could amplify demand further.

Stocks to Watch:

- Voltas, Havells, Whirlpool, Blue Star.

This sector is particularly attractive for festive-driven consumption plays.

Summary Table – GST Impact Stocks by Sector

| Sector | GST Impact Stocks | Why They Benefit |

|---|---|---|

| Automobiles | M&M, Maruti Suzuki, Bajaj Auto, TVS, Hero MotoCorp, Eicher Motors | GST cuts across SUVs, small cars, and 2-wheelers; tractors benefit from rural demand |

| FMCG | Nestlé, Britannia, Colgate, HUL, Dabur, Marico, Patanjali, GCPL | Reduced GST on food & personal care boosts volumes |

| Cement | UltraTech Cement, Shree Cement, ACC, Ambuja Cement | Rate cut from 28% to 18% enables demand growth & margin expansion |

| Consumer Durables | Voltas, Havells, Whirlpool, Blue Star | Lower GST on appliances supports festive season demand |

Economic Growth & Market Implications

The GST reform has far-reaching implications beyond individual sectors. It’s poised to reignite India’s consumption engine and accelerate GDP growth.

- Elara Capital expects GST-related demand to add 100–120 bps to GDP growth over the next 4–6 quarters.

- Geojit predicts India’s GDP could touch 6.5% in FY26 and 7% in FY27.

- Kotak AMC believes GST rationalization will help offset global headwinds like US tariffs.

With RBI rate cuts, income tax rebates, and easing inflation all aligning alongside this reform, India may be entering its strongest consumption cycle in a decade.

Investor Takeaways – How To Play GST Impact On Stock Market

For investors, the GST overhaul is both a short-term opportunity and a long-term structural trend.

- Short-term: Expect festive season demand to spike, particularly in autos and consumer durables.

- Medium to long-term: FMCG and cement will drive sustained earnings growth.

- Stock strategy: Focus on leaders in each sector with proven distribution and pricing power.

Top GST Impact Stocks for Investors

- Automobiles: M&M, Maruti Suzuki, Bajaj Auto, TVS.

- FMCG: Nestlé, Britannia, HUL, Dabur.

- Cement: UltraTech Cement, Shree Cement.

- Consumer Durables: Voltas, Havells, Whirlpool.

Conclusion

The sweeping GST reform is more than just a policy tweak — it’s a structural transformation of India’s consumption story. By cutting taxes across essentials, FMCG products, automobiles, cement, and white goods, the government has delivered a reform that directly boosts consumer spending power.

For the stock market, this translates into clear winners: GST Impact Stocks across autos, FMCG, cement, and consumer durables. Investors who position themselves in these names could ride the next wave of consumption-led growth.

Simply put, the GST Impact On Stock Market is both immediate — with rallies already visible — and long-lasting, with structural benefits that will play out over the next several years.

India’s growth story just got stronger, and for investors, this is the right time to align portfolios with the sectors and stocks leading the charge.

FAQs on GST Impact On Stock Market

1. What is the GST Impact On Stock Market?

The GST reform simplified tax slabs, reduced rates on key products, and boosted demand across sectors, leading to a positive stock market rally.

2. Which sectors benefit the most from GST reform?

Automobiles, FMCG, cement, and consumer durables are the biggest beneficiaries of GST cuts.

3. What are GST Impact Stocks in the automobile sector?

M&M, Maruti Suzuki, Bajaj Auto, TVS, Hero MotoCorp, and Eicher Motors are key GST Impact Stocks in autos.

4. How does GST reform affect FMCG companies?

GST cuts on food and personal care items make products cheaper, boosting volumes for companies like Nestlé, Britannia, HUL, and Dabur.

5. Why is cement considered a GST Impact Stock play?

Cement GST rates fell from 28% to 18%, improving both demand and profit margins, benefiting UltraTech Cement, Shree Cement, ACC, and Ambuja Cement.

6. Will GST reform boost India’s GDP?

Yes, economists expect GST-related demand to add 100–120 basis points to GDP growth in the next 4–6 quarters.

7. Is the GST Impact On Stock Market temporary or long-term?

The impact is structural, not temporary, as lower taxes on essentials create sustained demand growth.

8. How will GST reform affect rural consumption?

Lower GST on tractors, agri-machinery, and daily essentials will directly boost rural affordability and spending.

9. Which consumer durable stocks are GST Impact Stocks?

Voltas, Havells, Whirlpool, and Blue Star are consumer durable companies that may benefit from GST cuts.

10. Should investors buy GST Impact Stocks now?

With demand revival expected during the festive season and long-term structural benefits, many analysts see this as a good time to consider GST Impact Stocks.

Related Articles

India’s $40 Billion Spending Wave: What’s Powering the Next Consumption Boom?

Battery Energy Storage in India: The $32 Billion Opportunity Powering the Green Shift

Power Sector Boom in India: Stocks to Watch and Why It’s Just Beginning

Vehicle-to-Grid (V2G) Technology: How India Is Gearing Up and 5 Stocks to Watch