Introduction: Why Valuation Matters

If you’re serious about investing, there’s one skill that sets seasoned investors apart from speculators: the ability to value a business.

Markets often swing between extremes—euphoria and fear. But amid all the noise, the true investor looks for one thing: the intrinsic value of a company.

Valuation is not about predicting the next stock that will double overnight. It’s about understanding what a business is really worth based on its future ability to generate cash. Once you know what something is worth, you can decide whether it’s priced attractively.

And when it comes to valuation techniques, there’s one method that stands above the rest—Discounted Cash Flow (DCF). Often called the king of valuation, DCF helps you estimate a company’s worth by forecasting its future cash flows and discounting them to today’s value.

This method is not based on market sentiment or price multiples. It’s based on pure business fundamentals—making it a favorite of value investors like Warren Buffett.

In this guide, we’ll take a deep dive into how DCF works, why it’s so powerful, and when it’s best used.

What is Discounted Cash Flow (DCF)?

Discounted Cash Flow (DCF) is a valuation method that estimates the intrinsic value of a company by projecting its future cash flows and then discounting them back to the present.

In simple terms, DCF helps answer the question:

“If I could own all the future profits of this company today, how much should I pay for them now?”

Think of it like this:

If someone promised to pay you ₹100 every year for the next 10 years, how much would you pay today for that stream of income? You wouldn’t pay ₹1,000, because money received in the future is worth less than money in hand today due to inflation, risk, and opportunity cost.

This is where DCF comes in. It helps determine today’s value of future earnings, using a principle called the time value of money.

DCF in Action – The Intuition

- A business generates free cash flows (FCF) over time.

- These cash flows are projected into the future—usually for 5 to 10 years.

- Then they are discounted using a rate that reflects risk and opportunity cost (usually the discount rate or WACC).

- The result is the present value of all future cash flows.

- Add them up, and you get the company’s intrinsic value.

When this intrinsic value is greater than the current market price, the stock may be undervalued—making it a potential investment opportunity.

So, DCF is not a guess—it’s a framework that gives you a logical way to value what you’re buying based on the future cash it can generate.

The Core Idea: Time Value of Money

At the heart of Discounted Cash Flow (DCF) lies a timeless financial truth:

A rupee today is worth more than a rupee tomorrow.

This concept is known as the Time Value of Money (TVM), and it’s the foundation of all modern valuation methods.

Why is money today more valuable?

- Inflation reduces purchasing power over time.

- Opportunity cost – you could invest that money today and earn a return.

- Risk – there’s no guarantee that future payments will arrive as expected.

Because of these factors, receiving ₹100 now is more valuable than receiving ₹100 a year from now. DCF applies this principle by discounting future cash flows to reflect their present value.

How Discounting Works

Let’s say you expect a company to generate ₹1 crore in free cash flow one year from now. But instead of valuing it as ₹1 crore today, you discount it using a discount rate (let’s say 10%):

₹1 crore / (1 + 10%) = ₹90.91 lakhs today

The further out in time the cash flows are, the less they’re worth today.

By applying this logic to all future expected cash flows, DCF lets you calculate a business’s total value in today’s terms.

It’s not about hype or trends—it’s about what future profits are truly worth right now.

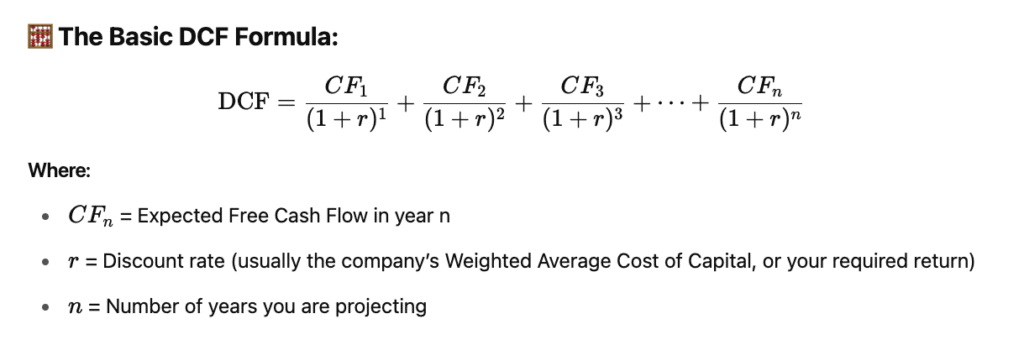

DCF Formula Explained Simply

Now that you understand the concept behind Discounted Cash Flow, let’s break down the actual math. Don’t worry—it’s more logic than complicated equations.

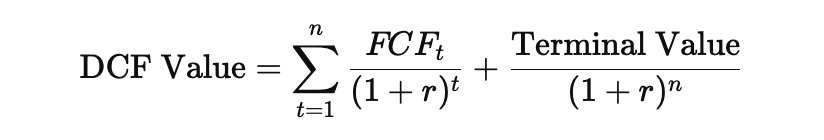

The Basic DCF Formula:

Breaking It Down Simply:

You estimate how much free cash flow the company will generate each year (say, over 5–10 years). Then, for each of those years:

- You divide that cash flow by (1+r)n(1 + r)^n(1+r)n

- This reduces the value of cash flows the farther out they are

- You add all those discounted values together

That total is the present value of the company’s expected cash flows—your estimate of what the business is worth today.

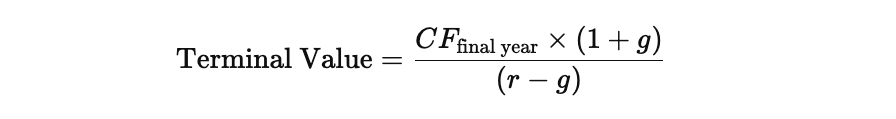

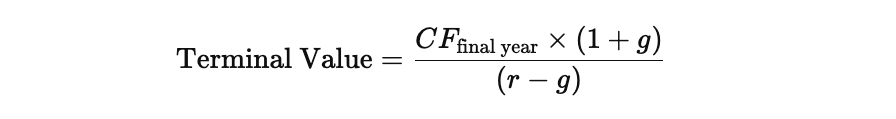

Terminal Value – The Second Half of the Formula

Since companies don’t just stop operating after 10 years, we also calculate something called the terminal value—the value of all cash flows after the projection period:

Then you discount the terminal value just like you did for yearly cash flows.

Final DCF Value = Sum of:

- All discounted yearly cash flows

- Discounted terminal value

This is your estimated intrinsic value of the company.

Steps to Perform a DCF Analysis

Discounted Cash Flow (DCF) may sound complex, but it becomes manageable when broken into clear, logical steps. Here’s how you can perform a DCF analysis step by step:

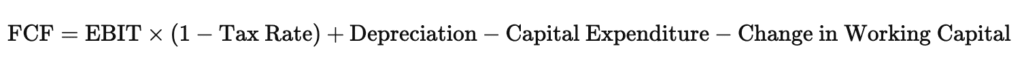

✅ Step 1: Forecast Future Free Cash Flows (FCFs)

Estimate the company’s Free Cash Flows for the next 5–10 years. These are the actual cash profits available to shareholders after expenses and reinvestment needs.

You can calculate:

Use:

- Company guidance

- Analyst reports

- Historical growth trends

✅ Step 2: Choose a Discount Rate (r)

This reflects the risk of investing in the company and your expected return.

Common options:

- WACC (Weighted Average Cost of Capital) – for company-level valuation

- Your required rate of return – for personal investing decisions (e.g., 10–15%)

The higher the risk, the higher the discount rate.

✅ Step 3: Calculate Terminal Value

After your projection period, estimate a terminal value to capture the company’s value beyond year 5 or 10.

Where:

- g = long-term growth rate (typically 3–5% for stable companies)

✅ Step 4: Discount All Future Cash Flows to Present

Use the DCF formula to discount:

- Each year’s projected cash flow

- The terminal value

✅ Step 5: Sum All Present Values

Add up the present value of all annual FCFs and the terminal value. This total is the intrinsic value of the business.

✅ Step 6: Compare with Market Capitalization

- If DCF value > Market Cap, the stock may be undervalued

- If DCF value < Market Cap, the stock may be overvalued

This gives you a rational basis for your investment decision.

Example – Simple DCF Model in Action

Let’s walk through a simplified DCF example to solidify the concept.

Imagine a company that’s expected to generate the following Free Cash Flows (FCFs) for the next five years:

| Year | Projected FCF (₹ in crores) |

|---|---|

| 1 | 100 |

| 2 | 120 |

| 3 | 140 |

| 4 | 160 |

| 5 | 180 |

We’ll assume:

- Discount rate (r) = 10%

- Terminal growth rate (g) = 4%

- We’ll calculate Terminal Value using Year 5’s cash flow

🧮 Step 1: Discount Each Year’s FCF

Present Value=FCF(1+r)n\text{Present Value} = \frac{\text{FCF}}{(1 + r)^n}Present Value=(1+r)nFCF

| Year | FCF (₹ Cr) | Discount Factor (10%) | Present Value (₹ Cr) |

|---|---|---|---|

| 1 | 100 | 0.909 | 90.9 |

| 2 | 120 | 0.826 | 99.1 |

| 3 | 140 | 0.751 | 105.1 |

| 4 | 160 | 0.683 | 109.3 |

| 5 | 180 | 0.621 | 111.8 |

Total PV of FCFs = ₹516.2 Cr

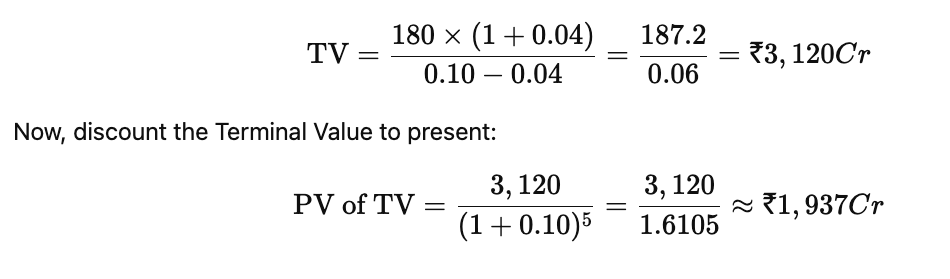

Step 2: Calculate Terminal Value

🧾 Step 3: Add Everything

DCF Valuation= ₹516.2 Cr+₹1,937 Cr = ₹2,453.2 CrIf the company’s current market capitalization is ₹2,000 Cr, the stock might be undervalued based on this DCF analysis.

Strengths and Weaknesses of DCF

While Discounted Cash Flow is one of the most powerful tools in an investor’s toolkit, it’s important to understand both its advantages and limitations.

Strengths of DCF

- Focus on Fundamentals

- DCF is grounded in the actual cash-generating ability of a business—not influenced by market hype or temporary sentiment.

- Long-Term Thinking

- It encourages investors to think like owners by focusing on long-term value creation, not short-term price movements.

- Intrinsic Value-Based

- Unlike PE or PB ratios, which compare prices across companies, DCF gives an absolute valuation of what a business is worth on its own merits.

- Customizable

- You can fine-tune assumptions (growth, risk, investment needs) to match your own outlook and risk tolerance.

Weaknesses of DCF

- Highly Sensitive to Assumptions

- Small changes in growth rates, discount rates, or terminal value can drastically alter the outcome.

- Forecasting Is Hard

- Predicting future cash flows over 5–10 years is inherently uncertain, especially for companies in fast-changing industries.

- Not Ideal for All Businesses

- DCF works best for stable, cash-generating businesses. It’s less reliable for startups, cyclical businesses, or those with erratic cash flows.

- Terminal Value Dominates

- In most DCF models, over 50–70% of the valuation comes from the terminal value, which is based on far-off assumptions.

Pro Tip:

Always run a sensitivity analysis—change the growth rate or discount rate slightly and see how much the valuation changes. It helps gauge the confidence range of your DCF estimate.

When to Use DCF (and When Not To)

Not every stock or company is suitable for a DCF valuation. Understanding when to apply this method can save you time and improve the quality of your investment decisions.

Best Scenarios for DCF:

- Mature, Predictable Businesses

- Companies with stable, recurring cash flows (e.g. FMCG, utilities, infrastructure)

- Example: Infosys, HUL, NTPC

- Capital-Intensive Companies

- Where reinvestment decisions and free cash flows matter more than reported earnings

- Example: Auto manufacturers, power and energy firms

- Long-Term Investment Approach

- If you’re holding for 5–10 years and want to understand a company’s real value, DCF is ideal.

- Value Investing

- When searching for undervalued companies based on fundamentals, not market noise.

Avoid DCF For:

- Early-Stage Startups or Tech Firms

- Uncertain or negative cash flows, no consistent profit history

- Example: Zomato in early years, high-growth SaaS startups

- Highly Cyclical Businesses

- Difficult to predict future cash flows due to boom-bust cycles

- Example: Airlines, commodity companies

- Companies with Rapidly Changing Business Models

- E.g. pivoting industries or those undergoing major transformation (like tech disruptors)

- Speculative Stocks

- Penny stocks or those driven by hype or short-term trends rather than cash flow.

Pro Tip:

“Use DCF when you understand the business well enough to make educated forecasts. If your inputs are guesses, your outputs are just ‘refined guesses’.”

Conclusion – DCF: A Tool for Rational Investors

In a market filled with noise—stock tips, trending reels, hype and herd mentality—the Discounted Cash Flow (DCF) method stands tall as a beacon of rational investing.

It doesn’t chase short-term momentum or flashy narratives. Instead, it asks the most fundamental question:

“How much cash can this business generate, and what is that worth today?”

Why DCF Matters:

- It brings discipline to your decision-making.

- It keeps you focused on intrinsic value, not just market price.

- It helps you think like a business owner, not a gambler.

Whether you’re analyzing a blue-chip stock or a hidden gem, DCF puts the focus where it belongs: on the cash a business generates and how well it uses it to grow.

Even legendary investors like Warren Buffett and Charlie Munger have long relied on variations of this approach. As Munger said:

“All intelligent investing is value investing — acquiring more than you are paying for. You must value the business in order to value the stock.”

Final Tip:

You don’t need to be a finance expert to use DCF effectively. Start simple. Focus on businesses you understand. Use conservative assumptions. And most importantly, think long-term.

Because at the heart of DCF is something powerful: patience, logic, and the belief that value eventually wins.

FAQs on Discounted Cash Flow (DCF)

Q1. What is Discounted Cash Flow (DCF)?

A: DCF is a valuation method that estimates the present value of a business based on its expected future cash flows, discounted using a risk-adjusted rate.

Q2. Why is DCF called the ‘King of Valuation’?

A: Because it focuses on intrinsic value based on real cash flows, not market speculation—making it ideal for long-term investors.

Q3. How is DCF different from PE or PB ratios?

A: DCF gives an absolute value based on future performance, while PE and PB are relative and depend on comparisons with peers or market averages.

Q4. What is the biggest challenge in using DCF?

A: Accurately forecasting future cash flows and choosing a suitable discount rate. Even small changes can significantly affect the valuation.

Q5. Can DCF be used for all companies?

A: No. DCF works best for stable, cash-generating businesses. It’s not ideal for early-stage startups or highly volatile industries.

Related Articles

Gold vs Silver vs Sensex: Who Made You Richer?

India’s Sparkling Shift to Lab-Grown Diamonds