Introduction: Climate Change and India’s Financial Health

When you hear “climate change,” you probably imagine melting glaciers, smog-filled skies, or activists yelling at world leaders.

But here’s the less glamorous — and far scarier — reality: Climate Change is already quietly bleeding India’s financial health.

From farms wilting under angry sun gods to insurance companies sweating over every monsoon, the economic impact is real, brutal, and worsening.

The World Bank warns that climate change could slice off 2.8% of India’s GDP by 2050 — and if things really spiral, the hit could be a mind-numbing 10%.

(That’s like losing half of India’s entire IT industry — gone, puff!)

However, it’s not all doom and gloom.

India’s ambitious net-zero 2070 pledge and booming green industries — like renewables and EVs — are lighting up billion-dollar opportunities.

The question isn’t whether climate change will reshape India’s economy — it already is.

The smarter question is: Will you adapt your investments before it’s too late?

How Climate Change is Hammering India’s Economy

Let’s skip the academic jargon and get real — climate change is squeezing India’s economy harder than ever before. Here’s how:

Agriculture Under Fire

- Agriculture makes up ~15% of India’s GDP and supports nearly half of Indian households.

- But climate change is breaking the backbone of this sector.

- Erratic monsoons, record heatwaves, and floods are slashing crop yields.

- Example?

In 2022, India’s wheat output plunged due to a brutal heatwave — forcing the government to ban wheat exports to avoid a domestic shortage. - Result: Rural incomes crash, farm loans sour, and food prices skyrocket.

Infrastructure Wreckage

- Floods, cyclones, and rising sea levels are battering India’s roads, cities, ports, and power grids.

- Each disaster triggers billions in repair costs for the government and private companies.

- Example:

2023 Mumbai floods caused infrastructure damage worth over ₹5,000 crore.

And this is just one city. Imagine the nationwide hit.

Insurance: Paying the Climate Bill

- Insurance companies are bleeding under a rising tide of claims.

- Crop insurance payouts are ballooning. Flood and storm damage claims are eating profits.

- In a twisted irony, just when Indians need more insurance (climate risks rising), premiums could jump 20–30% because insurers can’t cope with losses!

RBI and SEBI Sounding the Alarm

- Even India’s financial regulators are sweating.

- RBI called climate change “one of the biggest emerging risks” for banks.

- SEBI now forces top companies to publish detailed ESG (Environment, Social, Governance) reports — because investors are demanding to know who’s ready for the green future and who’s stuck in the dirty past.

The Double-Edged Sword — Risks AND Opportunities

Sure, climate change is wreaking havoc.

But here’s the fun twist: the same monster that’s torching old industries is also minting billion-dollar opportunities.

In simple words:

👉 Climate Change in India = Destruction + Creation.

And investors who get the “creation” side early could be riding the next big wealth wave.

Here’s how the opportunity map looks:

Renewable Energy Explosion

- India’s renewable energy sector is on fire — in a good way.

- Solar parks, wind farms, floating solar plants — we are seeing a green gold rush.

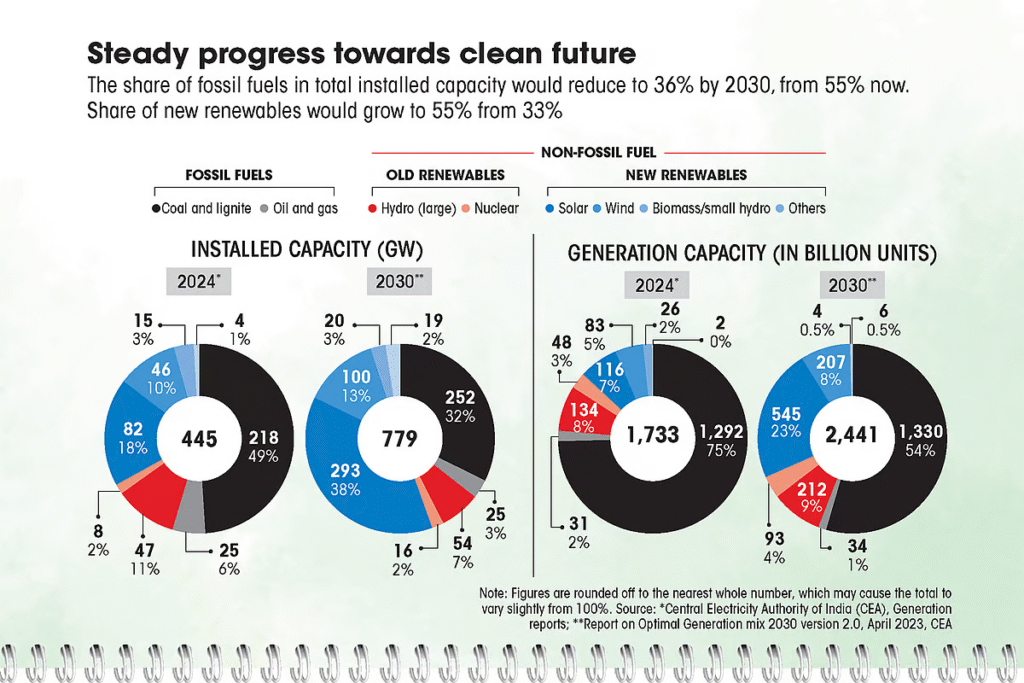

- India plans to install 500 GW of non-fossil fuel capacity by 2030. (That’s basically like lighting up the whole country… twice.)

Electric Vehicles Revolution

- EV sales in India are zooming faster than a 2-stroke scooter.

- Tata Motors, Mahindra, Ola, Ather — everyone wants a piece of the electric future.

- Government aims for 30% of all cars sold by 2030 to be electric.

- And with oil prices looking like your favorite soap opera (full of drama), EVs are an obvious winner.

Climate-Resilient Agriculture

- Smart seeds, drip irrigation, precision farming — climate-resilient farming is a booming industry.

- Companies helping farmers adapt to crazy weather will mint money.

- Seed firms, irrigation tech, agri-insurance — all entering beast mode.

Green Finance Boom

- Banks, insurance companies, and funds are pumping billions into green bonds, ESG funds, and sustainable finance.

- Even the Government of India issued Green Sovereign Bonds — which got oversubscribed like a hot iPhone launch.

Policy Support Tailwind

- Net Zero by 2070.

- 50% energy from non-fossil sources by 2030.

- EV incentives, solar subsidies, mandatory ESG reporting.

- The government isn’t just talking. They are throwing serious money and rules into this transition.

Bottom Line:

Climate Change in India is NOT just about floods and heatwaves.

It’s about new industries rising while old industries rust.

The question for you is:

🚀 Will you invest in the builders of the green economy or the victims of the old economy?

Investment Strategy for Climate Change in India

Alright.

You get it — climate change in India is serious.

But if you’re investing blindfolded, you might still end up backing the wrong side of history. 🥴

Here’s a smarter way to play it:

Defensive Bets: Play Safe, Stay Steady

- Focus on companies already adapting — those investing in clean energy, water conservation, or sustainable farming.

- These firms are too big to fail and too smart to ignore the climate shift.

- Example:

- NTPC — moving from coal plants to mega solar parks.

- HDFC Bank — pushing green loans and ESG lending.

Goal: Sleep peacefully. Grow slowly but steadily.

Aggressive Bets: Bet on Tomorrow’s Titans

- Go for high-growth sectors — electric vehicles, batteries, solar manufacturing, green hydrogen.

- Riskier, yes.

But the returns could be… let’s just say Elon Musk-level. - Example:

- Adani Green Energy — aiming to be world’s largest renewable power producer.

- Amara Raja Batteries — pivoting from old-school batteries to EV lithium-ion tech.

Goal: Get rich… if you can stomach the ride.

ESG and Sustainable Investing: The Smart Middle Ground

- Not too slow. Not too crazy.

- ESG funds and green companies give you exposure to climate winners without taking wild risks.

- Plus, ESG stocks are attracting global big-money — think pension funds, sovereign funds, etc.

- Example:

- Infosys — already carbon-neutral, strong ESG credentials.

- Tata Power — big renewable energy and EV charging network.

Goal: Ride the wave of money shifting into good-for-planet companies.

Build a Balanced Climate Portfolio

- Large-caps = Stability (Reliance, Tata Motors, NTPC)

- Mid-caps = Growth boosters (Tata Power, Adani Green, Amara Raja)

- Small-caps = Hidden gems (Suzlon, Olectra Greentech, Ion Exchange)

Mix a little bit of each.

Because let’s be honest — even the best weathermen can’t predict every storm.

Pro Tip:

Always remember, with Climate Change in India, time is money.

Those who adapt early (both companies and investors) will rule the next financial decade.

Best Stocks To Invest in Climate Change in India

Choosing the right companies isn’t just smart —

in the world of climate change in India, it’s survival of the cleanest.

Here’s your hand-picked portfolio:

Large-Cap Leaders: Big, Bold, and Green

1. Reliance Industries (Ticker: RELIANCE)

From oil baron to clean energy kingpin.

- Mukesh Ambani’s Reliance is throwing billions into green hydrogen, solar energy, and battery factories.

- Its new “Giga Complex” aims to make Reliance a renewable superpower.

- Reliance isn’t just surviving climate change in India — it’s looking to profit massively from it.

2. Tata Motors (Ticker: TATAMOTORS)

The undisputed EV king of India.

- Tata owns 70% of India’s electric car market today.

- Nexon EV, Tiago EV — their cars are literally zooming past competition.

- As EV adoption explodes, Tata Motors will be sitting comfortably on top of the green auto pile.

3. NTPC Ltd. (Ticker: NTPC)

India’s biggest power producer, now turning green.

- NTPC is pivoting hard into solar, wind, and green hydrogen projects.

- With sovereign backing, fat dividends, and new-age energy ambitions, it’s a solid defensive bet on climate change in India.

4. Mahindra & Mahindra (Ticker: M&M)

Farming, SUVs, and now EVs — Mahindra does it all.

- M&M is launching Born Electric SUVs and pushing climate-resilient agriculture.

- Big investments + proven execution = a smart way to ride India’s EV boom and rural adaption wave.

5. Larsen & Toubro (Ticker: LT)

If India builds it, L&T probably constructed it.

- L&T is the green engineer of India’s future — building solar plants, wind farms, metro systems, water solutions.

- Best way to bet on India’s climate-resilient infrastructure revolution.

Mid-Cap Rockets: Fast Climbers of the Green Economy

6. Tata Power (Ticker: TATAPOWER)

Not just another electric company — a green energy pioneer.

- Rooftop solar leader, EV charging station builder, clean grid player.

- Tata Power is becoming India’s distributed green energy titan.

7. Adani Green Energy (Ticker: ADANIGREEN)

Think big. Then think even bigger.

- World’s largest planned renewable energy company.

- Massive solar-wind parks coming online.

- High-risk, high-reward stock for believers in India’s renewable energy explosion.

8. Amara Raja Batteries (Ticker: AMARAJABAT)

From your inverter battery to your EV’s heart.

- Investing big into lithium-ion battery gigafactories.

- Perfectly positioned to fuel India’s EV battery revolution.

9. Borosil Renewables (Ticker: BORORENEW)

Glass so good, solar panels can’t live without it.

- India’s only solar glass maker.

- As India’s solar capacity triples, Borosil’s order book could burst at the seams.

10. ICICI Lombard General Insurance (Ticker: ICICIGI)

Who insures a world on fire? Smart companies like this.

- Rising climate risks = rising insurance demand.

- ICICI Lombard could turn climate disasters into steady premium growth — smart way to hedge in your portfolio.

Small-Cap Gems: Hidden Warriors of the Green Future

11. Suzlon Energy (Ticker: SUZLON)

The wind beneath India’s green wings.

- Back from the dead and bagging huge wind turbine orders.

- High-risk, high-reward play on India’s wind energy revival.

12. Olectra Greentech (Ticker: OLECTRA)

The Tesla of Indian public transport? Maybe.

- Maker of electric buses, already winning city contracts.

- If e-buses become mainstream, Olectra could quietly turn into a multi-bagger.

13. Kaveri Seed Company (Ticker: KSCL)

Climate chaos means smarter farming — and smarter seeds.

- Specialist in drought-resistant, heat-tolerant crop seeds.

- Plays directly into India’s climate-resilient agriculture revolution.

14. Ion Exchange India (Ticker: IONEXCHANG)

When water becomes gold, these guys strike first.

- Experts in water recycling, desalination, clean drinking water projects.

- As India faces water crises, Ion Exchange becomes indispensable.

Quick Recap Table:

| Category | Stock Picks |

|---|---|

| Large Cap (Stable) | Reliance, Tata Motors, NTPC, Mahindra, L&T |

| Mid Cap (Growth) | Tata Power, Adani Green, Amara Raja, Borosil, ICICI Lombard |

| Small Cap (High Risk-High Reward) | Suzlon, Olectra, Kaveri Seeds, Ion Exchange |

Conclusion: Adapt, Invest, Thrive

Here’s the cold truth:

Climate change in India is no longer just a weather report — it’s a financial reckoning.

Companies that adapt will thrive.

Companies that ignore it will rot faster than last week’s roadside samosas.

The good news?

You don’t have to wait helplessly for the next flood, drought, or heatwave.

You can invest smartly — today — into the companies building India’s green future.

👉 Whether it’s Reliance and Tata Motors steering the big ship…

👉 Or Adani Green, Tata Power tapping the renewable gold rush…

👉 Or small dynamos like Suzlon and Olectra rewriting clean-tech success stories…

One thing is crystal clear:

The next decade belongs to those who bet on resilience, not resistance.

In this high-stakes game called climate change in India,

Mother Nature isn’t the only one handing out grades.

Investors are grading companies too — and the winners will laugh all the way to the green bank.

♻️Ready to future-proof your portfolio?

Because whether you act or not, the climate (and the market) sure as hell will.

From green energy giants to emerging EV players, stay ahead with Angel One’s tools and smart recommendations.

👉 Open your Angel One account today and invest in India’s green revolution before everyone else catches up!

FAQs: Climate Change and Investing in India

1. What is the impact of climate change on India’s economy?

Climate change could cut India’s GDP by 2.8–10% by 2050, affecting agriculture, infrastructure, and overall financial health.

2. Why invest in climate change stocks in India?

Sectors like renewables, EVs, and green finance are booming as India transitions to a low-carbon economy.

3. Which sectors benefit the most from climate change in India?

Renewable energy, electric vehicles, green finance, agriculture technology, and sustainable water management.

4. What are some safe large-cap stocks for climate investing?

Reliance Industries, Tata Motors, NTPC, Mahindra & Mahindra, and Larsen & Toubro.

5. Are mid-cap companies good for green investments?

Yes, companies like Tata Power, Adani Green, and Amara Raja offer strong growth linked to India’s green shift.

6. Is investing in green small-cap stocks risky?

Small caps like Suzlon or Olectra have higher growth potential but also higher volatility. Diversify wisely.

7. How does EV adoption affect stock markets in India?

Rising EV sales boost companies like Tata Motors, battery makers like Amara Raja, and charging providers like Tata Power.

8. What is ESG investing?

ESG (Environmental, Social, Governance) investing focuses on companies practicing sustainability and ethical governance.

9. How does Angel One help in climate investing?

Angel One provides research, fast trading, and insights into sectors like green energy, EVs, and ESG-focused stocks.

10. Is climate change investing only about renewable energy?

No! It includes EVs, sustainable agriculture, green finance, water solutions, insurance, and more future-ready sectors.

Related Articles

Water is the New Oil: India’s Billion-Dollar Water Management Opportunity