China’s Fertilizer Export Halt

When China sneezes, global supply chains catch a cold — and India’s agricultural sector is currently feeling the chill.

Over the past two months, India has faced an abrupt disruption in one of its most sensitive input streams: specialty fertilizers. While headlines may have missed the nuance, the real story lies in the data — China has quietly halted all exports in this category to India, without issuing a formal ban. What appears to be a geopolitical maneuver is now creating real market tremors.

For Indian investors, this isn’t just trade news — it’s a signal. In an environment where 80% of specialty fertilizer imports come from a single country, any supply shock can tilt the balance in favor of domestic producers.

The China fertilizer halt impact stocks in a big way — shifting investor attention from importers to companies with deep manufacturing strength and localized supply chains. And amid this shake-up, one Indian player, known for its dominance in nitrate-based and value-added fertilizers, is emerging as a rare winner in the chaos.

This report breaks down the China fertilizer halt impact stocks trend — and why one under-the-radar company could be on the verge of a re-rating.

The Trigger: What China Did and Why It Matters

In late April 2025, Chinese authorities began quietly stalling shipments of specialty fertilizers to India — not through formal bans or trade restrictions, but via regulatory bottlenecks and customs delays. This method of “procedural stalling” has been China’s go-to trade tactic in the past for rare earths and critical minerals — and it’s now being applied to agriculture.

The impact is anything but subtle.

India imports around 150,000 to 160,000 tonnes of specialty fertilizers during the key June–December cropping cycle, with China supplying nearly 80% of that demand. These fertilizers — especially water-soluble and nitrate-based variants — are essential for high-value horticultural crops and precision farming.

For over two months now, imports have been completely stalled. No official explanation has come from Chinese authorities, but Indian industry voices have confirmed the disruption. According to Rajib Chakraborty, President of the Soluble Fertilizer Industry Association (SFIA), there has been a “complete halt” in imports from China since late April.

The result? Indian buyers are scrambling, prices are rising, and supply gaps are emerging just as the monsoon planting season begins — a worst-case scenario for both farmers and agri-input dealers.

But where there’s disruption, there’s also opportunity — and this is where the China fertilizer halt impact stocks narrative gains traction. Domestic producers with ready capacity, government access, and product diversity are in prime position to step in and fill the vacuum.

How the China Fertilizer Halt Impacted Indian Stocks So Far

The ripple effect of China’s silent export halt is beginning to surface on Dalal Street. Over the past 1–2 months, fertilizer stocks have surged, riding on a confluence of global disruptions and local tailwinds.

According to a CNBC TV18 report dated June 3, 2025, fertilizer stocks have rallied up to 15%, with several counters hitting fresh 52-week highs. This rally aligns not only with India’s early monsoon — a traditionally bullish signal for agri-input plays — but also with a noticeable shift in investor sentiment toward domestic fertilizer producers.

Two global macro events have intensified this shift:

- China’s stalling of specialty fertilizer exports to India, creating immediate supply gaps.

- The EU’s recent tariff hikes on fertilizer imports from Russia and Belarus, redirecting international attention toward Indian manufacturers.

Investors are clearly favoring companies with domestic manufacturing strength, nitrate-based formulations, and logistical resilience. In this context, the China fertilizer halt impact stocks theme is accelerating — positioning India’s self-reliant players for both pricing power and volume growth.

The rally isn’t just speculative. It reflects structural optimism about India’s fertilizer independence and the potential policy push that may follow. The market is actively rewarding producers that are insulated from geopolitical risks and positioned to gain from demand-supply rebalancing — a shift that places one company squarely in the spotlight.

Deepak Fertilisers: Top Pick Among China Fertilizer Halt Impact Stocks

Among India’s leading agri-input players, Deepak Fertilisers and Petrochemicals Corporation Ltd. stands out as a direct beneficiary of the current fertilizer supply disruption triggered by China’s export halt.

While many companies in the space operate with narrow margins or commodity-only models, Deepak Fertilisers has spent the last five years building a differentiated, high-margin portfolio anchored in value-added solutions, backward integration, and pan-India reach. That transformation is now paying off.

Product Strength: Specialty Fertilizers at the Core

Deepak Fertilisers isn’t just another NPK player. It’s the only producer of NP prill 24:24:0 in India, with a dominant presence in:

- Water-soluble fertilizers for high-efficiency irrigation systems,

- Micronutrient-rich blends,

- And Bentonite Sulphur, where it’s a recognized market leader.

Its flagship brand Mahadhan is trusted by over 3 million farmers and includes proprietary offerings like Smartek and Croptek — critical products for high-value crops that would be hardest hit by a supply disruption.

This positions Deepak Fertilisers as one of the few domestic firms capable of immediately stepping into the gap left by China.

Financial Strength & Operational Edge

- FY25 Revenue: ₹10,274 crore

- Net Profit: ₹945 crore

- ROE: 14%

- Market Cap: ₹20,127 crore

The company’s recent capex — a 510,000 MTPA ammonia plant (Q1 FY24) and a 376,000 MTPA TAN plant coming online by Q2 FY25 — is strengthening cost control and expanding margin headroom.

Its move from commodity to specialty offerings also reduces earnings volatility, boosting investor confidence.

Distribution Power & Agri Reach

With 600 industrial clients, 50+ channel partners, and a vast agri-retail network across major crop-producing states, Deepak Fertilisers has the infrastructure to scale supply quickly — a crucial advantage when import bottlenecks tighten availability.

Technical Setup: Momentum Backed by Fundamentals

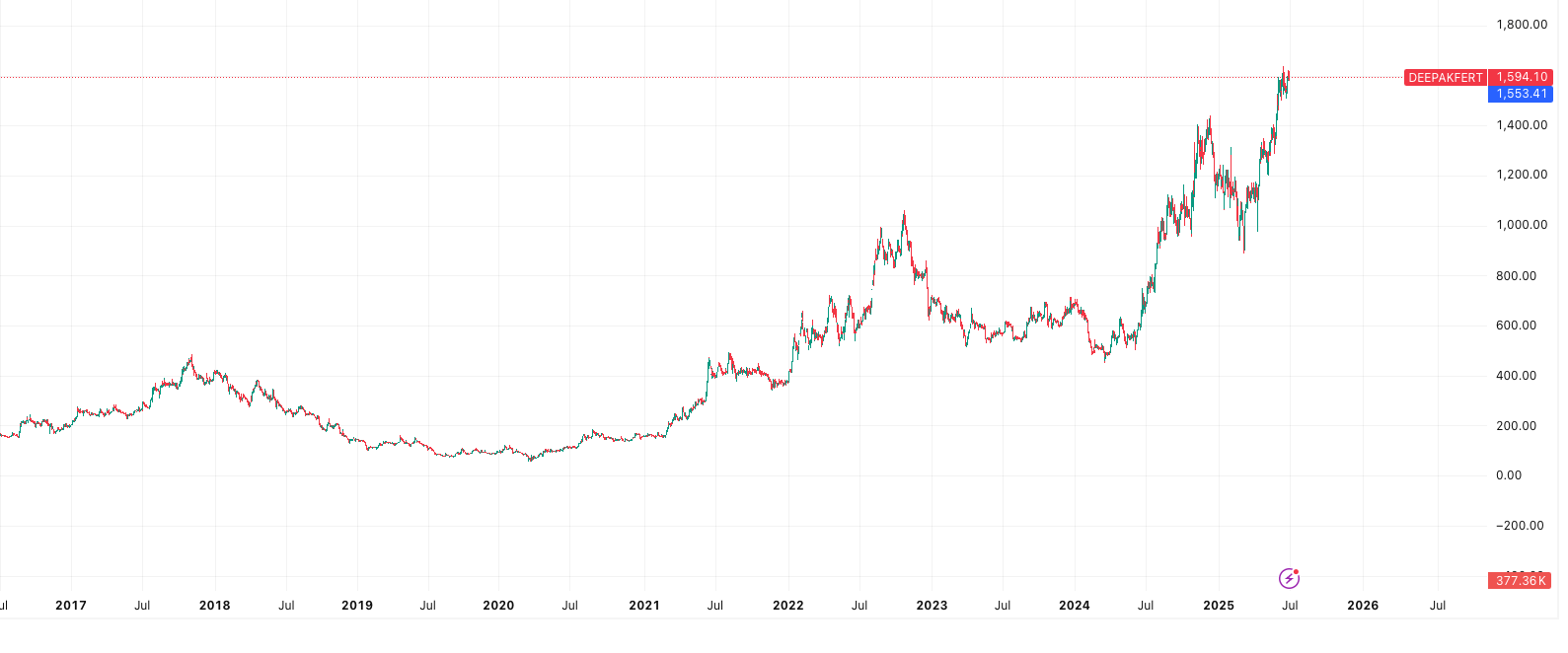

- Current Price: ₹1,595 (as of June 27, 2025)

- 1-Year Return: +142%

- Trend: Above 50- & 200-day MAs; bullish setup

- Analyst View: “Strong Buy”

- Momentum: RSI and MACD support further upside

After a sharp rally, the stock is now consolidating — potentially offering an entry point before the next leg up.

Strategic Vision

President of Crop Nutrition Business, Mahesh Girdhar, encapsulates the company’s forward-looking model:

“Our journey has been strongly driven by value-added solutions, and we see the industry from the nutrient perspective, not just the product perspective.”

This aligns perfectly with the emerging investor thesis: specialty-focused, innovation-led, and geopolitically insulated stocks will lead the next growth phase in agri-inputs.

Other Fertilizer Stocks Benefiting from the China Export Halt

While Deepak Fertilisers leads the pack, several other Indian fertilizer companies may also benefit from the shift in trade dynamics. The ongoing supply disruptions and rising import costs have pushed investor interest toward domestic producers.

🔹 Rashtriya Chemicals and Fertilizers Ltd (RCF)

RCF is a government-backed company with strong capacity in urea and complex fertilizers. It operates a wide distribution network across key farming regions.

Importantly, the government often relies on RCF to stabilize supply during shortages. As a result, it may see increased allocation or policy support.

🔹 Chambal Fertilisers and Chemicals Ltd

Chambal is one of India’s largest private urea manufacturers. It operates with scale and efficiency, particularly across northern and central India.

Thanks to its strong production base, it can respond quickly if imports are delayed. Therefore, it’s seen as a reliable buffer when supply chains tighten.

🔹 Gujarat State Fertilizers & Chemicals Ltd (GSFC)

GSFC offers a mix of fertilizers and industrial chemicals. It produces ammonium sulphate, phosphates, and micronutrients, and also supplies inputs to other agri players.

As input costs rise globally, GSFC could benefit from domestic buyers seeking more stable and cost-effective sourcing.

Summary View

In short, these companies are gaining attention as reliable alternatives to import-heavy models. The China fertilizer halt impact on stocks is broadening, and investors are beginning to build exposure across the sector. While Deepak Fertilisers leads in the specialty segment, RCF, Chambal, and GSFC offer complementary advantages.

Risks and Reversals on China fertilizer halt impact stocks

While the current setup favors domestic fertilizer companies, investors must remain cautious. Several factors could reverse the recent optimism.

Export Resumption by China

China has not issued a formal export ban. If it clears backlogs or resumes shipments, supply pressures could ease quickly. In that case, Indian companies may lose pricing power, especially in specialty segments.

Global Diversion of Supply

Countries like Russia, Morocco, or Middle Eastern players may step in to meet India’s shortfall. If India boosts imports from alternative sources, domestic players might not gain as much volume traction as expected.

Policy Risks

Government subsidies and import duties play a major role in the fertilizer sector. Any change in pricing formulas, margin caps, or subsidy delays can impact earnings. Investors should watch for signals from the Ministry of Chemicals and Fertilizers.

High Valuations and Profit Booking

Several fertilizer stocks have already surged 10–15% in recent weeks. If broader market sentiment weakens, or if monsoon projections fail, profit booking could set in.

Input Cost Volatility

Despite backward integration, many companies still rely on global ammonia, phosphoric acid, or natural gas prices. Sudden spikes in raw material costs can compress margins — even for integrated players like Deepak Fertilisers.

What to Watch

- China’s stance in July on clearing fertilizer exports

- Input cost trends in ammonia and phosphoric acid

- India’s fertilizer import volumes (Q2 data)

- Domestic subsidy announcements and PLI incentives

Conclusion: A Sector Rerated by Strategy, Not Sentiment

The silent fertilizer export halt by China has triggered more than just short-term supply anxiety — it has reshaped investor focus in India’s agri-input space. The spotlight is now on strategically positioned domestic producers that can fill the supply void, offer differentiated products, and withstand global volatility.

At the center of this shift is Deepak Fertilisers, a company that has quietly transitioned from commodity producer to value-added agri-solutions leader. With strong financials, backward integration, and a trusted product mix, it is well-placed to convert short-term disruptions into long-term market share gains.

Supporting players like RCF, Chambal Fertilisers, and GSFC are also in a stronger position than before — thanks to policy tailwinds, supply-side constraints, and global trade realignments.

Still, investors must stay vigilant. If China resumes exports or if input costs surge unexpectedly, the narrative could change quickly. That said, the broader China fertilizer halt impact stocks trend has already sent a clear signal: domestic resilience and supply chain independence are being rewarded.

For long-term investors, this may be a turning point — not just for one stock, but for the strategic future of India’s fertilizer industry.

Related Articles:

Insider Buying in Indian Stocks: Hidden Signals You Shouldn’t Ignore

India’s $40 Billion Spending Wave: What’s Powering the Next Consumption Boom?

Electric Plane Take Off: How Beta’s ₹700 Flight Could Disrupt Aviation Stocks

More Articles

India’s Obesity Crisis Fuels a Billion-Dollar Boom: Top Pharma Stocks to Watch

Rare Earth Magnet Manufacturing Stocks: Catch These Before India’s ₹1,000 Cr Push Lifts Off

Ready-to-Drink (RTD) Cocktails: The Fastest-Growing Segment in the Liquor Market