Introduction: Chennai’s Property Market Defies the National Trend

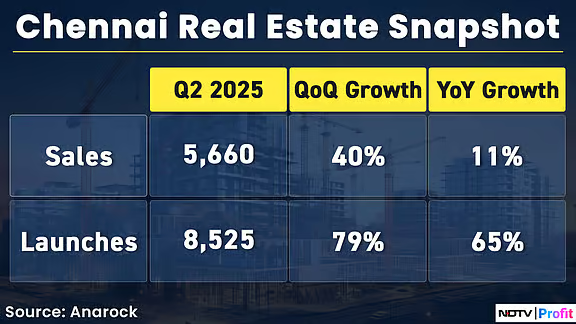

While most major Indian cities are witnessing a slowdown in real estate sales in 2025, Chennai is sprinting ahead. According to fresh Q2 2025 data, it is the only top metro city to post double-digit growth (11%) in residential sales — a rare feat when others like Bengaluru, Pune, and Hyderabad are seeing both supply and demand cool off.

What’s driving this surge? A unique mix of delayed supply, rising demand, and explosive commercial leasing activity — particularly from Global Capability Centres (GCCs) and IT firms. Add to this a wave of infrastructure developments like Metro Phase II and the Peripheral Ring Road, and Chennai looks like it’s just getting started.

This sustained growth presents a compelling opportunity for stock market investors. In this blog, we break down the forces behind the boom and highlight the best Chennai real estate boom stocks that could benefit from this rare metro-level momentum.

What’s Fueling Chennai’s Real Estate Bull Run?

Chennai’s real estate surge in 2025 isn’t just a blip — it’s the result of structural demand meeting a delayed supply response. While other top cities like Mumbai, Bengaluru, and Hyderabad had their property booms soon after the pandemic, Chennai’s real estate cycle took off late, and that’s proving to be its advantage now.

1. Delayed Supply = Pent-Up Demand

According to Anarock Research, Chennai added only 45,830 new housing units between 2023 and Q1 2025. That’s significantly lower than Hyderabad and Bengaluru, which added over 1.45 lakh and 1.46 lakh units, respectively, in the same period.

What this means is — when sales started rising in Chennai, there wasn’t enough fresh supply to match the momentum. That mismatch is driving strong price support and sustained buyer interest, especially among mid- to upper-middle-class homebuyers.

2. Focus on Mid and Premium Housing

Unlike Bengaluru or Mumbai, where luxury and ultra-luxury homes dominate recent launches, Chennai’s market remains rooted in practicality:

- Mid-segment (₹40–80 lakh): 41% share of new launches in Q2 2025

- Premium (₹80 lakh–₹1.5 crore): 38% share

- Luxury/Ultra-luxury (₹1.5 crore+): 21% share

The city is gradually moving up the value chain with developers now expanding into premium housing. However, the base remains stable, making it attractive for both end-users and investors.

3. Controlled Price Growth Adds Stability

Despite increased demand, Chennai’s residential prices have risen moderately — about 7% YoY to ₹6,950 per sq. ft. in Q2 2025. That’s lower than cities like Mumbai, Delhi NCR, and Hyderabad, but it also means:

- Less risk of price correction

- Greater affordability for first-time buyers

- Longer runway for appreciation

This balance of demand and stable pricing makes Chennai stand out in a year when many other metros are overheating or cooling off.

Commercial Real Estate on Fire: The GCC Factor

While Chennai’s residential market is making headlines for its sustained growth, the real fuel behind the fire lies in its commercial real estate boom. And at the heart of this boom is the rise of Global Capability Centres (GCCs).

1. The GCC Rush: 300 and Counting

Chennai has quietly become one of India’s fastest-growing hubs for GCCs — back-office and R&D centres of global corporations. As of 2025, the city already hosts around 300 GCCs, and projections from CBRE estimate this could rise to 450 by 2030.

This shift is not cosmetic. According to Anarock Research:

- 2 million sq. ft. of gross office space leased by GCCs in 2023

- 3.29 million sq. ft. leased in 2024

- That’s a massive 64% year-on-year jump

2. Leasing and Completions Up Sharply in 2025

In the first half of 2025 alone, commercial leasing activity in Chennai rose 57%, while new office completions jumped 67%, according to Colliers. This is a clear signal that businesses — especially in IT, fintech, and global operations — are betting on Chennai as their long-term base.

3. Spillover Effect on Residential Demand

Where offices go, homes follow. The rise in white-collar employment, particularly in IT corridors like OMR (Old Mahabalipuram Road) and Mount Poonamallee Road, is driving demand for larger, premium homes.

Professionals working in these sectors are increasingly seeking:

- Proximity to work hubs

- Gated communities with amenities

- Smart, sustainable housing options

This trend has led developers to launch mid and premium housing projects in areas such as Sholinganallur, Velachery, Siruseri, and Porur.

4. More Than Just IT: Auto & Logistics Step In

Chennai’s commercial real estate isn’t just about IT or GCCs. The city is also:

- An automobile and auto component manufacturing hub

- A growing base for third-party logistics (3PL) and warehousing

- Seeing rising demand from engineering and industrial players

This diversification adds resilience and broadens the base of housing demand, which is critical for long-term real estate stability — and by extension, for investors looking into Chennai real estate boom stocks.

The Rise of New Suburbs: Infrastructure Drives Demand

If Chennai’s real estate engine is powered by delayed supply and commercial demand, then infrastructure is the accelerator. Over the past year, major public projects have improved the city’s livability, enhanced connectivity, and unlocked new micro-markets — many of which are now hotbeds for residential and commercial activity.

1. Metro Expansion and Ring Roads Open Up New Zones

Two transformative infrastructure projects are reshaping Chennai’s urban footprint:

- Metro Phase II is boosting connectivity between the central city and peripheral zones, cutting down commute times significantly.

- The upcoming Chennai Peripheral Ring Road (CPRR) and Chennai-Bengaluru Industrial Corridor are opening up new real estate corridors and enhancing logistics movement.

These developments are not only easing traffic congestion but also making suburban living more attractive — especially for mid-income and premium buyers.

2. Emerging Hotspots: From Affordable to Premium Zones

Thanks to improved access and affordability, new suburbs have become the focus for developers and homebuyers alike:

Most Active Micro Markets in Q1–Q2 2025:

| Region | Key Localities | Segment Trend |

|---|---|---|

| South Chennai | Pallavaram, Medavakkam, Kanathur, Siruseri | Mid-to-premium housing |

| West Chennai | Poonamallee, Iyyappanthangal | Affordable-to-mid segment |

| North Chennai | Ambattur, Madhavaram | Affordable & emerging mid-segment |

| Coastal Suburbs | Chengalpattu, South Tambaram | Early-stage investor activity |

Developers are increasingly launching gated communities and smart homes in these areas, driven by rising aspirations and growing disposable incomes.

3. Premium Demand Near Employment Hubs

Areas close to IT corridors and commercial zones are witnessing a shift toward high-end housing. Locations such as:

- Velachery

- Sholinganallur

- OMR corridor

- Porur

…are seeing demand for luxury apartments, branded residences, and smart-home enabled communities. This is also attracting NRIs and high-net-worth individuals (HNIs) looking for value and connectivity.

4. Sustainability & Smart Homes in Demand

A new trend in Chennai’s suburbs is the growing preference for sustainable housing:

- Rainwater harvesting

- Solar power integration

- EV charging infrastructure

- Smart surveillance and energy optimization

These features are being seen as differentiators by developers and value-adds by buyers, particularly in mid to high-ticket properties.

Best Chennai Real Estate Boom Stocks to Watch

Chennai’s real estate boom is no longer just a local housing story — it’s creating investment-worthy opportunities on the stock market. With rising demand, improving infrastructure, and robust commercial leasing, listed developers and real estate-linked companies with strong Chennai exposure stand to benefit.

Here are some of the top stocks to watch as the city’s real estate growth gathers momentum:

1. Brigade Enterprises (NSE: BRIGADE)

Brigade has a strong presence in South India, including key Chennai localities like Perungudi and OMR. It’s actively expanding both residential and commercial projects in the city, including tech parks and office spaces catering to GCCs.

- 📊 FY25 revenue growth: ~18%

- 🏗️ Chennai projects: Brigade Xanadu, Brigade Residences

- 💡 Why it matters: Balanced play on both housing and commercial boom

2. Godrej Properties (NSE: GODREJPROP)

Though originally Mumbai-based, Godrej is aggressively expanding in Chennai. It recently launched mid-to-luxury residential projects in South Chennai and along OMR.

- 🏡 Focus: Mid to premium housing

- 📍 Recent launch: Godrej Sunrise Estate near Oragadam

- 💡 Why it matters: Strong brand appeal + pan-India execution strength

3. Sobha Ltd. (NSE: SOBHA)

Sobha is gaining traction in Chennai’s luxury and mid-income segment with high-quality gated communities. It’s focusing on premium residential demand in areas like Sholinganallur and OMR.

- 📦 Chennai share of total projects rising

- 💰 Steady order book & new launches

- 💡 Why it matters: Premium housing + quality-conscious buyers = ideal match

4. Mahindra Lifespace Developers (NSE: MAHLIFE)

Mahindra has deep roots in Chennai with integrated townships like Mahindra World City, a self-sustaining city with industrial and residential zones.

- 🌆 Chennai is one of its flagship zones

- 🏗️ Large land bank, strong ESG profile

- 💡 Why it matters: Smart city + affordable + industrial demand synergy

5. Prestige Estates Projects (NSE: PRESTIGE)

Another South India real estate giant making big moves in Chennai. Prestige is active in luxury apartments, malls, and commercial spaces.

- 📊 High pre-sales visibility

- 🏢 Expanding footprint in Chennai post-Bengaluru

- 💡 Why it matters: Strong commercial play + premium retail spaces

Bonus: Housing Finance & REITs with Chennai Exposure

LIC Housing Finance, PNB Housing Finance, and HDFC Ltd. could also benefit indirectly through rising home loan demand in the region.

Additionally, watch for REITs like Embassy REIT and Brookfield India REIT, which may look at commercial asset acquisitions in Chennai’s booming office market.

These companies are positioned at the intersection of rising demand, delayed supply, and economic activity, making them attractive options for investors hunting for Chennai real estate boom stocks.

Investment Outlook: Why Chennai May Outperform Other Real Estate Hubs

Chennai isn’t just catching up — it’s quietly positioning itself as the next big real estate and infrastructure growth story in India. For stock market investors, that means an opportunity to get in before valuations catch up to fundamentals.

Here’s why the investment case for Chennai real estate boom stocks looks strong heading into 2026 and beyond:

1. Delayed Cycle = More Upside Left

Unlike Mumbai or Bengaluru, which have already seen significant residential price run-ups, Chennai is still early in its upcycle. Price growth of 7% YoY in 2025 is healthy, but not euphoric — leaving room for further appreciation.

For investors, this means:

- Lower entry points for developers

- Higher ROI potential as supply picks up

- Reduced risk of near-term price correction

2. Balanced Supply & Demand Equation

The city has a favorable inventory situation — unlike other metros where oversupply often eats into margins.

- Supply is gradually rising but still catching up

- Demand is stable and driven by genuine end-users

- Developers are cautiously optimistic, avoiding oversaturation

This balance translates into strong cash flow visibility and lower project risk for listed developers — key metrics for earnings growth.

3. Commercial Activity Is Sustainable

Chennai’s leasing boom isn’t speculative — it’s driven by structural trends like:

- GCCs scaling up their India presence

- Manufacturing & auto sectors expanding

- IT sector talent continuing to favor Chennai for cost and culture

This will sustain residential demand across segments, especially in premium corridors, benefiting stocks with exposure to both verticals.

4. Rising Investor & NRI Confidence

Premium and luxury housing — once lagging in Chennai — is gaining serious traction, especially in smart, well-connected micro-markets. NRIs and HNIs are increasingly looking at Chennai not just as a home market, but as an investment-grade destination.

Developers with brand strength, transparent governance, and smart township planning will be first in line to capture this inflow of capital.

5. A Long Runway of Infrastructure-Led Growth

Metro Phase II, the Peripheral Ring Road, and industrial corridors like Chennai-Bengaluru will unlock new land, boost logistics, and improve intra-city commutes. This is the kind of long-duration economic catalyst that typically drives:

- Faster suburban development

- Higher absorption of residential inventory

- Steady commercial expansion

For listed companies with land banks or ongoing projects in these areas, this can translate into revenue visibility for the next 5–7 years.

Conclusion: Chennai’s Real Estate Rally Still Has Legs

While cities like Bengaluru, Hyderabad, and Pune are witnessing a real estate cooldown, Chennai is just getting started. With a unique combination of delayed supply, surging commercial demand, strategic infrastructure upgrades, and growing investor confidence, the city is entering a phase of sustained and balanced growth.

For stock market investors, this isn’t just a story of rising home prices — it’s a broader economic narrative playing out across housing, office space, construction finance, and infrastructure development. Listed developers with strong Chennai exposure, diversified project pipelines, and balance sheet strength are positioned to ride this wave profitably.

Whether you’re a long-term investor looking for compounders in real estate or a short-term trader tracking sector momentum, Chennai real estate boom stocks offer both opportunity and timing. And with India’s urban transformation moving deeper into Tier-1 and Tier-2 clusters, Chennai stands out as a rare metro still full of untapped potential — one worth betting on.

Frequently Asked Questions (FAQs)

What is driving the Chennai real estate boom in 2025?

Chennai’s real estate boom is driven by delayed supply, rising housing demand, commercial leasing by GCCs, and infrastructure upgrades like Metro Phase II and the Peripheral Ring Road.

Which are the best Chennai real estate boom stocks to invest in?

Top Chennai-focused stocks include Brigade Enterprises, Sobha Ltd., Godrej Properties, Prestige Estates, and Mahindra Lifespace Developers, all of which have active residential and commercial projects in the city.

Is Chennai real estate still affordable compared to other metros?

Yes, Chennai’s residential prices rose only 7% YoY in 2025, remaining more affordable than Mumbai, Bengaluru, or Delhi NCR, offering a better entry point for investors.

How is the commercial real estate market performing in Chennai?

Chennai’s commercial market is thriving, with GCCs leasing over 5 million sq. ft. in the last two years and office completions growing 67% YoY in H1 2025.

Why should investors consider stocks with Chennai exposure?

Stocks with Chennai exposure can benefit from stable demand, strong price support, commercial leasing activity, and long-term infrastructure-led growth.

Which sectors are boosting Chennai’s real estate growth?

Key sectors include IT, Global Capability Centres (GCCs), automobile manufacturing, engineering, and third-party logistics — all fueling demand for office and residential space.

What micro-markets are booming in Chennai real estate?

High-growth areas include OMR, Velachery, Sholinganallur, Pallavaram, Poonamallee, and Chengalpattu, thanks to proximity to IT hubs and upcoming infrastructure.

Are luxury and premium homes gaining traction in Chennai?

Yes, while mid-segment homes dominate, premium and ultra-luxury housing now make up nearly 60% of new launches, especially near IT and industrial zones.

Can NRIs benefit from investing in Chennai real estate stocks?

Absolutely. Rising interest in smart, gated communities and premium developments makes Chennai attractive for NRI investment through listed realty stocks.

What is the long-term outlook for Chennai real estate stocks?

With commercial demand, infrastructure growth, and affordable pricing, Chennai real estate stocks have strong long-term upside potential for investors in 2025 and beyond.

Related Articles

Best Ad Tech Stock: India’s Emerging Digital Goldmine for Investors

NABFID Infrastructure Lending Stocks: Impact on Infra Companies & Market Outlook

Retail Inflation Crashes to 2.10% in June 2025: What It Means for Consumers, RBI & Stocks