Introduction

Indian companies are rewriting their playbooks. From century-old conglomerates to agile new-age firms, many are turning to demergers as a way to unlock value and sharpen focus.

This shift signals a deeper change in strategy. Businesses are choosing to separate non-core verticals to build leaner, more focused entities. The goal? Greater operational efficiency, clearer market positioning, and stronger shareholder returns.

One standout example is the Apollo Hospitals demerger, announced in July 2025. Known as India’s first corporate hospital, Apollo is now preparing to carve out its pharmacy distribution and digital health platforms into a new listed company—Apollo Healthtech.

This bold move reflects both the rising potential of digital healthcare and the company’s intent to grow faster with more targeted execution. As healthcare demand rises and patient behavior evolves, Apollo is positioning itself to lead in two powerful directions: traditional hospital care and tech-enabled consumer health.

In this blog, we break down the Apollo Hospitals demerger—what’s changing, why it matters, and how investors should view this transformation.

About Apollo Hospitals

Before diving deeper into the Apollo Hospitals demerger, it’s important to understand the scale and legacy of the company itself.

Founded in 1983, Apollo Hospitals was India’s first corporate healthcare institution—and it has since grown into one of Asia’s largest and most respected private healthcare providers. The brand has become synonymous with quality medical care, innovation, and patient trust.

Over the past four decades, Apollo has built a comprehensive healthcare ecosystem that spans:

- 73 hospitals with over 10,134 beds

- 8,709 beds in 45 directly owned hospitals

- 639 beds in day surgery centers and maternity hospitals

- 790 beds managed through operations and management contracts

- A nationwide network of pharmacies, diagnostic clinics, telehealth, and Apollo 24/7, its fast-growing digital health platform

But Apollo is more than just hospitals and beds. It has transformed into a vertically integrated healthcare powerhouse—with reach across primary care, diagnostics, retail pharmacy, chronic care management, and digital health delivery. It touches the lives of millions across urban and semi-urban India, while also expanding overseas.

Financially, Apollo has shown strong and consistent growth. Between FY20 and FY25, its revenue grew at a CAGR of 14.7%, while net profit expanded at a CAGR of 35.7%, signaling both operational strength and scalability.

The company’s leadership, helmed by visionary founders like Dr. Prathap C. Reddy, has remained focused on evolving with the times. Now, with the Apollo Hospitals demerger, it is setting the stage for the next phase of growth—by giving its digital and pharmacy arms the independence to flourish as a separate entity.

Apollo Hospitals Demerger Announcement

On 1 July 2025, Apollo Hospitals made headlines by approving a bold structural transformation. In a board meeting held that day, the company granted in-principle approval for a Composite Scheme of Arrangement—a formal step toward executing the much-anticipated Apollo Hospitals demerger.

The core of the announcement? Apollo is carving out its pharmacy distribution and digital health businesses into a new listed company. This new entity, named Apollo Healthtech, will host the company’s high-growth consumer-facing verticals and operate independently on Indian stock exchanges.

The demerger includes two fast-scaling verticals that have gained massive traction in recent years:

- Apollo 24/7 – the company’s omnichannel digital health platform

- Pharmacy Distribution Network – which spans thousands of offline pharmacies and a growing e-commerce presence

This isn’t just a corporate shuffle—it’s a strategic reimagination of how Apollo delivers healthcare in India. The move positions Apollo Healthtech as a digitally native, consumer-first platform while allowing the parent entity to focus squarely on hospital operations and clinical excellence.

Importantly, the Apollo Hospitals demerger signals confidence in the standalone potential of each vertical. Both are now set to unlock independent value in their respective domains, backed by the Apollo legacy.

Structure of the Demerger

The Apollo Hospitals demerger isn’t just about separation—it’s a carefully structured move to build a new-age healthcare platform with clear ownership, defined focus, and market-ready scale.

🔹 What’s Being Demerged?

As per the proposed scheme, Apollo Hospitals Enterprise Ltd. (AHEL) will demerge its:

- Omnichannel pharmacy distribution network

- Apollo 24/7 digital health platform

- Telehealth and remote care services

- Keimed, Apollo’s wholesale pharma distribution arm

- Offline retail pharmacy operations

These will all come under a new company—Apollo Healthtech.

This freshly carved-out entity will combine the digital and retail capabilities of Apollo under one roof, creating an end-to-end consumer healthcare company with both online and offline reach.

🔹 Shareholding & Control

Apollo Healthtech will become an Indian Owned and Controlled Company (IOCC) and will be listed independently on Indian stock exchanges. However, AHEL will continue to hold a 15% strategic stake in the new company. This ensures operational continuity, branding synergy, and alignment with the broader Apollo ecosystem.

🔹 Consolidation of Front-End Pharmacy

Another important layer in the demerger is ownership consolidation. Apollo Healthtech will acquire the remaining 74.5% stake in Apollo Medicals (AMPL), which in turn fully owns Apollo Pharmacies Ltd (APL). This move eliminates cross-holdings and integrates the entire pharmacy value chain under the new structure.

Through this, the Apollo Hospitals demerger goes beyond separation—it’s a full restructuring aimed at efficiency, clarity, and future scalability.

Demerger Ratio & Shareholder Benefits

For investors tracking the Apollo Hospitals demerger, one of the most crucial elements is the share entitlement ratio. This ratio determines how existing shareholders will benefit from the newly created entity, Apollo Healthtech.

🔹 Demerger Ratio Explained

As per the official scheme, shareholders of Apollo Hospitals Enterprise Ltd. (AHEL) will receive:

195.2 shares of Apollo Healthtech for every 100 shares held in AHEL

This means that for every 100 shares you currently hold in Apollo Hospitals, you will be entitled to nearly double that in the new digital-pharmacy company. The specific number—195.2—was carefully calculated to reflect the estimated value and earnings potential of Apollo Healthtech.

🔹 What Does This Mean for Shareholders?

The intent behind this ratio is simple: to directly involve current shareholders in the growth journey of Apollo Healthtech. Rather than keep the value locked within AHEL, the demerger lets shareholders own pieces of two distinct businesses:

- AHEL, focused on hospital and clinical operations

- Apollo Healthtech, a fast-scaling consumer health and digital platform

By owning shares in both, investors gain diversified exposure within the same healthcare brand family.

🔹 Value Creation at Work

This structure is a textbook example of how a well-executed demerger can unlock value. Post listing, the market will assign independent valuations to Apollo Healthtech based on its revenue growth, margin profile, and addressable market.

In other words, the Apollo Hospitals demerger offers shareholders a front-row seat to two separate value creation journeys—each aligned with different growth drivers and investor profiles.

Revenue Breakdown Before and After Demerger

To understand the full impact of the Apollo Hospitals demerger, it’s essential to examine how the company’s revenue is currently distributed—and how this will change once Apollo Healthtech is listed as a separate entity.

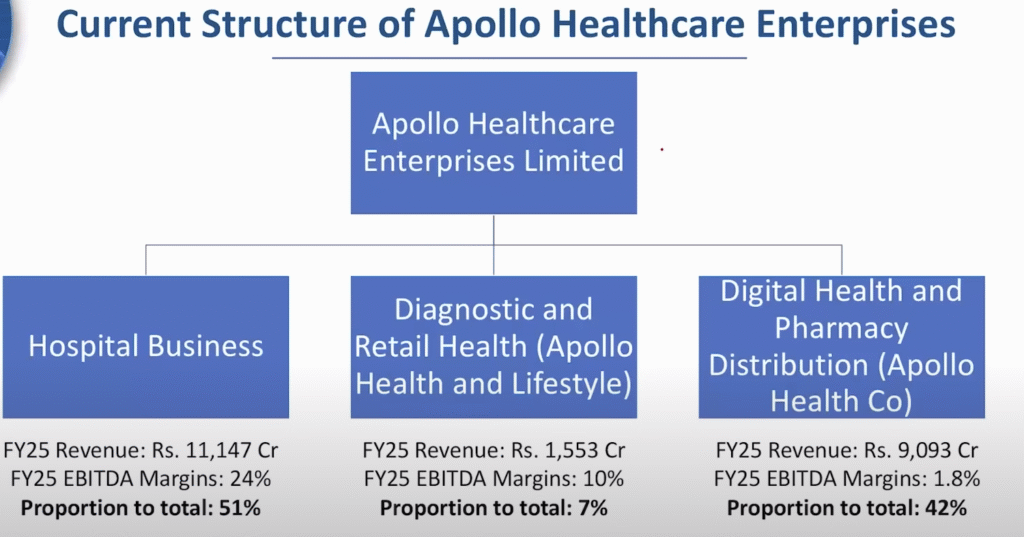

According to Apollo’s FY25 financials and investor presentations, the company reported a consolidated revenue of ₹21,790 crore. This revenue spans three main segments:

| Business Segment | FY25 Revenue (₹ crore) | % of Total Revenue | Post-Demerger Entity |

|---|---|---|---|

| Healthcare Services (Hospitals) | ~11,000 | ~51% | Apollo Hospitals |

| Apollo HealthCo (Pharmacy & Digital) | ~9,093 | ~42% | Apollo Healthtech |

| Apollo Health & Lifestyle Ltd (AHLL) | ~1,554 | ~7% | Apollo Healthtech |

| Total Revenue (Consolidated) | 21,647 | 100% | — |

Source: Apollo Hospitals Q4 FY25 investor presentation and media statements (as of July 2025)

What Changes After the Demerger?

Post-demerger, the pharmacy distribution, Apollo 24/7 digital platform, and diagnostic/lifestyle businesses will all operate under Apollo Healthtech. This new entity is projected to clock ₹16,300 crore in revenue for FY25, according to management commentary and filings. Furthermore, the company is targeting ₹25,000 crore by FY27, implying a growth rate of around 24% CAGR over the next two years.

This means nearly half of Apollo’s current consolidated revenue will now be reflected under a new listed company.

Why This Matters to Investors

This revenue clarity is one of the most compelling aspects of the Apollo Hospitals demerger. It gives investors a clearer view of where value lies—and allows them to make focused investment decisions based on growth preference:

- Apollo Hospitals will focus on core healthcare delivery through hospitals and clinical care

- Apollo Healthtech will scale as a consumer-first, digital-native health platform with faster growth and lower capital intensity

Together, these two arms create a dual-engine structure—each with distinct revenue models, risks, and potential.

Financial Highlights and Growth Potential

The real strength behind the Apollo Hospitals demerger lies in the company’s solid financial foundation and the robust future outlook of both business arms. Apollo has consistently demonstrated strong growth across revenue, profit, and return ratios—giving confidence to investors about the timing and sustainability of this strategic split.

Strong Q4 and FY25 Performance

In the March 2025 quarter, Apollo Hospitals reported:

- Revenue: ₹55.9 billion, up 13% YoY

- Net Profit: ₹3.9 billion, up 54% YoY

This surge in profitability was driven by healthy growth across hospital operations and improving efficiencies in the digital and pharmacy segments. Inpatient volumes rose by 4% YoY, despite headwinds from regulatory shifts affecting international patient inflows.

For the full year FY25, Apollo delivered:

- Revenue: ₹217.9 billion, up 14% YoY

- Net Profit: ₹14.5 billion, up 61% YoY

These numbers show not only growth, but operating leverage at work—an important signal for investors evaluating the post-Apollo Hospitals demerger entities.

Five-Year Financial Snapshot

| Metric | FY20 | FY21 | FY22 | FY23 | FY24 |

|---|---|---|---|---|---|

| Revenue (₹ million) | 112,468 | 105,600 | 146,626 | 166,125 | 190,592 |

| Revenue Growth (%) | 16.9 | -6.1 | 38.9 | 13.3 | 14.7 |

| Net Profit (₹ million) | 4,349 | 1,360 | 11,011 | 8,875 | 9,170 |

| Net Profit Margin (%) | 3.9 | 1.3 | 7.5 | 5.3 | 4.8 |

| ROE (%) | 13.0 | 3.0 | 19.6 | 14.5 | 13.6 |

| ROCE (%) | 19.3 | 9.5 | 24.3 | 18.9 | 20.1 |

Apollo’s five-year revenue CAGR stands at 14.7%, while net profit CAGR clocks in at a stellar 35.7%. This track record reflects operational maturity and capital discipline.

Growth Potential of Apollo Healthtech

Post demerger, the new entity—Apollo Healthtech—is expected to drive even faster growth.

- FY25 Projected Revenue: ₹163 billion

- FY27 Revenue Target: ₹250 billion

According to Shobana Kamineni, Executive Chairperson of Apollo HealthCo, the new platform aims to serve over 100 million Indians, covering 19,000+ pin codes through a network of 7,000+ physical stores and a robust online platform. The backend will be powered by Keimed, ensuring efficient supply chain integration.

This focused business model, separate from hospital operations, allows Apollo Healthtech to scale rapidly in a booming consumer health market.

Investment Plan & Sector Outlook

With the Apollo Hospitals demerger now in motion, both entities—Apollo Hospitals and Apollo Healthtech—are setting ambitious plans for the future. The timing couldn’t be better, as India’s healthcare sector is undergoing rapid transformation, driven by demographic shifts, rising incomes, digital adoption, and increased private equity interest.

Apollo’s Rs 80 Billion Investment Plan

Apollo Hospitals has laid out a capital expenditure plan of ₹80 billion over the next five years. A large portion of this will go toward:

- Adding 4,300+ new hospital beds

- Upgrading clinical infrastructure

- Expanding into Tier 2 and Tier 3 cities

- Enhancing digital integrations and diagnostics

This investment aims to solidify Apollo’s leadership in hospital care while enabling Apollo Healthtech to scale independently with a strong foundation.

Sector Outlook: India’s Healthcare Boom

India’s healthcare and pharma sector is not just expanding—it’s attracting serious capital. Between 2022 and 2024, the industry witnessed:

- 594 M&A and Private Equity (PE) deals

- Deal value exceeding US$ 30 billion

- A marked preference for hospital chains and consumer health platforms as investment destinations

According to a report by Grant Thornton Bharat and the Association of Healthcare Providers of India (AHPI), this trend is expected to accelerate, especially in digital and tech-enabled healthcare—exactly where Apollo Healthtech is headed post demerger.

Why the Timing is Right

The Apollo Hospitals demerger aligns perfectly with three major macro trends:

- Growing healthcare demand driven by an aging population and lifestyle diseases

- Rising preference for digital-first care, including app consultations and e-pharmacies

- Increased investor appetite for focused, scalable healthcare plays with strong execution

Apollo’s move to separate and list its consumer-facing unit gives both entities the freedom to raise capital, form partnerships, and innovate in their respective lanes.

For long-term investors, this split could mean greater visibility, faster decision-making, and more targeted growth opportunities.

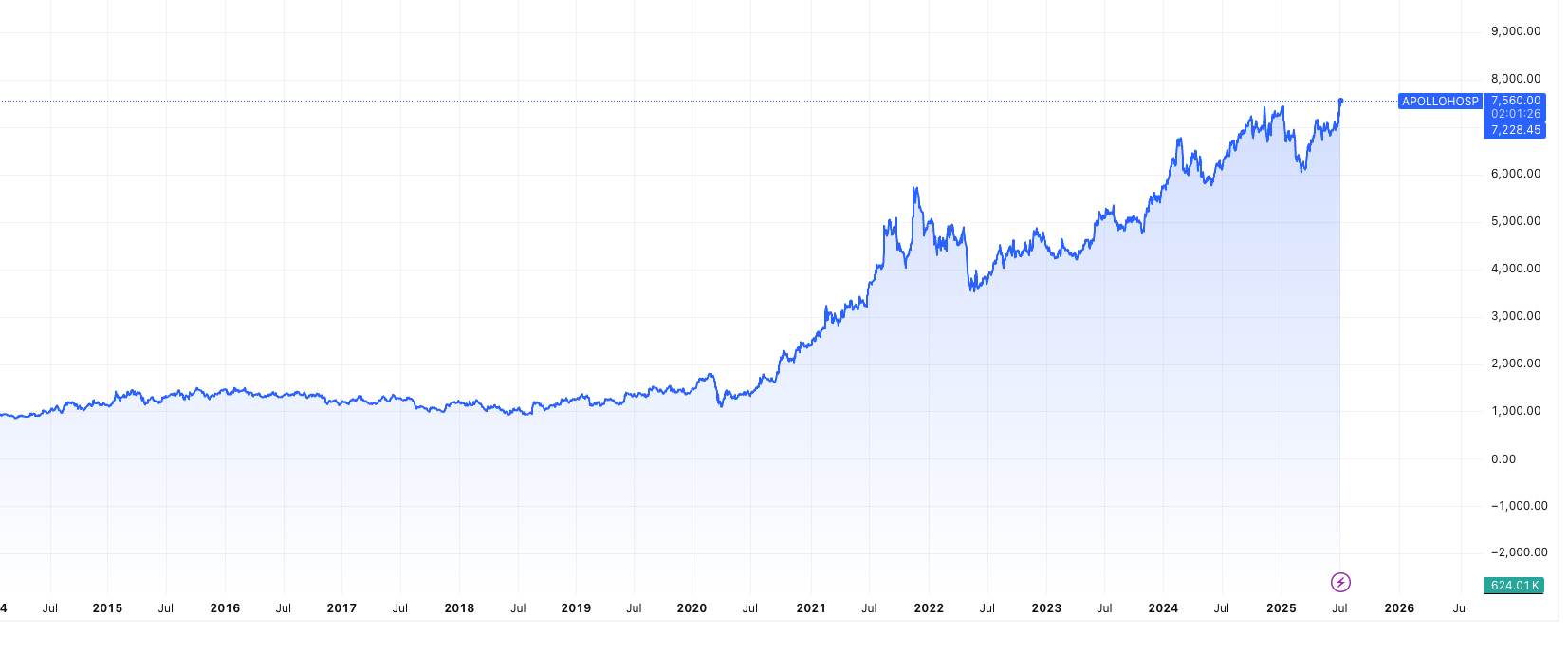

Apollo Hospitals Share Price Performance

The announcement of the Apollo Hospitals demerger has clearly caught the market’s attention.

In just one month, Apollo’s stock rose 7.7%, hitting a 52-week high of ₹7,583 on 1 July 2025, the day the demerger was approved. This marks a strong recovery from its 52-week low of ₹6,002.2 in February.

Over the past year, the stock has delivered a solid 22% return, backed by consistent earnings and expansion plans.

With Apollo Healthtech set to list as a separate entity, analysts expect a re-rating of both the hospital and digital verticals. For shareholders, the Apollo Hospitals demerger could mean direct exposure to two focused, high-potential businesses—each with its own growth trajectory.

Conclusion: What the Apollo Hospitals Demerger Means for Investors

The Apollo Hospitals demerger is more than just corporate restructuring—it’s a bold shift toward building two focused, future-ready healthcare giants.

On one hand, Apollo Hospitals will double down on clinical care, hospital expansion, and medical excellence. On the other, Apollo Healthtech will emerge as a tech-enabled, omnichannel consumer healthcare leader with vast growth potential.

For investors, this means greater transparency, targeted strategies, and the ability to tap into two different growth engines—each with its own risk-reward profile.

This move comes at a time when India’s healthcare sector is booming. With rising demand for quality care, expanding digital adoption, and strong private equity interest, both entities are well-positioned to thrive.

As always, while the demerger offers exciting possibilities, investors should evaluate fundamentals, governance, and valuations before making any investment decisions.

The Apollo Hospitals demerger signals the arrival of a new healthcare era—more focused, more scalable, and more value-driven than ever before.

Frequently Asked Questions (FAQs)

1. What is the Apollo Hospitals demerger about?

The Apollo Hospitals demerger refers to the separation of its pharmacy distribution and digital health businesses into a new listed entity called Apollo Healthtech. This strategic move aims to create focused platforms for both clinical care and consumer healthcare.

2. What will Apollo Healthtech include?

Apollo Healthtech will house the following businesses:

- Apollo 24/7 (digital health platform)

- Retail pharmacy chain

- Wholesale pharma distribution via Keimed

- Telehealth and remote care services

3. What is the share entitlement ratio in the demerger?

Shareholders of Apollo Hospitals Enterprise Ltd (AHEL) will receive 195.2 shares of Apollo Healthtech for every 100 shares held in AHEL.

4. Will Apollo Healthtech be listed on stock exchanges?

Yes. Apollo Healthtech will be listed on both the NSE and BSE, subject to regulatory and shareholder approvals. The listing is expected to be completed within 18–21 months.

5. Why is Apollo Hospitals doing this demerger?

The primary objective is to unlock shareholder value, improve operational focus, and allow each business to grow independently. The hospital business and digital health verticals have different growth dynamics and require distinct strategies.

6. What will happen to my Apollo Hospitals shares after the demerger?

You will continue to hold your existing Apollo Hospitals shares. In addition, you will receive shares in Apollo Healthtech as per the declared ratio, giving you ownership in both companies.

7. Will Apollo Hospitals retain any stake in the new entity?

Yes, AHEL will retain a 15% stake in Apollo Healthtech to ensure strategic alignment and continuity across the broader Apollo ecosystem.

8. How has the stock reacted to the demerger news?

Following the announcement, Apollo Hospitals’ stock touched a 52-week high of ₹7,583 and gained 7.7% over the past month, indicating strong market support for the demerger strategy.

9. Is Apollo Healthtech profitable on its own?

While exact standalone profitability isn’t disclosed yet, Apollo Healthtech’s segments have shown strong revenue growth and are projected to generate ₹163 billion in FY25, with plans to reach ₹250 billion by FY27.

10. Is this demerger beneficial for long-term investors?

Yes, if executed well, the Apollo Hospitals demerger offers investors clearer visibility, diversified exposure, and access to two high-potential healthcare businesses. However, like all investments, it requires careful evaluation of each entity’s fundamentals.

Related Articles

India’s $100 Billion Silicon Bet: The Semiconductor Investment Opportunity No One Should Ignore

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh

Rare Earth Magnet Manufacturing Stocks: Catch These Before India’s ₹1,000 Cr Push Lifts Off