Introduction

The Anantam Highways Trust IPO, also known as the Anantam Highways IPO, marks a significant entry in India’s booming infrastructure investment landscape. Structured as an Infrastructure Investment Trust (InvIT), the issue aims to channel investor capital into operational and revenue-generating highway assets across India.

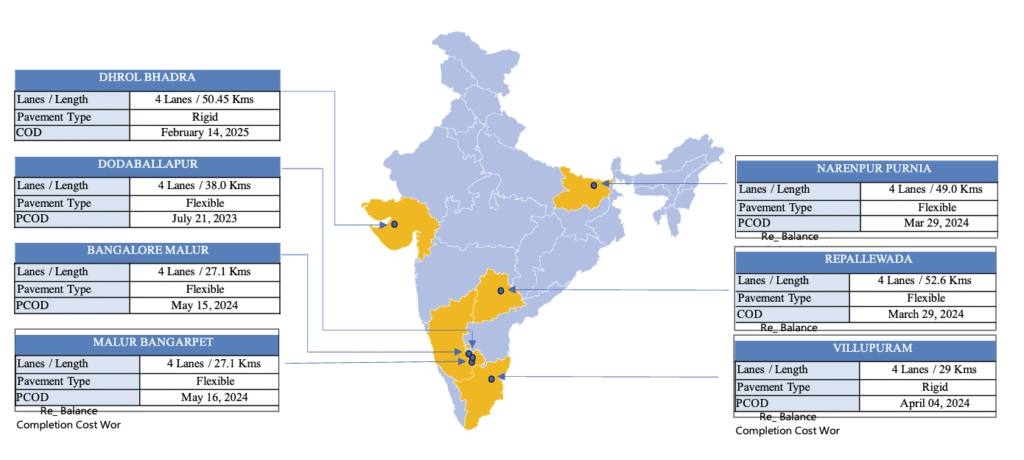

Backed by Alpha Alternatives Fund Advisors LLP, a leading multi-asset strategy investment firm, the trust manages a diversified portfolio of seven highway projects spanning 271.65 km (1,086.60 lane km) across five Indian states and one union territory. With India’s focus on infrastructure expansion through government-backed hybrid annuity models (HAM), this IPO presents investors with an opportunity to participate in stable, long-term returns from road infrastructure assets.

Anantam Highways Trust IPO Overview

Anantam Highways Trust IPO Details

| Particulars | Details |

|---|---|

| IPO Name | Anantam Highways Trust IPO |

| IPO Type | Book-Build InvIT |

| Issue Size | ₹400.00 crore (4.00 crore shares) |

| Issue Type | Fresh Issue |

| Price Band | ₹98 – ₹100 per share |

| Lot Size | Not disclosed |

| Listing At | NSE, BSE |

| Lead Manager | Nuvama Wealth Management Ltd. |

| Registrar | KFin Technologies Ltd. |

| Issue Structure | QIBs – up to 75%, NIIs – at least 25% |

| IPO Documents | DRHP/RHP |

Important Dates – Anantam Highways IPO Schedule

| Event | Date |

|---|---|

| IPO Open Date | October 7, 2025 |

| IPO Close Date | October 9, 2025 |

| Allotment Date (Tentative) | October 14, 2025 |

| Refund Initiation | October 16, 2025 |

| Credit of Shares to Demat | October 16, 2025 |

| Listing Date (Tentative) | October 17, 2025 |

| UPI Mandate Cut-off Time | 5 PM, October 9, 2025 |

Objects of the Issue – Purpose of Anantam Highways Trust IPO

The Anantam Highways InvIT IPO aims to utilize its net proceeds toward the following objectives:

| Objects of the Issue | Expected Amount (₹ in crores) |

|---|---|

| Providing loans to Project SPVs for repayment or prepayment of debt, including accrued interest | ₹376.00 Cr |

| General corporate purposes | Balance amount |

The major focus of the issue is debt reduction and strengthening the financial structure of its road projects, which will enhance cash flow stability and reduce interest burden on SPVs.

Company Background – About Anantam Highways Trust

The Anantam Highways Trust is an Indian Infrastructure Investment Trust (InvIT), registered with SEBI on August 19, 2024, and established by Alpha Alternatives Fund Advisors LLP on July 24, 2024. The trust focuses primarily on road infrastructure assets through Public-Private Partnership (PPP) projects under the Hybrid Annuity Model (HAM) — a mechanism balancing government and private sector participation to ensure steady annuity-based income.

Portfolio & Reach

The trust’s portfolio consists of seven operational highway projects across Karnataka, Telangana, Gujarat, Bihar, Tamil Nadu, and Puducherry, totaling 271.65 km (1,086.60 lane km). These projects are all under the National Highways Authority of India (NHAI) and include:

- Dhrol Bhadra Highways Ltd. (DBHL) – Gujarat

- Dodaballapur Hoskote Highways Ltd. (DHHL) – Karnataka

- Repallewada Highways Ltd. (RHL) – Telangana

- Viluppuram Highways Ltd. (VHL) – Tamil Nadu & Puducherry

- Narenpur Purnea Highways Ltd. (NPHL) – Bihar

- Bangalore Malur Highways Ltd. (BMHL) – Karnataka

- Malur Bangarpet Highways Ltd. (MBHL) – Karnataka

Business Model

Anantam Highways Trust’s revenue is derived from annuity payments under the HAM model, ensuring stable, inflation-linked cash flows regardless of traffic volume. This model minimizes operational risks while maintaining long-term revenue visibility.

Sponsor & Management

The sponsor, Alpha Alternatives, brings strong financial backing and a diversified asset management experience across infrastructure, real estate, and credit. Supported by Dilip Buildcon Limited as project manager and investment manager, the trust benefits from deep industry expertise and operational efficiency.

Sector Outlook

India’s infrastructure sector is poised for sustained growth, driven by the National Infrastructure Pipeline (NIP) and the government’s commitment to expanding highways through NHAI. With strong policy support and demand for improved connectivity, Anantam Highways Trust IPO stands well-positioned to capture growth opportunities in the sector.

Anantam Highways Trust IPO Financials – Revenue, Profit & Growth Trends

The Anantam Highways Trust IPO reflects an evolving financial trajectory as the InvIT transitions from acquisition and integration phases toward stable operations. Despite a 63% decline in total income in FY25, profitability surged 357% YoY, indicating strong operational leverage and efficient cost management post-consolidation of project SPVs.

| Particulars | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Total Assets (₹ Cr) | 4,241.89 | 4,151.92 | 3,530.23 | 2,425.48 |

| Total Income (₹ Cr) | 212.28 | 942.36 | 2,527.05 | 2,591.87 |

| Profit After Tax (₹ Cr) | 67.86 | 410.62 | -160.05 | -178.48 |

Key Financial Insights:

- FY25 revenue dipped as the InvIT restructured its project debt and transitioned annuity payments.

- PAT turned positive, rising sharply from a loss of ₹160 Cr in FY24 to a profit of ₹410 Cr in FY25 — a significant turnaround.

- Total assets grew consistently from ₹2,425 Cr in FY23 to ₹4,151 Cr in FY25, reflecting expanding infrastructure ownership.

- Improved margins and a lower debt burden signal strong financial efficiency moving forward.

Key Performance Indicators (KPIs) & Highlights

The operational data of Anantam Highways InvIT underscores stable annuity income and strong project-level efficiency, despite restructuring and one-time financial adjustments.

| Particulars | Period Ended June 30, 2025 | Year Ended Mar 31, 2025 | Year Ended Mar 31, 2024 | Year Ended Mar 31, 2023 |

|---|---|---|---|---|

| Revenue from Operations (₹ Mn) | 2,020.36 | 9,265.46 | 25,256.92 | 25,902.24 |

| Other Income (₹ Mn) | 102.48 | 158.18 | 13.53 | 16.46 |

| Total Income (₹ Mn) | 2,122.83 | 9,423.64 | 25,270.45 | 25,918.69 |

| Finance Costs (% of Total Income) | 32.59% | 32.56% | 8.98% | 5.52% |

| Profit / (Loss) for the Year (₹ Mn) | 678.64 | 4,106.23 | -1,600.50 | -1,784.82 |

| Total Comprehensive Income (₹ Mn) | 679.44 | 4,173.00 | -1,536.10 | -1,786.46 |

Performance Highlights:

- Operating Margins: Over 40% in FY25, driven by annuity-based revenue under the HAM model.

- Finance Cost Efficiency: Stable at ~32% of total income, with strong debt management discipline.

- Turnaround Performance: From consistent losses to robust profitability — a sign of maturing operational stability.

- Predictable Cash Flows: Due to fixed annuity income structure from NHAI contracts, ensuring minimal traffic-related risk.

Anantam Highways Trust IPO Valuation & Peer Comparison

With a price band of ₹98–₹100, the Anantam Highways Trust IPO values the InvIT at a modest premium to comparable listed infrastructure trusts. Its balance sheet strength, annuity-based revenue model, and improving profitability justify the valuation range.

| Particulars | NAV per Unit (₹) | Premium / (Discount to NAV) % |

|---|---|---|

| Anantam Highways Trust | — (To be updated post listing) | — |

| Capital Infra Trust (formerly National Infra Trust) | 82.26 | (6.67)% |

| Indus Infra Trust (formerly Bharat Highways InvIT) | 115.81 | (3.63)% |

- The Anantam Highways IPO is priced close to peers, though its improving profitability offers long-term upside potential.

- Given India’s strong infrastructure outlook and the InvIT’s stable annuity streams, valuations appear fair to moderately attractive for income-seeking investors.

Anantam Highways Trust IPO Strengths & Weaknesses / Risks

| Strengths | Weaknesses / Risks |

|---|---|

| Strong Sponsor Support: Backed by Alpha Alternatives and Dilip Buildcon, providing financial and operational strength. | Revenue Concentration: High dependence on NHAI annuity payments may limit diversification. |

| Predictable Cash Flows: HAM-based annuity payments ensure steady, inflation-linked revenues. | Interest Rate Sensitivity: Rising borrowing costs could affect future profitability. |

| Diversified Portfolio: Seven projects across six regions minimize geographic concentration risk. | Regulatory Dependence: Subject to SEBI InvIT regulations and NHAI contract renewals. |

| Operational Efficiency: Improved PAT and reduced losses indicate financial discipline. | Limited Market Liquidity: InvIT units often trade at lower volumes compared to equities. |

| Sectoral Tailwinds: Government push through NIP and Bharatmala ensures sustained project flow. | Macroeconomic Risks: Inflation and fiscal tightening could impact valuations. |

The Anantam Highways Trust IPO offers a balanced risk-reward profile — steady income visibility from operational assets, professional management, and long-term sectoral growth, albeit with regulatory and annuity concentration risks.

Anantam Highways Trust IPO GMP (Grey Market Premium)

As of the latest data, Anantam Highways Trust IPO GMP has not yet started in the grey market.

Typically, GMP activity for Infrastructure Investment Trusts (InvITs) begins closer to the listing date, after institutional and retail demand trends become clear.

| Date | IPO Price (₹) | GMP (₹) | Estimated Listing Price (₹) | Remark |

|---|---|---|---|---|

| 06-Oct-2025 | 98-100 | — | — | GMP yet to start |

Note: Investors should not base their application decisions purely on grey market trends, especially for InvITs where yield potential and asset stability often play a larger role than listing gains.

Conclusion & Outlook

The Anantam Highways Trust IPO represents an interesting opportunity in India’s fast-expanding infrastructure financing space.

Despite a 63% drop in revenue, the Trust delivered a 357% surge in profit, indicating improved operational efficiency and cost optimization. The asset base continues to grow steadily, signaling long-term sustainability.

Outlook:

- Short-Term: Stable, given strong backing and predictable cash flows.

- Medium to Long-Term: Positive, if traffic growth and toll collections remain consistent across key highway assets.

While the absence of GMP signals cautious early sentiment, long-term investors seeking steady yield and exposure to road infrastructure may find this InvIT appealing.

Retail investors, however, should analyze the distribution policy and NAV movement before applying.

FAQs – Anantam Highways Trust IPO

Q1. What is the Anantam Highways Trust IPO?

A1. It’s an Infrastructure Investment Trust (InvIT) focusing on operational highway assets under India’s national road network.

Q2. Who is the sponsor of the Anantam Highways Trust?

A2. The Trust is sponsored by leading infrastructure developers managing multiple road projects under NHAI concessions.

Q3. What is the IPO issue size?

A3. The final issue size will be 400 cr.

Q4. What are the IPO opening and closing dates?

A4. Tentatively scheduled for 7 October To 9 October.

Q5. What is the price band of Anantam Highways Trust IPO?

A5. The price band will be 98 to 100 Rupees Per Share.

Q6. What are the key financial highlights of Anantam Highways Trust?

A6. Revenue fell by 63%, but PAT grew by 357% YoY in FY25, reflecting strong margin recovery.

Q7. How does Anantam Highways Trust compare to peers?

A7. Its NAV performance is comparable to industry players like Indus Infra Trust and Capital Infra Trust, trading near NAV parity.

Q8. What are the key strengths of this InvIT?

A8. Strong sponsor backing, predictable revenue from toll/annuity assets, and stable long-term yields.

Q9. What are the major risks?

A9. Traffic slowdown, interest rate hikes, or policy shifts in highway monetization can affect returns.

Q10. Should investors apply for Anantam Highways Trust IPO?

A10. It suits long-term, yield-focused investors looking for stable infrastructure income rather than short-term listing gains.

Related Articles

Top 5 REITs to Invest in India 2025 – Your Guide to Smart Investing

SEBI’s New Rules for REITs and InvITs: Impact on Investors

Why Most SEBI Regulations Help Big Players, Not Retail Investors

More Articles

One Demat, Multiple Benefits: Power of a Single Demat Account

One Demat vs Multiple Demat – Which is Better for IPO Allotment?