Introduction

Back in the early 1990s, when Indian markets were just opening up and investors were still learning the ropes, a new name quietly entered the financial services space — Anand Rathi. Over the next three decades, the brand grew into a trusted powerhouse in broking, wealth management, and financial product distribution.

Now, in 2025, that same legacy is taking center stage on Dalal Street with the Anand Rathi Share IPO, one of the most anticipated offerings in the financial services sector this year. With a ₹745 crore issue size, this IPO isn’t just about raising capital — it’s about cementing Anand Rathi Share & Stock Brokers’ position as a leading full-service brokerage with a strong digital presence and nationwide reach.

The company’s track record is impressive: double-digit growth in revenue and profits, over 1,100 authorized agents spread across 290 cities, and a clientele that stretches from Tier 1 metros to Tier 3 towns. Backed by experienced promoters and a legacy of more than three decades, the Anand Rathi IPO has already caught the attention of retail investors, HNIs, and institutional players alike.

In this blog, we’ll take a deep dive into the Anand Rathi Share IPO — covering its details, financials, valuations, strengths, risks, and of course, the much-discussed grey market premium (GMP). Whether you’re planning for listing gains or long-term investment, this review will help you make an informed decision.

Anand Rathi Share IPO Overview

Anand Rathi Share IPO Snapshot

| Particulars | Details |

|---|---|

| IPO Name | Anand Rathi Share & Stock Brokers IPO |

| IPO Type | Book-Building IPO |

| Issue Size | ₹745.00 Cr (Fresh Issue: 1.80 Cr shares) |

| Price Band | ₹393 – ₹414 per share |

| Face Value | ₹5 per share |

| Lot Size | 36 shares |

| Minimum Investment (Retail) | ₹14,904 (at upper price band) |

| Total Shares Offered | 1,79,95,169 |

| Issue Structure | 100% Fresh Issue |

| Employee Discount | ₹25 per share |

| Listing | BSE, NSE |

| Pre-Issue Shareholding | 4,47,14,558 shares |

| Post-Issue Shareholding | 6,27,09,727 shares |

| IPO Document | RHP File |

| BRLM (Book Running Lead Manager) | Nuvama Wealth Management Ltd. |

| Registrar | MUFG Intime India Pvt. Ltd. |

The Anand Rathi Share & Stock Brokers IPO is designed to strengthen the company’s financial foundation while offering investors an entry into a trusted financial services brand.

Important Dates – Anand Rathi IPO Tentative Schedule

| Event | Date |

|---|---|

| IPO Open Date | Tuesday, Sep 23, 2025 |

| IPO Close Date | Thursday, Sep 25, 2025 |

| Allotment Date | Friday, Sep 26, 2025 |

| Refund Initiation | Monday, Sep 29, 2025 |

| Credit of Shares to Demat | Monday, Sep 29, 2025 |

| Listing Date (Tentative) | Tuesday, Sep 30, 2025 |

| Cut-off time for UPI Mandate Confirmation | 5 PM, Sep 25, 2025 |

These timelines make the Anand Rathi IPO a short-window opportunity for investors looking to participate.

Objects of the Issue – Anand Rathi Share IPO

The company proposes to utilize the net proceeds from the Anand Rathi Share IPO for the following objectives:

- Funding long-term working capital requirements – ₹550 Cr

- General corporate purposes – Balance amount

The Anand Rathi Share & Stock Brokers IPO aims to strengthen liquidity, support growth, and improve financial flexibility for the business.

Company Background – Anand Rathi Share IPO

The Anand Rathi Share IPO is being launched by Anand Rathi Share & Stock Brokers Limited (ARSSBL), one of India’s most trusted brokerage and wealth management firms. Established in 1991, the company has built a strong reputation for guiding investors through India’s capital markets with research-backed advisory and innovative trading solutions.

Legacy & Trust

Over the last three decades, Anand Rathi Share has transformed into a leading brokerage brand, catering to retail, HNI, UHNI, and institutional clients. It operates under the well-recognised ‘Anand Rathi’ brand, which is synonymous with trust and wealth creation in India.

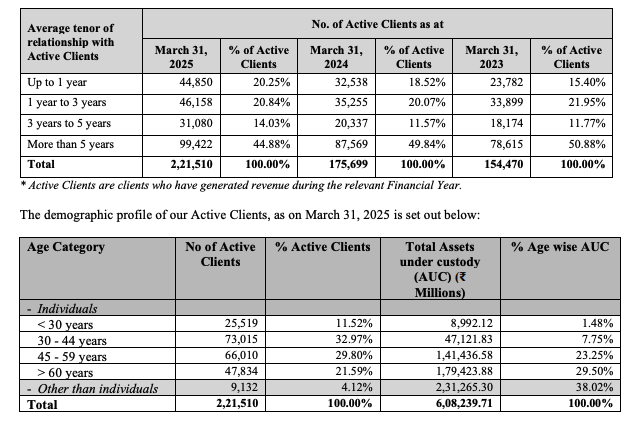

A significant highlight is its client demographics – more than 84% of active clients are above 30 years of age, and nearly 65% of revenues come from clients who have been associated for over 3 years. This demonstrates the company’s ability to build long-term relationships and ensure stable income streams.

Business Model & Services

The Anand Rathi IPO reflects the company’s diversified revenue model and wide service portfolio. Its business verticals include:

- Broking Services: Equity, commodity, currency, and derivatives.

- Margin Trading Facility (MTF): Enabling clients to leverage collateral for delivery trades.

- Distribution of Financial Products: Mutual funds, bonds, PMS, AIFs, structured products, fixed deposits.

- Value-Added Services: Algorithmic trading, securities lending and borrowing, investment baskets, IPO distribution.

- Research-Driven Advisory: In-house thematic and strategy reports guiding clients across segments.

Strong Distribution & Digital Footprint

Anand Rathi Share has built a hybrid distribution network that combines physical presence with digital scalability:

- 90 branches across 54 cities

- 1,125 authorised persons in 290 cities

- Presence across Tier 1, Tier 2, and Tier 3 cities

- Subsidiary Anand Rathi International Ventures (IFSC) Pvt. Ltd. operates from GIFT-IFSC, serving NRIs and global clients with access to international equities and bullion products.

On the digital side, it has developed proprietary platforms like:

- Trade Mobi & AR Invest: For mobile investing.

- Trade Xpress: For easy onboarding and execution.

- MF Client App: For mutual fund investments.

This seamless combination of offline advisory with digital technology strengthens customer stickiness.

Competitive Position

The Anand Rathi Share IPO stands out among peers due to its strong client base and superior revenue metrics. As per the CARE report, Anand Rathi achieved the highest Average Revenue Per Client (ARPC) in FY25 compared to similar brokerage houses.

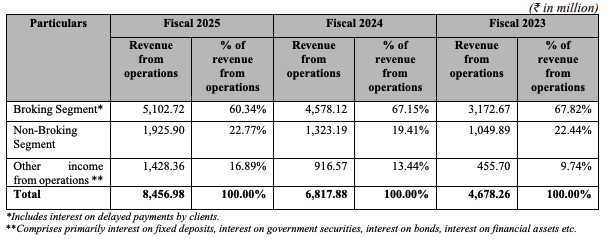

- Diversified income: In FY25, about 40% of revenue came from non-broking segments, reducing dependency on volatile trading volumes.

- High client engagement: Over 72% of clients are digitally active, using mobile/web platforms for transactions.

- Premium client mix: Higher proportion of HNIs/UHNIs vs. peers, ensuring better yields and stable brokerage.

✨ In summary, the Anand Rathi Share IPO is not just about raising funds—it’s a story of a three-decade-old brand, a deeply loyal client base, a diversified business model, and a future-ready digital ecosystem. Together, these factors give the Anand Rathi IPO a strong competitive edge in India’s fast-growing capital markets.

Financials & Key Ratios – Anand Rathi Share IPO

The financial performance of Anand Rathi Share & Stock Brokers Ltd. reflects consistent growth, strong profitability, and a scalable business model. The company has demonstrated healthy growth in both revenue and profitability in recent years.

Anand Rathi Share IPO Financials (₹ in Crore)

| Period Ended | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|

| Assets | 3,365.00 | 2,585.10 | 1,628.78 |

| Total Income | 847.00 | 683.26 | 468.70 |

| Profit After Tax (PAT) | 103.61 | 77.29 | 37.75 |

| EBITDA | 311.27 | 230.58 | 115.07 |

| Net Worth | 503.76 | 392.66 | 265.23 |

| Reserves & Surplus | 481.58 | 370.48 | 245.07 |

| Total Borrowing | 905.57 | 879.24 | 423.00 |

Between FY24 and FY25, Anand Rathi Share & Stock Brokers Ltd. delivered a 24% rise in revenue and a 34% increase in PAT. This growth is driven by higher client activity, increased contribution from non-broking verticals, and operating leverage benefits. Strong EBITDA growth highlights operational efficiency, while rising reserves point toward healthy internal accruals.

Anand Rathi Share IPO Key Ratios

| KPI | Values |

|---|---|

| ROE | 23.12% |

| ROCE | 21.32% |

| Debt/Equity | 1.80 |

| RoNW | 23.12% |

| PAT Margin | 12.23% |

| EBITDA Margin | 36.81% |

| Market Cap | ₹2596.18 Cr |

The Anand Rathi Share IPO shows strong profitability ratios with a high ROE of 23.12%, reflecting efficient capital use. The EBITDA margin of 36.81% underscores strong cost control and business scalability. While the debt-to-equity ratio at 1.80 indicates higher leverage, it is supported by a healthy return profile. Overall, the metrics highlight a well-capitalized and profit-generating business, making the Anand Rathi IPO attractive for investors seeking both growth and stability.

Valuation & Peer Comparison – Anand Rathi Share IPO

Valuation Metrics

| Metric | Pre IPO | Post IPO |

|---|---|---|

| EPS (₹) | 23.17 | 16.52 |

| P/E (x) | 17.87 | 25.06 |

| Price to Book Value (P/BV) | 4.68 | 4.68 |

Post issue, the EPS is expected to dilute from ₹23.17 to ₹16.52, pushing the P/E higher from 17.87x to 25.06x. At the upper price band of ₹414, the IPO appears slightly expensive compared to select peers, but the premium reflects the company’s strong brand, full-service brokerage model, and consistent profitability.

Peer Comparison of Anand Rathi Share IPO

| Company Name | EPS (Basic) | NAV (₹/share) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|

| Anand Rathi Share & Stock Brokers Ltd. | 23.36 | 113.57 | 25.03 | 23.12 | 4.68 |

| Motilal Oswal Financial Services Ltd. | 41.83 | 185.73 | 20.91 | 25.21 | 4.63 |

| IIFL Capital Services Ltd. | 23.06 | 80.98 | 13.49 | 33.17 | 3.69 |

| Geojit Financial Services Ltd. | 6.18 | 44.57 | 11.53 | 15.49 | 1.61 |

| Angel One Ltd. | 130.05 | 624.53 | 17.42 | 7.78 | 0.00 |

- Motilal Oswal and IIFL Capital trade at reasonable P/E multiples of 20.91x and 13.49x respectively, with strong RoNW profiles.

- Angel One has the highest EPS in the sector, but its RoNW (7.78%) is much lower than peers.

- Anand Rathi Share IPO positions itself with a strong RoNW of 23.12%, comparable to Motilal Oswal, though at a relatively higher valuation post issue.

- Overall, the IPO is priced at a premium to mid-sized players like Geojit and IIFL, justified by its brand legacy, diversified offerings, and digital push.

Strengths & Risks – Anand Rathi Share IPO

| Strengths | Risks |

|---|---|

| Established Brand Legacy – Over 30 years in the financial services industry with a trusted reputation under the Anand Rathi brand. | Market Dependency – Heavily reliant on overall stock market performance; downturns may impact revenue. |

| Diversified Offerings – Broking, margin trading, algorithmic trading, research, and distribution of multiple financial products. | Regulatory Risk – Subject to SEBI and stock exchange regulations; any changes can affect operations. |

| Pan-India Presence – 90 branches in 54 cities, 1,125 authorised persons across 290 cities, plus strong digital platforms. | High Competition – Competes with Motilal Oswal, Angel One, Zerodha, IIFL, and other well-established brokers. |

| Strong Digital Ecosystem – Proprietary mobile apps and platforms (Trade Mobi, AR Invest, MF Client, Trade Xpress) supporting seamless client onboarding & trading. | Technology Risk – Cybersecurity threats or system failures could disrupt client services and damage trust. |

| High ARPC (Average Revenue Per Client) – Highest ARPC in FY25 among peers, reflecting premium clientele and strong relationship management. | Concentration Risk – Large share of brokerage income still comes from equity cash trading; over-dependence on this segment may affect growth if volumes fall. |

| Rising Non-Broking Income – Rapid growth in distribution of mutual funds, bonds, and other products adds resilience to revenue streams. | Debt Levels – Debt/Equity at 1.80 is higher than some peers, which may put pressure on margins in rising interest rate scenarios. |

| Strong RoNW & Margins – RoNW of 23.12%, PAT Margin of 12.23%, and EBITDA Margin of 36.81%, showing strong operational efficiency. | EPS Dilution Post IPO – EPS expected to drop from ₹23.17 (pre-IPO) to ₹16.52 (post-IPO), impacting valuation attractiveness. |

The strengths highlight Anand Rathi’s legacy, diversified business model, and strong financial performance. However, the risks mainly come from regulatory pressures, competitive intensity, and dependency on market cycles. Investors must balance the company’s digital growth story against these structural risks before investing.

Grey Market Premium (GMP) – Anand Rathi Share IPO

The Anand Rathi IPO GMP has started reflecting strong investor interest in the unlisted market. GMP trends often give a glimpse of expected listing sentiment, though actual performance depends on market conditions.

Anand Rathi Share IPO GMP Today

| GMP Date | IPO Price | GMP | Sub2 Sauda Rate | Estimated Listing Price | Estimated Profit* | Last Updated |

|---|---|---|---|---|---|---|

| 19-09-2025 | ₹414.00 | ₹70 (Today’s Movement – No Change) | 1900/26600 | ₹484 (16.91%) | ₹2520 | 19-09-2025 |

💡 Analysis:

- The Anand Rathi Share IPO GMP of ₹70 indicates a ~17% premium over the issue price of ₹414.

- This reflects healthy subscription demand and positive listing expectations in the grey market.

- However, investors should note that GMP is unofficial and keeps fluctuating until the listing day.

⚠️ Disclaimer: GMP (Grey Market Premium) is an unofficial indicator and should not be the sole basis for investment decisions.

Conclusion – View on Anand Rathi Share & Stock Brokers IPO

The Anand Rathi Share & Stock Brokers IPO presents an interesting mix of legacy, scale, and growth potential. With over 30 years in the industry, the company has built strong trust among retail, HNI, and institutional clients. Its diversified business model spanning broking services, margin trading facility, and distribution of financial products provides multiple revenue streams.

Financially, the company has delivered 24% revenue growth and 34% PAT growth in FY25, showcasing robust fundamentals. Valuation-wise, while the Anand Rathi Share IPO looks slightly expensive compared to some peers, its higher ROE and strong brand recall make it a differentiated play. The grey market premium (GMP) of ₹70 further signals positive investor sentiment.

That said, competitive intensity in the broking sector, regulatory changes, and heavy reliance on equity cash segment remain key risks. Investors must weigh these factors before applying.

Short-Term Strategy

The current Anand Rathi IPO GMP suggests a potential 16–18% listing gain. Short-term investors can consider subscribing purely for listing benefits.

Long-Term Strategy

For long-term investors, the Anand Rathi Share IPO offers exposure to a full-service brokerage house with consistent earnings growth, rising digital adoption, and strong client engagement. If the company maintains its growth momentum, it could unlock higher valuations over the next 3–5 years.

Allotment Strategy

In the Anand Rathi Share IPO, allotment in the retail category is done via lottery. Applying for more than one lot from the same PAN does not improve chances. Instead, investors looking to enhance their probability of allotment can apply through multiple family or friend accounts, provided each has a valid demat and bank account.

The Anand Rathi Share & Stock Brokers IPO is not just another broking play—it’s a bet on a trusted brand with digital agility and strong fundamentals. If you’re looking for a blend of legacy and growth, this IPO could be your entry ticket into India’s evolving financial markets.

FAQs on Anand Rathi Share IPO

1. What is the Anand Rathi Share IPO issue size?

The Anand Rathi Share IPO is a fresh issue of ₹745.00 crore.

2. What are the Anand Rathi Share IPO dates?

The IPO opens on September 23, 2025, and closes on September 25, 2025.

3. What is the price band of Anand Rathi Share & Stock Brokers IPO?

The price band is fixed at ₹393 to ₹414 per share.

4. What is the minimum investment in Anand Rathi IPO?

Retail investors can apply with a minimum of 1 lot = 36 shares = ₹14,904 (upper price).

5. How many shares can retail investors apply for in Anand Rathi Share IPO?

Retail investors can apply for a maximum of 13 lots = 468 shares = ₹1,93,752.

6. When is the allotment date for Anand Rathi Share IPO?

The allotment is expected on September 26, 2025.

7. What is the Anand Rathi IPO listing date?

The tentative listing date is September 30, 2025, on BSE and NSE.

8. What is the GMP of Anand Rathi Share IPO today?

The GMP is ₹70 as of September 19, 2025.

9. Who are the lead managers of Anand Rathi Share IPO?

Nuvama Wealth Management Ltd. is the BRLM, and MUFG Intime India Pvt. Ltd. is the registrar.

10. What will the promoter holding be after Anand Rathi Share & Stock Brokers IPO?

Promoter holding will reduce from 98.06% to 69.90% post-issue.

📌 Disclaimer:

All information and data presented in this blog about Anand Rathi Share & Stock Brokers IPO has been sourced from the company’s Red Herring Prospectus (RHP), stock exchange filings, and publicly available resources. This blog is for educational and informational purposes only and should not be considered as investment advice. Investors are advised to read the RHP carefully and consult their financial advisor before making any investment decisions.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?