Introduction

The Indian stock market has been witnessing a flood of small and medium enterprise offerings this year, and one that has caught every investor’s eye is the Airfloa Rail Technology IPO. Opening for subscription from September 11, 2025 to September 15, 2025, this SME IPO has generated strong buzz in the grey market even before it hits the exchanges.

With a fresh issue size of ₹86.53 crore and a total issue size of ₹91.10 crore, the company is aiming to strengthen its balance sheet, fund expansion, and tap into the ever-growing demand for high-tech railway, aerospace, and defence components. Early GMP trends suggest the possibility of a 100% Listing Gain, which makes this IPO worth a deep dive.

In this article, we will cover every detail about the Airfloa Rail Technology IPO, including its issue structure, company background, financial health, objectives, industry outlook, competitive strengths, and what investors can expect on listing day.

Airfloa Rail Technology SME IPO Details

This is a book-built SME IPO that will be listed on BSE SME. Below are the important details every investor should know:

| Particulars | Details |

|---|---|

| IPO Opening Date | September 11, 2025 |

| IPO Closing Date | September 15, 2025 |

| Price Band | ₹133 – ₹140 per share |

| Face Value | ₹10 per share |

| Total Issue Size | ₹91.10 crore |

| Fresh Issue | ₹86.53 crore |

| Reserved for Market Maker | ₹4.56 crore |

| Tentative Listing Date | September 18, 2025 |

| IPO Listing Exchange | BSE SME |

| Lot Size | 2 lots (1000 shares each) |

| Retail Minimum Investment | ₹2,80,000 |

| RHP | Click Here |

This higher ticket size for retail participation (₹2.8 lakh minimum) is typical for SME IPOs, and it ensures that only serious investors with risk appetite enter the market.

Airfloa Rail Technology IPO Reservation

The issue has been structured carefully with balanced allocations across investor categories.

| Category | Shares Offered | % of Total |

|---|---|---|

| Market Maker | 3,26,000 | 5.01% |

| QIB | 30,87,000 | 47.44% |

| NII (HNI) | 9,30,000 | 14.29% |

| Retail | 21,64,000 | 33.26% |

| Total | 65,07,000 | 100% |

Almost one-third of the IPO is reserved for retail investors, while nearly half is earmarked for Qualified Institutional Buyers (QIBs), ensuring balanced participation.

Objectives of the Issue

The proceeds from the Airfloa Rail Technology IPO will be utilized across multiple fronts:

- Capital Expenditure – Purchase of new machinery and equipment (₹13.68 crore). This will help the company expand its manufacturing capabilities.

- Debt Repayment – Reducing borrowings (₹6 crore) to strengthen the balance sheet and improve leverage ratios.

- Working Capital – The largest chunk (₹59.27 crore) is earmarked for working capital, reflecting the company’s focus on scaling order execution.

- General Corporate Purposes – To cover other operational and expansion-related needs.

The emphasis on reducing debt while expanding production highlights a balanced approach — lowering financial risk while building future capacity.

About Airfloa Rail Technology Ltd.

Founded in 1998, Airfloa Rail Technology is not a newcomer to the Indian industrial landscape. It has been a trusted partner of Indian Railways for decades, providing critical rolling stock components and turnkey interior projects.

Business Segments

- Railways

- Manufacturing car bodies, rail interiors, and composites.

- Executed turnkey projects for Train-18 (Vande Bharat Express), Vistadome Coaches, and Agra-Kanpur Metro.

- Supplies seating, air diffusers, passenger doors, and interior panels, ensuring both functionality and passenger comfort.

- Aerospace

- Manufactures high-precision parts for projects like the AMCA ground simulator.

- Supplies components requiring high strength, accuracy, and reliability.

- Defence

- Produces artillery tank bodies and body armour components.

- Contributes to India’s defence self-reliance initiatives.

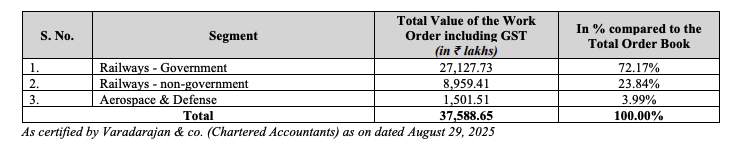

Order Book Strength

As of Aug 29, 2025, the company’s order book stood at ₹3,758.86 crore, providing strong revenue visibility for the coming years.

Certifications & Workforce

Airfloa Rail Technology is certified with ISO 9001:2015, EN 15085-2, and BMS, reflecting international quality standards. The company has 281 employees, including highly skilled engineers and technicians.

Financial Performance

The company’s financials showcase consistent growth and improving profitability.

| Particulars (₹ Cr) | FY23 | FY24 | FY25 |

|---|---|---|---|

| Revenue from Operations | 9,517.39 | 11,930.36 | 19,238.70 |

| Total Income | 9,532.90 | 12,287.22 | 19,266.26 |

| Profit Before Tax | 234.49 | 2,060.01 | 3,497.68 |

| Net Profit | 149.36 | 1,423.28 | 2,555.80 |

| EPS (₹) | 1.00 | 9.50 | 15.64 |

Highlights:

- Revenue nearly doubled in FY25 compared to FY24.

- Net profit rose from ₹149 crore in FY23 to ₹2,556 crore in FY25, a massive turnaround.

- EPS grew 15x in just two years, indicating profitability and scale.

Key Ratios (FY25):

- ROE – 30.64%

- ROCE – 26.28%

- PAT Margin – 13.28%

- EBITDA Margin – 24.61%

- Debt/Equity – 0.54

These metrics highlight operational efficiency and a strong return profile, making the stock attractive both for listing gains and long-term holding.

Grey Market Premium (GMP) & 100% Listing Gain Buzz

The Airfloa Rail Technology IPO is creating a storm in the grey market. As of September 8, 2025, the GMP was recorded at ₹150, against the upper price band of ₹140.

This means the stock is expected to list at around ₹290 per share, which translates to a 107% premium.

For investors, this points towards a strong possibility of 100% Listing Gain on the listing date, making it one of the hottest SME IPOs in 2025.

Competitive Strengths

- Diverse Business Model – Operations across railways, aerospace, and defence reduce dependency on a single sector.

- Turnkey Solutions Provider – Offers end-to-end project execution, simplifying client needs.

- Strong Order Book – Ensures revenue stability and growth visibility.

- Modern Manufacturing – Advanced machinery and high-quality production standards.

- Experienced Promoters – Deep understanding of industry trends and client demands.

Industry Outlook

The timing of the Airfloa Rail Technology IPO aligns with multiple growth drivers:

- Railways – Government of India’s continued push for modern trains, metro projects, and high-speed rail corridors.

- Aerospace – Rising investments in indigenous fighter jet programs and simulators.

- Defence – India’s increasing defence budget and Make in India push.

These trends create a long runway for companies like Airfloa, positioning them to capture upcoming opportunities.

Conclusion

The Airfloa Rail Technology IPO is more than just another SME IPO. Backed by strong fundamentals, a massive order book, and a diversified presence in three high-growth sectors, it holds significant long-term potential.

But in the short term, the Grey Market Premium (GMP) suggests that investors may enjoy a 100% Listing Gain, making this IPO a hot pick for traders and HNIs.

That said, SME IPOs are known for higher risk due to lower liquidity and stricter lot sizes. Therefore, retail investors should weigh their risk tolerance before applying.

Final Word: If the GMP trend continues, the Airfloa Rail Technology IPO could reward investors with solid 100% Listing Gain, while also holding promise as a long-term wealth creator in the railway and aerospace ecosystem.

FAQs on Airfloa Rail Technology IPO

Q1. What are the IPO dates for Airfloa Rail Technology IPO?

The IPO will open on September 11, 2025 and close on September 15, 2025. The tentative listing date is September 18, 2025 on the BSE SME exchange.

Q2. What is the price band for Airfloa Rail Technology IPO?

The price band has been set at ₹133 to ₹140 per share with a face value of ₹10.

Q3. What is the minimum investment required in this SME IPO?

Retail investors must apply for at least 2 lots (1000 shares), which equals a minimum investment of ₹2,80,000.

Q4. What is the total issue size of Airfloa Rail Technology IPO?

The IPO size is ₹91.10 crore, out of which ₹86.53 crore is a fresh issue.

Q5. Where will the shares of Airfloa Rail Technology IPO be listed?

The shares will be listed on the BSE SME platform.

Q6. What is the Grey Market Premium (GMP) of this IPO?

As of September 8, 2025, the GMP stood at ₹150, indicating a potential 100% Listing Gain.

Q7. What will be the estimated listing price of Airfloa Rail Technology IPO?

Based on the GMP, the estimated listing price is around ₹290 per share, which is more than double the issue price.

Q8. How strong is Airfloa Rail Technology’s financial performance?

The company’s revenue grew from ₹9,517 crore in FY23 to ₹19,238 crore in FY25, with net profit rising from ₹149 crore to ₹2,556 crore during the same period.

Q9. What are the key business areas of Airfloa Rail Technology?

The company operates in railways, aerospace, and defence, manufacturing rolling stock components, turnkey interiors, simulators, and artillery body parts.

Q10. Is Airfloa Rail Technology IPO good for listing gains?

Yes, given the high GMP trend, the IPO has strong potential to deliver 100% Listing Gain, though investors should also consider long-term fundamentals and risks typical of SME IPOs.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?