Market Outlook 15 October — Intro

Good morning and welcome to your Market Outlook 15 October Edition.

The second trading day of the week began with a sharp jolt for investors as the broader market cracked, extending its losing streak amid global weakness and heavy FII selling. On Tuesday, both frontline indices slipped for a second straight session — the Nifty 50 fell 108 points to close at 25,119.20, while the Sensex dropped 368 points to 81,958.98.

Sectorally, the IT index slipped nearly 0.45%, reflecting weakness in global tech cues, while Bank Nifty also lost 146 points, ending at 56,478.55. The real pain, however, was visible in the broader market — the BSE SmallCap index plunged over 1%, signaling a sharp risk-off sentiment among retail participants.

The weakness came on the back of escalating global trade tensions and sustained selling in mid- and small-cap counters. With the GIFT Nifty indicating a flat-to-negative start today, traders may brace for another volatile session.

In this Market Outlook 15 October, we’ll break down the technical view of key indices, the top market-moving news, IPO updates, and stocks that could remain in focus today.

Index Technical View — Market Outlook 15 October

After Tuesday’s decline, the Indian indices showed some weakness, but the broader trend remains technically positive according to EquityPandit analysis. In today’s Market Outlook 15 October, traders should focus on key support and resistance levels to manage positions effectively.

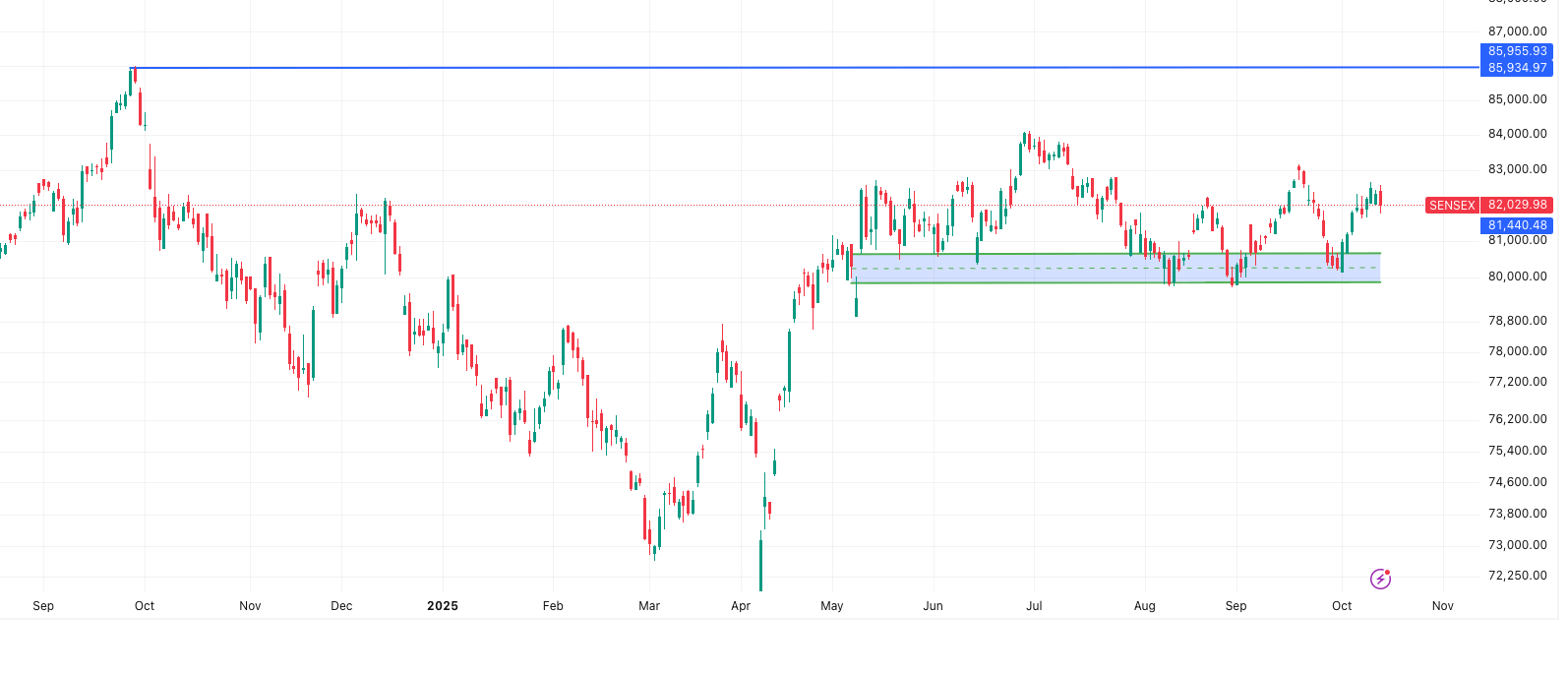

🔹 SENSEX (82,030) — Positive Bias

SENSEX has shown resilience despite broader market pressure. Traders holding long positions should continue with the daily closing stoploss at 81,758. Momentum remains tilted toward the upside, and any sustained close above 82,475 may extend gains toward the next resistance levels. However, caution is advised if SENSEX closes below 81,758, which could trigger short-term selling.

- Support: 81,683 – 81,337 – 80,892

- Resistance: 82,475 – 82,920 – 83,267

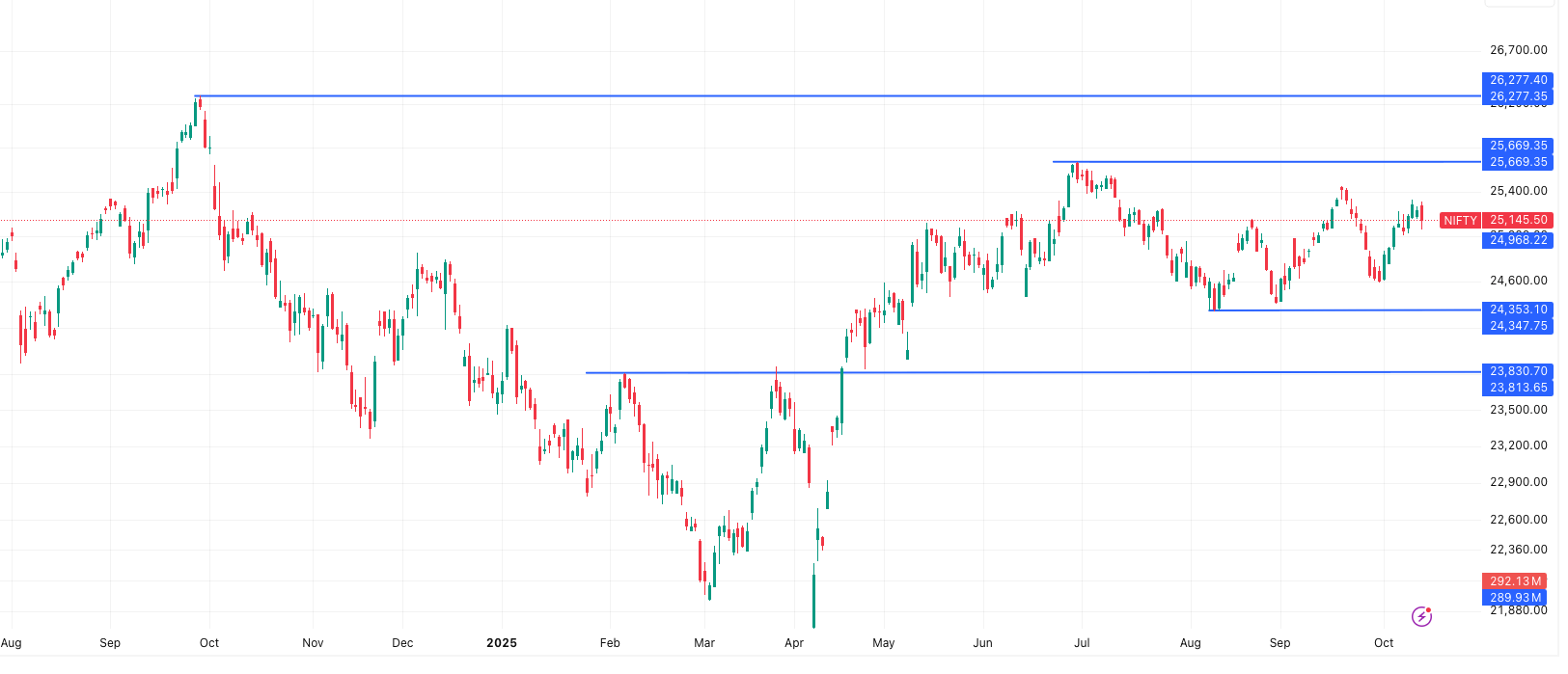

🔹 NIFTY 50 (25,146) — Positive Bias

NIFTY 50 continues to trade in a positive trend but has faced mild pressure in the last session. Long positions remain valid with a stoploss at 25,065. A move above 25,284 could provide momentum for a rally toward 25,500–25,534, while a close below 25,065 may indicate short-term weakness. Traders should monitor intraday swings and global cues closely.

- Support: 25,034 – 24,922 – 24,784

- Resistance: 25,284 – 25,422 – 25,534

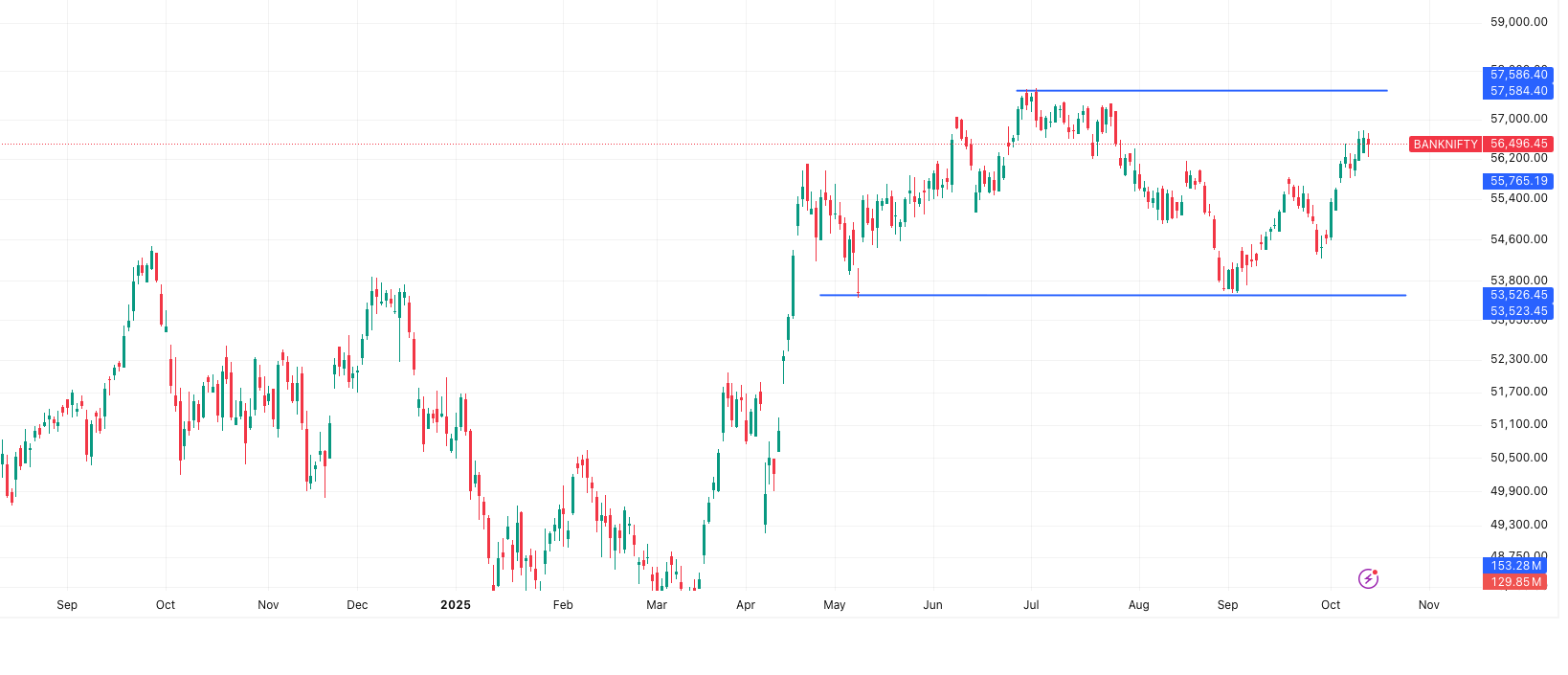

🔹 BANK NIFTY (56,496) — Mildly Positive

Bank Nifty has stayed relatively stable and maintains a positive bias. Long positions are advised above 56,061, while a break below this level could see profit booking. Sustained buying above 56,735 may help the index test higher targets around 57,200. Overall, Bank Nifty is expected to remain range-bound with opportunities for cautious upside trades.

- Support: 56,244 – 55,991 – 55,753

- Resistance: 56,735 – 56,974 – 57,226

The Market Outlook 15 October indicates a cautious approach with buying on dips preferred while keeping stoploss levels in mind due to lingering global uncertainties.

News & Stocks — Market Outlook 15 October

In today’s Market Outlook 15 October, global cues and domestic developments are shaping investor sentiment. Here’s a concise roundup of key news and stock updates to watch:

Global Market Update:

Escalating US-China trade tensions pushed investors toward safe-haven assets, with government bonds rallying worldwide. Two-year US Treasury yields fell to 3.47%, the lowest since April, while German and UK bonds also saw declines. Equities and commodities fell, with Bitcoin dropping nearly 4% and Brent crude toward $62/bbl. Analysts highlight risk aversion and expect cautious moves in US policy amid potential government shutdown and economic uncertainty.

Thyrocare Technologies Ltd:

- Declared a second interim dividend of Rs 7 per share for FY25; record date: Oct. 24.

- Announced a bonus issue of 2:1 ahead of Diwali, celebrating Silver Jubilee.

- Q2FY26 results: Revenue up 22% YoY to Rs 217 crore; net profit up 80% YoY to Rs 48 crore; margin expanded to 33%.

- Stock has gained ~39% YTD, with analysts maintaining BUY and an average target of Rs 1,517.

Google AI Investment in India:

Union Minister Ashwini Vaishnaw welcomed Google’s $15 billion AI hub in Vishakhapatnam. Key requests to Google include:

- Large-scale AI skilling and reskilling of IT professionals.

- Develop Andaman & Nicobar as a strategic global internet hub.

- Support “AI services” as a pillar of India’s digital economy, creating jobs.

This move strengthens India’s AI Mission and digital infrastructure.

Kerala Health Vision 2031:

Kerala aims for universal healthcare by 2031, expanding the ‘Karunya Arogya Suraksha Padhathi’ to cover more families. Initiatives include:

- Screening for lifestyle diseases under ‘Aardram Janakeeya’.

- Mass cancer screening campaigns.

- Epidemic intelligence system for rare infections like amoebic meningoencephalitis.

Kerala aims to become a global health hub with robust preventive and curative healthcare.

Infosys NHS Contract:

Infosys secured a £1.2 billion contract to build a workforce management platform for NHS England and Wales, replacing the Electronic Staff Record system. The 15-year project integrates AI to enhance recruitment, payroll, and career management for 1.9 million NHS employees. Infosys CEO emphasized leveraging AI and digital expertise to improve efficiency and workforce planning.

In today’s Market Outlook 15 October, investors should track these developments for potential trading and investment opportunities in healthcare, AI, and tech sectors, while staying cautious amid global market volatility.

| Stock | Sector | Key Update | Note / Outlook |

|---|---|---|---|

| Thyrocare Technologies | Healthcare / Diagnostics | Declared interim dividend Rs 7; Bonus issue 2:1; Q2 revenue +22%, profit +80% YoY | Strong fundamentals, analysts maintain BUY, target Rs 1,517 |

| Google (Indirect / AI Stocks) | Technology / AI | $15B AI hub in Vishakhapatnam; AI skilling & infrastructure push | Potential long-term growth for Indian AI ecosystem |

| Infosys | IT Services | £1.2B NHS workforce management contract; AI-powered platform | Large-scale AI/tech implementation, strengthens international IT revenues |

| Healthcare Stock | Healthcare | Policy 2031, preventive & specialty care expansion | Opportunity in healthcare services & related investments (State-led projects) |

IPO Update – Market Outlook 15 October

Mainboard IPOs

| Name | Open Date | Close Date | Listing Date | GMP / Listing Gain |

|---|---|---|---|---|

| Midwest IPO | 15-Oct | 17-Oct | 20-Oct | ₹21 (1.97%) |

| Canara HSBC Life IPO | 10-Oct | 14-Oct | 15-Oct | ₹– (0.00%) |

| Canara Robeco IPO | 9-Oct | 13-Oct | 14-Oct | ₹11 (4.14%) |

| Rubicon Research IPO | 9-Oct | 13-Oct | 14-Oct | ₹137 (28.25%) |

Analysis:

Rubicon Research IPO continues to show strong listing gains of 28.25%, making it the top performer to watch. Canara Robeco IPO has a modest listing gain of 4.14%, while Midwest IPO opens today with a small initial GMP of ₹21, signaling cautious investor sentiment. Canara HSBC Life IPO is expected to list today without significant change in price.

SME IPOs

| Name | Open Date | Close Date | Listing Date | GMP / Listing Gain |

|---|---|---|---|---|

| No active SME IPOs currently | – | – | – | – |

Stocks in Radar – Market Outlook 15 October

Elecon Engineering (EECL) – BUY

Research by: Emkay Research

CMP: Rs 552 | Target Price: Rs 750

Business Overview & Q2FY26 Performance:

Elecon Engineering reported a mixed Q2FY26 performance with revenue up 14% YoY to Rs 5.8bn, EBITDA rising 12% YoY, while PAT remained flat. EBITDA margin slightly declined by 37bps to 21.7%, impacted by an unfavorable mix in the Gear business and higher staff costs from new capacity commissioning. On a positive note, the Material Handling Equipment (MHE) segment saw strong margin expansion of 137bps YoY.

Order Inflow & Backlog:

The company’s order inflow surged 28% YoY to Rs 6.9bn, taking the order backlog to Rs 12.3bn, up 27% YoY. Strong domestic demand from Power, Steel, and Cement sectors supports the growth outlook, while exports are expected to recover gradually, especially in Europe, Middle East, Americas, Nordic countries, and Russia. Management targets increasing exports contribution to 50% by FY30.

Valuation & Outlook:

With leadership in gears, robust MHE growth, and a strong export pipeline, Elecon Engineering is well-positioned to benefit from India’s industrial and infrastructure expansion. The stock trades at ~18.4x Sep-27E P/E, offering an attractive risk-reward. Revenue and PAT are projected to grow at a CAGR of 21% and 24% respectively over FY25-28.

Financial Snapshot (FY24–FY28E):

| Metric | FY24 | FY25 | FY26E | FY27E | FY28E |

|---|---|---|---|---|---|

| Revenue (Rs mn) | 19,374 | 22,270 | 26,584 | 32,559 | 39,925 |

| EBITDA (Rs mn) | 4,745 | 5,176 | 6,848 | 8,475 | 10,430 |

| Adj. PAT (Rs mn) | 3,556 | 3,901 | 4,855 | 6,016 | 7,457 |

| Adj. EPS (Rs) | 15.8 | 17.4 | 21.6 | 26.8 | 33.2 |

| EBITDA Margin (%) | 24.5 | 23.2 | 25.8 | 26.0 | 26.1 |

| P/E (x) | 34.8 | 31.8 | 25.5 | 20.6 | 16.6 |

Key Points:

- Strong order inflow and backlog indicate robust business momentum.

- Geopolitical tensions impacted exports temporarily; recovery expected.

- Attractive valuations at current CMP with potential upside of ~36%.

Conclusion:

Elecon Engineering remains a BUY for investors looking to leverage growth in India’s industrial and infrastructure sectors, backed by strong order momentum and expansion in export markets.

Conclusion – Market Outlook 15 October

In summary, the broader markets continued to show weakness as Nifty 50, Sensex, and Bank Nifty faced a second consecutive day of correction, signaling cautious investor sentiment. While key indices remain in a positive trend technically, support levels need to be closely monitored before initiating fresh positions.

Global cues, particularly rising US-China trade tensions, drove safe-haven flows into government bonds, while equities and commodities saw selling pressure. Domestically, companies like Thyrocare Technologies and Infosys showcased strong earnings growth and strategic initiatives, highlighting opportunities in select sectors. The government and private investments in AI infrastructure, coupled with health sector reforms, indicate long-term structural growth, offering potential for stock-specific gains.

On the IPO front, mainboard offerings like Rubicon Research and Canara Robeco Life continue to attract strong investor interest, while SME IPO activity remains quiet. Investors should track listing gains (GMP) and subscription trends closely for tactical plays.

Among individual stocks, Elecon Engineering emerges as a key pick, backed by strong order inflow, healthy backlog, and robust export potential, offering attractive upside from current levels.

Overall Outlook:

While the near-term market environment remains cautious with global and domestic headwinds, selective stock picks, strategic IPOs, and structural growth stories offer opportunities for investors with a medium- to long-term perspective. Risk management via stop-losses and monitoring support/resistance levels will remain crucial for navigating market volatility.

Related Articles

Pharma Tariff Effect – 100% Tariff Creates Big Risks & Hidden Opportunities

Trump’s Tariff Shockwave: How Indian Stocks & Sectors Will Be Hit or Rise

Tariff and Great Depression: Will History Repeat?