Market Outlook 19 September

Good morning and welcome to your Market Outlook 19 September Edition.

Thursday’s trading session once again belonged to the bulls. The Nifty 50 surged 90 points to close at 25,420, while the Sensex crossed the 83,000 mark with a 331-point rally. Banking stocks stayed steady with Bank Nifty ending above 55,700, while the IT index jumped nearly 1%, turning into the star performer of the day.

Smallcaps, however, showed signs of fatigue, with the BSE SmallCap index barely managing to stay in the green after weeks of a relentless uptrend. This slight pause could hint at some profit booking in the broader market, even as frontline indices continue their march upwards.

Globally, investors found comfort as oil prices stabilized and US markets held firm, offering supportive cues to Indian equities. Meanwhile, domestic sentiment stayed upbeat with strong institutional flows and selective sector rotations keeping the market’s energy alive.

The big question for Friday’s session is whether this momentum can push Nifty into fresh record highs or if profit booking will finally catch up.

In today’s newsletter, you’ll get detailed technical levels, sectoral insights, stock-specific news, IPO highlights, and ideas to trade smarter in this dynamic market.

Index Technical View – Market Outlook 19 September

According to Equitypandit’s analysis, the Indian indices remain in a positive trend, but with key levels that traders should carefully watch as we step into Friday’s session.

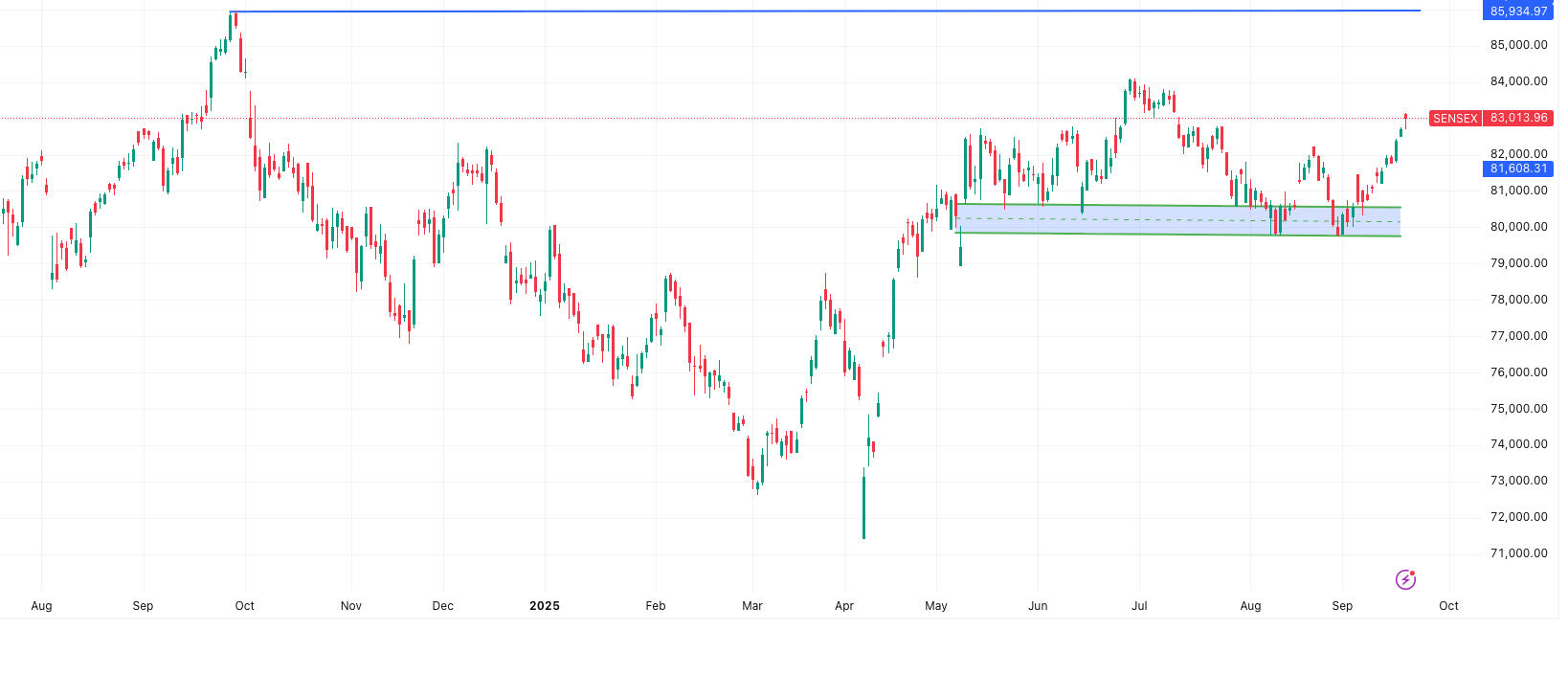

SENSEX Outlook

The Sensex closed at 83,014, continuing its bullish momentum. Equitypandit suggests that long positions can be held with a daily closing stoploss at 82,394. On the flip side, fresh short positions may only be considered if the index closes below this critical level.

- Support levels: 82,766 – 82,517 – 82,329

- Resistance levels: 83,202 – 83,390 – 83,638

The tentative trading range for the day is expected between 83,581 and 82,446.

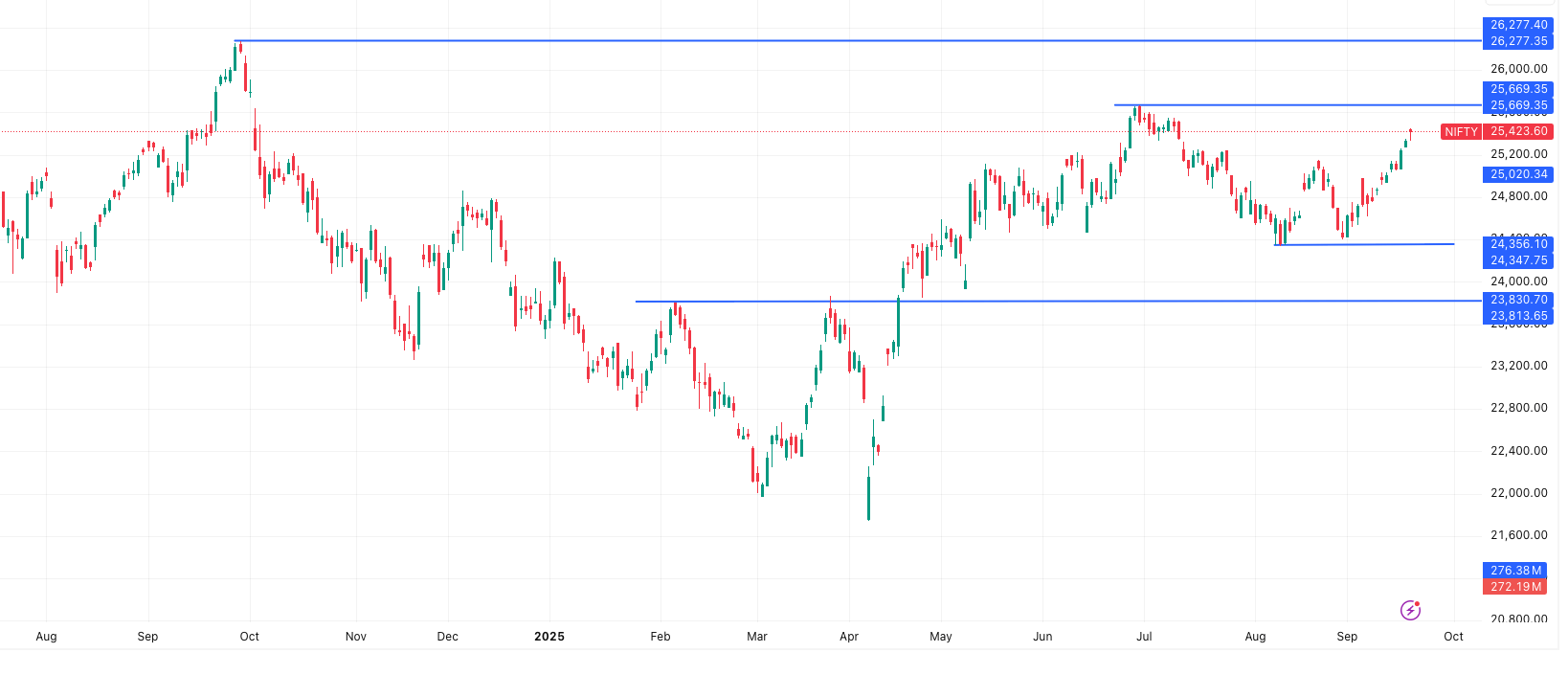

NIFTY Outlook

Nifty ended at 25,424, maintaining its strength above the 25,400 zone. Equitypandit’s analysis indicates that long trades remain safe with a stoploss at 25,232, while fresh shorts should only be activated if the index falls below this mark.

- Support levels: 25,353 – 25,282 – 25,233

- Resistance levels: 25,472 – 25,520 – 25,591

The tentative range for Nifty lies between 25,594 and 25,252.

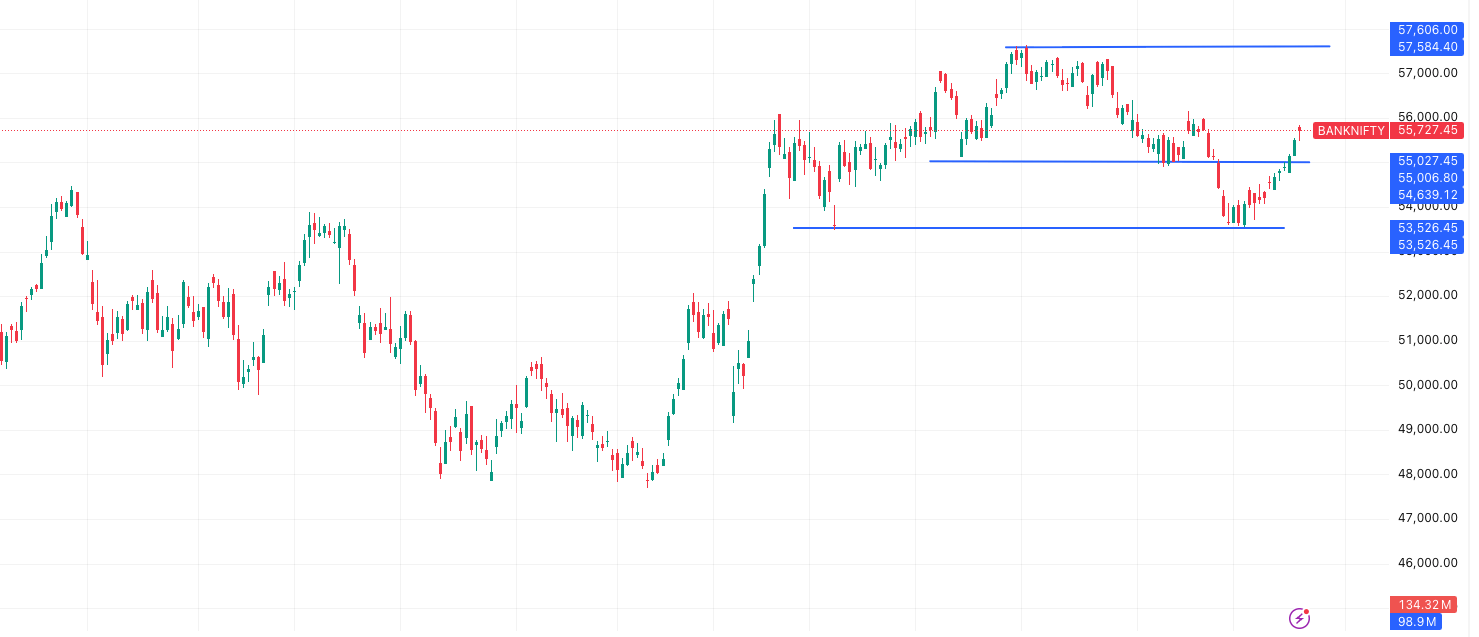

BANK NIFTY Outlook

Bank Nifty settled at 55,727, showing resilience despite some intraday volatility. Equitypandit advises holding long positions with a stoploss at 55,253, while shorts can be considered below the same.

- Support levels: 55,534 – 55,340 – 55,189

- Resistance levels: 55,878 – 56,029 – 56,223

The expected trading range is seen between 56,165 and 55,289.

Overall, the market setup for Friday points to continued bullish momentum as long as indices hold above their respective stoploss levels. A break below support zones, however, may trigger short-term profit booking.

News & Stocks – Market Outlook 19 September

Government’s ₹3.6 Lakh Crore Push for Infrastructure

The Finance Minister has announced an unprecedented ₹3.6 lakh crore interest-free assistance to 22 states under the Scheme for Special Assistance to States for Capital Investment (SASCI). This initiative is designed to accelerate infrastructure creation at the state level while encouraging reforms in land, industrial norms, and governance. Over the last decade, India’s capital investment has leapt from 1.7% of GDP in FY14 to 4.1% in FY25, powering new airports, rail tracks, and highways. This signals a sustained growth cycle in India’s infrastructure story.

Stock Impact: Infrastructure players such as L&T, KNR Construction, and IRB Infra could see improved order flows. Cement majors like Ultratech and Ambuja Cement may also benefit from higher construction demand.

WEF-BCG Report Warns of $1.5 Trillion Productivity Loss from Climate Health Risks

A joint report by the World Economic Forum (WEF) and Boston Consulting Group (BCG) has flagged a looming crisis: climate change-linked health risks could drain $1.5 trillion in productivity by 2050. Agriculture and food alone may lose $740 billion, while construction and the built environment could take a $570 billion hit. Heat stress, hazardous work conditions, and rising healthcare costs are key concerns. The report urges businesses to adopt resilient practices like climate-proof crops, cooling technologies, and stronger insurance models.

Stock Impact: Companies in green energy (Adani Green, NTPC Renewables), cooling and insulation (Blue Star, Voltas), and sustainable agri-tech (UPL, PI Industries) may gain investor focus as climate adaptation themes strengthen.

TCS Partners with Vodafone Idea to Build AI-Powered BSS Platform

Tata Consultancy Services (TCS) has struck a five-year deal with Vodafone Idea (Vi) to revamp its business support systems using AI-powered platforms like TCS HOBS™ and TCS TwinX™. The overhaul aims to deliver hyper-personalized customer experiences, greater agility, and improved integration across Vi’s digital ecosystem. For Vi, this move is a survival strategy to rebuild customer trust, while for TCS, it reinforces its dominance in telecom transformation and AI-led enterprise solutions.

Stock Impact: TCS could see incremental revenue growth from this partnership, while Vodafone Idea may witness improved sentiment if the transformation aids subscriber retention and ARPU (Average Revenue Per User) recovery

US Tariffs Hit Indian Auto Component Exports

The United States has imposed a steep 50% tariff on Indian auto component exports, impacting nearly 8% of India’s total production. This move puts Indian exporters at a clear disadvantage compared to Japan, Vietnam, and China, where tariffs remain much lower. However, Chief Economic Advisor (CEA) has hinted that the tariff standoff may be resolved within 8–10 weeks, offering hope to the sector. India exported $7.3 billion worth of auto components to the US in FY25, highlighting the importance of this market.

Stock Impact: Auto component exporters like Motherson Sumi, Bharat Forge, and Sundram Fasteners are directly exposed. A swift resolution could bring relief, but until then, near-term volatility may persist in these stocks.

SEBI Calls for Strengthening Municipal Bond Market

At an infrastructure conclave, SEBI Chairperson Tuhin Kanta Pandey underscored the potential of India’s municipal bond market while pointing out weaknesses in urban local bodies’ balance sheets. Municipal bonds have been vital for city-level projects like transport, sanitation, and water, but challenges in project readiness and governance have held them back. With green bonds, REITs, and InvITs gaining traction, SEBI aims to push municipal bonds as a credible, long-term financing channel.

Stock Impact: Financial institutions such as HDFC Bank, SBI, and PNB Housing Finance may benefit from participating in bond-linked infra financing. Developers active in urban projects, including DLF and Godrej Properties, could also see improved funding ecosystems.

Online Used-Car Unicorns Gear Up for IPOs

India’s leading used-car platforms — CARS24, CarDekho, and Spinny — are restructuring operations and trimming costs as they prepare for IPOs expected to raise over $1 billion in the next 12–18 months. Backed by investors like SoftBank, Tencent, and Tiger Global, these unicorns are now streamlining to focus on profitability amid tightening private capital flows. With India ranking as the third-busiest IPO market in 2025, these companies aim to cash in on rising investor appetite for domestic consumer-driven businesses.

Stock Impact: While not yet listed, these IPOs could impact listed peers like Mahindra & Mahindra (due to its stake in FirstCry and auto ecosystem exposure), Maruti Suzuki, and fintech/insurance partners connected to these platforms. The IPO rush also adds momentum to India’s vibrant equity market.

IPO Update – Market Outlook 19 September

Mainboard IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Approx. Listing Gain) |

|---|---|---|---|---|

| Jaro Institute IPO | 23-Sep | 25-Sep | 30-Sep | ₹74 (8.31%) |

| Anand Rathi Share IPO | 23-Sep | 25-Sep | 30-Sep | ₹72 (17.39%) |

| Seshaasai Technologies IPO | 23-Sep | 25-Sep | 30-Sep | ₹60 (14.18%) |

| Atlanta Electricals IPO | 22-Sep | 24-Sep | 29-Sep | ₹70 (9.28%) |

| Saatvik Green Energy IPO | 19-Sep | 23-Sep | 26-Sep | ₹71 (15.27%) |

| GK Energy IPO | 19-Sep | 23-Sep | 26-Sep | ₹44 (28.76%) |

| Ivalue Infosolutions IPO | 18-Sep | 22-Sep | 25-Sep | ₹25 (8.36%) |

| Euro Pratik Sales IPO | 16-Sep | 18-Sep | 23-Sep | ₹– (0.00%) |

Summary:

Among mainboard offerings, GK Energy IPO is drawing the most attention with a strong GMP of nearly 29%, while Anand Rathi Share and Seshaasai Technologies are also showing solid listing gains potential above 14%. Meanwhile, Saatvik Green Energy IPO opens today, adding excitement to the already active primary market.

SME IPOs

| IPO Name | Open Date | Close Date | Listing Date | GMP (Approx. Listing Gain) |

|---|---|---|---|---|

| JD Cables BSE SME | 18-Sep | 22-Sep | 25-Sep | ₹40 (26.32%) |

| VMS TMT IPO | 17-Sep | 19-Sep | 24-Sep | ₹16 (16.16%) |

| Sampat Aluminium BSE SME | 17-Sep | 19-Sep | 24-Sep | ₹21 (17.50%) |

| TechD Cybersecurity NSE SME | 15-Sep | 17-Sep | 22-Sep | ₹200 (103.63%) |

| L.T. Elevator BSE SME | 12-Sep | 16-Sep | 19-Sep | ₹43 (55.13%) |

| Ecoline Exim NSE SME | 23-Sep | 25-Sep | 30-Sep | ₹5 (3.55%) |

Summary:

The SME segment remains red-hot, with TechD Cybersecurity IPO leading the pack at a staggering 104% GMP, signaling massive investor demand. L.T. Elevator IPO is also a standout with over 55% premium expected, while JD Cables and Sampat Aluminium show healthy momentum with gains above 17%.

Stocks in Radar – Market Outlook 19 September

Interarch Building Solutions Ltd. (INTERARCH)

CMP: ₹2,120 | Target: ₹2,332 | Upside Potential: ~10% | Horizon: 6–12 Months | Research: SBI Securities

Interarch Building Solutions Ltd. is a market leader in turnkey pre-engineered steel construction solutions with capabilities spanning design, engineering, manufacturing, and on-site project management. The company caters to industrial, infrastructure, and residential projects, giving it a well-diversified growth base.

Why Interarch is in Focus:

- Strong product offering: From complete turnkey PEB contracts to material sales and light gauge framing systems, Interarch covers the full spectrum of pre-engineered building solutions.

- Robust manufacturing & order book: Operating five plants with 1,61,000 MTPA capacity, set to cross 2,00,000 MTPA by Sep’25. Order book stands strong at ₹1,695 crore as of Jul’25.

- Industry tailwinds: India’s PEB market is expected to grow at 11–12% CAGR till FY29, supported by industrial, infrastructure, and real estate demand.

- Growth guidance: The company maintains 17.5% revenue growth guidance for FY26, with potential upside if execution improves. Margins are likely to expand due to operational efficiencies.

- Valuation comfort: Trading at 27.6x/21.3x FY26E/27E P/E, offering attractive upside given industry prospects.

Key Risks to Watch:

- Lower infrastructure spending by the government.

- Rising raw material costs.

- Potential order cancellations.

Outlook:

With a healthy order book, capacity expansion, and sector tailwinds, Interarch looks well-positioned for steady growth. The stock offers a short to medium-term opportunity with around 10% upside potential.

Conclusion – Market Outlook 19 September

As we step into Friday’s session, the market mood remains cautiously optimistic. With Nifty and Sensex holding on to their positive momentum and Bank Nifty providing strong support, the near-term structure looks resilient. At the same time, investors must remain alert to global cues and sector-specific developments that could sway intraday moves.

IPO activity continues to keep the primary market buzzing, while stock-specific opportunities like Interarch Building Solutions Ltd. highlight the potential in niche industrial segments.

For traders, disciplined stop-loss placement and close watch on support–resistance levels remain the key. For investors, staying selective and focusing on quality businesses with growth visibility will be crucial as we navigate into the final trading day of the week.

Stay informed, stay disciplined — and let the Market Outlook 19 September guide your trading and investment decisions.

More Articles

NITI Aayog Reports on India’s Hand & Power Tools Sector: 5 Stocks to Watch

India Automotive Sector Stocks – NITI Aayog’s 2030 Vision

India’s Plan to Stop Power Cuts: How It Could Boost These Stocks