Introduction:

“Why sell your shares when you can gift them — tax-free — to your loved ones?”

Imagine this: You’ve been investing for years, building a strong equity portfolio. Now, you want to pass on a part of that wealth to your spouse, child, or parent. Maybe it’s to help your son start investing. Or to gift shares to your wife on her birthday. Or perhaps to balance your family’s portfolio across different accounts.

Good news — you don’t need to sell your shares or pay any capital gains tax. You can transfer shares from one Demat to another within your family completely legally, safely, and in most cases, free of cost.

Whether you’re consolidating holdings, planning wealth succession, or just gifting out of love — this guide will walk you through the step-by-step process of transferring shares to a family member’s Demat account using both CDSL Easiest and NSDL Speed-e portals (plus the offline method if needed).

Let’s unlock this lesser-known but powerful financial move together.

Is It Legal to Transfer Shares to Family Members?

Yes — it’s completely legal to transfer shares from your Demat account to a family member’s Demat account in India. The Securities and Exchange Board of India (SEBI), along with depositories like CDSL and NSDL, allow non-commercial transfers between individuals, especially when marked as a “Gift”.

This is especially common for:

- Spouses transferring part of their holdings

- Parents gifting shares to children

- Siblings sharing family wealth

- Tax planning and asset diversification

Important Note:

As long as the transfer is genuine (not a disguised sale) and marked appropriately in the transfer reason (like “Gift” or “Off-market – family”), it is recognized as a valid, tax-free movement.

Methods to Transfer Shares to Family Members

There are three ways to transfer shares between Demat accounts:

a. Online Transfer via CDSL Easiest (For CDSL Accounts)

Best for brokers like Zerodha, Groww, Angel One, 5paisa, etc., who are linked with CDSL.

b. Online Transfer via NSDL Speed-e (For NSDL Accounts)

Used by brokers like ICICI Direct, HDFC Securities, Kotak Securities, etc.

c. Offline Method via DIS Slip (For Inter-Depository or Non-Supported Brokers)

Needed when one account is in CDSL and the other is in NSDL, or if your broker doesn’t support online transfers.

Step-by-Step Guide to Transfer Shares Using CDSL Easiest

Who Can Use This?

Anyone who has a CDSL Demat account (starting with “120”) and wants to transfer shares to another CDSL Demat account — like that of a spouse, parent, or child.

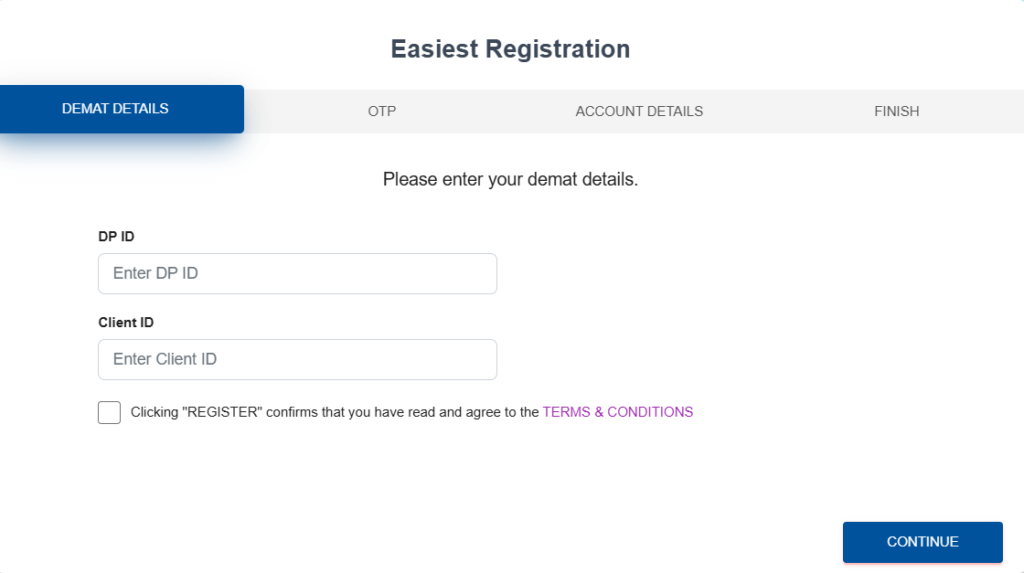

Step 1: Register for CDSL Easiest

- Go to the CDSL Easiest portal or Google “CDSL Easiest Login”.

- Click on ‘Register for Easiest’.

- Enter your 16-digit Demat number (8-digit DP ID + 8-digit Client ID).

- Submit your details and verify via OTP.

- Set up your User ID and password for login.

⏱ Time required: 5–10 minutes

Step 2: Wait for Broker Authentication

Once you register, CDSL sends your request to your stockbroker (Depository Participant).

- Your broker usually approves within 24–48 hours.

- You’ll get a confirmation email/SMS once approved.

- Now log in to CDSL Easiest using your new credentials.

Step 3: Add the Family Member’s Demat Account as a Trusted Account

- After logging in, go to the ‘Trusted Account’ section.

- Add your family member’s 16-digit Demat number (must also be CDSL).

- Submit the request and wait for approval from CDSL.

🔐 This step ensures shares only go to verified accounts, reducing fraud risk.

Step 4: Initiate the Share Transfer

- Go to ‘Transaction’ > ‘Setup’ > ‘Bulk Setup’.

- Choose the execution date (can be same-day or later).

- Enter the BO ID (Beneficiary Owner ID) of your family member.

- Select the ISIN (e.g., INE467B01029 for Reliance Industries).

- Enter the number of shares you want to transfer.

- In Reason for Transfer, choose ‘Gift’.

- Confirm and submit using your OTP or PIN.

Step 5: Track the Status

- Go to Transaction > Inquiry > Status to track your request.

- Shares are typically transferred within 24 working hours.

Pro Tip:

Do all actions before 5 PM on working days. Transfers initiated after 5 PM may get delayed by 1 business day.

Step-by-Step Guide to Transfer Shares Using NSDL Speed-e

Who Can Use This?

Anyone who has a Demat account under NSDL (DP IDs starting with IN), and wants to transfer shares to another NSDL Demat account — for example, gifting shares to a family member.

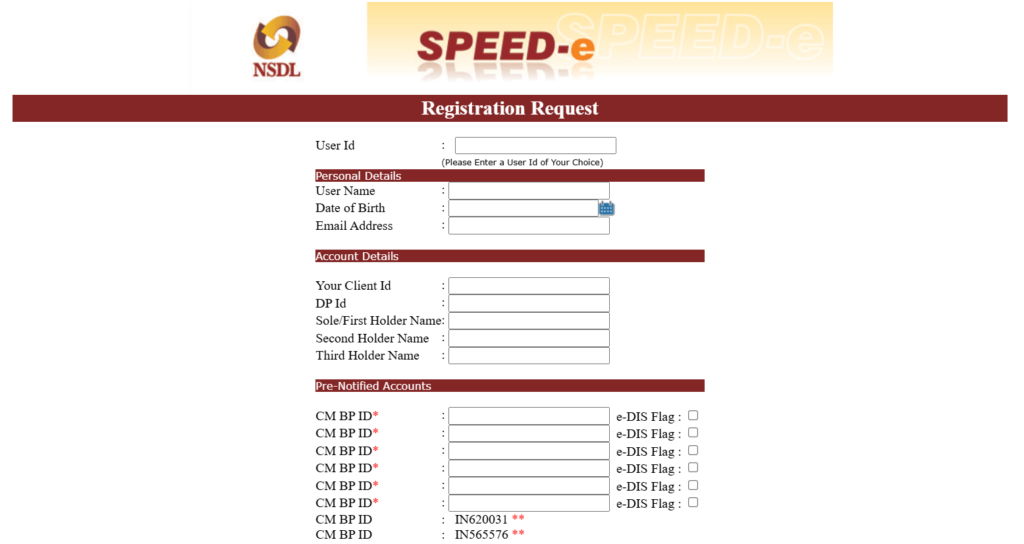

Step 1: Register for NSDL SPEED-e

- Visit NSDL e-Services.

- Click on “New User Registration – Speed-e”.

- Choose ‘Password’ user type (for retail investors).

- Fill the form with:

- Your DP ID + Client ID

- Preferred User ID and Password

- Print the form and submit it to your DP (broker) along with:

- A recent Transaction Statement

- Copy of PAN or proof (if required)

📝 Some DPs may offer e-sign, but most still need physical form submission for security.

Step 2: Broker (DP) Approval

Once submitted, your broker will verify the form and approve the registration.

- This may take 2–3 working days.

- Once approved, you’ll receive a confirmation.

- You can now log in to NSDL SPEED-e Portal using your credentials.

Step 3: Add Beneficiary (Family Member’s Demat)

- After logging in, go to the ‘Trusted Account Registration’ section.

- Add the DP ID + Client ID of your family member.

- Wait for approval from your DP and NSDL.

✅ This is a one-time setup for secure transfers.

Step 4: Transfer the Shares

- Go to ‘Transactions > Delivery Instructions’.

- Select the execution date and choose the trusted account.

- Enter:

- ISIN of the shares (e.g., INE467B01029)

- Quantity of shares

- Reason for transfer → Select ‘Gift’

- Submit and verify using your password or token-based OTP.

Step 5: Monitor the Transfer

Track the request in real-time in the ‘Instruction Inquiry’ section.

Transfers usually complete within 24–48 hours, if submitted on a working day before the cut-off time.

A Few Things to Note:

- Joint Demat accounts need a Power of Attorney (PoA) if the transfer is initiated by only one holder.

- Some brokers may charge a nominal fee (₹25–₹100). Confirm with your DP beforehand.

How to Transfer Shares Offline Using the Delivery Instruction Slip (DIS)

If either you or your family member uses a different depository (e.g., one account is with CDSL and the other with NSDL), or your broker does not support CDSL Easiest or NSDL Speed-e, you’ll need to use the physical method — the Delivery Instruction Slip (DIS).

This method may seem traditional, but it’s still widely used for inter-depository or manual transactions.

Who Should Use This Method?

- Transferring shares between CDSL and NSDL (inter-depository)

- Your broker does not support CDSL Easiest or NSDL Speed-e

- You are not comfortable with online processes or want physical documentation

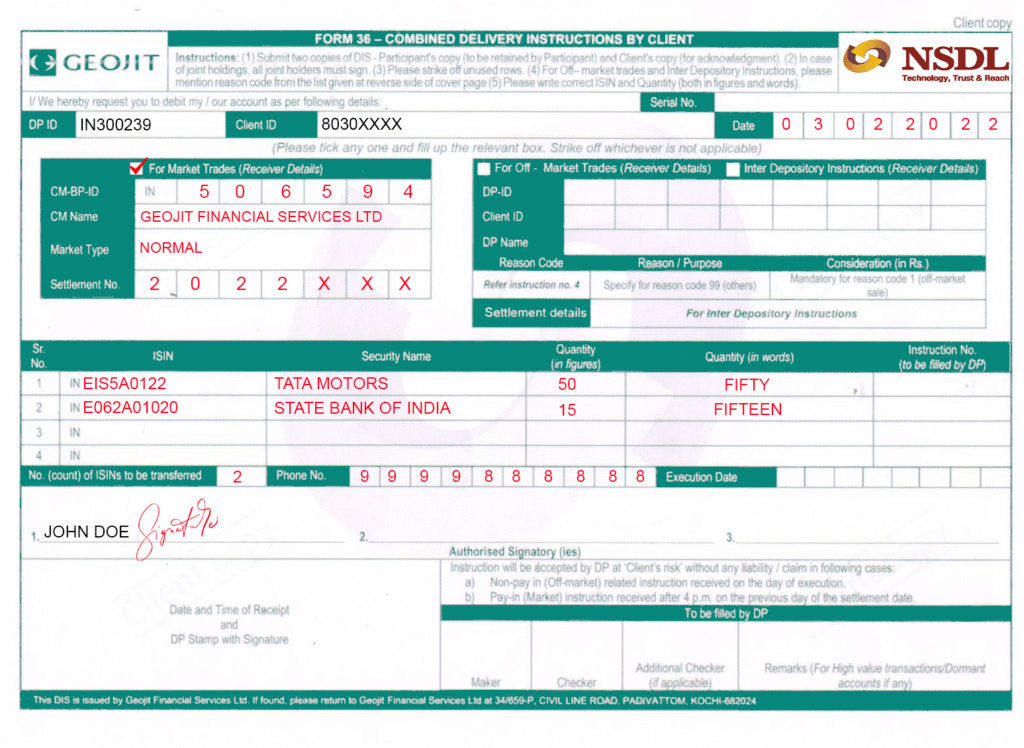

Step-by-Step Guide to Transfer Shares Using DIS

1: Obtain the DIS Booklet

- Request a Delivery Instruction Slip booklet from your existing broker (the broker where your shares currently reside).

- If you already have a DIS booklet, use a fresh, unused slip.

2: Fill in the DIS Form Carefully

You’ll need to enter the following details:

- DP ID and Client ID of the recipient (family member’s Demat account)

- ISIN of the security you’re transferring (this is unique for each stock)

- Quantity of shares

- Market Type: Select Off-market

- Reason for transfer: Mention Gift or Transfer to family member

- Execution date (optional, if your broker allows scheduling)

- Sign the slip as per your account signature

3: Submit the DIS to Your Broker

- Hand over the filled DIS slip to your broker’s branch or courier it to their registered office, depending on their process.

4: Confirmation and Processing

- Your broker will process the transfer, and shares will be moved within 5–7 working days.

- You can check your statement or confirm with your broker once the transfer is completed.

Important Tips for Using DIS

- Always double-check the recipient’s DP ID, Client ID, and ISIN. Mistakes can lead to failed transfers or shares going to the wrong account.

- Keep a photocopy or digital scan of the filled and signed DIS for your records.

- Some brokers may charge ₹25–₹100 per ISIN for processing the DIS transfer.

- DIS slips may expire after a certain period. Make sure yours is still valid.

Tax Implications and Charges on Family Share Transfers

One of the most common concerns when transferring shares to family is — “Will I have to pay tax?” The good news is: In most cases, transferring shares to your family is tax-free.

Here’s a breakdown of the taxation rules and potential costs involved.

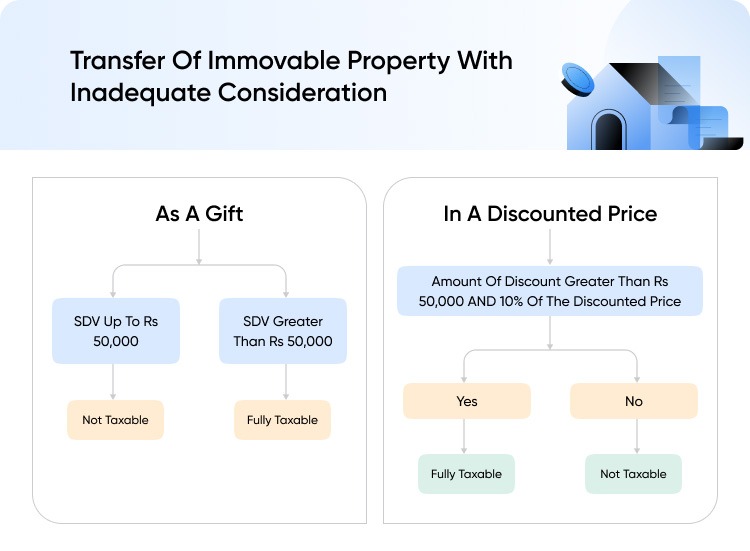

A. Income Tax on Gifting Shares

1. For the Giver (You)

- There is no capital gains tax because you’re not selling the shares, just transferring them.

- The transfer must be genuine and non-commercial — simply mark the reason as “Gift” when initiating the transaction.

2. For the Receiver (Your Family Member)

- Under Section 56(2)(x) of the Income Tax Act, gifts from certain relatives are fully exempt from tax.

- Relatives include:

- Spouse

- Children

- Parents

- Siblings

- Grandparents

- Daughter-in-law / Son-in-law

So, if you’re gifting shares to any of the above, no income tax is applicable at the time of transfer.

3. When Will Tax Be Applicable?

- Capital Gains Tax will apply only when your family member sells the shares in the future.

- In that case, the original purchase date and cost of acquisition (by you) will be considered for calculating gains.

B. Stamp Duty or Transfer Fees

- CDSL Easiest and NSDL Speed-e: These platforms allow free transfers under “Gift” category. No stamp duty or transaction charges are levied by the depositories.

- Delivery Instruction Slip (DIS): Some brokers may charge a nominal fee, typically between ₹25 to ₹100 per ISIN. Check with your broker beforehand.

C. Gift Deed – Is It Required?

- Not mandatory, but for larger transfers or future clarity (especially if the value is substantial), drafting a simple notarized gift deed is a good practice.

- This can be helpful if there are any disputes, IT scrutiny, or documentation requirements in the future.

D. Reporting the Gift

- There is no need to report the gift separately in your ITR if it’s between exempted relatives.

- Still, keeping a record of the transfer (like transaction ID, Demat statements, or optional gift deed) is good financial hygiene.

Best Practices & Mistakes to Avoid

Best Practices

- Always choose “Gift” as the reason for transfer.

- Double-check Demat details (DP ID, Client ID, ISIN) to avoid errors.

- Keep records of your transfer (screenshot or email).

- Ensure PAN & KYC are updated in both accounts.

- Consider a simple gift deed for large or future-proof transfers.

Mistakes to Avoid

- Don’t select the wrong reason like “Off-market.”

- Don’t try online transfer between CDSL and NSDL — use DIS instead.

- Avoid transferring to non-family members without checking tax rules.

- Don’t assume all transfers are free — some brokers charge small DIS fees.

Final Thoughts

Transferring shares between family members isn’t just about moving assets — it’s about passing on trust, values, and financial wisdom.

Whether you’re gifting shares to your spouse as part of a long-term plan, helping your children start their investment journey, or simplifying family holdings, the process is smoother than most people realize. With tools like CDSL Easiest, NSDL Speed-e, or the traditional DIS slip, you can execute the transfer without selling your holdings, triggering taxes, or paying brokerage fees.

Importantly, such transfers — when done mindfully — keep wealth within the family and help align everyone’s financial goals. They also encourage a sense of ownership and awareness in younger generations, especially when combined with transparent conversations around investing.

Just ensure that the documentation is correct, the reason for transfer is clearly marked as a gift, and both parties maintain proper records. This ensures peace of mind today — and fewer complications tomorrow.

In a world where financial literacy and family wealth go hand in hand, knowing how to transfer shares from one Demat to another within your family is a small but powerful step forward.

FAQs: Transfer Shares to Family

1. Can I transfer shares from my Demat account to my wife’s account?

Yes, you can transfer shares to your wife’s Demat account using CDSL Easiest, NSDL Speed-e, or a DIS slip. Mark the transfer as a gift to avoid tax.

2. Is gift of shares to family taxable in India?

No, shares gifted to relatives like spouse, children, or parents are exempt from income tax under Section 56 of the Income Tax Act.

3. What is the easiest way to transfer shares to a family member?

Using the CDSL Easiest or NSDL Speed-e portal is the fastest and most convenient way to transfer shares to family online.

4. Can I transfer shares from CDSL to NSDL within family?

Yes, but not online. CDSL to NSDL transfers require the offline DIS slip method, filled manually and submitted to your broker.

5. Is PAN required for transferring shares to family?

Yes, both Demat accounts must have a valid and updated PAN for a successful and compliant share transfer.

6. Are there any charges for transferring shares to family?

CDSL and NSDL don’t charge for transfers marked as gifts. However, some brokers may charge a small DIS fee (₹25–₹100).

7. How long does a family Demat share transfer take?

Online transfers are completed in 1–2 working days. DIS-based transfers may take up to 5–7 working days.

8. Do I need a gift deed to transfer shares to a family member?

A gift deed is not mandatory but recommended for high-value transfers as legal proof of gift.

9. Can I transfer shares to my child’s Demat account?

Yes, you can gift shares to your child’s account as long as they have a Demat account in their name.

10. Will the recipient pay tax when selling gifted shares?

Yes, when the recipient sells the shares, capital gains tax applies based on the original purchase price and date.

Related Articles:

How to Transfer Shares Between Demat Accounts Online: A Complete Guide

What Happens to Your Shares and Mutual Fund After Death? Transmission Process Explained

Best Stock Broker in India: How to Choose Best Broker in 2025

More Articles

India’s Obesity Crisis Fuels a Billion-Dollar Boom: Top Pharma Stocks to Watch

Rare Earth Magnet Manufacturing Stocks: Catch These Before India’s ₹1,000 Cr Push Lifts Off

Ready-to-Drink (RTD) Cocktails: The Fastest-Growing Segment in the Liquor Market