Introduction: Trump Strikes with 25% Tariff on India

The global trade landscape shifted dramatically on July 30, 2025, as former U.S. President Donald Trump announced a sweeping 25% tariff on India. Effective from August 1, this move has sent shockwaves through global markets, Indian export sectors, and investor sentiment.

This 25% Tariff on India is not just a political signal—it’s a direct economic blow aimed at pressuring India over trade imbalances, high tariff barriers, and its continued ties with Russia. From agriculture and pharmaceuticals to auto components, several sectors are now under direct threat from this unilateral tariff hike.

India’s trade negotiations with the U.S. were already strained, and this latest escalation adds a new layer of complexity just as both nations aimed to push toward a $500 billion trade target by 2030.

In this article, we break down the impact of the 25% Tariff on India—sector by sector, stock by stock—to help investors, traders, and exporters make sense of what comes next.

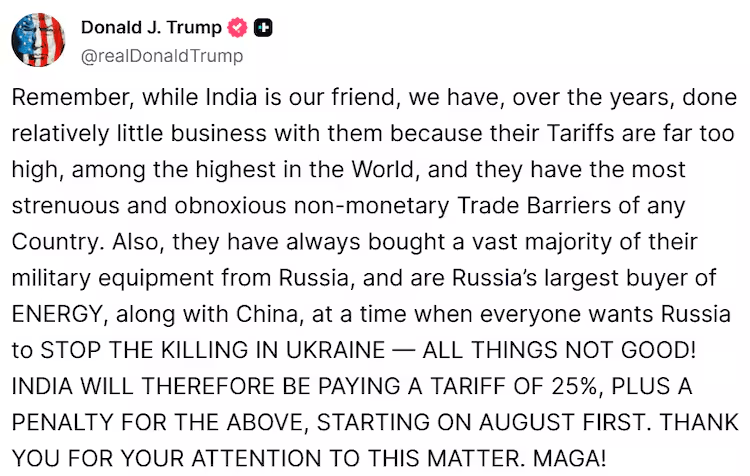

What Did Trump Announce? – Decoding the 25% Tariff on India

On July 30, 2025, Donald Trump officially declared a 25% Tariff on India, targeting a wide range of goods exported from India to the United States. This tariff is set to take effect on August 1, 2025, and comes as part of Trump’s broader “America First Trade Reset” campaign in his second presidential term.

This move follows months of stalled trade negotiations between India and the U.S., particularly over disputes in sectors like agriculture, dairy, and pharmaceuticals. Trump claimed that India’s high import duties and non-tariff barriers unfairly block American goods, justifying what he called a “reciprocal tariff” policy.

Adding fuel to the fire, Trump also hinted at an additional “penalty” for India’s continued oil and defense trade with Russia, calling India’s foreign policy stance “unfriendly” toward U.S. interests.

Key Points of the 25% Tariff on India:

- Tariff Rate: 25% flat on Indian goods across major sectors

- Effective From: August 1, 2025

- Reason Cited: High Indian tariffs, non-tariff trade restrictions, and India-Russia ties

- Announced By: Donald Trump, Former U.S. President

- Mode of Enforcement: Executive authority under IEEPA (International Emergency Economic Powers Act)

Timeline of Events Leading to the Tariff

| Date | Event |

|---|---|

| April 2025 | Trump proposes “reciprocal tariffs” for all trading partners |

| May 2025 | India–U.S. talks stall over farm and pharma access |

| July 25, 2025 | U.S. raises concerns over India–Russia oil trade |

| July 30, 2025 | 25% Tariff on India officially announced |

| Aug 1, 2025 | Tariff implementation scheduled |

The 25% Tariff on India is seen as both an economic and geopolitical message. It penalizes India’s trade practices while simultaneously pressing the country to realign its foreign policy more closely with U.S. interests.

Sector-Wise Breakdown of the 25% Tariff on India

Trump’s 25% Tariff on India doesn’t just make headlines—it hits India where it hurts most: its top export sectors. From agriculture to pharmaceuticals, this tariff directly affects products that dominate India’s trade with the U.S. The move aims to disrupt supply chains, force renegotiations, and push India to lower its import barriers.

Let’s break down how each sector stands to be impacted by the 25% Tariff on India:

Agriculture: High-Value Exports Under Fire

The U.S. has long criticized India’s steep tariffs on American agricultural products. Now, Trump strikes back. The 25% Tariff on India will likely reduce demand for Indian basmati rice, shrimp, spices, and dairy in the U.S. market.

- Affected products: Basmati rice, buffalo meat, marine exports, dairy

- Top companies at risk: LT Foods, KRBL, Avanti Feeds

Auto Components: Supply Chains in the Crosshairs

India exports billions worth of auto parts to North America. The 25% Tariff on India could disrupt this flow, especially for firms supplying electric vehicle (EV) components and precision parts.

- Affected products: Engine parts, wiring sets, transmission components

- Top companies at risk: Motherson, Bharat Forge, Sundram Fasteners

Pharmaceuticals: U.S. Market Access Threatened

India is the world’s largest supplier of generic drugs, and the U.S. is its biggest customer. With the 25% Tariff on India, Indian pharma giants could face a pricing disadvantage, reducing their competitiveness in tenders and long-term contracts.

- Affected products: Generic drugs, APIs, biologics

- Top companies at risk: Sun Pharma, Dr. Reddy’s, Aurobindo, Laurus Labs

Energy and Defense: Penalty Beyond Tariffs

In addition to the tariff, Trump announced a vague but serious “penalty” linked to India’s continued oil and defense purchases from Russia. This adds a geopolitical layer to the 25% Tariff on India, threatening sectors that depend on imports from sanctioned partners.

- Affected areas: Crude oil imports, defense co-development, arms systems

- Top companies at risk: ONGC, Oil India, Bharat Electronics, HAL

Logistics: Indirect Damage from Trade Slowdown

While logistics companies won’t get hit by tariffs directly, a drop in export volumes will reduce shipping demand. The 25% Tariff on India could increase port idle time, delay shipments, and lower revenue for Indian logistics players.

- Top companies at risk: Adani Ports, Container Corp (CONCOR), Gateway Distriparks

The 25% Tariff on India sends a clear message: sectors that have long relied on U.S. export demand must now prepare for disruption, volatility, and possible redirection of trade.

Summary Table

| Sector | Companies at Risk | Why? |

|---|---|---|

| Agriculture | LT Foods, KRBL, Avanti Feeds | U.S. is a top destination for these exports |

| Auto Components | Motherson, Bharat Forge, Sundram Fasteners | Export significant volume to NAFTA region |

| Pharma | Sun Pharma, Dr Reddy’s, Aurobindo, Laurus | U.S. is their largest market |

| Defense | BEL, HAL | Could be part of U.S. scrutiny over arms |

| Logistics | Adani Ports, CONCOR | Indirect impact via trade route slowdown |

How the 25% Tariff on India Is Moving the Market

Rather than re-listing stocks, this section zooms out to show how markets have reacted to Trump’s announcement, giving your readers a macro view that complements the sector-level breakdown.

Stock Market Reacts to the 25% Tariff on India

The moment Trump announced the 25% Tariff on India, markets didn’t wait to digest the impact—they responded instantly.

- The GIFT Nifty dropped over 170 points in early trade on July 31, reflecting fears of reduced export earnings and a weaker rupee.

- Export-heavy indices like Nifty Pharma, Auto, and FMCG slipped into the red.

- The INR weakened slightly against the USD as investors braced for lower foreign currency inflows from exports.

Institutional Investors Are Already Rebalancing

Funds with high exposure to Indian export leaders began shifting toward domestic-facing sectors like banking, power, and infra. The 25% Tariff on India has clearly forced a portfolio rethink, especially for FII-heavy names in auto and pharma.

- Pharma stocks with heavy U.S. exposure saw selling pressure.

- Auto ancillary firms dipped 2–4% in intraday trades.

- Logistics and shipping stocks lost momentum after weeks of rallying on global demand themes.

What This Tells Investors

The 25% Tariff on India isn’t just a headline—it’s already reshaping market behavior. While panic selling hasn’t taken over, smart money is rotating out of vulnerable sectors and into safer domestic themes. For retail investors, this means:

- Avoid overreacting, but don’t ignore global risk exposure.

- Review export-heavy holdings—especially with U.S.-centric revenue models.

- Watch sectoral indices, not just individual stocks, to gauge macro trends.

How India May Respond to the Tariff on India

India isn’t sitting quietly. As Trump’s 25% Tariff on India takes effect, New Delhi is already weighing its options. Officials have confirmed that a formal protest will be lodged through diplomatic channels, while trade negotiators prepare a legal challenge.

First, India may escalate the issue at the World Trade Organization (WTO), arguing that the U.S. move violates trade norms. This won’t yield immediate results but signals intent to push back on legal grounds.

Second, India could impose retaliatory tariffs on select American goods—possibly targeting farm and tech imports—to exert pressure on U.S. stakeholders.

Third, policymakers may work to diversify export markets, redirecting agri and pharma products toward Europe, the Middle East, and Southeast Asia. This won’t replace the U.S. entirely but could soften the blow.

Meanwhile, behind closed doors, Indian diplomats are expected to reopen stalled negotiations, especially on agriculture and pharma access. The goal now shifts from long-term trade growth to damage control and de-escalation.

In short, India recognizes the threat. Whether it retaliates directly or chooses to negotiate, the 25% Tariff on India has triggered a diplomatic balancing act that will shape the next phase of trade relations.

Conclusion: The 25% Tariff on India Marks a Turning Point

Trump’s 25% Tariff on India isn’t just a political maneuver—it’s a direct challenge to India’s export-driven growth strategy. By targeting key sectors like agriculture, auto components, and pharmaceuticals, the U.S. has forced Indian exporters to rethink their global positioning.

The immediate market reaction shows how seriously investors are taking this threat. While panic hasn’t set in, volatility has returned. Export-heavy stocks are under pressure, and foreign investors are watching India’s next moves closely.

Yet, this isn’t the end of the story. India still has tools—diplomacy, trade diversification, and legal options—to counter the fallout. What matters now is how quickly policymakers act and how resilient Indian businesses prove to be under stress.

For investors, this is a moment to stay alert—not fearful. The Tariff on India is a wake-up call, but not a collapse. Staying informed and focusing on fundamentals will matter more than ever in the weeks ahead.

FAQs

What is the 25% Tariff on India?

The U.S. has imposed a 25% import tariff on Indian goods starting August 1, 2025.

Who announced this tariff?

Former U.S. President Donald Trump announced the tariff on July 30, 2025.

Why did the U.S. impose this tariff?

Trump cited high Indian import duties, trade barriers, and India’s Russia ties.

Which sectors are most affected?

Agriculture, auto components, pharmaceuticals, and defense exports.

Will this hurt Indian exporters?

Yes, especially those dependent on the U.S. market for sales and margins.

Can India retaliate?

Yes, India may respond through WTO, impose counter-tariffs, or renegotiate.

How have Indian markets reacted?

Indices fell sharply; export-heavy stocks and the rupee saw pressure.

Will this affect Indian pharma companies?

Likely, as many rely on the U.S. for over 30–40% of their revenue.

Is this the first time Trump targeted India with tariffs?

No, Trump pushed for tariffs on Indian goods during his earlier term too.

Should investors panic?

No—but staying cautious in export-focused sectors is advised.

Related Articles

Trump’s Tariff Shockwave: How Indian Stocks & Sectors Will Be Hit or Rise

Tariff and Great Depression: Will History Repeat?

Tariff Paused: A Golden Opportunity for Indian Stocks?