Introduction

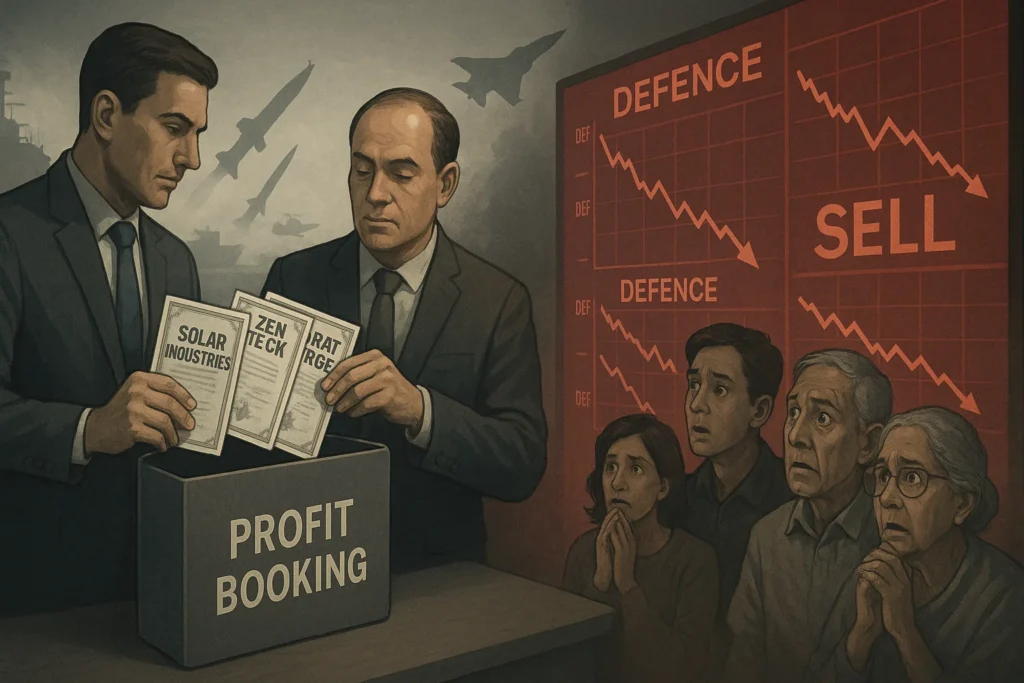

The defence sector in India has seen a meteoric rise over the last few years, culminating in an explosive rally post-Operation Sindoor. But like all hot trends in the stock market, what goes up too fast often faces a reality check — and that’s exactly what’s happening to defence stocks now. In June 2025, mutual funds offloaded over ₹1,700 crore worth of shares across key defence players, prompting many retail investors to ask a pressing question: What to do with defence stocks now?

Let’s break down what’s happening in the sector, why valuations are under pressure, and how smart investors should position themselves for the next phase of this high-potential but volatile theme.

The Rally: What Fuelled the Defence Boom?

Defence stocks in India have enjoyed an unprecedented rally since 2022, with the momentum accelerating after the geopolitical tensions following Operation Sindoor and the growing threat matrix in Asia and the Middle East.

Key drivers of the rally:

- Massive Government Orders: Defence Acquisition Council (DAC) approvals crossed ₹1 trillion recently.

- Emergency Procurement Plans: Following Operation Sindoor, the Ministry of Defence fast-tracked ₹400 billion worth of procurement.

- NATO Influence: NATO’s new spending targets of 5% of GDP by 2035 created a ripple effect globally, signalling export potential for Indian defence firms.

- Make in India & Indigenization: Government policy strongly favored domestic procurement, reducing import dependency.

- Export Boom: India’s defence exports hit record highs, with companies like BEL, HAL, and BDL gaining large orders from Southeast Asia and Africa.

All of this created a euphoric narrative around defence stocks — and prices followed. The Nifty India Defence Index surged nearly 84% in just 3 months.

The Sell-Off: When Smart Money Gets Nervous

Despite strong fundamentals and robust order books, mutual funds decided to exit en masse in June 2025. According to data from Prime Database, MFs sold over ₹1,713 crore across nine major defence stocks, a red flag for retail investors.

Biggest Outflows:

| Stock | MF Selling (₹ Cr) |

|---|---|

| Solar Industries | ₹952 Cr |

| Zen Technologies | ₹192 Cr |

| Bharat Forge | ₹165 Cr |

| GRSE | ₹153 Cr |

| Cochin Shipyard | ₹120 Cr |

| Mazagon Dock | ₹96 Cr |

On the flip side, buying was just ₹100 crore, across names like Bharat Dynamics, BEL, and Unimech. The result? Many defence stocks corrected sharply.

- GRSE, Cochin Shipyard: 10–12% down

- Solar Industries: Down 9%

- HAL: Mild correction of 3%

What’s Spooking Institutions?

1. Valuation Overstretch

Most defence stocks have seen their P/E ratios skyrocket over the past 12–18 months. Mutual funds, which focus on long-term value, are now flagging these valuations as unsustainable.

Motilal Oswal recently downgraded Bharat Dynamics (BDL) to ‘Neutral’, setting a target price below market value — a strong indication of froth.

2. Execution Risks

Veteran investor Ambareesh Baliga raised concerns around order book delivery. “They’ve won massive orders. But can they deliver?” he warned. Many companies have not expanded capacity proportionately.

For example:

- HAL has faced delays in production scale-up.

- Private players like Zen Tech are struggling to keep pace with demand.

3. Geopolitical Cooling

Easing tensions in the Middle East, especially between Iran and Israel, reduced the urgency around defence stocks, which were previously seen as a geopolitical hedge.

Institutional Wisdom: What Are Fund Managers Saying?

Even bullish fund managers are now preaching caution:

“We’re not increasing our position right now… valuations are on the higher side,” said Harsha Upadhyaya, CIO at Kotak AMC, which has been an early mover in defence stocks.

“There’s overenthusiasm among market participants,” echoed Vikas Khemani, Founder of Carnelian Capital.

This doesn’t mean they are dumping the sector altogether. Rather, they’re selectively trimming positions, preferring to wait for valuation resets or earnings catch-up before re-entering aggressively.

The Long-Term Story Remains Intact

Despite the correction, there’s no structural change in India’s defence narrative. If anything, the visibility of future growth has improved.

Macro Growth Drivers Still Strong:

- ₹1 trillion worth of DAC approvals recently cleared

- FY26 expected to see robust order inflows

- India’s defence exports growing at >20% CAGR

- NATO & partner nations opening up defence export routes

- Continued push for indigenization through Atmanirbhar Bharat

Expert Consensus:

“Defence is a structural story with a 10–15 year runway. But after such a sharp run, caution is warranted,” says Aamar Deo Singh of Angel One.

So, What Should Retail Investors Do Now?

Here’s a playbook for retail investors wondering what to do with defence stocks now:

1. Don’t Panic Sell

If you’re already invested in fundamentally strong defence stocks, don’t exit entirely. Take some profits if you’re overweight, but don’t abandon the story.

2. Avoid Chasing Expensive Stocks

Stay away from recently hyped defence names that have no execution history or thin margins. Focus on stocks with:

- Strong balance sheets

- Large, executable order books

- Capacity expansion plans

3. Use SIP or Staggered Entry

Instead of lump-sum investments, spread your buying over 3–6 months. This allows you to average costs as stocks consolidate.

4. Watch for Earnings Visibility

With order books secured for 5–8 years, the key is execution and delivery. Monitor quarterly earnings, margins, and order-to-revenue conversion.

Top Defence Stocks to Watch in 2025–2026

Let’s split this into Private Players and DPSUs (Public Sector):

Private Players:

| Company | Why Watch |

|---|---|

| Solar Industries | Strong exports in explosives & missile systems; guidance of 25–30% revenue growth |

| Astra Microwave | Defence electronics; high-margin niche segment |

| Azad Engineering | Precision manufacturing; backed by order visibility from global OEMs |

DPSUs:

| Company | Strengths |

|---|---|

| BEL | Leading in defence electronics; export growth + localisation focus |

| HAL | Long-term fighter jet contracts, UAV development; moderate valuation |

| Midhani | Specialty alloy provider; niche but important role in indigenization |

Final Word: Be Cautious, Not Bearish

The recent correction in defence stocks is not a reason to abandon the sector. It’s a healthy reset after an overheated rally. The macro fundamentals remain strong, but valuation discipline is now critical.

Smart investors will:

- Trim frothy positions

- Accumulate quality stocks on dips

- Track delivery timelines and quarterly performance

- Adopt a staggered, long-term investing approach

This is a tactical pause, not the end of the defence bull market. Knowing what to do with defence stocks now is not about panic — it’s about patience and positioning.

✍️ Ready to make smart moves in defence stocks?

Don’t let short-term noise cloud your long-term strategy. Watch, wait, and buy right.

FAQs on What to Do with Defence Stocks Now

- What to do with defence stocks now after mutual fund selling?

Retail investors should assess valuations and consider trimming positions in overvalued stocks while holding long-term winners. - Why are mutual funds exiting defence stocks?

They’re booking profits after a massive rally due to stretched valuations and execution concerns. - Is it risky to invest in defence stocks now?

Yes, in the short term. Mutual fund selling indicates caution is warranted due to high prices and delivery risks. - Which defence stocks saw the highest mutual fund selling?

Solar Industries, Zen Technologies, and Bharat Forge led the sell-off in June 2025. - Does mutual fund selling mean the defence rally is over?

Not necessarily. It’s a valuation-driven correction, not a collapse of the sector’s fundamentals. - Should I buy defence stocks during this dip?

Yes, but do it gradually using SIPs or staggered entries. Focus on fundamentally strong companies. - Are defence stocks still good for long-term investment?

Absolutely. The sector has strong government backing, export potential, and structural tailwinds. - How can I identify which defence stocks to hold or exit?

Track mutual fund activity, valuation metrics, and order book execution capabilities. - Is the mutual fund exit a sign of broader weakness in the defence sector?

No, it’s more about short-term profit booking and rotating into better-valued opportunities. - What’s the best strategy for retail investors in defence stocks now?

Avoid panic. Stay invested in leaders like BEL or HAL and wait for better entry points in high-growth private players.

Related Articles

South India’s Manufacturing Boom: Top Stocks to Watch as Tamil Nadu Becomes the Next China

DRDO’s Emergency Weapon Orders: Defence Stocks Set to Gain

Defence Stock Crashing Soon? The Risks No One’s Talking About