Weekly Stock Market Update: Smallcaps Outshine as Benchmarks Slip

The Indian stock market wrapped up the week on a slightly negative note, with frontline indices facing mild profit-booking after their recent record highs. This week’s action was marked by a divergence between large-cap and small-cap stocks, as investors rotated capital amid mixed earnings, global uncertainty, and sector-specific headwinds.

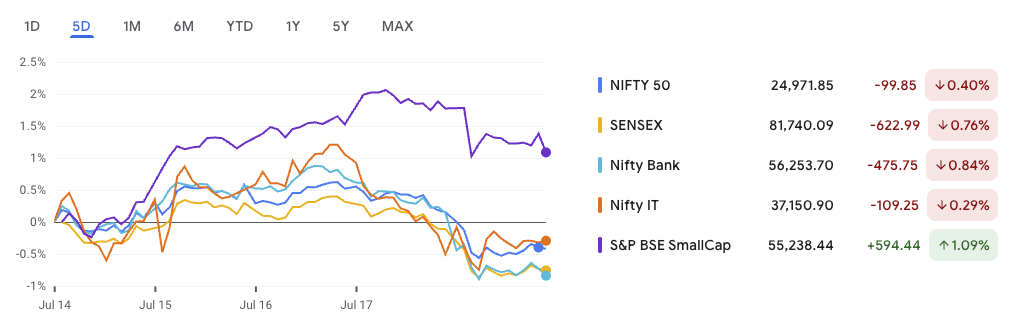

- The Nifty 50 declined by 0.40% to close at 24,971.85, failing to hold the 25,000 milestone.

- The Sensex shed 622.99 points, ending the week at 81,740.09, down 0.76%.

- Bank Nifty lost 0.84%, reflecting pressure in key banking stocks.

- Nifty IT also remained subdued with a 0.29% decline.

In contrast, broader indices outperformed, with the S&P BSE SmallCap index rising by 1.09%, as retail and domestic investors continued showing interest in mid and small-cap counters.

This weekly stock market update highlights sectoral rotation, stock-specific momentum, and key data points that could guide the market’s next move. Let’s dive into which sectors led the charge and which ones dragged the market down.

Sector Highlights: Media, FMCG Shine While Tech & Telecom Drag

As part of this weekly stock market update, one of the most striking trends was the strong rebound in consumer-facing and defensive sectors, while technology and industrials came under pressure. This divergence reflects investors rotating into safer, domestic demand-driven sectors amid global tech concerns and oil price volatility.

Top Performing Sectors This Week

| Rank | Sector | Weekly Change |

|---|---|---|

| 1 | Media | +8.67% |

| 2 | Hotels, Restaurants & Tourism | +3.52% |

| 3 | Pharmaceuticals & Biotechnology | +2.69% |

| 4 | Food, Beverages & Tobacco | +2.41% |

| 5 | FMCG | +2.17% |

- Media stocks led the rally, buoyed by strong ad-spend expectations ahead of the festive season and specific buying in broadcasting counters.

- Hotel and tourism stocks continued gaining traction as travel bookings surged post-summer lull.

- Pharma and FMCG sectors saw defensive buying amid global uncertainty and a stable rupee.

Worst Performing Sectors This Week

| Rank | Sector | Weekly Change |

|---|---|---|

| 1 | Hardware Technology & Equipment | -3.36% |

| 2 | Software & Services | -2.34% |

| 3 | General Industrials | -2.34% |

| 4 | Telecom Services | -2.12% |

| 5 | Oil & Gas | -1.87% |

- The technology space remained weak amid concerns over global IT demand and margin pressures.

- Telecom stocks fell after news of rising competition in data tariffs and delays in 5G monetization.

- Oil & gas names were under pressure due to softer crude oil prices and weak GRMs.

This sectoral shift played a key role in driving stock-specific action, which we cover in the next section.

Weekly Stock Market Update: Top Gainers & Losers

This weekly stock market update saw strong action in select midcaps and pharma names, while some recent outperformers witnessed sharp corrections due to earnings disappointments and high-volume selling. Here’s a look at the top five gainers and losers of the week:

Top Gainers of the Week

| Rank | Stock | Weekly Change | LTP (₹) | Trigger |

|---|---|---|---|---|

| 1 | Anand Rathi Wealth | +23.65% | 2621.2 | 10-Year High |

| 2 | Neuland Laboratories | +20.06% | 14,263 | Dividend Announcement |

| 3 | Glenmark Pharma | +16.89% | 2225.5 | Pharma Rally |

| 4 | Patanjali Foods | +16.72% | 1941.7 | Bonus Issue |

| 5 | Piramal Enterprises | +14.08% | 1326.7 | 52-Week High |

- Anand Rathi Wealth surged to a 10-year high amid strong Q1 performance and increased investor interest in the wealth management space.

- Neuland Labs and Glenmark Pharma rode the pharma sector’s outperformance, with dividend news and positive momentum aiding the rally.

- Patanjali Foods saw sharp gains after announcing a bonus issue, boosting investor sentiment.

- Piramal Enterprises rose steadily, hitting a fresh 52-week high driven by renewed investor interest in financial services.

Top Losers of the Week

| Rank | Stock | Weekly Change | LTP (₹) | Trigger |

|---|---|---|---|---|

| 1 | Valor Estate | -17.69% | 199.47 | High Volatility / Profit Booking |

| 2 | Newgen Software | -12.90% | 962.6 | Earnings Miss |

| 3 | Bharat Dynamics | -11.69% | 1671.6 | Dividend & High Volume Sell-Off |

| 4 | Garden Reach Shipbuilders | -9.62% | 2618.2 | Correction Post Rally |

| 5 | Raymond Lifestyle Ltd. | -9.40% | 1196.1 | Consolidation Phase |

- Valor Estate (formerly DB Realty) corrected sharply following a steep rally earlier this month.

- Newgen Software was hammered after Q1 earnings missed analyst expectations.

- Bharat Dynamics saw heavy volume-led losses post-dividend and weak guidance.

- Stocks like Garden Reach and Raymond Lifestyle gave up some recent gains due to profit booking.

These stock moves highlight how sector rotation, corporate announcements, and technical levels continue to shape price action each week.

Why Did the Market Fall This Week? Key Triggers Behind the Dip

This weekly stock market update for July 14–18, 2025, reflects a cocktail of domestic and global pressures that weighed on Indian equities. While broader indices like smallcaps showed resilience, the benchmark indices faced selling pressure across most sessions. Here are the key reasons behind this week’s market decline:

1. Heavy FII Selling: Over ₹10,000 Cr Pulled Out in 5 Days

Foreign Institutional Investors (FIIs) turned net sellers, offloading over ₹10,000 crore worth of Indian equities between July 14–18. In fact, total FPI outflows in July so far have crossed ₹17,330 crore, marking a major reversal from the inflows seen in May and June. This persistent selling was one of the strongest bearish triggers this week.

2. Weak Earnings & Sectoral Drag

The Q1 earnings season has kicked off on a disappointing note. Notably:

- Axis Bank dropped over 5% on July 18 after missing earnings estimates, dragging down financials.

- IT majors, including TCS and others, have reported lackluster numbers, further dampening sentiment.

This weakness in key heavyweight sectors like financials and IT significantly contributed to the fall in indices.

3. Global Uncertainty: Mixed Fed Signals & Rising Oil Prices

Investors remain cautious amid:

- Conflicting signals from the US Federal Reserve, including policy confusion and rumors of leadership changes.

- Sticky US inflation data and a delay in rate-cut expectations, leading to global risk-off sentiment.

- Crude oil prices rose due to geopolitical tensions in the Middle East, heightening concerns around input costs for Indian companies.

4. Citi Downgrade: “Overweight” to “Neutral”

Adding to the negative sentiment, Citibank downgraded Indian equities from “overweight” to “neutral” on July 18, citing stretched valuations and muted earnings growth. This shift in institutional sentiment further dampened investor confidence.

5. SEBI’s Jane Street Ban: Liquidity Drain in Derivatives

SEBI’s ban on US-based HFT firm Jane Street (July 4) led to a massive 36% drop in weekly index options turnover. The resulting liquidity crunch in the derivatives market reduced volatility and price discovery, indirectly weakening market momentum.

6. Trade Tensions: US Tariff Threats & India’s Response

President Trump’s renewed threats to impose tariffs on the EU and Mexico, combined with ongoing uncertainty around the India-US trade deal, created a tense global trade environment. India’s counter-tariff proposals added to investor caution domestically.

7. Stretched Valuations & Profit Booking

With the Nifty trading above its two-year average P/E ratio, many investors opted to book profits, especially in frontline stocks where valuations appear unsustainable without strong earnings backing.

In essence, this weekly stock market update underscores how a mix of weak earnings, foreign outflows, global tensions, and valuation concerns led to market weakness. As we move into the next week, all eyes will be on key earnings releases and macroeconomic data for further direction.

Economic Calendar & Dividend Tracker: Key Events to Watch Next Week

As part of this weekly stock market update, here’s a look at the key macroeconomic indicators and corporate dividend announcements investors should keep an eye on in the coming days. These events could provide cues for the next leg of market movement.

Key Economic Data (July 21–26, 2025)

| Date | Event | Previous | Forecast/Notes |

|---|---|---|---|

| July 21 | Infrastructure Output YoY | 0.7% | Moderate trend expected |

| July 23 | M3 Money Supply YoY | 9.6% | Watch for liquidity signals |

| July 24 | HSBC PMI Flash (Composite) | 61.0 | Remains in expansion zone |

| HSBC Manufacturing PMI Flash | 58.4 | Strong factory growth | |

| HSBC Services PMI Flash | 60.4 | Strong demand seen | |

| July 25 | Foreign Exchange Reserves | — | Weekly update awaited |

Takeaway: Robust PMI numbers are expected to signal economic resilience, especially in services and manufacturing. However, infrastructure output and money supply will be crucial to understanding demand trends and liquidity flow.

Upcoming Dividend Announcements

Several high-profile and mid-tier companies are distributing dividends this week. Here’s a snapshot of some key payouts:

Monday, July 21

| Company | Dividend (₹) | Yield (%) | Payout Date |

|---|---|---|---|

| SHREE CEMENT LTD | 60.00 | 0.36% | August 5, 2025 |

| THANGAMAYIL JEWELLERY LTD | 12.50 | 0.00% | August 27, 2025 |

| WINDLAS BIOTECH LTD | 5.80 | 2.62% | August 27, 2025 |

| ORIENT BELL LTD | 1.50 | 1.06% | August 28, 2025 |

Tuesday, July 22

| Company | Dividend (₹) | Yield (%) | Payout Date |

|---|---|---|---|

| VOLTAMP TRANSFORMERS LTD | 100.00 | 1.04% | August 28, 2025 |

| SIYARAM SILK MILLS LTD | 5.00 | 3.06% | September 1, 2025 |

| STRIDES PHARMA SCIENCE LTD | 4.00 | 0.45% | September 6, 2025 |

| HAPPY FORGINGS LTD | 3.00 | 0.32% | August 28, 2025 |

Wednesday, July 23

| Company | Dividend (₹) | Yield (%) | Payout Date |

|---|---|---|---|

| ADITYA BIRLA SUN LIFE AMC LTD | 24.00 | 1.59% | August 29, 2025 |

| ADVANCED ENZYME TECHNOLOGIES LTD | 1.20 | 2.78% | August 29, 2025 |

| BANSWARA SYNTEX LTD | 1.00 | 0.69% | August 28, 2025 |

Dividend Outlook: Several mid-cap names are offering strong yields, which could attract yield-hunting investors. SHREECEM and VOLTAMP stand out with high absolute payouts.

Conclusion: A Mixed Week with Pockets of Strength — What’s Next?

This weekly stock market update captures a week where volatility ruled Dalal Street. While the Nifty and Sensex cooled off from recent highs, the resilience in smallcaps and the strength in sectors like media, FMCG, and pharma offered pockets of optimism.

Heavy FII outflows, weak Q1 earnings, and mixed global signals weighed heavily on market sentiment. The underperformance of financials and IT only added to the pressure, especially with Axis Bank’s earnings disappointment. Meanwhile, global concerns — including rising oil prices and Fed policy uncertainty — have added to the cautious stance among institutional investors.

However, strong PMI data and robust dividend declarations point to continued domestic demand and corporate strength in selective pockets.

What to Watch Next Week:

- Key Q1 earnings, especially from heavyweights in BFSI and Auto

- Trend in FII flows — will selling continue or reverse?

- Global cues, particularly from the US Fed and oil markets

In short, the market may remain range-bound with a negative bias unless earnings surprises or a reversal in foreign fund flows spark momentum. For investors, it may be a good time to stay stock-specific and focus on quality names with earnings visibility.

FAQs: Weekly Stock Market Update

Q1. Why did the Indian stock market fall this week (July 14–18, 2025)?

The market fell due to FII selling, weak Q1 earnings (especially in banking and IT), and global uncertainties like rising oil prices and Fed policy confusion.

Q2. Which sectors performed best this week in the Indian stock market?

Top-performing sectors included Media (+8.67%), FMCG (+2.17%), and Pharma (+2.69%).

Q3. Who were the top stock gainers this week?

Anand Rathi Wealth, Neuland Labs, Glenmark Pharma, and Patanjali Foods led the gainers’ list.

Q4. Which stocks declined the most this week?

Valor Estate, Newgen Software, and Bharat Dynamics were among the top losers.

Q5. What key data should investors watch next week?

Watch out for PMI numbers, infrastructure output, foreign exchange reserves, and upcoming Q1 earnings reports.

Related Articles

Ongoing and Upcoming IPO Details, Review and Best Strategy

Patanjali Foods Bonus Issue 2025: Sweet Deal or Temporary Hype?

HDFC Bank Bonus Issue: Is This the Right Time to Enter the Stock?