VMS TMT IPO: Can This Steel Player Forge Strong Returns for Investors?

The much-awaited VMS TMT IPO is opening for subscription from September 17 to September 19, 2025, with a fresh issue worth ₹148.50 crore. The company is a Gujarat-based manufacturer of Thermo Mechanically Treated (TMT) bars, along with scrap and binding wires, catering mainly to Tier II and Tier III cities through a strong distribution network of 227 dealers.

One of the highlights is its brand association with Kamdhenu NXT, which gives it a trusted name in the steel segment. Priced at ₹94–₹99 per share, the issue requires a minimum retail investment of just ₹14,850, while post-issue market capitalization is expected to touch nearly ₹491 crore.

With rising infrastructure demand and a focus on debt repayment, the VMS IPO is drawing investor attention. But the real question is—does this IPO have the strength to deliver long-term value, or will it face heat from industry giants? Let’s dive deep in this VMS TMT IPO analysis to find out.

VMS TMT IPO Details

VMS TMT IPO Snapshot

Here’s a quick snapshot of the VMS TMT IPO for investors:

| Particulars | Details |

|---|---|

| IPO Date | September 17, 2025 to September 19, 2025 |

| Listing Date | September 24, 2025 (Tentative) |

| Face Value | ₹10 per share |

| Price Band | ₹94 to ₹99 per share |

| Lot Size | 150 Shares |

| Total Issue Size | 1.50 crore shares (₹148.50 Cr) |

| Issue Type | Book Building Issue (Fresh Issue only) |

| Listing At | BSE, NSE |

| Pre-Issue Shareholding | 3,46,31,210 shares |

| Post-Issue Shareholding | 4,96,31,210 shares |

| Lead Manager | Arihant Capital Markets Ltd. |

| Registrar | Kfin Technologies Ltd. |

| IPO Document | RHP File |

This makes the VMS IPO a mid-sized issue with potential attraction for both retail and institutional investors.

VMS TMT IPO Important Dates (Tentative)

| Event | Date |

|---|---|

| IPO Open Date | September 17, 2025 (Wednesday) |

| IPO Close Date | September 19, 2025 (Friday) |

| Basis of Allotment | September 22, 2025 (Monday) |

| Initiation of Refunds | September 23, 2025 (Tuesday) |

| Credit of Shares to Demat | September 23, 2025 (Tuesday) |

| Listing Date | September 24, 2025 (Wednesday) |

| UPI Mandate Confirmation Cut-off | September 19, 2025 (5 PM) |

The IPO has a short but sharp window, so investors should be ready with UPI mandates and funding before closing day.

Objects of the Issue

The net proceeds from the VMS TMT IPO will be utilized towards:

- Repayment/Prepayment of Borrowings – ₹115 crore will be used to reduce debt burden, strengthening the balance sheet.

- General Corporate Purposes – To meet working capital requirements and business expansion.

The debt-reduction plan stands out as the key highlight, which may enhance profitability ratios in the long run.

Company Overview & Business Model – VMS TMT Ltd.

Founded in 2013, VMS TMT Ltd. is a steel manufacturing company engaged in producing high-strength Thermo Mechanically Treated Bars (TMT Bars) — a critical material for India’s booming construction and infrastructure industry. Known for their exceptional strength, ductility, and corrosion resistance, TMT Bars manufactured by the company are used extensively in residential, commercial, and industrial construction projects.

Manufacturing Backbone

The company operates its manufacturing facility at Bhayla Village, Ahmedabad (Gujarat) with an installed annual capacity of 200,000 MT of TMT Bars. In FY2025, the company completed a backward integration of its Continuous Casting Machine (CCM) division, allowing it to produce TMT Bars directly from scrap instead of relying heavily on billets. This has lowered procurement dependency, reduced costs, and enhanced supply-chain efficiency.

The facility uses advanced furnaces, rolling mills, and reheating technology to produce TMT Bars, while also manufacturing billets, scrap, and binding wires as secondary revenue streams.

Revenue Mix & Geographic Focus

VMS TMT’s business is predominantly Gujarat-centric, with over 96% of revenues in FY2025 derived from this region (excluding Saurashtra & Kutch). Within Gujarat, the company has developed a stronghold in Tier II and Tier III cities, tapping into the growing demand for housing and infrastructure development.

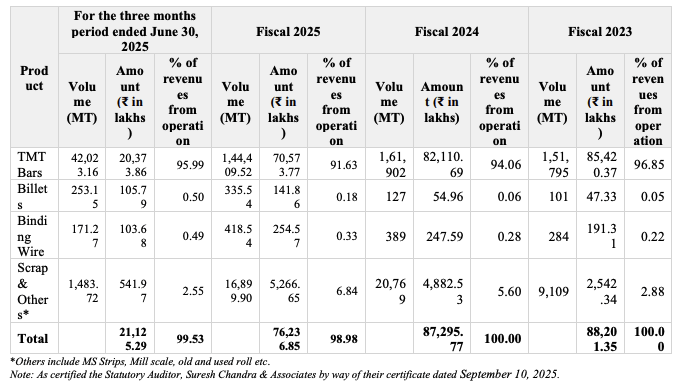

The product mix is heavily skewed towards TMT Bars, which contribute over 90% of revenues. Secondary products such as billets, binding wires, and scrap account for less than 10% but help diversify revenue.

Sales Channels & Distribution Network

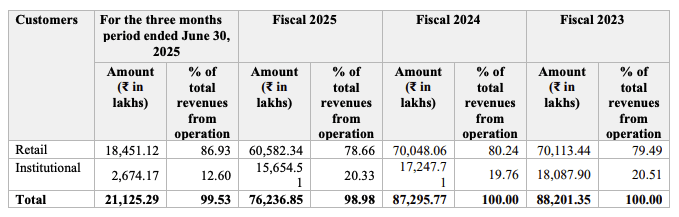

The company sells its products through both retail and institutional channels, with retail sales forming ~79% of FY2025 revenues. VMS TMT has a non-exclusive retail license agreement with Kamdhenu Limited, enabling it to market products under the popular Kamdhenu NXT brand across Gujarat (excluding Saurashtra & Kutch).

To strengthen its reach, the company leverages a distribution network of 3 distributors and 227 dealers (as of July 2025), supported by a fleet of 50+ trucks through third-party logistics partners, ensuring doorstep delivery to customers.

Strategic Partnerships & Expansion

- Kamdhenu Branding Agreement – enhances brand visibility and acceptance in a competitive market.

- MoU with Aditya Ultra Steel Ltd. – clearly divides operational territories within Gujarat, avoiding overlap and fostering focused market penetration.

- Solar Power Plant Initiative – a 15 MW solar project (in partnership with Prozeal Green Energy) is being set up to reduce power costs and support sustainable operations.

Leadership & Workforce

The company is led by its promoters Varun Manojkumar Jain, Rishabh Sunil Singhi, Manojkumar Jain, and Sangeeta Jain, who collectively bring over three decades of experience in the steel industry. Backed by 230 permanent employees and an experienced management team, VMS TMT has built operational resilience and scalability.

👉 In summary, VMS TMT Ltd. has transformed itself from a Gujarat-focused TMT manufacturer into a backward-integrated, brand-supported, and distribution-driven steel player. Its strong retail presence, Kamdhenu branding, and sustainability initiatives position it as a niche player in the mid-sized steel manufacturing segment.

Financial Performance of VMS TMT Ltd.

A closer look at the financials provides deeper insights into the fundamentals behind the VMS TMT IPO. The company has shown consistent growth in profitability, despite some fluctuations in revenue.

Financial Summary (₹ in Crores)

| Period Ended | Assets | Total Income | EBITDA | Profit After Tax | Net Worth | Reserves & Surplus | Total Borrowing |

|---|---|---|---|---|---|---|---|

| 30 Jun 2025 | 449.35 | 213.39 | 19.48 | 8.58 | 81.77 | 47.14 | 309.18 |

| 31 Mar 2025 | 412.06 | 771.41 | 45.53 | 15.42 | 73.19 | 38.56 | 275.72 |

| 31 Mar 2024 | 284.23 | 873.17 | 41.20 | 13.47 | 46.51 | 33.18 | 197.86 |

| 31 Mar 2023 | 227.28 | 882.06 | 21.91 | 4.20 | 30.84 | 18.23 | 162.70 |

Key Takeaways:

- Revenue Decline: Total income fell 12% YoY from ₹873.17 Cr in FY2024 to ₹771.41 Cr in FY2025.

- Profit Growth: Despite lower revenue, PAT increased 14% YoY to ₹15.42 Cr in FY2025, reflecting better operational efficiency.

- Balance Sheet Expansion: Assets rose from ₹227.28 Cr in FY2023 to ₹412.06 Cr in FY2025, driven by capacity expansion and backward integration.

- Debt Dependency: Borrowings climbed steadily to ₹275.72 Cr in FY2025, reflecting a debt-heavy growth model.

Key Performance Indicators (KPI)

Based on the IPO pricing, the market capitalization of VMS TMT IPO stands at ₹491.35 Cr, placing it in the small-cap segment.

| KPI | Value | Insight |

|---|---|---|

| ROCE | 12.79% | Indicates moderate efficiency in deploying capital. |

| Debt/Equity | 6.06 | A high leverage ratio, signaling significant reliance on debt. |

| RoNW | 20.14% | Strong return on net worth, showing good shareholder value creation. |

| PAT Margin | 1.91% | Low margins, typical of the steel sector. |

| EBITDA Margin | 5.91% | Improved efficiency, supported by backward integration. |

Overall, the VMS IPO presents a story of moderate revenue pressure but improving profitability, supported by backward integration and operational efficiency. However, its high debt levels remain a key point of caution for investors analyzing the company’s financial health.

VMS TMT IPO Valuation & Peer Comparison

When it comes to investing in IPOs, valuation is often the most decisive factor. The VMS TMT IPO pricing suggests a relatively balanced entry point compared to peers, though some financial ratios highlight both opportunities and risks.

Valuation Metrics

| Particulars | Pre-IPO | Post-IPO |

|---|---|---|

| EPS (₹) | 4.45 | 6.91 |

| P/E (x) | 22.24 | 14.32 |

| Price to Book Value | 7.43 | – |

Insights:

- At the upper price band, the P/E ratio post-issue is 14.32x, which places the VMS IPO in line with other small-cap steel manufacturers.

- The Price-to-Book Value (P/BV) of 7.43x looks stretched compared to peers, signaling that the stock is priced at a premium to its book value.

- EPS expansion post-IPO indicates improved earnings leverage, but actual performance will depend on debt reduction and margin stability.

Peer Comparison (as of March 31, 2025)

| Company Name | EPS (Basic) | EPS (Diluted) | NAV (₹/share) | P/E (x) | RoNW (%) | P/BV Ratio | Financials |

|---|---|---|---|---|---|---|---|

| VMS TMT | 4.29 | 4.29 | 13.32 | 22.24 | 20.14 | 7.43 | Standalone |

| Kamdhenu | 2.18 | 2.18 | 11.66 | 13.50 | 18.82 | 2.64 | Standalone |

| Vraj Iron & Steel | 13.55 | 13.55 | 116.53 | 11.77 | 10.88 | 1.37 | Standalone |

| BMW Industries | 2.83 | 2.83 | 30.84 | 16.57 | 9.16 | 1.53 | Standalone |

| Electrotherm (India) | 336.42 | 336.42 | -89.01 | 2.37 | -377.85 | -8.96 | Standalone |

Analytical View

- Compared to Kamdhenu and BMW Industries, the VMS TMT IPO offers a stronger RoNW of 20.14%, reflecting better shareholder return efficiency.

- However, the P/BV ratio of 7.43x makes the VMS IPO look expensive relative to peers like Vraj Iron & Steel (1.37x) and Kamdhenu (2.64x).

- Valuation comfort lies in post-IPO EPS growth, but much will depend on execution of backward integration strategies and debt management.

In summary, the VMS TMT IPO stands out with higher return ratios but trades at a premium compared to established listed peers. For investors, this makes it a growth-driven but valuation-sensitive bet.

Strengths & Risks of VMS TMT IPO

| Strengths | Risks |

|---|---|

| Established manufacturing capacity – Strong presence in TMT bar segment with a strategically located plant in Gujarat. | High debt levels – Debt/Equity ratio of 6.06 indicates leverage risk despite planned repayments. |

| Strong distribution network – 3 distributors & 227 dealers across Gujarat and beyond. | Geographic concentration – Over 98% of revenue comes from Gujarat, limiting diversification. |

| Retail license with Kamdhenu Limited – Ability to market premium “Kamdhenu NXT” brand. | Cyclicality of steel industry – Prices of raw materials and finished goods are highly volatile. |

| Growing profitability – PAT grew 14% YoY in FY25 despite revenue decline. | Low PAT margins – PAT margin stands at just 1.91%, leaving less cushion in downturns. |

| Experienced promoters & workforce – 230+ permanent employees and proven leadership. | Valuation premium – P/BV of 7.43x makes the IPO expensive versus peers. |

This balanced view helps investors weigh whether the VMS TMT IPO is an attractive bet for long-term growth or carries higher-than-average risk due to leverage and concentration.

VMS TMT IPO GMP Today (VMS IPO GMP)

As of now, the Grey Market Premium (GMP) for VMS TMT IPO has not started yet. This means there is no unofficial premium being quoted in the market before listing. Investors are closely watching upcoming subscription numbers and market mood, which usually drive GMP trends.

Here’s the day-wise GMP update table:

| GMP Date | IPO Price | GMP | Estimated Listing Price | Estimated Profit* |

|---|---|---|---|---|

| 12-09-2025 | ₹99.00 | ₹10 | ₹109 (10.10%) | ₹1500 |

*Estimated profit is based on current GMP trends and may change as subscription and market sentiment evolve.

Since GMP is very low, investors should focus on fundamentals, peer comparison, and subscription status before deciding on applying.

Conclusion – View on VMS TMT IPO

The VMS TMT IPO presents a mix of strong growth potential and notable risks. On the positive side, the company has a dominant presence in Gujarat, consistent revenue from retail and institutional customers, and a backward integration that reduces raw material dependency. Financially, it has shown stable profitability with rising PAT and decent RoNW of 20.14%. At a post-IPO P/E of 14.32x, the valuation looks reasonable compared to peers in the steel and allied industries.

However, risks like high debt-equity (6.06), reliance on a concentrated geography (mainly Gujarat), and cyclical steel industry dynamics cannot be ignored. For investors, this IPO is more suitable for those with a balanced appetite for risk and an eye on medium-to-long term growth.

Short-term Strategy

- Given the GMP is currently flat (₹10), there may not be immediate listing gains.

- Short-term investors should monitor subscription numbers (especially QIB demand). If demand builds strongly in later days, it could offer modest listing upside.

- Conservative traders may choose to skip purely for listing gains unless market mood turns bullish.

Long-term Strategy

- For long-term investors, VMS TMT’s focus on backward integration, capacity expansion (200,000 MT), and renewable energy plans provide a strong growth runway.

- Its leadership team with 3+ decades in steel and established dealer-distributor network support sustainable operations.

- The steel sector is cyclical, but with India’s infrastructure and construction boom, VMS could benefit over the next 3–5 years.

Allotment Strategy

- Retail investors may apply with a moderate approach (1–2 lots) if looking at fundamentals rather than short-term GMP play.

- HNI and long-term investors can consider a larger exposure if subscription builds strongly in QIB and HNI categories.

- Conservative investors may adopt a wait-and-watch stance until GMP and demand visibility improve.

Final Takeaway: VMS TMT IPO looks fairly valued with strong fundamentals, but investors must balance its growth potential against sector cyclicality and high leverage before deciding.

VMS TMT IPO – FAQs

What is the VMS TMT IPO?

VMS TMT IPO is a fresh issue of ₹148.50 crore through the book-building process, offering 1.50 crore shares to the public.

When does the VMS TMT IPO open and close?

The IPO opens on September 17, 2025, and closes on September 19, 2025.

What is the price band of the VMS TMT IPO?

The price band is ₹94 to ₹99 per share.

What is the lot size for the VMS TMT IPO?

The minimum lot size is 150 shares, requiring a minimum retail investment of ₹14,850 at the upper price band.

Which exchanges will the VMS TMT IPO be listed on?

The shares will list on BSE and NSE with a tentative listing date of September 24, 2025.

Who are the book running lead managers and registrar?

Arihant Capital Markets Ltd. is the book running lead manager, and Kfin Technologies Ltd. is the registrar.

What is the allotment date for the VMS TMT IPO?

The allotment is expected to be finalized on September 22, 2025, with shares credited to demat accounts on September 23, 2025.

What is the minimum and maximum investment for retail investors?

- Minimum: ₹14,850 (1 lot)

- Maximum: ₹1,93,050 (13 lots)

Is this a fresh issue or offer for sale?

It is a fresh issue, raising capital for the company’s repayment of borrowings and general corporate purposes.

Can I apply as a retail or HNI investor?

Yes, the IPO is open to retail investors, sophisticated HNIs, and qualified institutional buyers (QIBs) as per the prescribed quota.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?