Introduction – Vikram Solar IPO

Vikram Solar Limited, one of India’s top solar PV module makers, is launching its ₹2,079.37 crore Initial Public Offering (IPO). The issue includes a fresh issue of 4.52 crore shares worth ₹1,500 crore and an Offer for Sale of 1.75 crore shares worth ₹579.37 crore.

The IPO will open for subscription on August 19, 2025 and close on August 21, 2025. Shares will list on BSE and NSE, with a tentative listing date of August 26, 2025. The price band is set between ₹315 – ₹332 per share. Investors can bid for a minimum lot of 45 shares.

Vikram Solar has shown steady revenue growth and serves a wide range of customers. The company specializes in high-efficiency solar modules, a fast-growing segment in the clean energy market. In this blog, we will explore the Vikram Solar IPO in detail, covering key facts, financials, valuations, GMP, and strategies for investors.

Vikram Solar IPO Details

Vikram Solar Limited is set to raise ₹2,079.37 crore through its upcoming IPO. The issue is a mix of a fresh equity raise and an offer for sale by existing shareholders.

| IPO Details | Information |

|---|---|

| IPO Opening Date | August 19, 2025 |

| IPO Closing Date | August 21, 2025 |

| Listing Date (Tentative) | August 26, 2025 |

| Face Value | ₹10 per share |

| Price Band | ₹315 – ₹332 per share |

| Lot Size | 45 shares |

| Issue Size | ₹2,079.37 crore |

| Fresh Issue | ₹1,500 crore |

| Offer for Sale | ₹579.37 crore |

| Listing Exchange | BSE, NSE |

| QIB Quota | 50% |

| NII Quota | 15% |

| Retail Quota | 35% |

Vikram Solar IPO Important Dates

| Event | Date |

|---|---|

| IPO Opening Date | August 19, 2025 |

| IPO Closing Date | August 21, 2025 |

| Basis of Allotment | August 22, 2025 |

| Initiation of Refunds | August 25, 2025 |

| Credit of Shares to Demat | August 25, 2025 |

| Listing Date | August 26, 2025 |

Vikram Solar IPO Objectives (as per RHP)

| Objects of the Issue | Amount (₹ crore) |

|---|---|

| Partial funding of capital expenditure for the Phase-I Project | 769.73 |

| Funding of capital expenditure for the Phase-II Project | 595.21 |

| General Corporate Purposes | Balance of net proceeds |

Note: The RHP specifies amounts for Items 1 and 2. Item 3 (General Corporate Purposes) will utilize the remaining net proceeds; the exact figure isn’t separately disclosed in your data.

About Vikram Solar Ltd.

Vikram Solar Limited, incorporated in 2005, is one of India’s largest solar photovoltaic (PV) module manufacturers. With over 17 years of experience, the company has established itself as a leader in high-efficiency solar solutions (Source: CRISIL Report). As of March 31, 2025, Vikram Solar has an installed manufacturing capacity of 4.50 GW and is one of the largest pure-play module manufacturers in India. Its capacity, as per the Ministry of New & Renewable Energy’s Approved List of Modules and Manufacturers (ALMM), stands at 2.85 GW as of June 30, 2025 (Source: CRISIL Report).

The company has gained international recognition, featuring in BloombergNEF Tier 1 manufacturer lists since CY 2014 and most recently in Q1 2025. In May 2025, Vikram Solar received the prestigious EUPD Top Brand PV Seal, reflecting its commitment to delivering reliable, high-efficiency solar products.

Manufacturing Footprint and Expansion Plans

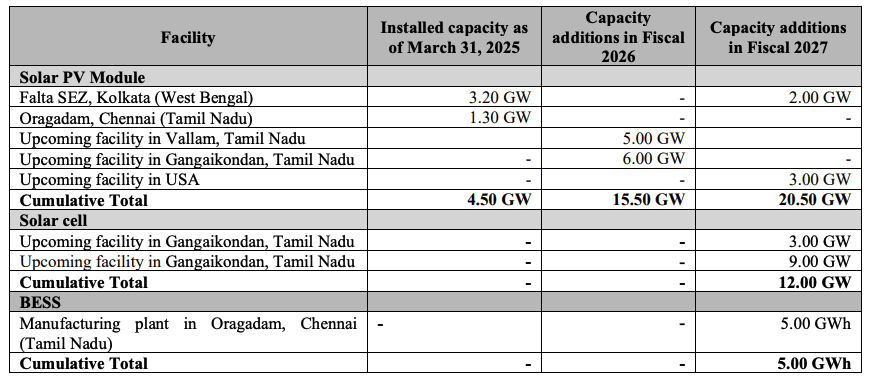

Vikram Solar commenced manufacturing operations in 2009 with an installed capacity of 12 MW, which has now grown to 4.50 GW. Its key facilities are located at:

- Falta SEZ, Kolkata, West Bengal – 3.20 GW

- Oragadam, Chennai, Tamil Nadu – 1.30 GW

To meet rising demand, the company is undertaking greenfield and brownfield expansions, aiming to achieve:

- 15.50 GW by FY 2026

- 20.50 GW by FY 2027

Additionally, Vikram Solar is strategically backward-integrating into solar cell manufacturing with facilities in Gangaikondan, Tamil Nadu, with a total of 12 GW planned by FY 2027. The company also plans to enter the Battery Energy Storage System (BESS) market with a greenfield plant in Tamil Nadu, initially 1 GWh, expandable to 5 GWh by FY 2027.

Engineering Capabilities and Product Quality

Vikram Solar has developed strong engineering capabilities to design highly automated production lines. This has improved product efficiency from 17.52% in CY 2016 to 23.66% in CY 2025. The company was the first Indian firm featured in Kiwa PVEL reports in 2017 and has been recognized as a ‘Top Performer’ in reliability testing across multiple metrics for seven consecutive years (Source: CRISIL Report).

The company has also executed pioneering solar projects in India, including:

- The world’s first fully solarized airport at Cochin International Airport (2013)

- One of India’s first floating solar plants

Sales, Distribution, and Client Base

Vikram Solar serves multiple business divisions, including:

- Domestic Solar PV Module Sales – Direct orders from key accounts (10 MW – 500 MW+) and via distributors for smaller retail orders

- Export Sales – Supplying global key customer accounts

- Integrated Solar Solutions – EPC and O&M services for solar power projects

The company has a pan-India presence in 19 states and 2 union territories through:

- 83 authorized distributors

- 250+ dealers

- 67 system integrators

Key domestic clients include NTPC, Neyveli Lignite Corporation, Gujarat Industries Power Company, ACME Cleantech, Adani Green Energy, Azure Power, and JSW Energy. Internationally, Vikram Solar has supplied solar PV modules to 39 countries, including marquee clients such as PureSky Development Inc and Sundog Solar LLC, with over 7.12 GW shipped globally since inception (Source: CRISIL Report).

Global Solar Market Outlook

The global installed solar PV capacity reached 1,859 GW in CY 2024, with 452 GW added in CY 2024 alone, reflecting a 32% YoY growth. India’s solar capacity is projected to increase by 150–170 GW between FY 2026–2030, with robust government support and growing electricity demand linked to GDP growth of 6.2% in FY 2026 and 6.3% in FY 2027 (Source: CRISIL Report).

Financials and Key Ratios of Vikram Solar IPO

Vikram Solar Ltd. has displayed impressive financial growth over recent years. Between FY 2024 and FY 2025, the company’s revenue surged by 37%, while profit after tax (PAT) jumped by 75%, reflecting operational efficiency and growing demand for solar PV modules.

Key Financials

| Metric | FY 2025 | FY 2024 | FY 2023 | Unit |

|---|---|---|---|---|

| Assets | 2,832.15 | 2,585.50 | 2,476.29 | ₹ Crore |

| Total Income | 3,459.53 | 2,523.96 | 2,091.91 | ₹ Crore |

| EBITDA | 492.01 | 398.58 | 186.18 | ₹ Crore |

| EBITDA Margin | 14.37% | 15.87% | 8.98% | % |

| Profit After Tax (PAT) | 139.83 | 79.72 | 14.49 | ₹ Crore |

| PAT Margin | 4.08% | 3.17% | 0.70% | % |

| Net Worth / Total Equity | 12,419.89 | 4,454.17 | 3,651.95 | ₹ Crore |

| Reserves & Surplus | 932.60 | 192.16 | 113.07 | ₹ Crore |

| Net Debt | 4.17 | 69.26 | 63.35 | ₹ Crore |

| Debt/Equity Ratio | 0.19 | 1.81 | 2.02 | Times |

| EPS (Basic) | 4.61 | 3.08 | 0.56 | ₹ per share |

| Return on Equity (ROE) | 16.57% | 19.67% | 4.05% | % |

| Return on Capital Employed (ROCE) | 24.49% | 20.76% | 12.78% | % |

| Current Ratio | 1.55 | 1.39 | 1.35 | Times |

Note: Net debt is converted from ₹ Million to ₹ Crore (divide by 100).

Operational KPIs

Vikram Solar’s operational metrics highlight its growing manufacturing and sales scale:

| Metric | FY 2025 | FY 2024 | FY 2023 | Unit |

|---|---|---|---|---|

| Total Rated Capacity | 4,500 | 3,500 | 3,500 | MW |

| Module Sales | 1,900.03 | 879.20 | 588.13 | MW |

| Total Order Book Quantity | 10,340.82 | 4,376.16 | 2,786.87 | MW |

| Revenue from Operations | 3,423.45 | 2,510.99 | 2,073.23 | ₹ Crore |

| EBITDA | 492.01 | 398.58 | 186.18 | ₹ Crore |

| PAT | 139.83 | 79.72 | 14.49 | ₹ Crore |

Analysis

- Returns: ROCE of 24.49% demonstrates effective utilization of capital for growth projects.

- Revenue Growth: A 37% increase highlights strong demand for solar PV modules and EPC services.

- Profitability: PAT margin improved to 4.08% in FY 2025, showing better cost efficiency despite expansion plans.

- Debt Management: Debt-equity ratio reduced to 0.19, reflecting stronger financial stability.

- Operational Scale: Module sales more than doubled from 879 MW in FY 2024 to 1,900 MW in FY 2025, backed by a robust order book of over 10 GW.

Valuation and Peers Comparison of Vikram Solar IPO

Vikram Solar’s IPO valuation is positioned based on its earnings, book value, and peer comparison. The company’s Price to Book Value (P/BV) stands at 8.46, while the Post-IPO EPS is ₹3.87, resulting in a Post-IPO P/E of 85.88x.

| Metric | Pre IPO | Post IPO |

|---|---|---|

| EPS (₹) | 4.42 | 3.87 |

| P/E (x) | 75.16 | 85.88 |

| Price to Book Value | 8.46 | 8.46 |

Peer Comparison

| Company Name | EPS (Basic) | NAV per share (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|

| Vikram Solar Ltd. | 4.61 | 39.24 | 85.88 | 11.26 | 8.46 |

| Waaree Energies Limited | 68.24 | 334.00 | 45.79 | 20.09 | 9.32 |

| Premier Energies Limited | 21.35 | 62.61 | 47.01 | 33.21 | 16.18 |

| Websol Energy System Limited | 36.66 | 65.88 | 40.04 | 55.65 | 22.28 |

Analysis

- Vikram Solar’s pre-listing P/E of 85.88x reflects a premium valuation, justified by its strong growth potential, expanding manufacturing capacity, and Tier-1 reputation in the solar PV sector.

- Its P/BV of 8.46 is comparable to Waaree Energies, but lower than Premier Energies and Websol, indicating moderate investor valuation relative to net asset value.

- RoNW of 11.26% shows improving profitability, leaving room for growth as new capacities and projects come online.

Vikram Solar IPO GMP (Grey Market Premium)

The Vikram Solar IPO is generating strong interest in the grey market, reflecting investor sentiment before listing.

| GMP Date | IPO Price (₹) | GMP (₹) | Estimated Listing Price (₹) | Estimated Profit* (₹) |

|---|---|---|---|---|

| 18-08-2025 | 332.00 | 52 | ₹384 (15.66%) | ₹2340 |

The current GMP of ₹52 suggests a positive sentiment, implying the stock may list at a premium. Based on the grey market, the estimated listing price is ₹384, potentially giving a profit of 15.66% (₹2,340) for investors applying at the upper end of the IPO price band.

Conclusion & Investment Review

Vikram Solar IPO brings an opportunity to invest in one of India’s leading solar PV module manufacturers, backed by 17+ years of experience, a strong domestic and international presence, and a rapidly expanding manufacturing capacity. Here’s a detailed review of the IPO for potential investors:

Short-Term Strategy

For investors looking for short-term listing gains, the IPO looks attractive. With an IPO price band of ₹315–₹332 and a current GMP of ₹59, the estimated listing price of around ₹391 suggests a potential 17–18% gain on listing. While these numbers indicate an immediate profit opportunity, investors should remain cautious of market volatility, sector trends, and global energy price fluctuations before committing large amounts.

Long-Term Strategy

From a long-term perspective, Vikram Solar offers a compelling growth story:

- Strategic expansions: The company plans to increase PV module capacity to 20.50 GW by FY27 and set up solar cell and BESS facilities, positioning it as a vertical-integrated solar player.

- Strong financial growth: Revenue jumped 37% and PAT surged 75% in FY25, reflecting operational efficiency and a healthy order book of 10.34 GW.

- Valuation perspective: With a P/B ratio of 8.46 and post-IPO EPS of ₹3.87, the stock trades at a post-issue P/E of 85.88, indicating a premium compared to peers but justified by growth potential, technological edge, and market leadership.

- Diversified revenue streams: Domestic sales, exports, and EPC/O&M services reduce dependency on a single segment and enhance resilience.

Long-term investors aiming for exposure to India’s clean energy transition could benefit from the company’s innovation, capacity expansions, and strategic positioning in the solar sector.

Allotment Strategy

- Retail investors: Apply for the maximum permissible lots within ₹2 lakh to increase chances of allocation.

- HNI investors: Spread applications across sNII and bNII categories to improve allotment probability.

- Employees & strategic investors: Leveraging employee quota can provide additional allocation if eligible.

Vikram Solar IPO is a blend of listing gains and long-term growth potential, offering investors an opportunity to participate in India’s solar energy revolution with a well-capitalized, technologically advanced, and expansion-driven company.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?