Introduction

Let’s be honest—the US-China Trade War has lasted longer than some celebrity marriages and has had more plot twists than a K-drama. What started as a “small disagreement over trade imbalances” has now evolved into an all-out tariff boxing match.

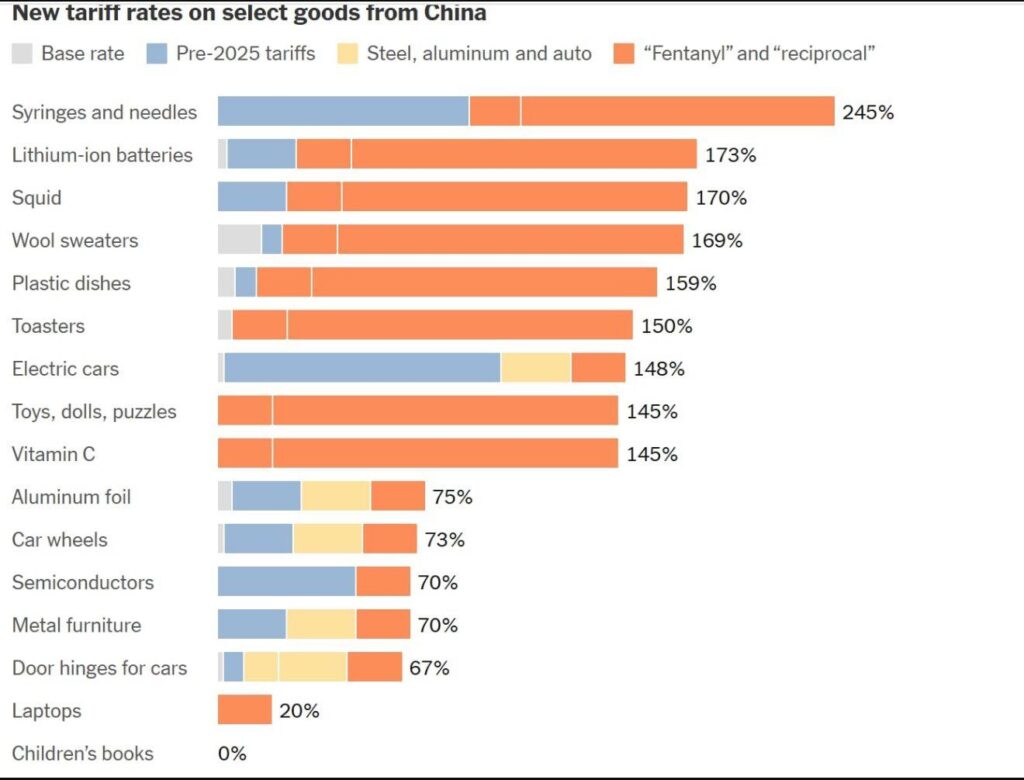

The latest? The US has slammed new tariffs—some as high as 245%—on Chinese imports. Syringes and needles? 245%. Electric cars? 148%. Even innocent items like squid and wool sweaters are caught in the crossfire.

But while these two economic giants throw tariff tantrums, guess who’s quietly getting ready to take their lunch money?

Yep, India.

And in this blog, we’re going to tell you how. But first, let’s rewind the drama a bit.

What’s Even Happening in the US-China Trade War?

In simple terms, the US-China Trade War is Uncle Sam and the Great Dragon playing economic chess since 2018. The US accused China of unfair trade practices, currency manipulation, and theft of intellectual property. China, naturally, hit back with tariffs of its own.

But in 2024 and now 2025, things escalated like a Bollywood family feud.

📈 According to the latest US tariff data, here are the new slapdowns:

- Syringes & needles: 245% (Yes, medical essentials!)

- Lithium-ion batteries: 173%

- Electric vehicles (EVs): 148%

- Plastic dishes, toasters, toys, squid, sweaters – all face tariffs of 145% to 170%

- Even laptops got hit with a 20% hike

The goal? Punish China for its alleged overcapacity, especially in green technologies like EVs and solar panels, and retaliate against its “fentanyl” exports and lack of market reciprocity.

The result? Chinese exports become very expensive for American consumers and businesses.

So… Where Does This War End?

Ah, the billion-dollar question.

The honest answer? Probably not anytime soon.

With US elections looming and both countries digging in their heels, this isn’t ending over green tea and dumplings. China’s manufacturing dominance is now being questioned. And the US? It’s looking for new partners, friendlier faces, and cheaper alternatives.

Which brings us to…

India: The Smart Third Kid in the Class

India’s sitting at the back of the classroom, quietly doing its homework, while the two class toppers fight over whose notes got stolen. The US-China Trade War is India’s golden chance to step up.

And here’s the twist — we’re not just speculating. There’s data and real shifts to back this up.

Let’s break it down by sectors.

🇮🇳 Sectors in India That Could Win Big

🚗 1. Electric Vehicles & Auto Components

Let’s start with the obvious: EVs. The US just slapped a 148% tariff on Chinese electric cars. That’s like turning a ₹10 lakh car into a ₹25 lakh one overnight.

Now, who’s waiting in the wings with booming EV potential?

India, baby.

- Tata Motors is ramping up EV output. In fact, they sold over 73,000 EVs in FY24, with plans to expand exports.

- Ola Electric is entering four-wheeler EVs by 2025.

- Bharat Forge and Sona Comstar are making high-end EV components ready for global markets.

This is India’s chance to go global with clean vehicles. Call it revenge for all the Maruti 800 jokes we endured in the 90s.

⚙️ 2. Auto Ancillaries & Engineering Goods

Tariffs on car wheels, metal furniture, hinges—basically everything you’d need to build a car or a robot—mean the US wants to move away from Chinese parts.

- Motherson Sumi and Bosch India can capture this vacuum.

- India’s exports of auto components already grew by 7% in FY24, and this will only accelerate.

Why import a Chinese hinge when you can get a ‘Made in Pune’ one with better chai?

⚡ 3. Electronics & Semiconductors

If China faces 70% tariffs on semiconductors and laptops, the US will have to look elsewhere.

- India’s PLI scheme for electronics is pulling in biggies like Foxconn and Micron.

- Vedanta and Tata Electronics are already investing in chip fabs in Gujarat and Tamil Nadu.

Imagine—India, not just the back office of the world, but the motherboard too.

💊 4. Pharma & Medical Devices

Let’s not ignore that syringes and needles are now taxed at a whopping 245%.

That’s not just a jab (pun intended)—it’s a business opportunity.

- India is the world’s largest vaccine supplier.

- Lupin, Cipla, and Biocon already export critical generics to the US.

- Sahajanand Medical Technologies and Poly Medicure can export low-cost, high-quality medical devices.

Bonus: We don’t overprice plastic dishes either. Yes, those too are now taxed at 159%.

🐟 5. Seafood & Agro Exports

You’d think seafood would stay out of international politics, right? Well, nope.

Thanks to the 170% tariff on squid and other seafood products from China, the US is fishing for new suppliers. And India? We’re already chilling on the dock, rods in hand.

Why India Wins:

- We’re the second-largest aquaculture producer globally

- Indian seafood is already a hit in the US (especially shrimp and prawns)

- Our processing facilities are expanding, and the government is throwing subsidies like confetti

Top Stocks to Watch:

- Avanti Feeds – India’s leading shrimp feed and prawn exporter

- Waterbase Ltd – Niche player in aquaculture and shrimp feed

- Coastal Corporation Ltd – Directly exports frozen seafood to the US and Europe

- Godrej Agrovet – Broader agri exposure including animal feed and aquaculture inputs

Pro Tip: These stocks may be low on glamour but high on global demand. After all, when you’re exporting dinner, the world pays attention.

But Wait, Can India Really Replace China?

Let’s get real. Replacing China is like replacing Ranveer Singh with a theatre kid—it’s gonna take time.

But partial replacement? That’s already happening.

- US imports from China fell 20% in 2023.

- India’s exports to the US rose 8.4%, especially in textiles, electronics, and pharma.

- India is negotiating multiple trade pacts (like INDIA-USA iCET) focused on semiconductors and AI.

So, Where Does It All End?

Honestly, it ends when both countries are too tired or too broke to continue. Until then, the US-China Trade War is India’s free business class upgrade. We just need to take the seat and serve up some masala chai with a side of EV batteries.

Final Thoughts: What Should Investors Watch?

🧐 If you’re an investor, keep your eyes on:

- EV stocks: Tata Motors, Sona Comstar

- Auto ancillaries: Motherson Sumi, Bosch India

- Electronics & chips: Dixon Tech, Tata Elxsi

- Pharma & Med-tech: Cipla, Poly Medicure

- Export-oriented seafood/agro players

The war may not be ours—but the opportunity sure is.

If you liked this take, don’t forget to open your Angel One demat account.

They offer fastest algo APIs, rock-bottom brokerage, and one-click investing in global winners.

👉 Open your account now and ride the trade war wave like a pro!

FAQs

What is the US-China Trade War?

It’s an ongoing economic conflict between the US and China involving heavy tariffs, trade restrictions, and supply chain shifts.

Why did the US-China Trade War start?

It began over trade deficits, unfair trade practices, and intellectual property concerns raised by the US.

What are the latest US tariffs on Chinese goods?

In 2025, the US imposed tariffs up to 245% on Chinese products like syringes, EVs, batteries, and semiconductors.

Is the US-China Trade War good for India?

Yes. As companies move away from China, India is becoming a preferred alternative for manufacturing and exports.

Which sectors in India benefit the most?

EVs, electronics, pharmaceuticals, seafood, textiles, and toys are top gainers from the US-China Trade War.

Can India replace China in global trade?

Not fully, but India is gradually capturing market share in high-potential sectors with global demand.

How does the US-China Trade War affect Indian investors?

It opens up opportunities in export-oriented stocks and sectors linked to global supply chains.

What companies benefit from the trade war in India?

Tata Motors, Dixon Technologies, Sun Pharma, Avanti Feeds, and Motherson Sumi are key beneficiaries.

Will the US-China Trade War end soon?

Unlikely. It has moved beyond trade to include tech rivalry and national security issues.

What should investors do now?

Focus on Indian companies with strong exports, US clients, and support from government incentives.

Related Articles

125% Tariff on China – Golden Opportunity for This Stocks