Introduction: Impact of Trump Tariffs Sends Shockwaves Through Global Trade

The impact of Trump tariffs is making waves across global markets. Former US President Donald Trump has launched a fresh round of tariffs on 20 countries, shaking up trade dynamics and sparking uncertainty.

Tariff rates range from 25% to 50%, with Brazil hit the hardest at 50%, and Brunei, Japan, Kazakhstan, Malaysia, Moldova, South Korea, and Tunisia facing the lowest rate of 25%. The affected sectors include textiles, auto parts, electronics, and steel, with global supply chains now under pressure.

For India, this disruption could open new doors. Countries like Bangladesh and Vietnam, which face 35% and 20% tariffs respectively, may lose market share in key sectors like garments and electronics. Indian exporters—less exposed to these tariffs—could step in as competitive alternatives.

This blog explores the impact of Trump tariffs on the Indian market:

- The full list of affected countries

- Sector-by-sector analysis of opportunities and risks

- Stocks that could benefit or be hurt

- And how Indian investors can position their portfolios

Trump’s tariff storm has returned—but this time, India might be better positioned to ride the wave.

The Full Hit List: 20 Countries Affected by US Tariffs

Trump’s latest tariff wave targets a diverse mix of 20 countries, from Asia to South America. The new tariff rates range from 25% to 50%, covering exports across textiles, automotive parts, electronics, metals, and more.

Here’s the complete breakdown of countries and their respective tariff rates:

| 🌍 Country | 📈 Tariff Rate |

|---|---|

| 🇧🇷 Brazil | 50% (Highest) |

| 🇲🇲 Myanmar | 40% |

| 🇱🇦 Laos | 40% |

| 🇰🇭 Cambodia | 36% |

| 🇹🇭 Thailand | 36% |

| 🇧🇩 Bangladesh | 35% |

| 🇷🇸 Serbia | 35% |

| 🇮🇩 Indonesia | 32% |

| 🇩🇿 Algeria | 30% |

| 🇧🇦 Bosnia & Herzegovina | 30% |

| 🇮🇶 Iraq | 30% |

| 🇱🇾 Libya | 30% |

| 🇿🇦 South Africa | 30% |

| 🇱🇰 Sri Lanka | 30% |

| 🇧🇳 Brunei | 25% (Lowest) |

| 🇯🇵 Japan | 25% (Lowest) |

| 🇲🇾 Malaysia | 25% (Lowest) |

| 🇰🇿 Kazakhstan | 25% (Lowest) |

| 🇲🇩 Moldova | 25% (Lowest) |

| 🇰🇷 South Korea | 25% (Lowest) |

| 🇹🇳 Tunisia | 25% (Lowest) |

Trade Turmoil in Action

The impact of Trump tariffs will likely be uneven across the globe. Countries with higher dependency on US trade (like Bangladesh for garments or Vietnam for electronics) will feel the heat the most. On the other hand, countries hit with the lowest 25% rate may still see competitiveness erode depending on product category and value addition.

This shake-up sets the stage for India to benefit from redirected trade flows—especially in sectors like textiles, where Bangladesh and Vietnam face major headwinds.

India’s Strategic Position in the Trade Crossfire

While Trump’s aggressive tariff push has rattled many economies, India stands in a unique position—somewhat shielded, and potentially even favored by the shifting trade winds.

India’s Relative Protection

According to Moody’s, India is likely to face fewer tariff headwinds compared to other Asia-Pacific economies. This offers Indian exporters a relative advantage, especially as the US looks to reduce over dependence on China, Bangladesh, and Vietnam.

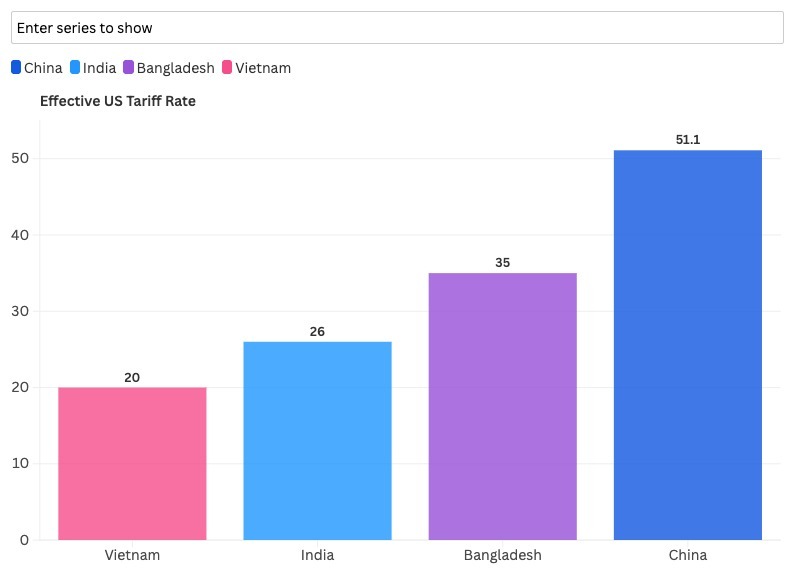

For instance:

- Bangladesh’s 35% tariff on textiles directly makes Indian garments more cost-competitive.

- Vietnam’s flat 20% tariff on all exports (plus 40% on Chinese-origin transshipments) makes India a safer alternative for buyers.

- China faces an average tariff of 51.1%, but still remains a price-aggressive rival.

The Ongoing US-India “Mini Trade Deal”

India and the US are currently negotiating a “mini trade deal” focused on:

- India’s ask: Duty-free/quota-free access for labor-intensive exports like textiles, leather, and gems

- US demands: Access for agriculture products (dairy, maize, GM crops)

This deal could be crucial. If India can secure lower reciprocal tariffs on its exports, it may:

- Outprice Bangladesh and Vietnam on key categories

- Strengthen its appeal as a manufacturing base for global firms shifting out of China

Investor Note: Talks were expected to conclude around July 9 but may now push into August 2025. A breakthrough could trigger re-rating of export-focused Indian stocks.

What This Means for India’s Export Playbook

India’s window of opportunity lies in:

- Leveraging the disruption caused by tariffs on competitors

- Doubling down on PLI schemes and FTAs (Free Trade Agreements)

- Strengthening supply chain trust with the US through compliance, scale, and delivery consistency

Sector-Wise Impact of Trump Tariffs on Indian Industries

Trump’s tariff wave will affect different Indian sectors in very different ways. While some, like textiles, are poised to benefit, others—especially pharma and metals—may need to brace for volatility.

We’ll break this down by sector, using clear analogies, real stock names, and investor logic.

1. Textiles & Apparel: India’s Tailored Advantage

Picture a game of musical chairs. When Vietnam and Bangladesh are suddenly penalized, more chairs become available—and India is better positioned to sit.

Impact:

- Bangladesh faces a 35% US tariff on garments starting August 1.

- Vietnam now pays a flat 20% on all exports.

- India faces a lower 10–26% tariff (average around 10–12%).

- Buyers looking to shift sourcing will now seriously consider India.

Government Support:

- India is pushing for zero-duty access under the trade deal.

- If tariffs are cut to even 15%, India becomes extremely competitive.

Stocks to Watch:

| Company | Logic & Data |

|---|---|

| Gokaldas Exports | Already saw an 8.3% surge on July 8 after Bangladesh’s tariff hike. Long-term orders from US brands may shift here. |

| KPR Mill | Vertically integrated, strong export base. Lower cost of production = better margins. Watch for rise in export revenue. |

| Vardhman Textiles | Indirect gainer via yarns/fabrics demand. If Indian apparel production rises, their sales should follow. |

| Arvind Ltd | Diversified and brand-driven. Denim exports could gain share from Vietnam/Bangladesh disruption. |

2. Pharma: Bitter Pills Ahead

Imagine if your biggest customer not only raises prices on your goods but also threatens to ban half your product line.

Impact:

- Trump is considering 200% tariffs on imported pharma products.

- India supplies 30–40% of US generics.

- Any sudden hike would crush margins and kill competitiveness.

Government Role:

- India may negotiate exemptions or phase-out windows, but the risk is real.

Stocks to Watch (Risk-Zone):

| Company | Risk Factor |

|---|---|

| Sun Pharma | ~35% US revenue share. Needs to either cut costs or shift operations. |

| Aurobindo Pharma | One of the most US-dependent. Watch for margin contractions. |

| Lupin, Cipla | US generic pipeline under threat. Follow their US business updates. |

Investor Tip: Look out for updates on US FDA site approvals or plans to open US manufacturing units to bypass tariffs.

3. Steel & Metals: Hit from All Sides

Think of the US as a fortress. Steel tariffs are like building higher walls to keep foreign metal out.

Impact:

- The US has slapped 50% tariffs on steel and aluminum.

- Indian exports to the US in this category are low but still affected.

Stocks to Watch (Pressure Points):

| Company | Commentary |

|---|---|

| JSW Steel, Tata Steel | May lose growth from US-bound orders. Need to pivot to Europe, SE Asia, or focus more on domestic infra demand. |

| Hindalco | Copper unaffected (India is a net importer), but aluminum exports to US may drop. |

Note: Keep an eye on export revenue mix and commentary on diversifying markets.

4. Auto & Components: Mexican Roadblock

You’re selling cars in a showroom next to someone who doesn’t have to pay rent (Mexico). You’re paying a 25% entry fee.

Impact:

- India faces 25% tariff on cars.

- Mexico has zero duty thanks to a trade pact.

- Auto exports from India become expensive in comparison.

Stocks to Watch:

| Company | Impact |

|---|---|

| Tata Motors | Direct exports to US are limited, but Indian-made models face cost disadvantages. JLR could be partially insulated. |

| Samvardhana Motherson | Exports components globally. If Indian auto exports drop, so will component demand. |

Watch: Order book trends from North American clients. A fall could reflect tariff-related slowdown.

5. IT Services: Shielded, but Sensitive

The storm is outside, but your windows are rattling. You’re not drenched, but the pressure is on.

Impact:

- No direct tariffs—IT exports are services.

- But global uncertainty may slow down tech spending in the US.

- Indian IT firms are watching deal flow, especially in BFSI and retail.

Stocks to Monitor:

| Company | Signal to Track |

|---|---|

| Infosys, TCS, Wipro, HCLTech | Client spending trends, US hiring, new deal announcements. |

Pro tip: These stocks may outperform in volatility due to cash flows and dollar exposure, but slower growth can cap upside.

6. Agriculture & Dairy: A Tense Standoff

The US wants to sell milk and maize, but India has locked the barn door.

Impact:

- US pushing for greater agri access in the trade deal.

- India refuses to open sensitive segments like dairy, maize, and GM crops.

Stock Impact:

- Minimal direct stock risk in agriculture.

- But failed agri negotiations could block progress on textile/duty relief.

Watch: Political headlines around agri clauses in the US-India trade deal.

Cross-Border Reactions: How Tariff Shocks Could Benefit India

In a hyper-connected global economy, tariffs on one country often become opportunities for another. Trump’s tariff war doesn’t just hurt the targeted nations—it causes supply chains to rewire, production hubs to shift, and buying behavior to change.

Let’s explore how India stands to benefit from the fallout hitting Bangladesh, Vietnam, China, and ASEAN nations.

🇧🇩 Bangladesh: Garment Giant Under Pressure

- Hit with a 35% US tariff on textile and apparel exports (effective August 1, 2025).

- The country is heavily dependent on the US for garment exports (over 20% of its GDP).

- Indian textile companies could gain significant order inflows, especially in knits, denim, and basics.

India’s Advantage:

- Indian exporters like Gokaldas Exports, KPR Mill, and Arvind Ltd are already receiving more inquiries from US buyers.

- India’s long-standing trade infrastructure and government PLI schemes boost scalability.

🇻🇳 Vietnam: From Poster Child to Penalty Zone

- Faces a flat 20% US tariff on all exports.

- An additional 40% tariff applies to goods that are transshipped from China (e.g., electronics, furniture).

India’s Opportunity:

- Furniture, electronics, garments, and footwear buyers may now switch orders to Indian manufacturers.

- Companies in leather goods, fabrics, and home textiles could gain market share.

🇨🇳 China: The Original Target Still Feels the Heat

- The average US tariff on Chinese goods stands at 51.1%.

- Many companies are looking to diversify away from China, especially in:

- Electrical machinery

- Auto components

- Pharmaceuticals

- Chemicals

India’s Position:

- The “China+1” strategy gains momentum.

- Sectors like specialty chemicals, API pharma, mobile phone assembly, and auto parts see renewed investment.

Stocks to Track:

- Aarti Industries, Divi’s Labs, Bharat Forge, Amber Enterprises

🌏 ASEAN Nations: Broad Tariff Shock Spills into India

- Countries like Thailand (36%), Indonesia (32%), Malaysia (25%), and Cambodia (36%) are also under pressure.

- These nations were once the preferred China alternatives—but the tariff hit resets the narrative.

Ripple to India:

- Indian exporters in furniture, processed foods, agri commodities, and electronics may get a boost.

- More firms might consider shifting their base to India or outsourcing to Indian players.

What This Means for Indian Investors:

| Region/Country | Tariff (%) | Sector Impacted | Indian Sector Gainers |

|---|---|---|---|

| Bangladesh | 35% | Textiles/Apparel | Gokaldas, KPR Mill, Arvind |

| Vietnam | 20–40% | Electronics, Garments | Dixon Tech, Lux Industries |

| China | 51.1% avg | Auto, Chemicals, Pharma | Divi’s, Bharat Forge, Aarti Ind. |

| ASEAN (Thailand etc) | 25–36% | Agro, Furniture, Metals | Greenply, Century Ply, Avadh Sugar |

Conclusion: Will the Impact of Trump Tariffs Hurt or Help India?

The impact of Trump tariffs has stirred volatility in global trade, yet for India, it opens up a dual narrative—risk on one side, opportunity on the other.

While countries like Bangladesh, Vietnam, and China struggle under steep tariffs, India’s exporters—especially in textiles, chemicals, and electronics—stand to benefit from a shift in global sourcing patterns.

At the same time, risks remain. The pharmaceutical sector faces the threat of a 200% tariff, auto exporters lose ground to tariff-free Mexico, and steel/aluminum producers continue to face 50% US import duties.

However, India’s relative tariff advantage, growing manufacturing capacity through PLI schemes, and the anticipated US-India mini trade deal offer strong tailwinds. These shifts could significantly strengthen India’s position as a global supply chain alternative.

For investors, the strategy is clear:

- Focus on domestic demand-led sectors

- Back export-focused players with US market potential

- Remain cautious on sectors heavily tied to US policy outcomes

In essence, while the Trump tariffs have disrupted the global order, they may well serve as a catalyst for India’s emergence as a key manufacturing and export hub.

FAQs: Impact of Trump Tariffs on Indian Economy and Stocks

Q1. What is the impact of Trump tariffs on Indian exports?

The impact of Trump tariffs on Indian exports is mixed. While some sectors like textiles may benefit due to higher US tariffs on competitors like Bangladesh and Vietnam, others like pharmaceuticals and auto components could face challenges if tariff rates rise on Indian goods.

Q2. Which Indian sectors will benefit from Trump’s new tariff policies?

Sectors such as textiles, specialty chemicals, and electronics manufacturing could benefit as global buyers shift sourcing away from tariff-hit countries like China, Bangladesh, and Vietnam.

Q3. How will the pharmaceutical sector be affected by Trump tariffs?

If the US implements a 200% tariff on pharmaceutical imports, Indian drug exporters—especially those heavily dependent on the US—may face margin pressure and reduced competitiveness.

Q4. Why is India less affected by Trump tariffs than other Asian countries?

India currently faces lower average tariffs on most goods and is negotiating a trade deal with the US. Additionally, its diversified export base and domestic demand reduce dependence on any single market.

Q5. Which Indian textile stocks could gain due to the impact of Trump tariffs?

Stocks like Gokaldas Exports, KPR Mill, Arvind Ltd, and Vardhman Textiles may benefit as US buyers shift orders from Bangladesh and Vietnam to India.

Q6. Will Indian auto companies be hit by US tariffs?

Yes, Indian auto exports to the US face a 25% tariff, while Mexico enjoys duty-free access. This puts Indian firms at a competitive disadvantage in the American market.

Q7. What is the US-India mini trade deal and how does it relate to Trump tariffs?

The US-India mini trade deal is an ongoing negotiation aimed at reducing tariffs and expanding market access. A successful deal could reduce existing barriers and mitigate the negative impact of Trump’s tariff policies.

Related Articles:

Trump’s Big Beautiful Bill: Impact on Indian Stock Market and Key Stocks to Watch

US Tariffs Impact on Indian Stocks- What To Buy

Trump’s 26% Tariffs: Which Sectors Will Win & Who’s in Trouble?

More Articles

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)

Why Fundamentals Are Failing—and Market Cycles Are Getting Shorter

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh