Introduction

Looking to transfer shares from one NSDL broker to another? Whether you’re switching for better trading features, reduced brokerage, or simply portfolio management, the good news is that the process is smooth and doesn’t require you to sell your investments.

NSDL (National Securities Depository Limited) is India’s first and largest depository, used by top brokers like HDFC Securities, ICICI Direct, SBI Securities, Kotak Securities, and Axis Direct. So, if you hold shares with one of these brokers and want to move them to another within the NSDL network (say, from HDFC Securities to ICICI Direct), it can be done without any loss of ownership.

This guide will help you understand how to transfer shares from one NSDL broker to another using both offline and online methods, including what documents you need, timelines, charges, and crucial tips to avoid delays.

Documents & Details Needed Before You Transfer Shares from One NSDL Broker to Another

Before initiating a share transfer from one NSDL broker to another, make sure you have the following details and documents ready. These are essential to ensure a smooth and error-free transfer process:

1. DIS Slip (Delivery Instruction Slip)

- Issued by your current (transferor) NSDL broker.

- This is similar to a cheque book for your demat account.

- You’ll use it to fill in details of the shares you want to transfer.

2. Target Demat Account Details

- The 16-digit NSDL demat account number of your new (receiving) broker.

- Make sure it belongs to another NSDL broker and not a CDSL broker (NSDL account numbers start with “IN”).

3. Client Master Report (CMR)

- Issued by your target (new) NSDL broker.

- Contains details like name, DP ID, client ID, and account type.

- Must be stamped and signed by the new broker if submitting offline.

4. PAN Card Copy

- For identity verification.

5. Registered Mobile Number & Email

- Needed for OTP and communication (especially for online transfers via NSDL’s SPEED-e portal).

Step-by-Step Guide: Transfer Shares from One NSDL Broker to Another NSDL Broker (Online Method)

If you’re moving from one NSDL broker (like HDFC Securities, SBI Securities, or IIFL) to another NSDL broker (such as Groww, Upstox, or Zerodha’s NSDL demat), the easiest and most secure way is via the SPEED-e portal by NSDL. This online route eliminates paperwork and helps you transfer shares from the comfort of your home.

Here’s a complete step-by-step guide to help you through the process.

Step 1: Check if Your Current Broker is Registered with NSDL SPEED-e

Before starting, make sure your existing broker (where your shares currently reside) is registered as a Depository Participant (DP) with NSDL’s SPEED-e facility. You can confirm this by:

- Visiting https://eservices.nsdl.com

- Navigating to the “SPEED-e Users” list under the ‘About’ or ‘Help’ section

- Or simply contacting your broker’s customer support

📌 Most large brokers like HDFC Securities, ICICI Direct (NSDL demat), SBI Capital, or IIFL are SPEED-e enabled.

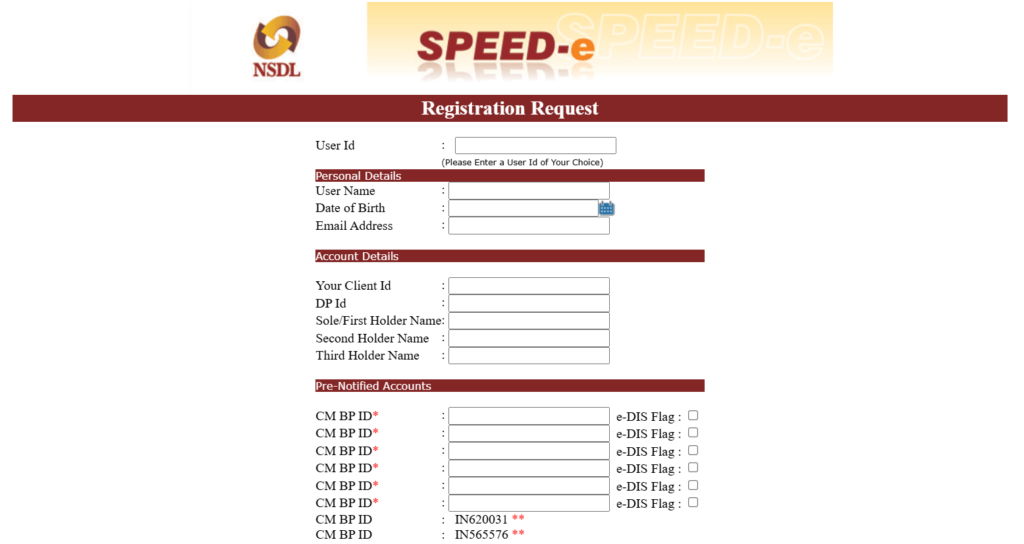

Step 2: Register Yourself on NSDL SPEED-e

Once confirmed, you need to register as a user on the SPEED-e platform.

Here’s how:

- Go to https://eservices.nsdl.com

- Click on the ‘SPEED-e’ login option in the top menu

- Select ‘Registration’, then choose ‘Individual User’

- Fill in:

- Your DP ID and Client ID (check your demat account statement for these)

- Your PAN and other personal details

- Email ID and mobile number (linked with your demat)

- Select the ‘Password-based login’ option (recommended for retail investors)

- Submit the registration request online

Now, download the acknowledgment form and submit it physically or via courier to your current broker, depending on their onboarding policy.

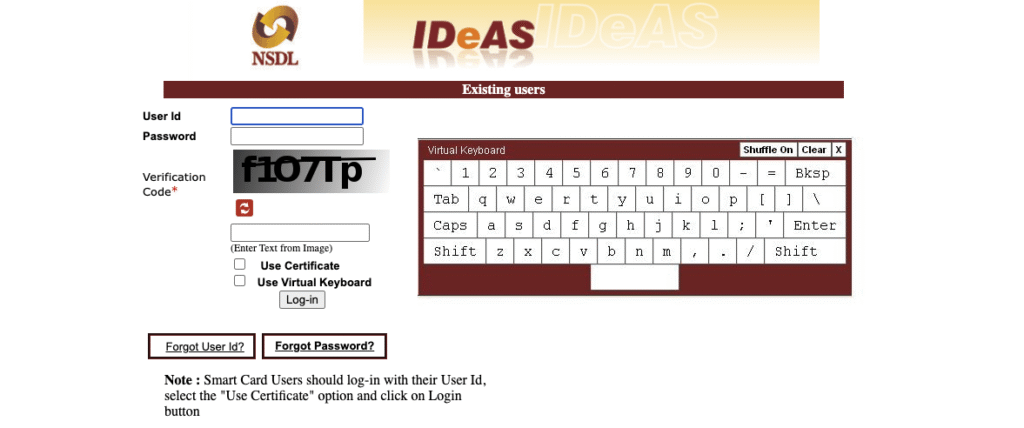

Step 3: Wait for Broker Approval & Receive Login Credentials

Once your broker verifies your details and processes your registration, you will receive:

- A User ID and temporary password

- A link to reset the password and activate your SPEED-e account

This process typically takes 1–2 working days.

Step 4: Add the New NSDL Demat Account as a Trusted Account

To initiate a share transfer, you need to whitelist (trust) your target demat account (i.e., the new NSDL broker you are transferring shares to).

Steps:

- Log in to NSDL SPEED-e

- Go to the ‘Trusted Account Registration’ section

- Enter:

- New broker’s DP ID and Client ID

- Select “Self Transfer” as the reason

- Submit the request and wait for approval (typically within 24–48 hours)

Once approved, you’ll be ready to make the actual transfer.

Step 5: Initiate the Transfer of Shares

Now comes the final step — moving your shares from the old NSDL demat to the new one.

Steps:

- Log in to NSDL SPEED-e with your credentials

- Go to the ‘Transaction’ or ‘Transfer of Shares’ section

- Choose ‘Off-Market Transfer’

- Select your source demat account

- Enter the destination (trusted) NSDL account details

- Choose the ISINs and quantities of shares to transfer

- Select Transfer Reason as:

- “Transfer to Own Account” or “Self-transfer”

- Review all the details carefully and verify using OTP (sent to your registered mobile/email)

Processing Time:

The shares are usually transferred within 1–2 working days, and you’ll receive a confirmation SMS/email from NSDL once the transfer is successful.

Offline Process: Transfer Shares Between NSDL Brokers Manually

While the online mode is quicker and paperless, some investors may still prefer or require an offline method to transfer shares from one NSDL broker to another — especially when digital access is limited or if their brokers do not support online DIS. Fortunately, NSDL also allows an offline process using the Delivery Instruction Slip (DIS), which is widely accepted.

Let’s walk through the offline method step by step.

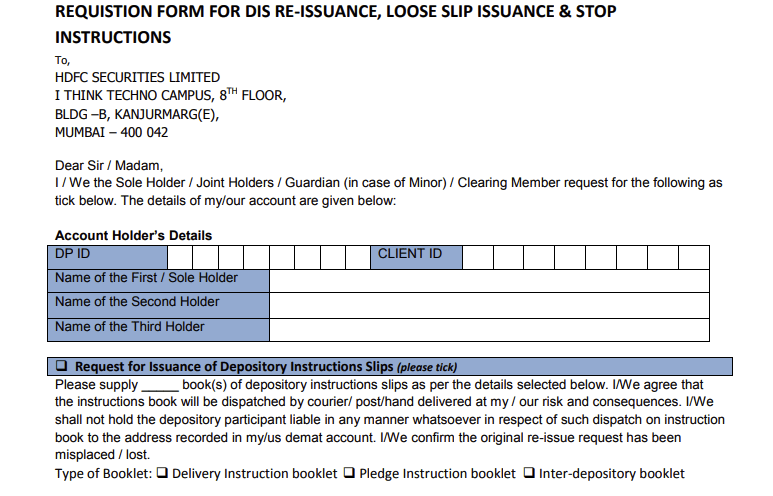

Step 1: Obtain the Delivery Instruction Slip (DIS) from Your Existing Broker

To begin with, you need a DIS booklet. This can be requested from your existing NSDL DP (Depository Participant) — for example, HDFC Securities, SBI Securities, Axis Direct, or any other NSDL-based broker. Most DPs will issue the DIS booklet during the account opening process, but if you don’t have it, request a new one.

➡️ Tip: Keep your Client ID and DP ID handy when requesting the DIS.

Step 2: Fill Out the DIS Accurately

Next, fill in the DIS form carefully. Mistakes here can lead to rejection. Ensure the following fields are correctly entered:

- Target DP ID (of the new NSDL broker): This is the 8-digit DP ID of your new NSDL broker.

- Target Client ID: Your new demat account number with the target broker.

- ISIN (International Securities Identification Number): Each stock has a unique ISIN code.

- Quantity of shares to be transferred.

- Market Type: Typically ‘Off Market’ for transfers between your own accounts.

👉 Use clear handwriting if it’s a physical form. Errors due to illegible writing can cause delays.

Step 3: Submit the DIS to Your Existing Broker

Once filled out, you’ll need to submit the form in person or through courier to the existing broker. Some brokers also allow drop-box submissions at their branches.

⚠️ Note: Your signature on the DIS must match your registered signature with the DP. If it doesn’t, the transfer will be rejected.

Step 4: Verification and Processing

After submission, your broker will verify the DIS and initiate the transfer. This generally takes 1 to 2 working days. You will receive a confirmation SMS or email from NSDL once the shares are moved.

Pro Tip: Always ask for an acknowledgement receipt after submitting the DIS. This acts as proof of submission in case of any future dispute.

Step 5: Verify Share Transfer in the New Demat Account

Finally, log in to your new broker’s platform or NSDL CAS (Consolidated Account Statement) and verify that the shares have been successfully credited.

If the shares don’t reflect within 2–3 days, contact both brokers to resolve any discrepancies quickly.

Key Things to Keep in Mind During the Transfer

To ensure a smooth transfer between two NSDL brokers, here are some best practices and precautionary tips:

- Check ISIN Status: Ensure the ISINs of your stocks are active and not under lock-in. Frozen or suspended ISINs cannot be transferred.

- Match Holder Details: The name and order of holders in both demat accounts must match exactly. Even a slight mismatch can lead to rejection.

- Transfer Charges: While NSDL doesn’t charge you, the originating broker may levy DP transfer charges. Check the tariff sheet beforehand.

- Trusted Account Approval: Without prior approval of the destination BO ID as a trusted account, the transfer will not go through.

- Multiple ISINs: You can transfer multiple stocks in one go, provided all are NSDL-listed ISINs and are present in your holdings.

- Avoid Peak Days: Prefer initiating transfers mid-week to avoid delays caused by weekend backlogs.

Conclusion: Seamless Way to Transfer Shares from One NSDL Broker to Another

To sum up, if you’re planning to transfer shares from one NSDL broker to another, the process can be both efficient and secure—provided you follow the correct steps. The online route via NSDL Speed-e offers speed and convenience, while the offline DIS method gives a paper-trail-based alternative for those who prefer it.

More importantly, taking time to ensure accurate details—like DP ID, Client ID, ISINs, and signature—can help you avoid rejections and delays. Additionally, always track your transfer request status using the NSDL portal or through your broker’s support team.

Whether you’re switching brokers for better features, consolidating your portfolio, or aiming to streamline your investments, understanding how to transfer shares from one NSDL broker to another helps you stay in control of your holdings.

By staying cautious, following compliance, and cross-checking all documentation, you ensure your share transfer experience remains smooth and hassle-free.

FAQs: transfer shares from one NSDL broker to another:

What does it mean to transfer shares from one NSDL broker to another?

It means moving your demat holdings from your current NSDL-linked broker (like HDFC Securities, IIFL, or SBI Capital) to another NSDL-registered broker while retaining ownership and avoiding a sale.

Can I transfer shares online between NSDL brokers?

Yes, you can transfer shares online through the NSDL Speed-e portal. It requires registration and linking your demat account for secure, paperless share transfers.

Is there any fee to transfer shares from one NSDL broker to another?

Most brokers charge a nominal fee per ISIN (stock) transferred. Charges vary, so it’s best to check with your existing and new brokers.

How much time does it take for the transfer to complete?

Typically, online transfers via NSDL Speed-e take 1–2 working days. Offline DIS-based transfers may take 3–5 working days.

Will I have to pay tax for transferring shares between brokers?

No, there are no taxes involved in transferring shares between demat accounts if the ownership remains the same and it’s not a sale.

Can I transfer only selected stocks or the entire portfolio?

You can transfer either a few selected ISINs or your entire holding. NSDL Speed-e allows you to select specific stocks to move.

Is it possible to transfer shares from NSDL to CDSL?

Yes, but the process is slightly different and is known as an inter-depository transfer. It requires filling a separate DIS slip and may involve additional charges.

More Articles

Protect Your Demat Account from Cyber Threats: A Complete Guide

How to Transfer Shares from Upstox to Zerodha Without Selling: Step-by-Step Guide

How to Transfer Shares from Groww to Angel One – Step-by-Step Guide