Why Everyone’s Quietly Betting on Data Centres

While most retail investors are chasing the next electric vehicle stock or riding the AI hype train, the real money might just be quietly humming away in cold, sterile buildings filled with blinking servers—India’s data centres.

The numbers don’t lie. India’s data centre market is expected to attract a jaw-dropping $25 billion in investment over the next 5–6 years. What’s fueling this? Everything digital—from streaming reels to scanning QR codes—needs storage, speed, and security. And with the Indian government pushing for data localisation, the demand is only getting hotter.

But here’s the twist: it’s not the big-name tech giants or real estate players that could see the fastest gains.

It’s the smallcap companies.

From cabling to cooling, from cybersecurity to backup power, these niche smallcap stocks are quietly positioning themselves at the heart of India’s data centre revolution. They don’t just support the infrastructure—they are the infrastructure.

In this blog, we’ll break down the biggest trends in this digital gold rush and reveal five lesser-known data centre stocks in India that could offer multibagger potential in the long run.

Ready to plug in?

The Real Boom: India’s Data Centre Gold Rush

The digital economy isn’t just growing—it’s exploding. And India, with its 1.4 billion people, is sitting right at the epicenter of this data explosion.

From UPI payments to OTT binge sessions, from government databases to AI models—everything is now data-driven. And all that data needs a home.

That’s where data centres come in.

So… why the sudden boom?

A few key reasons:

- Digital India push: The government’s aggressive push for digitisation and data localisation laws means more data must be stored within the country.

- AI + 5G = data tsunami: The rise of GenAI, IoT devices, and 5G technology is generating massive volumes of data that need to be processed and stored closer to the user—leading to edge and hyperscale data centre demand.

- MNC interest: Big global players like Amazon Web Services, Google, Microsoft, and Meta are already investing heavily to build or lease data centres in India.

The numbers speak louder

- India currently has ~870 MW of operational data centre capacity.

- That number is expected to triple to over 2,500 MW by 2030.

- Nearly ₹2 lakh crore ($25 billion) is expected to flow into this sector in the next 5–6 years.

But here’s what most people miss:

This boom isn’t just about tech giants building shiny new server farms. It’s about the massive ecosystem being built around it.

That’s where smallcap companies come in—powering, protecting, and connecting India’s data future. And for smart investors looking at data centre stocks India, that’s where the real opportunity lies.

The Backbone: 5 Sectors That Power Every Data Centre

Let’s get one thing straight: a data centre isn’t just a building with servers.

It’s a complex, high-security, ultra-efficient machine that needs power, cooling, networking, and infrastructure running 24/7—without a hiccup.

And while the spotlight is on the Googles and Amazons of the world, the real heroes are often smaller players working behind the scenes.

Here are 5 key sectors that make data centres tick—and the smallcap companies in each space that could ride this ₹2 lakh crore wave:

1. Electrical Infrastructure

You can’t run petabytes of data without massive amounts of power. Data centres need transformers, substations, cabling, and backup systems—all tailored for round-the-clock operation.

🧠 Opportunity: Smallcap electrical EPC players with government and private project experience.

2. Power Backup & Cooling

Servers generate heat. A lot of it. Uninterrupted power (with DG sets or batteries) and precision cooling systems (HVACs, chillers, etc.) are critical for keeping operations stable.

🧠 Opportunity: Niche companies in industrial cooling and backup generation are set to thrive.

3. Network Infrastructure

Data without connectivity is like gold buried underground. Fibre optic cabling, network switches, and edge computing nodes are vital for the fast and secure transmission of data.

🧠 Opportunity: Telecom infra players and fibre-optic specialists stand to benefit.

4. Data Centre Construction

Not your average building—these are fortified, fireproof, seismic-resistant bunkers with raised floors, smart racks, and energy-efficient designs.

🧠 Opportunity: Specialised construction firms with tech-building experience will grow with hyperscale data centre expansion.

5. Real Estate & Leasing

Not every company wants to build their own facility. That’s why data centre parks—where companies lease space—are in high demand, especially around Mumbai, Chennai, and Hyderabad.

🧠 Opportunity: Real estate developers with exposure to industrial leasing or tech parks can gain massively.

These are the sectors quietly fuelling the rise of data centre stocks India—and helping create a new investing frontier outside of IT bluechips.

Now let’s get to the juicy part—which smallcap companies are actually benefiting from all this?

5 Smallcap Companies Riding the Data Wave

Alright, theory’s great—but let’s talk stocks.

Here are five smallcap companies that are uniquely positioned to ride the data centre boom in India. Each one solves a crucial piece of the puzzle—and they’ve got the financials and tailwinds to back it up.

1. Bajel Projects – Powering the Grid

What they do: Power transmission EPC player, formerly part of Bajaj Electricals. They handle turnkey projects for substations and transmission lines.

Why they matter: As data centres demand uninterrupted high-voltage power, companies like Bajel become indispensable for laying down and maintaining that power backbone.

Growth trigger: The parent company’s backing, recent demerger, and government push for power infra make this a quiet winner.

🔍 Keyword Fit: Among emerging data centre stocks India, Bajel is one to watch on the electrical infrastructure side.

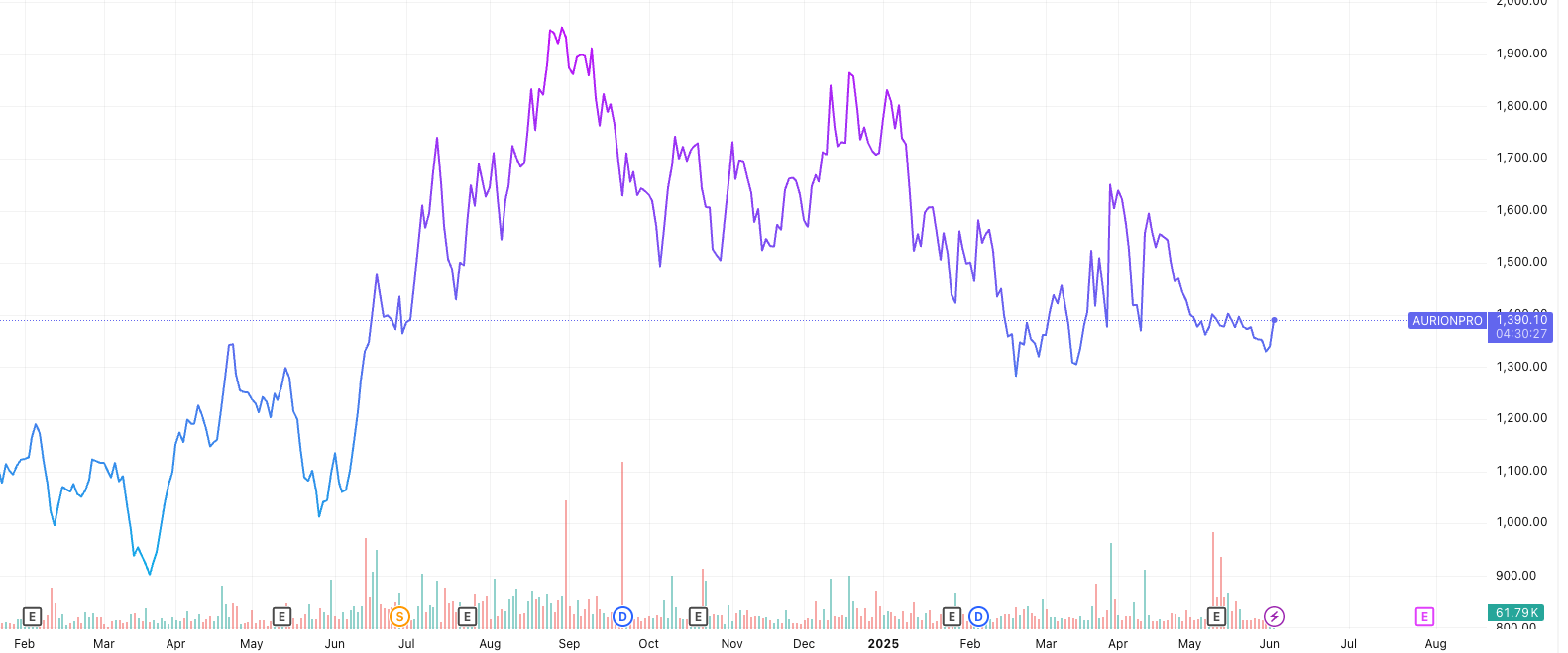

2. Aurionpro Solutions – Securing Digital Assets

What they do: Software and tech infra company focused on cybersecurity, data centre automation, and enterprise banking solutions.

Why they matter: Data centres need not just hardware, but secure access, monitoring, and smart controls. That’s where Aurionpro shines—with its command-and-control platforms and DCIM solutions.

Growth trigger: Tie-ups with large PSUs and smart city projects; rising demand for in-house data security solutions.

3. RailTel Corporation of India – Laying the Fibre Highway

What they do: PSU under the Ministry of Railways. Owns a 61,000+ km fibre optic network across India and operates Tier-III data centres in Delhi and Secunderabad.

Why they matter: They provide both the connectivity and the infrastructure backbone needed to run data centres efficiently—especially in Tier-2 cities.

Growth trigger: Rising bandwidth demand + government contracts + digital rail infra.

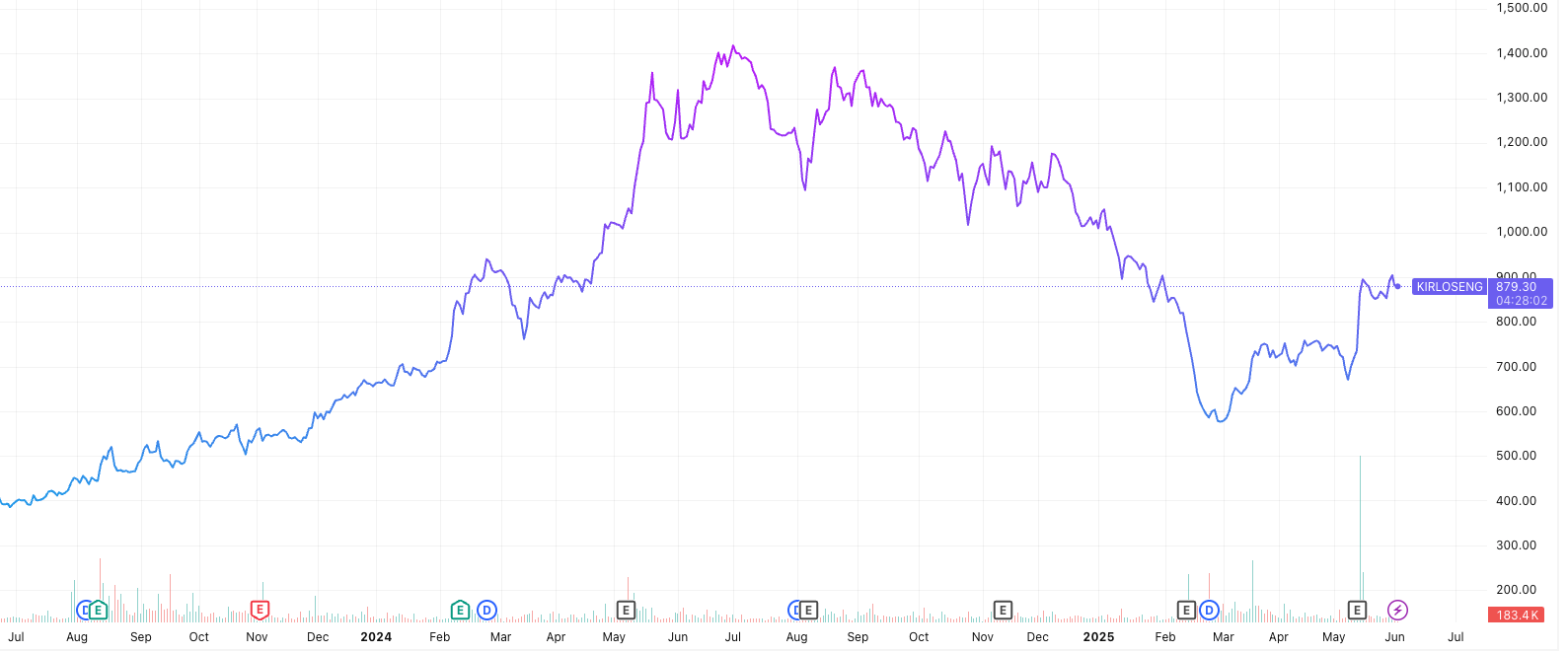

4. Kirloskar Oil Engines – Power Backup King

What they do: Leading manufacturer of diesel gensets and backup power systems for industries and infrastructure.

Why they matter: No data centre can risk a blackout. KOEL provides the standby power that keeps data flowing when the grid fails.

Growth trigger: Data centre expansion = more orders for industrial gensets. Simple math.

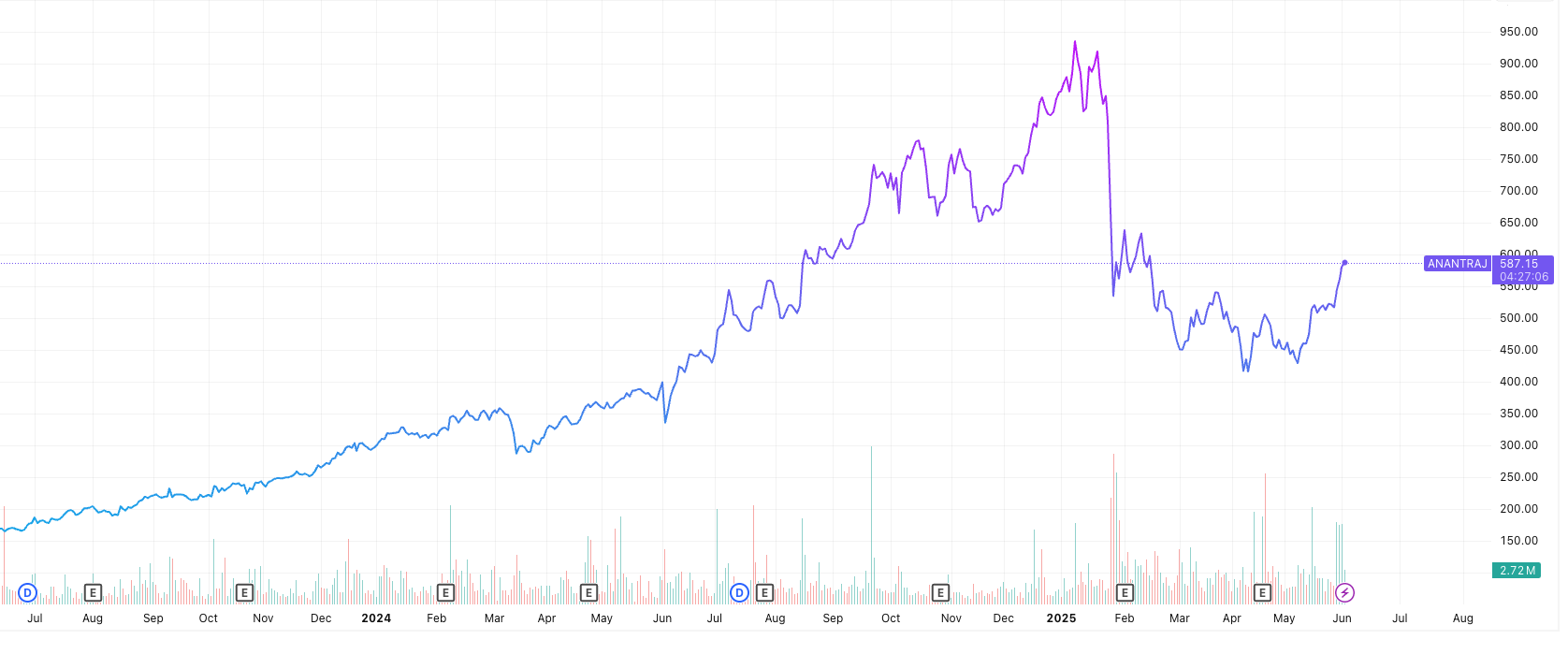

5. Anant Raj – Leasing Out Digital Land

What they do: Real estate developer with large land banks near Delhi NCR. Now actively developing data centre parks under Anant Raj Tech Park.

Why they matter: They’re turning industrial land into ready-to-lease hyperscale data centre campuses—exactly what cloud giants are hunting for.

Growth trigger: Partnering with global hyperscalers + undervalued compared to peers like DLF or Hiranandani.

🔍 Keyword Fit: A strong long-term bet in the data centre stocks India theme for those looking at the real estate + infra angle.

Each of these companies plays a distinct role—from powering up the grid to laying fibre to building or securing the data centres themselves.

If you’re betting on India’s data centre boom, these are the smallcap disruptors you don’t want to ignore.

Conclusion & Your Next Move

India’s data centre story isn’t just a tech fad—it’s a full-on infrastructure revolution powered by massive investments, government push, and unstoppable digital demand. From Bajel Projects lighting up power lines to Anant Raj carving out prime data centre parks, the ecosystem is getting ready for a giant leap.

If you want to ride this wave, these data centre stocks India—especially the smallcaps—offer exciting opportunities to get in early, before the big institutional investors flood in.

But remember: smallcaps can be wild rides. Do your homework, keep your stops ready, and don’t bet the farm on just one idea.

If you’re looking for a simple, trusted way to explore these stocks and manage your portfolio without breaking a sweat, give Angel One a shot. With their easy-to-use platform, instant updates, and low fees, you can invest confidently and keep up with India’s booming markets.

FAQs

Q1: Why are data centre stocks important in India?

A1: Data centre stocks represent companies building infrastructure to support India’s growing digital economy, making them crucial for future tech growth.

Q2: What factors are driving the data centre boom in India?

A2: Key drivers include rising internet usage, AI adoption, data localisation policies, and large investments in digital infrastructure.

Q3: Are smallcap data centre stocks risky investments?

A3: Yes, smallcaps tend to be more volatile and less liquid. Investors should do thorough research and have a long-term perspective.

Q4: How can I invest in these data centre stocks easily?

A4: Platforms like Angel One offer user-friendly ways to invest in such stocks with low fees and quick execution.

Q5: What are some top smallcap data centre stocks in India?

A5: Companies like Bajel Projects, Aurionpro Solutions, RailTel, Kirloskar Oil Engines, and Anant Raj are some promising options.