Introduction: The AI Revolution in Investing

Artificial Intelligence (AI) is no longer a futuristic concept confined to tech labs. In 2025, it has firmly embedded itself in the stock market, revolutionizing how investments are analyzed, traded, and managed. From predicting stock movements to enabling algorithmic trading, AI is transforming the investment landscape, making it faster, more efficient, and data-driven.

This blog explores how AI is reshaping the stock market, the tools it offers, and the benefits and challenges it brings to investors.

AI Applications in the Stock Market

1. Predictive Analysis and Stock Forecasting

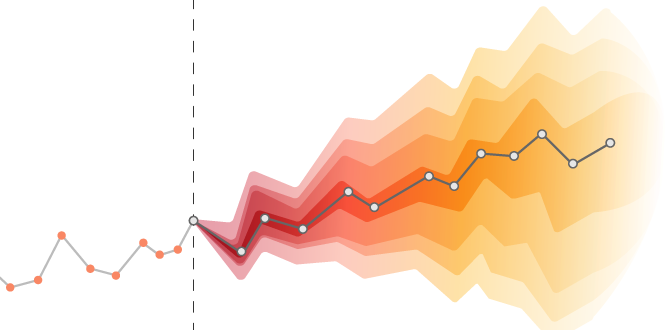

AI leverages vast amounts of historical and real-time market data to identify patterns and predict stock price movements. With advanced machine learning algorithms, AI systems can analyze market trends, news sentiment, and macroeconomic indicators to make highly accurate forecasts.

Real-World Application:

Platforms like Bloomberg Terminal and Reuters Eikon integrate AI to offer predictive analytics tools. These systems assist traders in identifying potential opportunities and risks with unparalleled precision.

2. Algorithmic Trading

Algorithmic trading, also known as algo trading, relies heavily on AI to execute trades at lightning speed based on pre-set criteria such as price, volume, or timing. AI ensures minimal human intervention, reducing emotional biases and improving trading efficiency.

Benefits:

- Executes trades within microseconds, faster than any human trader.

- Optimizes buying and selling decisions based on real-time data.

- Minimizes transaction costs by identifying the best prices.

Example:

India’s National Stock Exchange (NSE) has seen a surge in algo trading, with over 50% of daily trades executed through algorithms in 2024.

3. Robo-Advisors for Retail Investors

Robo-advisors are AI-powered tools designed to provide automated financial advice. These platforms use algorithms to assess an investor’s risk tolerance, financial goals, and investment horizon to create personalized portfolios.

Popular Robo-Advisors in India:

- ET Money: Offers goal-based investment strategies.

- Scripbox: Provides mutual fund recommendations tailored to user needs.

4. Sentiment Analysis for Market Trends

AI systems analyze market sentiment by scanning news articles, social media platforms, and financial reports. By gauging public and institutional sentiment, AI helps investors anticipate market reactions to events like earnings reports, mergers, or geopolitical developments.

Example:

In 2024, an AI-powered sentiment analysis tool accurately predicted a stock rally for Reliance Industries following a positive quarterly earnings report.

Benefits of AI in the Stock Market

1. Enhanced Decision-Making

AI provides data-driven insights, enabling investors to make informed decisions. By eliminating guesswork, AI ensures strategies are backed by analytics and probabilities.

2. Improved Risk Management

AI models can simulate various market scenarios and stress tests, helping investors identify and mitigate potential risks before making significant investments.

3. Democratization of Investing

With AI-powered tools like robo-advisors, even novice investors can access professional-grade financial advice at a fraction of the cost.

4. Real-Time Market Monitoring

AI systems monitor global markets 24/7, ensuring that investors never miss out on critical opportunities or warning signs.

Challenges of AI in the Stock Market

1. Over-Reliance on Algorithms

While AI is powerful, excessive dependence can lead to systemic risks. Flash crashes, such as the one in 2010, highlight how algorithmic errors can disrupt markets.

2. Data Quality Issues

AI systems rely on accurate data to function effectively. Inconsistent or inaccurate data can result in flawed predictions and strategies.

3. Lack of Transparency

AI algorithms often function as black boxes, making it difficult for users to understand how decisions are made. This lack of transparency can erode trust.

4. Regulatory Challenges

In India, regulatory frameworks are still evolving to address AI-driven trading. Ensuring compliance while fostering innovation remains a balancing act for authorities like SEBI.

How Retail Investors Can Leverage AI in 2025

1. Use AI-Powered Tools

Platforms like Zerodha’s Kite and Angel One’s ARQ Prime integrate AI to offer advanced analytics, stock screening, and personalized recommendations.

2. Stay Informed

Understanding how AI works and its limitations will help investors make better use of these tools. Educational platforms like Varsity by Zerodha provide insights into AI in trading.

3. Diversify with AI-Based Mutual Funds

AI-managed mutual funds, such as Tata Quant Fund, use machine learning models to optimize portfolio allocations dynamically.

The Road Ahead: AI’s Growing Role in Investing

As AI continues to evolve, its role in the stock market will only grow more significant. From retail investors to institutional traders, AI is leveling the playing field, making investing more efficient and accessible. However, as with any technology, it’s crucial to approach AI tools with an informed perspective, understanding their capabilities and limitations.

In 2025 and beyond, the synergy between human intelligence and artificial intelligence will define the next era of investing. By embracing this technological shift, investors can stay ahead of the curve in an increasingly competitive market.

FAQs

- What is algorithmic trading?

Algorithmic trading involves using AI and algorithms to execute trades automatically based on predefined criteria. - Are robo-advisors suitable for beginners?

Yes, robo-advisors are designed to simplify investing for beginners by providing automated, personalized financial advice. - Can AI predict stock prices accurately?

While AI can identify trends and patterns, predicting stock prices with 100% accuracy remains challenging due to market complexities. - Are there AI-based mutual funds in India?

Yes, funds like Tata Quant Fund use AI-driven models for portfolio management.