The RBI Just Slashed Repo Rate

It’s Friday, December 5, 2025. If you’ve been watching the tickers on CNBC-TV18 or just checking your trading app while having your morning chai, you have probably seen a sea of green. It feels like a festival on Dalal Street today. The Nifty has crossed 26,100, and the Sensex has totally shattered the 85,500 ceiling. It is wild out there.

Why is everyone celebrating? Because RBI Governor Sanjay Malhotra just delivered exactly what the market was hungry for. He announced a repo rate cut of 25 basis points, bringing it down to 5.25%.

Now, if you are new to this, you might be scratching your head. You might think, “It’s just 0.25%, that is such a tiny number. Why is everyone losing their mind?” Why do real estate developers cheer and bank stocks rally when this number drops? It seems small, but in the world of finance, this is a massive jolt of electricity.

If you are an investor, understanding the Impact of Repo rate isn’t just academic or something for economists to discuss in boring seminars. It is literally the difference between spotting a trend early and chasing it when it’s too late. Let’s sit down and decode the “why” and “how” behind today’s buzz, using simple stories instead of complex jargon.

The Wholesaler Analogy: What actually is the Repo Rate?

To really get the Impact of Repo rate on your portfolio, you first need to understand the relationship between the Reserve Bank of India (RBI) and your local bank, like HDFC, ICICI, or SBI.

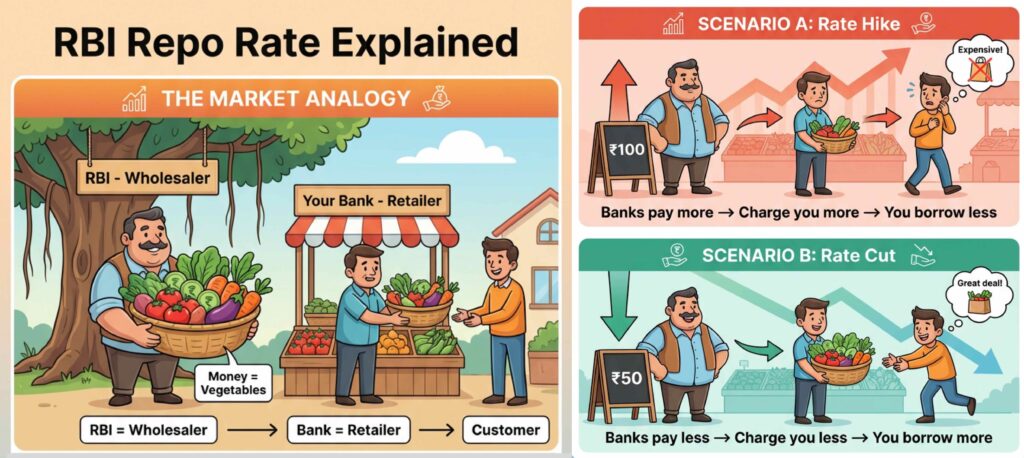

I always like to think of it like a vegetable market. It’s the easiest way to visualize it.

Imagine the RBI is the big Wholesaler in the market. Your Bank is the Retailer or the local shopkeeper. And Money? Well, Money is the Vegetable.

Now, when the retailer (your Bank) runs out of vegetables (Money) to sell to you, they have to go to the wholesaler (RBI) to buy more supply. The Repo Rate is simply the price tag the wholesaler puts on those vegetables. It is the cost the bank pays to borrow money from the RBI.

Here is how the scenarios play out. In Scenario A, the wholesaler increases the price. This is a Rate Hike. The retailer has to pay more, so obviously, they are going to charge you more to keep their margin. Vegetables (Loans) become expensive. You decide, “maybe I won’t buy that extra kilo today.” You buy less.

But today, we saw Scenario B. The wholesaler dropped the price. This is a Rate Cut. The retailer pays less to the RBI, so they can afford to sell to you at a cheaper rate and still make a profit. Vegetables (Loans) become cheap. You feel like buying more.

Today’s move was clearly Scenario B. The RBI made money cheaper for banks, expecting them to pass that benefit to you. This simple dynamic triggers a domino effect that defines the Impact of Repo rate on the entire economy.

The Domino Effect: How a Cut Travels to Your Stocks

When the RBI cuts the rate, it doesn’t just help people buying homes; it fundamentally changes the valuation of companies. It is like a chain reaction.

First, the banks lower their lending rates. You might have heard terms like MCLR or EBLR, but basically, the interest rate on loans goes down. This leads to the second step: Lower EMIs. People like you and me see our EMIs drop. Suddenly, that car or that 3-BHK flat looks a lot more affordable than it did yesterday.

This leads to increased spending. When your EMI is lower, you have more disposable income left in your pocket at the end of the month. What do you do with it? You spend it. We spend more on travel, clothes, gadgets, and eating out.

This spending goes directly to the companies. Corporate Earnings start to rise because companies are selling more products. Their profits go up. And finally, when profits go up, stock prices go up. The market loves growth.

This cycle is why the Impact of Repo rate is so heavily watched. It is the fuel injection system of the economic engine. When the fuel is cheap, the car goes faster.

Which Stocks Win? Identifying Repo Rate Cut Stocks

Now, not all sectors party equally when rates drop. If you are an IT company exporting to the US, a rate cut in India matters, but maybe not as much as it does for a builder in Mumbai. If you want to position your portfolio for a bull run, you need to identify the classic Repo rate Cut stocks. These are companies whose fortunes are directly tied to interest rates.

1. The Real Estate Giants: The Biggest Beneficiaries

Real estate is hands down the most interest-rate-sensitive sector in India. Think about it: almost no one buys a house with 100% cash in a suitcase. It is all about the Home Loan.

Let me tell you a story about a guy named Rohan. Rohan has been wanting to buy a ₹1 Crore apartment in Bengaluru for six months. But every time he calculates the EMI at 8.5% interest, he gets scared. It takes up too much of his salary. So, he waits. He is what we call a “fence-sitter.”

Now, with the repo rate cut to 5.25%, home loan rates are likely to drop. Suddenly, Rohan’s EMI calculation looks different. It might drop by a few thousand rupees per month. It psychologically feels “doable.” Now, multiply Rohan by thousands of people across India who were waiting. Suddenly, developers like DLF, Godrej Properties, and Oberoi Realty see a surge in bookings. They sell their inventory fast.

That is why you saw the Nifty Realty index jump over 1% today immediately after the announcement. It is the anticipation of the “Rohans” of the world finally signing the deal.

2. The Auto Sector: Accelerating Demand

Similar to homes, cars and bikes are heavily financed. Very few people pay full cash for a new SUV. A drop in rates makes vehicle loans attractive.

The Repo rate Cut stocks in this space include the big players like Maruti Suzuki, Tata Motors, and Hero MotoCorp. Lower rates mean more people upgrading their wheels. A guy driving a hatchback might think, “Hey, the loan is cheap, let’s upgrade to the SUV.” This directly boosts the top line revenue of these manufacturers.

3. Banks and NBFCs: The Volume Game

This one is a bit tricky to understand but stay with me. Technically, when rates fall, the interest margin (the profit) banks earn on existing loans might squeeze slightly because they lower the rates for borrowers. However, the volume of loans explodes.

Instead of lending to 10 people at a high rate, they lend to 20 people at a slightly lower rate. The total profit goes up. NBFCs (Non-Banking Financial Companies) like Bajaj Finance often benefit even more than banks. Why? Because NBFCs borrow money from banks to lend to us. If their borrowing cost drops, their profit margin expands instantly. This creates a sweet spot for Repo rate Cut stocks in the financial services sector.

To truly understand the repo rate cut stocks relationship, let’s look at the broader pattern in 2025.

Timeline of 2025 Rate Cuts

| Date | Rate Cut | Previous Rate | New Repo Rate | Market Reaction |

|---|---|---|---|---|

| February 2025 | 25 bps | 6.50% | 6.25% | Positive; rate-sensitive sectors gained |

| April 2025 | 25 bps | 6.25% | 6.00% | Steady gains; market priced in expectation |

| June 2025 | 50 bps + 100 bps CRR cut | 6.00% | 5.50% | Strong rally; Nifty rose 252 pts; ₹3.6L crore wealth created |

| August & October 2025 | Pause (no cut) | 5.50% | 5.50% | Neutral; market consolidated |

| December 2025 | 25 bps | 5.50% | 5.25% | Positive; banking, auto, realty stocks rose 0.4-1% |

Historical Proof: Rates vs. Rallies

History is the best teacher, right? If we look back at previous cycles, the Impact of Repo rate cuts has almost always preceded a bull run. We have seen this movie before.

Here is the factual data on how the market reacted during major rate cut cycles in India. It is quite eye-opening:

| Year / Event | RBI Action (Repo Rate) | Market Impact (Nifty 50) | The Lesson |

| 2008 (Global Crisis) | Cut from 9.00% to 4.75% (Oct ’08 – Apr ’09) | Nifty initially crashed with the global market but then doubled (~100% Rally) in 2009 as cheap money fueled recovery. | Repo rate Cut stocks eventually lead the recovery after the panic settles. |

| 2020 (COVID-19) | Slashed to Historic Low of 4.00% (Mar ’20 – May ’20) | Nifty rallied over 140% from the March 2020 lows (~7,500) to the October 2021 highs (~18,600). | Cheap money fuels risk-taking and massive stock buying. |

| 2025 (Current) | Cut to 5.25% (Dec 5, 2025) | Nifty crosses 26,100; Sensex crosses 85,500. | Strong GDP (7.3% proj.) + Rate Cuts = “Goldilocks” Scenario. |

As you can see from the table, while immediate reactions can be volatile, the long-term Impact of Repo rate cuts is usually a rising market tide. In 2008 and 2020, the cuts were desperate measures to save the economy. But look at where the market went after that. It skyrocketed.

Why This Cut is Special

Today’s cut is unique and feels different from 2008 or 2020. Usually, central banks cut rates when the economy is struggling, like a doctor giving medicine to a sick patient. But look at India today.

Our GDP Growth is projecting 7.3% for the fiscal year. That is strong. Inflation is controlled and within the RBI’s comfort zone.

This is what economists call a “Goldilocks” scenario. The porridge is not too hot, not too cold; it is just right. The RBI isn’t cutting rates to save a dying economy; they are cutting rates to boost an already strong one. This is rocket fuel for Repo rate Cut stocks.

Also, the Governor’s commentary on the Rupee was crucial. Despite the Rupee touching 90 against the dollar recently, the RBI’s confidence suggests they have enough forex reserves to manage volatility. This stability gives foreign investors (FIIs) the confidence to return to Indian equities. When FIIs come back, they bring billions of dollars, driving prices up further.

The Saver’s Dilemma: The Hidden Push for Stocks

There is another side to this story that explains the Impact of Repo rate on the stock market, and it has to do with your uncle or father who loves Fixed Deposits (FDs).

When the Repo rate goes down, banks lower the interest rates on Fixed Deposits. If you are a retiree relying on FD interest, this is bad news. Your passive income drops. You are not happy.

So, what do these conservative savers do? They start looking for alternatives. They realize that 6% in an FD won’t beat inflation effectively. They are forced to move some money into Mutual Funds or the Stock Market in search of better returns. This flow of money from savings accounts to the stock market is massive. It creates a demand for stocks, further inflating stock prices. It’s the “TINA” factor—There Is No Alternative.

What Should You Watch Out For?

While the Impact of Repo rate cuts is generally positive, it’s not a magic wand. There are risks we should not ignore.

The biggest one is Inflation Risk. If money becomes too cheap, people spend wildly. When too much money chases too few goods, prices rise. If inflation roars back, the RBI might have to reverse course and hike rates again, which would be bad for the market.

Also, you have to be careful about what you buy. Just because rates are cut doesn’t mean a bad company becomes a good company. A company with bad management is still bad, even with cheap loans.

Building Your Repo Rate Cut Stocks Portfolio

So, knowing all this, how do you play it? If you believe the Impact of Repo rate will continue to play out over the next 6-12 months, here is how you might structure your watchlist.

If you are an Aggressive investor, you look at high-beta Repo rate Cut stocks. I am talking about Realty stocks like DLF or Godrej, and mid-cap NBFCs. These stocks move fast. When the market goes up 1%, these might go up 3%. But remember, they fall fast too.

If you want a Balanced approach, stick to Large-cap Private Banks like HDFC or ICICI. They get the volume growth with lower risk. They are the elephants that will dance, just a bit slower.

And don’t forget Consumption. With more money in pockets, FMCG and Consumer Durables stocks tend to do well. People will buy ACs, fridges, and better clothes.

Conclusion: Don’t Fight the RBI

There is an old saying on Wall Street: “Don’t fight the Fed.” In India, it is “Don’t fight the RBI.”

When the central bank is making money cheaper and liquidity easier, the path of least resistance for the stock market is up. It is like swimming in a river; it is much easier to swim with the current than against it.

Today’s move to 5.25% is a clear signal that the RBI prioritizes growth. For investors, understanding the Impact of Repo rate allows you to swim with the tide. The window for Repo rate Cut stocks is open. The liquidity tap is on. The question is, are you watching the right ones, or are you still sitting on the fence like Rohan?

Repo Rate FAQs: Quick Answers for Indian Investors

Got questions about how RBI’s repo rate moves shake up your stocks? We’ve got you covered with these bite-sized FAQs. From basics to bull runs, let’s decode the impact of repo rate in under a minute each.

1. What is the repo rate, anyway?

The repo rate is the interest RBI charges banks for short-term loans. It’s like the economy’s thermostat—cool it to fight inflation, crank it up for growth. Right now, at 5.25% in December 2025, it’s easing to boost spending.

2. How does the impact of repo rate hit the stock market?

Lower rates mean cheaper loans for companies, fattening profits and sparking rallies. Stocks love liquidity floods; think Nifty jumping 3-5% post-cuts. Higher rates? They squeeze margins, often triggering corrections.

3. Which repo rate cut stocks should I watch in 2025?

Banking (HDFC, ICICI) and real estate (DLF) shine brightest. Autos like Maruti also rev up as EMIs drop. These rate-sensitive picks surged 7-12% after June’s big slash.

4. Why do rate cuts supercharge repo rate cut stocks?

Cuts slash borrowing costs, freeing cash for expansions and hires. Investors chase yields in equities over FDs, driving valuations higher. Remember 2020? Cuts turned auto stocks into multi-baggers.

5. What’s the impact of repo rate hikes on my portfolio?

Hikes make debt pricier, hitting leveraged firms hard—realty and infra dip 10-15%. But defensives like IT hold steady. 2022’s tightening saw Nifty correct 15%, a reminder to diversify.

6. How fast does the impact of repo rate show in stocks?

Immediate buzz can spike markets 1-3% on announcement day. Real juice? 3-6 months later, as lending rates fall and earnings pop. December 2025’s cut already has banks buzzing.

7. Does global stuff affect the impact of repo rate in India?

Absolutely—US Fed hikes can weaken the rupee, muting RBI cuts. Oil spikes add inflation pressure too. But with GDP at 8%, 2025’s easing is holding strong against headwinds.

8. Are there risks with repo rate cut stocks?

Over-reliance on cyclicals can bite if inflation rebounds and RBI reverses. Bubbles in realty? Possible. Balance with 20-30% in stables like FMCG for a smoother ride.

9. How do I track repo rate changes for trading?

Follow RBI’s bi-monthly MPC meets—next one’s February 2026. Apps like Moneycontrol ping alerts. Post-cut, scan repo rate cut stocks via Nifty Bank or Realty indices for quick wins.

10. Will more cuts come in 2026, and what’s the impact of repo rate outlook?

With inflation at 2.2%, experts eye 50 more bps easing. That could push Nifty to 26,000, supercharging repo rate cut stocks. Stay tuned—it’s fuel for India’s bull story.

References

- India Central Bank Cuts Key Rate – Reuters

- RBI MPC Meeting Live Updates – Times of India

- RBI Monetary Policy 2025 LIVE – LiveMint

- RBI Repo Rate Cut Live – Economic Times

- RBI Slashes Repo Rate to 5.25% – NDTV

- RBI Pumps Rs 1.5 Lakh Crore Post-Cut – Indian Express

- RBI Rate Cut Sparks Optimism – CNBC TV18

- Will Home Loans Get Cheaper? – India Today

Read Daily Market Update here: