Introduction

In the lanes of middle-class India, where dreams are often measured in grams of gold, something has changed drastically. The same jewelry that once glittered in wedding albums is fast slipping out of reach. Not long ago, a silver coin cost around ₹1,100 to ₹1,200 — today, the same coin sells for ₹2,000. The purchasing power of families has shrunk, and ₹1 lakh no longer buys what it did a decade ago.

This pain, however, is part of a much larger story, one that stretches far beyond Indian homes — a story about geopolitics, the falling dollar, and the global gold rally 2025.

In the past three years, the world has witnessed a steady yet explosive rise in gold prices — a rally unlike anything seen in decades. To the everyday investor, it appears as a mere market trend. But beneath it lies a complex web of global ambitions, political warfare, and shifting economic powers.

Let’s peel back this golden curtain.

The Great Global Gold Buying Spree

Look at the data: China, Russia, India, Turkey, and Poland are aggressively hoarding gold. It’s not an accident — it’s a coordinated global movement.

In the 2025 financial year alone, India’s Reserve Bank (RBI) added gold worth $19 billion to its reserves. That move alone contributed significantly to the ongoing global gold rally 2025. The RBI, like its counterparts in China and Russia, is quietly cutting exposure to U.S. government debt — trimming dependence on the dollar.

In fact, India’s gold reserves have jumped from 661 tonnes in 2020 to 879 tonnes today, a historical increase of 220 tonnes within five years. This isn’t just financial diversification; it’s an economic defense mechanism against a weakening world currency.

Now, contrast this with the performance of traditional stock indices. In the past year, India’s Nifty grew only 2.46%, Sensex posted 2.41%, while gold boomed with a 63% return. Over five years, Nifty climbed 117%, Sensex 118%, but gold soared 165%.

That’s not coincidence. That’s confidence shifting towards an ancient asset that speaks the universal language of trust.

Every War Leaves a Golden Trail

History confirms one pattern — every major global crisis sends gold prices surging.

When the Iranian Revolution erupted in 1970, gold prices spiked. When the Soviet Union invaded Afghanistan, the climb renewed. The Yom Kippur War, the Gulf War, the Iraq invasion, and the Ukraine conflict — each event triggered fresh interest in gold.

Why does war lead to a gold rally?

Because gold doesn’t depend on promises or paper; it relies on scarcity. It cannot be printed, and it doesn’t default.

The roots of this trust lie in 1944, during the Bretton Woods Agreement, an event that defined modern finance. As the world emerged battered from World War II, one nation stood intact and rich — the United States. Holding almost 66% of the world’s gold reserves, America proposed a deal: base global trade on the U.S. dollar, backed by gold.

For every $35, America guaranteed an ounce of real gold. Nations agreed, and the dollar became the global reserve currency — a symbol of wealth, trust, and power.

But everything changed on August 15, 1971, when President Richard Nixon announced the end of the gold standard. America unpegged the dollar from gold, giving itself the freedom to print currency at will.

The impact was immediate. Gold prices skyrocketed from $17 an ounce to $932 within nine years — a whopping 458% rise, marking the earliest version of a global gold rally.

That single decision told the world one thing: paper money is infinite, but gold is eternal.

| Year / Period | Term / Event | Description / Impact |

|---|---|---|

| 1944 | Bretton Woods Agreement | Established the U.S. dollar as the global reserve currency, backed by gold at $35 per ounce. |

| Post–WWII (Late 1940s–1960s) | U.S. Gold Dominance | America held about 66% of the world’s gold, symbolizing postwar stability and trust in the dollar. |

| 1970s | Iranian Revolution | Triggered a surge in gold prices due to geopolitical instability in the Middle East. |

| 1971 (August 15) | Nixon Ends Gold Standard | The U.S. unpegged the dollar from gold, enabling unlimited currency printing and ending gold’s fixed link to the dollar. |

| 1971–1980 | Gold Price Surge | Gold prices skyrocketed from $17 to $932 per ounce — a massive 458% increase over the decade. |

| 1973 | Yom Kippur War | Heightened Middle East tensions boosted gold demand as investors sought safety. |

| 1979 | Soviet Invasion of Afghanistan | Renewed global gold rally as investors moved capital into safe-haven assets. |

| 1990–1991 | Gulf War | Geopolitical uncertainty drove global investors toward gold. |

| 2003 | Iraq Invasion | Another wave of geopolitical risk revived demand for gold, lifting prices. |

| 2014, 2022 | Ukraine Conflict | Modern example of a gold price spike during prolonged international conflict and sanctions. |

| — (Timeless Economic Principle) | Scarcity Principle | Gold’s value consistently rises in crises because it cannot be printed, inflated, or defaulted. |

| Ongoing Pattern | Global Gold Rally | Wars, inflation, and crises consistently trigger renewed investor interest in gold as a secure asset. |

Distrust in the Dollar – The Beginning of a New Era

Fast-forward to recent years. In 2022, when Russia invaded Ukraine, the United States and its allies froze $300 billion of Russia’s reserves held in dollars. The rest of the world watched in alarm.

If Washington could freeze a sovereign nation’s funds, then were any reserves truly safe?

The result: a silent economic revolution.

By 2024, global central banks had collectively bought 3,200 tonnes of gold, the largest accumulation in history — a pillar moment for the global gold rally 2025.

- China’s reserves grew from 395 tonnes to 2,279 tonnes.

- Russia’s reserves climbed from 884 tonnes to 2,333 tonnes.

- India, too, expanded its reserves to 876 tonnes.

- Even smaller nations like Turkey and Poland joined the movement.

It’s no coincidence that all these countries are strategically reducing their U.S. Treasury holdings. The geopolitics behind gold prices is clear — nations are building an insurance policy against American financial dominance.

This collective distrust in the U.S. dollar may one day lead to what economists call a “post-dollar world economy.”

Gold ETFs: Digitizing the Ancient Metal

The modern generation has embraced gold too — but not in coins or jewelry. They’re buying Gold ETFs, turning the most ancient form of wealth into a digital asset.

A Gold Exchange-Traded Fund (ETF) allows investors to buy and sell gold like stocks, without physically holding it. But behind every unit lies actual gold stored in vaults. So, when you invest in a Gold ETF, someone somewhere has to buy real gold to back your transaction.

During global stress events like the COVID-19 pandemic or the Ukraine war, individual investors rushed toward gold ETFs. This surge in digital demand forced institutions to purchase massive volumes of physical gold — tightening supply and pushing prices up.

The data speaks for itself. In India, the total value of gold ETFs stood at ₹5,768 crore in 2019. By 2025, it reached a staggering ₹91,136 crore — over 15 times growth in just six years.

Globally, $26 billion flowed into Gold ETFs in September 2025 alone, fueling the global gold rally 2025 further.

Digital gold is not replacing physical gold. It’s amplifying its demand — a bridge between traditional security and modern convenience.

The Microeconomic Storm Behind the Glitter

While geopolitics usually dominate headlines, local economies also influence gold prices dramatically.

The first reason: the depreciation of local currencies.

In 2013, $1 equaled ₹61. Gold at the time was around ₹29,600 per 10 grams. In 2025, $1 equals ₹88.8, and the same 10 grams cost over ₹1.22 lakh.

This difference isn’t just due to global prices; it’s because the rupee has weakened over time. The weaker the currency, the higher the domestic cost of gold — automatically pushing Indian gold prices up.

The second factor: festive and cultural buying.

India celebrates gold. Every wedding season and festival — from Dhanteras to Akshaya Tritiya — sends millions rushing to jewelry shops and digital platforms alike. When over a billion Indians buy gold within months, the price pressure is inevitable.

The third factor: global investment behavior, especially in China.

In China, the stock market and real estate sectors have underperformed drastically. The Shanghai Composite Index grew only 17% over five years, compared to India’s Sensex, which jumped 118%. Chinese home prices fell 4.5% in 2024, eroding household wealth. As a result, Chinese investors shifted funds toward gold — traditionally seen as a safe haven.

This surge boosted the global gold rally 2025, proving yet again that when markets stumble and currencies falter, gold shines brighter.

| Key Metric | Value/Result |

|---|---|

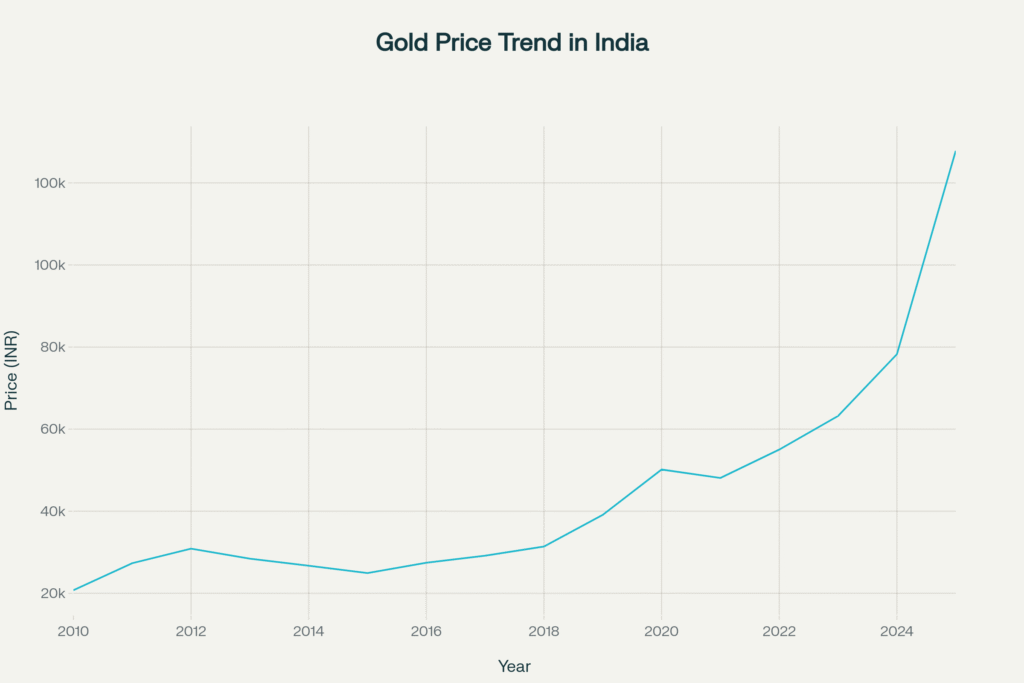

| Gold price in India (2010, 10g) | ₹20,728 |

| Gold price in India (2025, 10g) | ₹1,27,820 |

| India’s gold reserves (2025) | 876–880 tonnes |

| Global central banks’ gold buy (2022–24) | 3,200 tonnes |

| 5-year Nifty return (2020–25) | 117% |

| 5-year Sensex return (2020–25) | 118% |

| 5-year Gold return (2020–25) | 165% |

| India Gold ETF size (2019–2025) | ₹5,768 crore → ₹91,136 crore |

The Psychological Game: War, Fear, and Gold

Gold is not just an asset — it’s emotion, psychology, and survival combined.

When uncertainty rises — wars, financial collapses, or pandemics — people instinctively seek security. Stocks crash, crypto stumbles, but gold remains the world’s ultimate safety net.

Every major crisis has validated this belief:

- The 1991 Gulf War drove gold up 15%.

- The 2008 Financial Crisis made gold double in value.

- The 2020 Pandemic sent it past $2,000 per ounce for the first time.

- The ongoing Russia-Ukraine tensions reignited a similar upward wave, culminating in the global gold rally 2025.

As global threats multiply, gold reasserts itself as not only the oldest currency but also the most trusted one.

Beyond Economics: The Return of Resource Power

The modern geopolitics behind gold prices is eerily similar to oil politics of the 20th century.

Countries like the U.S. wielded power not just through diplomacy, but through control over key resources — first oil, now currency. But that dominance is slipping.

China and Russia recognize that military and political power alone cannot challenge America’s financial machinery. However, controlling tangible resources like gold and rare earth metals can.

That’s why they are steadily replacing dollar-backed reserves with gold-backed assets. It’s a subtle, long-term play to neutralize U.S. influence in international trade.

And India, though not leading this charge, is smartly positioning itself within this shift — strengthening its financial immunity while ensuring stability against global shocks.

This is not about currency wars anymore. It’s about wealth realignment — and that is the invisible engine behind the global gold rally 2025.

The Role of Interest Rates: A Quiet Catalyst

Interest rate cuts are the less flashy but powerful force behind gold’s rise.

When interest rates drop, returns from bonds and savings accounts shrink. Smart investors move toward assets that promise value preservation — primarily gold. With the U.S. Federal Reserve and major central banks signaling sustained or lower interest rates amid global slowdown fears, gold finds consistent buyers.

Moreover, the liquidity pumped into global economies during crises (like the $2.1 trillion of quantitative easing by the U.S. post-2008) directly boosts inflation. That inflation weakens currencies and strengthens gold’s relative worth. (Read More)

This dynamic ensures that gold remains a critical hedge against both inflation and policy unpredictability — thus extending the gold rally 2025 story far beyond its immediate causes.

How Should You Invest in Gold Today?

As the glitter turns into a global strategy, investors face the ultimate question:

Should you invest in gold now?

The answer depends on personal goals and risk appetite — but diversification is the golden rule.

- Keep at least six months of income as cash or savings for emergencies.

- Then, divide investments across gold, stocks, and bonds.

- Gold should ideally make up 10–15% of a balanced portfolio.

Today’s investors don’t have to buy jewelry or heavy bars. They can diversify through:

- Digital Gold Platforms for small, liquid investments.

- Gold ETFs for exchange flexibility.

- Sovereign Gold Bonds (SGBs) for tax-efficient, interest-yielding exposure.

Each route reinforces the same underlying fact — no matter how the post-dollar world economy unfolds, gold will continue to be the ultimate hedge.

Charting the Future: Gold Beyond 2025

Gold’s recent surge is not a bubble — it’s a reflection of changing global realities.

Three forces ensure this momentum will sustain for the next decade:

- Persistent geopolitical tensions between major powers.

- De-dollarization trends among major nations.

- Growing investor distrust in overvalued markets and fiat-based assets.

The global gold rally 2025 is less about greed and more about survival — nations, institutions, and individuals protecting their wealth from systemic risks.

As more countries pivot from paper promises to physical wealth, gold will not just remain a commodity — it will become an instrument of power, politics, and protection.

And if history is any guide, every empire that underestimated gold eventually lost control over global finance.

Final Thoughts: The Light That Never Fades

From temples and vaults to ETFs and trade wars, gold has transcended time, technology, and ideology. It has witnessed revolutions, recessions, and resurging superpowers — yet its value endures.

In 2025, amid all economic chaos and shifting alliances, gold isn’t glimmering just as metal — it’s glowing as a message.

For some, it’s a symbol of prosperity.

For others, it’s a weapon of sovereignty.

For everyone, it’s security against uncertainty.

And as long as humans value trust, scarcity, and permanence, the global gold rally 2025 will remain the most powerful reflection of human faith — in the oldest currency the world has ever known.

More Articles

How to Invest in Gold: A Step-by-Step Guide for 2025

Gold vs Silver vs Sensex: Who Made You Richer?

Gold and Silver at ₹125,000: What History Tells Us About What’s Next