Introduction

Indian stock markets in 2025 have been buzzing with SME IPOs delivering stunning listing gains. Investors have been hunting for the next opportunity that blends solid fundamentals with strong grey market demand. Now, all eyes are on the TechD Cybersecurity SME IPO, which opens for subscription on September 15, 2025.

This isn’t just another SME issue. It’s a chance to tap into India’s fast-growing cybersecurity industry at a time when digital infrastructure has become the backbone of every sector—banking, healthcare, aviation, manufacturing, and beyond. TechD’s IPO is backed by impressive financial growth, marquee clients like the Adani Group and Zensar Technologies, and a grey market premium that already signals a possible Mega listing Gain.

So, what makes this IPO stand out? Let’s dive into every detail—from issue structure and financials to the company’s story and market outlook.

IPO Details: TechD Cybersecurity SME IPO at a Glance

The issue is a book-built SME IPO with a total size of ₹37.03 crore. Unlike many SME issues that have a mix of fresh issue and offer-for-sale, TechD’s IPO is a 100% fresh issue, ensuring the funds directly flow into business expansion.

Here’s the full breakdown:

| IPO Particulars | Details |

|---|---|

| Issue Opening Date | 15 September 2025 |

| Issue Closing Date | 17 September 2025 |

| Total Issue Size | ₹37.03 crore (Fresh Issue) |

| Face Value | ₹10 per equity share |

| Price Band | ₹183 – ₹193 per share |

| Listing Platform | NSE SME |

| Issue Type | Book Built Issue |

| Market Lot | 600 shares |

| Minimum Retail Application | 2 lots (1,200 shares) = ₹2,31,600 |

| Minimum HNI Application | 3 lots (1,800 shares) |

| Promoter Holding (Pre-IPO) | 86.61% |

| Market Maker Portion | ₹1.96 crore |

The minimum entry ticket of ₹2.31 lakh means this IPO is targeted towards serious retail participants rather than casual investors.

IPO Reservation Structure

The share allocation gives institutional players a big role, unusual for SMEs and a positive sign for market confidence.

- QIBs (Qualified Institutional Buyers): 47.46%

- Non-Institutional Investors (HNIs): 14.26%

- Retail Investors: 33.26%

- Market Maker: 5.02%

This distribution ensures a balanced demand pool, with institutional involvement likely to give confidence to retail investors.

IPO Timeline: Fast-Track from Subscription to Listing

The TechD Cybersecurity IPO has a quick turnaround time, with allotment, refunds, and credit of shares scheduled within just two days of closing.

| IPO Activity | Date |

|---|---|

| Issue Opens | 15 September 2025 |

| Issue Closes | 17 September 2025 |

| Basis of Allotment | 18 September 2025 |

| Refunds Initiation | 19 September 2025 |

| Credit of Shares | 19 September 2025 |

| Listing Date | 22 September 2025 |

The short gap between closure and listing is a boon for investors, minimizing waiting time.

Grey Market Premium (GMP): Fueling the Mega Listing Gain Buzz

One of the hottest talking points in this IPO is the Grey Market Premium (GMP). The GMP trend is often used as an informal indicator of investor demand and expected listing performance.

| Date | IPO Price | GMP (₹) | Estimated Listing Price (₹) | Potential Gain (%) | Profit per Lot (₹) |

|---|---|---|---|---|---|

| 12 Sep 2025 | ₹193 | ₹158 | ₹351 | 81.87% | ₹94,800 |

At this premium, the IPO is signaling nearly 82% listing gains. For a retail investor putting in ₹2.31 lakh (minimum application), this translates into almost ₹95,000 profit on day one—hence the widespread chatter about a Mega listing Gain.

Of course, it’s worth noting that GMP is speculative and unofficial, but the numbers certainly add excitement.

The TechD Cybersecurity Story: From Defence Labs to a Cyber Powerhouse

The company began its journey in 2017 under the name Tech Defence Labs Solutions before rebranding as TechD Cybersecurity Limited. This wasn’t just a cosmetic change—it reflected its transformation into a global cybersecurity solutions provider.

TechD has built its identity on two strong pillars:

- Comprehensive Security Services – Offering managed security services, cyber program management, VAPT (Vulnerability Assessment and Penetration Testing), compliance advisory, specialized solutions, and staff augmentation.

- Cybersecurity Education & Training – Partnering with universities, offering certification programs, hands-on workshops, and corporate training modules. This dual focus makes TechD not only a defender of businesses but also a builder of the next generation of cybersecurity talent.

Its clientele reads like a who’s who of Indian industry—Adani Group, Zensar Technologies, Astral, Kedia Capital, Cyber Valley, ETO Gruppe Technologies, and IQM Corporation—spanning BFSI, manufacturing, healthcare, aviation, and NBFCs.

Such diversity insulates TechD from sector-specific risks while proving its ability to handle complex digital security needs across industries.

Strengths vs Risks

Like every IPO, the TechD Cybersecurity SME IPO has both attractive strengths and noteworthy risks.

| Strengths | Risks |

|---|---|

| Comprehensive and integrated cybersecurity services portfolio | Cybersecurity is highly competitive with global players like Palo Alto & Check Point dominating |

| CERT-In empanelment and strong regulatory credibility | Heavy dependence on skilled manpower availability and retention |

| Impressive financial growth: 97% revenue and 159% PAT growth in FY25 | Rapid tech changes mean constant need for upgrades |

| Strong OEM partnerships and trusted client relationships | Revenue concentration risk from large clients |

The balance shows that while risks exist, the strengths create a strong foundation for growth.

IPO Objectives: Building for the Future

The fresh issue proceeds will be channeled into three critical areas:

- Investment in Human Resources (₹260.92 million): Building a larger talent base to meet growing cybersecurity demand.

- Global Security Operations Centre (GSOC) in Ahmedabad (₹58.88 million): Enhancing capacity to manage clients’ real-time security needs.

- General Corporate Purposes: Supporting expansion and operational efficiency.

This roadmap clearly underlines TechD’s ambition to scale from a niche Indian provider to a global cybersecurity powerhouse.

Financial Performance: Explosive Growth

TechD’s financial trajectory is nothing short of remarkable. From a modest income base of ₹7.59 crore in FY23, the company nearly doubled revenue each year to hit ₹30.23 crore in FY25. Profits rose even faster, with PAT jumping from ₹0.94 crore in FY23 to ₹8.40 crore in FY25.

| Financial Metrics (₹ Cr) | FY23 | FY24 | FY25 |

|---|---|---|---|

| Total Income | 7.59 | 15.36 | 30.23 |

| Profit After Tax | 0.94 | 3.24 | 8.40 |

| EBITDA | 1.36 | 4.91 | 12.24 |

| Net Worth | 1.56 | 4.80 | 22.14 |

| Assets | 6.98 | 9.14 | 29.08 |

Such consistent growth signals both operational efficiency and rising demand for its services.

Peer Comparison: Positioned Strongly Among SMEs

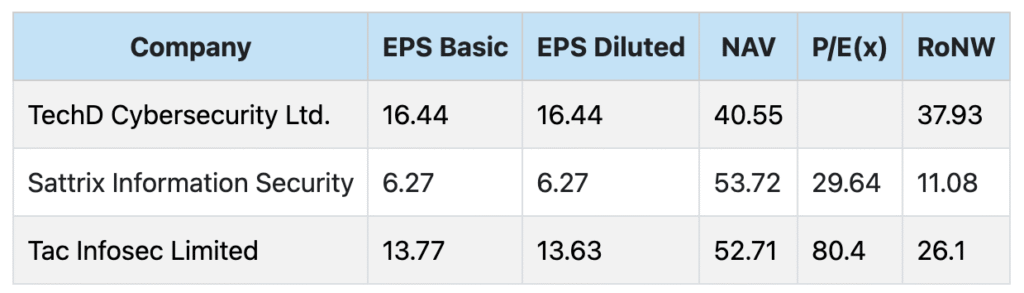

Against other listed cybersecurity SMEs, TechD holds its ground firmly.

- EPS: ₹16.44, higher than peers.

- RoNW: 37.93%, among the strongest in the segment.

- P/E Ratio: Attractive compared to Tac Infosec’s 80.4x.

Peers like Sattrix Information Security and Tac Infosec Ltd. are well-regarded, but TechD’s financial efficiency and client credibility make it an appealing option at current valuations.

Investor Takeaway: Why TechD Cybersecurity IPO is Different

The TechD Cybersecurity SME IPO arrives at the perfect time. Cybersecurity has moved from being a back-office concern to a boardroom priority, and companies like TechD are reaping the benefits. With a proven track record, marquee clients, exponential financial growth, and a GMP hinting at a possible Mega listing Gain, this IPO is already on the radar of both retail and institutional investors.

Yes, the entry cost is high and risks exist, but for those with a medium-to-long-term horizon, TechD could become a strong wealth compounder in the SME space. For short-term players, the GMP already paints a lucrative listing picture.

Conclusion

The TechD Cybersecurity SME IPO is shaping up to be one of the most exciting SME issues of 2025. It combines sectoral tailwinds in cybersecurity, robust financial performance, and strong investor interest. While the official listing is set for 22 September 2025, the grey market is already betting big on a Mega listing Gain.

For investors ready to commit serious capital and willing to balance opportunity with risk, TechD’s IPO might be the gateway to both short-term profits and long-term digital security growth.

FAQs on TechD Cybersecurity SME IPO

Q1. When does the TechD Cybersecurity SME IPO open and close?

It opens on 15 September 2025 and closes on 17 September 2025.

Q2. What is the price band for TechD Cybersecurity IPO?

The price band is ₹183–₹193 per share.

Q3. What is the minimum investment required?

Retail investors must invest at least ₹2,31,600 for 2 lots.

Q4. What is the TechD Cybersecurity IPO GMP today?

As of 12 September 2025, the GMP is ₹158, indicating strong demand.

Q5. When is the IPO expected to list?

The tentative listing date is 22 September 2025.

Q6. What are the IPO objectives?

Funds will be used for human resources, setting up a GSOC in Ahmedabad, and general corporate purposes.

Q7. Who are TechD’s major clients?

Some include Adani Group, Zensar Technologies, Astral, Kedia Capital, and IQM Corporation.

Q8. How much listing gain is expected?

Based on GMP, a Mega listing gain of ~82% is possible, though not guaranteed.

Q9. How has the company performed financially?

Revenue grew 97% and PAT surged 159% in FY25 compared to FY24.

Q10. Should retail investors apply?

Investors seeking both listing gains and long-term exposure to cybersecurity may consider applying, keeping risks in mind.

Related Articles

Airfloa Rail Technology IPO: Can This SME IPO Deliver 100% Listing Gain?