Introduction – Sudeep Pharma IPO

The Sudeep Pharma IPO has sparked significant attention in India’s pharmaceutical and specialty chemicals sector. As one of the most anticipated offerings of 2025, investors are eager to evaluate its growth prospects, financials, and listing sentiment. Backed by over three decades of excellence in supplying pharmaceutical excipients and food-grade minerals, Sudeep Pharma Ltd. is making its debut on the main board—inviting both retail and institutional investors to participate in its journey.

Are you curious if the Sudeep Pharma IPO aligns with your portfolio strategy? This detailed review will walk you through all critical aspects: from IPO issue details, subscription schedule, intended use of proceeds, and much more. Whether you’re an IPO enthusiast or a first-time investor (check out our Everything about IPO), this blog will provide actionable insights and links to relevant IPO analysis and daily market summary (onedemat.com IPO analysis section). Stay tuned as we decode the facts and future potential of the Sudeep Pharma IPO.

Sudeep Pharma IPO Overview

Sudeep Pharma IPO Details

The Sudeep Pharma IPO is a book built issue aggregating to ₹895.00 crores—comprising a fresh issue of 0.16 crore shares (₹95.00 crores) and an offer for sale of 1.35 crore shares (₹800.00 crores). Investors can subscribe between November 21 and November 25, 2025, with a price band set at ₹563–₹593 per share. The minimum application lot size is 25 shares, requiring an investment of ₹14,825 for retail. sNII and bNII categories have higher minimum lot sizes and investment amounts.

For detailed RHP information, refer to the official Red Herring Prospectus (RHP), and to explore the Draft Red Herring Prospectus, visit SEBI DRHP. If you want to track upcoming IPOS, consult Upcoming IPOs in 2025.

Below is a table summarizing key details of the Sudeep Pharma IPO:

| Parameter | Details |

|---|---|

| IPO Date | November 21, 2025 to November 25, 2025 |

| Listing Date | November 28, 2025 (Tentative) |

| Face Value | ₹1 per share |

| Issue Price Band | ₹563 to ₹593 per share |

| Lot Size | 25 Shares |

| Issue Size | 1,50,92,750 shares (₹895.00 Cr) |

| Fresh Issue | 16,02,024 shares (₹95.00 Cr) |

| Offer for Sale | 1,34,90,726 shares (₹800.00 Cr) |

| Listing | BSE, NSE |

| Pre-Issue Equity | 11,13,46,602 shares |

| Post-Issue Equity | 11,29,48,626 shares |

| Reservation | QIB: ≤50%, Retail: ≥35%, NII: ≥15% |

| Lead Manager | ICICI Securities Ltd. |

| Registrar | MUFG Intime India Pvt.Ltd. |

Learn more about IPOs and how to apply through Zerodha by opening an account with us: Apply IPO with Zerodha.

IPO Timeline (Tentative Schedule)

For investors tracking the Sudeep Pharma IPO, here’s the tentative schedule, including subscription and listing dates:

| Event | Date |

|---|---|

| IPO Open | Fri, Nov 21, 2025 |

| IPO Close | Tue, Nov 25, 2025 |

| Allotment Finalization | Wed, Nov 26, 2025 |

| Refund Initiation | Thu, Nov 27, 2025 |

| Credit to Demat Account | Thu, Nov 27, 2025 |

| Listing Date | Fri, Nov 28, 2025 |

| UPI Mandate Confirmation | 5 PM, Tue, Nov 25, 2025 |

Follow daily market summaries (onedemat.com day-end market summary) and premarket updates (premarket newsletter section) to stay ahead before the listing.

Use of IPO Proceeds – Sudeep Pharma IPO

The Sudeep Pharma IPO proceeds are earmarked for:

- Capital expenditure for procuring machinery at the Nandesari Facility I (₹75.81 crores)

- General corporate purposes

These allocations highlight the company’s strategy for expanding production capacity and strengthening its market position. For direct access to Sudeep Pharma’s investor information, visit the company website.

Company Overview – Sudeep Pharma Ltd.

Sudeep Pharma Ltd., established in 1989, has carved a niche as a reliable producer of pharmaceutical excipients, food-grade minerals, and specialty nutrition ingredients. With six state-of-the-art manufacturing facilities totaling a 50,000 MT production capacity, the company delivers over 200 products to customers in more than 100 countries. The product portfolio encompasses minerals such as calcium, iron, magnesium, zinc, potassium, and sodium—catering to pharmaceutical, food, and nutrition industries.

Notably, Sudeep Pharma’s robust R&D operations, equipped with in-house laboratories and pilot-scale plants, empower the company to innovate in mineral salts and excipients. This dedication to innovation and customer-centricity forms a solid foundation for the Sudeep Pharma IPO, positioning the company for sustainable growth in regulated, high-barrier markets.

Key highlights of Sudeep Pharma Ltd.:

- Six integrated manufacturing units with global regulatory accreditations

- 704 permanent employees as of December 31, 2024

- Proven track record of catering to pharma, food, and specialty ingredient segments

- Diversified product base fueling steady revenues

- Strong, long-standing relationships with distinguished global customers

Explore more about the company’s product mix, strategy, and management vision on the official company website.

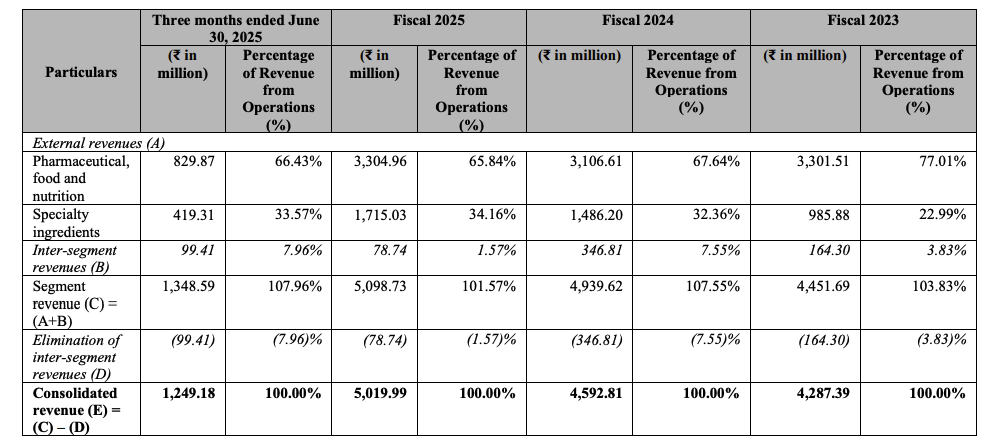

Financial Performance – Sudeep Pharma IPO

Key Financial Summary (in ₹ Cr)

The Sudeep Pharma IPO is underpinned by the company’s solid financial growth. Between FY2023 and FY2025, revenue grew at a healthy pace, and profitability witnessed an uptick, underlining Sudeep Pharma’s operating leverage and efficient cost structure.

Here’s a consolidated summary of financials:

| Period Ended | 30 Jun 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Assets | 922.26 | 717.17 | 513.87 | 420.11 |

| Total Income | 130.08 | 511.33 | 465.38 | 438.26 |

| Profit After Tax (PAT) | 31.27 | 138.69 | 133.15 | 62.32 |

| EBITDA | 48.57 | 199.28 | 187.76 | 98.64 |

| Net Worth | 688.32 | 497.53 | 359.07 | 226.29 |

| Reserves & Surplus | 668.52 | 481.11 | 354.59 | 221.88 |

| Total Borrowing | 135.97 | 135.25 | 75.03 | 82.26 |

(All figures in ₹ crores, consolidated and restated)

Sudeep Pharma posted a 10% rise in revenue and 4% growth in PAT from FY24 to FY25, showing that the Sudeep Pharma IPO brings a fundamentally strong player to market.

Key Financial Ratios – Sudeep Pharma IPO

Strong profitability and stable leverage further reinforce Sudeep Pharma’s investment case. Key ratios as of March 31, 2025:

| KPI | Value |

|---|---|

| Debt/Equity | 0.20 |

| RoNW (Return on Net Worth) | 27.88% |

| PAT Margin | 27.63% |

| EBITDA Margin | 39.70% |

With high EBITDA and PAT margins, the Sudeep Pharma IPO positions itself attractively amongst specialty ingredient peers. The robust RoNW further signals efficient capital utilization.

For deeper dives into IPO company financials, visit our IPO analysis section and stay updated on listings at our upcoming IPOs page.

Valuation & Peer Comparison – Sudeep Pharma IPO

Sudeep Pharma IPO Valuation

With robust fundamentals, the Sudeep Pharma IPO is priced to reflect both its growth potential and strong financials. The price-to-book value and P/E ratios highlight how the company stacks up against its performance benchmarks.

Sudeep Pharma IPO Valuation Table:

| Metric | Pre-IPO | Post-IPO |

|---|---|---|

| EPS (₹) | 12.46 | 11.07 |

| P/E Ratio (x) | 47.61 | 53.55 |

| Price to Book Value | 12.93 | — |

| Market Capitalization (₹ Cr) | 6,697.85 | — |

Despite premium valuations, the Sudeep Pharma IPO draws confidence from its high profitability and sector leadership. For a detailed read on these metrics, learn more in our IPO analysis section. Deep-dive into the Sudeep Pharma IPO RHP document here.

Sudeep Pharma IPO Peer Comparison

The Sudeep Pharma IPO stands out in India’s competitive speciality minerals and excipients sector. Here’s a quick peer comparison, focusing on major listed and unlisted players:

| Company | Revenue (₹ Cr) | PAT (₹ Cr) | Market Cap (₹ Cr) | P/E Ratio | Geography |

|---|---|---|---|---|---|

| Sudeep Pharma | 511 (FY24) | 139 (FY24) | 688 (Post-IPO) | ~53.6 | Gujarat, IN |

| Colorcon Asia | 500+ | NA | Private | N/A | Goa, IN |

| JRS Pharma & Gujarat Microwax | 320 | 51 | Private | N/A | Gujarat, IN |

| Global Calcium | 600–750 | NA | Private | N/A | TN, IN |

| Kerry Group (Pharma) | 6,400 (₹ Cr) | NA | Global | N/A | Global (IE) |

| Roquette (Pharma) | 7,700 (₹ Cr) | NA | Global | N/A | Global (FR) |

Compared to its Indian and international peers, the Sudeep Pharma IPO offers higher EBITDA and PAT margins, pointing to operational edge and focus on niche sectors.

For more company matchups and sector analysis, don’t miss our IPO deep-dive section.

Strengths & Risks – Sudeep Pharma IPO

When evaluating the Sudeep Pharma IPO, investors should balance the impressive strengths with key risks. Here’s a clear side-by-side breakdown:

| Strengths | Risks |

|---|---|

| Market leadership in specialty minerals & excipients | Premium IPO pricing could limit upside |

| Diversified product portfolio across pharma, food, nutrition | Dependence on select export markets |

| Well-equipped, globally compliant manufacturing | Fluctuations in raw material costs |

| Extensive global export footprint (100+ countries) | Regulatory risks in India & overseas |

| High EBITDA & PAT margins vs. peers | Forex volatility impacting revenues |

| Strong R&D and customer relationships | Competition from global unlisted majors |

With its unique positioning, the Sudeep Pharma IPO seeks to deliver value, but prudent consideration of sector-specific risks and valuations is essential. For context on broader IPO trends and risk factors, check our comprehensive IPO guide.

Grey Market Premium (GMP) & Listing Sentiment

Sudeep Pharma IPO GMP Update

As of now, the Sudeep Pharma IPO grey market premium (GMP) has not started—in fact, there are zero trades reported in the unofficial market.

Investors are advised to stay cautious and rely more on fundamental and peer analysis (see IPO analysis onedemat.com) rather than speculative GMP chatter. For GMP updates and prelisting trends, check our premarket update section.

Listing Day Expectations

Given the absence of a Sudeep Pharma IPO GMP, listing day sentiment will likely develop only closer to the final allotment and listing date.

The best way to check real-time Sudeep Pharma IPO allotment status is via this IPO allotment link. For daily market moves and post-listing performance, visit our Day-End Market Summary.

Conclusion – Final Verdict

The Sudeep Pharma Ltd. IPO delivers exposure to a market leader in specialty pharmaceutical minerals and excipients with impressive global reach and a strong client profile across over 100 countries. Its healthy financials—marked by double-digit revenue growth, robust PAT margins, and consistent profitability—offer confidence to quality-conscious investors. The Sudeep Pharma IPO’s edge lies in its diversified product basket, high entry barriers, and advanced manufacturing/R&D facilities.

However, investors must consider the premium valuations, sector-specific risks, and absence of early GMP signals. Given all factors, the Sudeep Pharma IPO appears well-suited for those seeking growth exposure in the pharma ingredients space, especially with a long-term perspective. Conservative investors may wait for post-listing volatility to subside before entering.

Don’t forget to explore our complete IPO guide for a 360-degree approach to IPO investing, and keep an eye on all upcoming IPOs in 2025 for more opportunities.

For analysis of similar IPOs, real-time market recaps, and actionable insights, visit our:

Ready to apply for the Sudeep Pharma IPO? Open your account and apply through Zerodha for a seamless IPO experience!

For direct company resources, review the official RHP and SEBI DRHP. To learn more about the company, visit the official Sudeep Pharma Ltd. website.

Frequently Asked Questions (FAQs) about Sudeep Pharma Ltd. IPO

What is the total size of the Sudeep Pharma Ltd. IPO?

The Sudeep Pharma IPO is a ₹895.00 crore issue, combining fresh shares and an offer for sale.

What is the price band for Sudeep Pharma Ltd. IPO?

The price band is set at ₹563 to ₹593 per share for the Sudeep Pharma IPO.

When does the Sudeep Pharma Ltd. IPO open and close for subscription?

Sudeep Pharma IPO opens on November 21, 2025, and closes on November 25, 2025.

What is the lot size for the Sudeep Pharma IPO?

The minimum application lot is 25 shares for the Sudeep Pharma IPO.

Where will the Sudeep Pharma IPO get listed?

The Sudeep Pharma IPO will list on both BSE and NSE.

Who are the promoters of Sudeep Pharma Ltd.?

Promoters include Sujit Jaysukh Bhayani, Avani Sujit Bhayani, Shanil Sujit Bhayani, and associated entities.

What will the proceeds of the Sudeep Pharma Ltd. IPO be used for?

Proceeds will be used for machinery purchase at the Nandesari Facility I and general corporate purposes.

Is there any grey market premium (GMP) for the Sudeep Pharma IPO yet?

No, as of now the Sudeep Pharma IPO GMP is zero and has not started.

How can I check Sudeep Pharma Ltd. IPO allotment status?

You can check your status via the official IPO allotment link.

How to apply for the Sudeep Pharma Ltd. IPO online?

Apply for Sudeep Pharma Ltd. IPO conveniently through Zerodha account opening link or any registered broker.

For more info, visit our IPO analysis section and read our IPO guide.

References

- NSE India — for benchmark index data & FPI flows.

- BSE India — for corporate results and announcements.

- Moneycontrol — for real-time market coverage.

- Economic Times Markets — for expert commentary and sectoral analysis.

Read Daily Market Update here: