Stock Market Weekly Report – July 28 to August 1, 2025

The Indian equity markets witnessed a sharp downturn this week, with benchmark indices under pressure amid global trade jitters and sector-specific stress. In this Stock Market Weekly Report, we break down the key movements, sector highlights, top gainers & losers, and the factors that spooked investors.

The Nifty 50 ended the week at 24,611, falling 173.90 points or 0.70%, while the Sensex closed at 80,584.32, down 725.38 points or 0.89%. Broader markets were hit even harder — the S&P BSE SmallCap index slumped by 2.53%, and the Nifty Bank fell 1.31%, highlighting deep selloffs in financial and mid-small cap counters. The Nifty IT index dropped a steep 2.28%, indicating heavy profit booking in tech names.

One of the major dampeners was Donald Trump’s announcement of a 25% tariff on Indian imports, rekindling fears of a new wave of trade tensions. This announcement came at a time when the Indian market was already grappling with foreign outflows and valuation concerns — adding fuel to the bearish fire.

As we dive deeper into this week’s market action, let’s first look at which sectors stood tall and which ones crumbled under pressure.

Sector Highlights: Top Winners and Losers

As part of our Stock Market Weekly Report, it’s clear that while the broader market saw a decline, select pockets of strength did emerge. Let’s take a quick look at the sectors that delivered gains — and those that bore the brunt of the selloff.

Top Performing Sectors This Week

Despite the overall weakness, these sectors managed to post gains, driven by stock-specific momentum and defensive plays:

| S.No | Sector | Weekly Change (%) |

|---|---|---|

| 1 | Hardware Technology & Equipment | +6.21% |

| 2 | FMCG | +1.80% |

| 3 | Fertilizers | +1.53% |

| 4 | Food, Beverages & Tobacco | +0.75% |

| 5 | — | — |

The standout performer was Hardware Technology & Equipment, possibly benefiting from renewed interest in AI-linked hardware and export demand. FMCG and Fertilizers continued to attract buyers amid monsoon stability and consumption strength.

Worst Performing Sectors This Week

Several cyclical and rate-sensitive sectors came under significant pressure, dragging the indices lower:

| S.No | Sector | Weekly Change (%) |

|---|---|---|

| 1 | Telecommunications Equipment | -5.67% |

| 2 | Realty | -5.41% |

| 3 | Textiles, Apparels & Accessories | -5.26% |

| 4 | Diversified | -5.08% |

| 5 | Commercial Services & Supplies | -4.62% |

Telecom Equipment led the losses, likely due to global supply chain pressures and tariff fears. Real estate and textiles were hit hard by weak earnings visibility and FIIs pulling money from mid-cap names.

Weekly Stock Market Update: Top Gainers & Losers

While the broader indices struggled, several individual stocks stood out with remarkable price action. This part of the Stock Market Weekly Report zooms in on the week’s top performers and biggest laggards, along with the key reasons behind their moves.

Top Gainers of the Week

The following stocks delivered solid gains, supported by strong results, margin improvement, or technical breakouts:

| S.No | Stock | Weekly Change (%) | LTP (₹) | Key Trigger |

|---|---|---|---|---|

| 1 | GE T&D | +17.51% | 2,863.1 | Margin growth, 10-year high |

| 2 | Kaynes Technology | +11.91% | 6,371.5 | Estimates beat |

| 3 | Netweb Technologies | +10.80% | 2,135.2 | High gain, high volume |

| 4 | Schneider Electric | +9.65% | 1,001.3 | 10-year high, bullish momentum |

| 5 | Amber Enterprises | +8.21% | 7,871 | Strong post-earnings rally |

GE T&D emerged as the star performer with nearly 18% gains on the back of improved margins and record-high levels. Kaynes and Netweb followed suit, supported by upbeat quarterly numbers and strong trading volumes.

Top Losers of the Week

These stocks suffered heavy losses due to weak earnings, management changes, or sector-wide pressure:

| S.No | Stock | Weekly Change (%) | LTP (₹) | Key Trigger |

|---|---|---|---|---|

| 1 | PNB Housing Finance | -19.99% | 808.45 | CEO resignation, high volume decline |

| 2 | Home First Finance | -19.05% | 1,197.3 | Post-results correction |

| 3 | IIFL Finance | -17.35% | 427.2 | Weak profit growth, heavy selling |

| 4 | Redington | -15.21% | 249.45 | Margin decline |

| 5 | Zen Technologies | -13.85% | 1,533.2 | Valuation cooling after prior rally |

PNB Housing led the losers after its CEO’s resignation triggered panic selling. IIFL Finance and Redington were also hit hard by disappointing financials and profit pressure.

Why Did the Market Fall This Week?

Key Triggers Behind the Dip

In this Stock Market Weekly Report, one of the most notable takeaways is the sharp decline across major indices. The week of July 28 to August 1, 2025, saw the Indian equity market reel under pressure, driven by a mix of domestic and global headwinds.

Let’s break down the key reasons behind this market downturn:

🔻 1. U.S. Tariffs on Indian Goods

The biggest blow came from the announcement by the U.S. President imposing a 25% tariff on Indian imports, effective August 1. This escalated global trade tensions and triggered concerns especially for export-heavy sectors such as textiles, pharmaceuticals, and automobiles, which witnessed heavy selling. The move sparked fears of retaliatory measures and long-term disruption in trade flows.

🔻 2. Persistent FII Outflows

Foreign Institutional Investors (FIIs) continued their selling spree, putting further pressure on the markets. The outflow was exacerbated by:

- Strengthening of the U.S. dollar

- Diminished risk appetite in emerging markets due to global trade uncertainty

This trend has been ongoing since mid-July and intensified this week, adding to the bearish momentum.

🔻 3. Weak Corporate Earnings

The Q1 FY26 earnings season failed to lift sentiment:

- Tata Consultancy Services (TCS) reported workforce reductions, sparking concerns of weak global tech demand

- Other IT majors hinted at a sluggish outlook

- Some major banks and NBFCs also posted declines in profits and net interest margins, hurting sector sentiment

Overall, earnings disappointed across several sectors, contributing to the market’s downward bias.

🔻 4. Global Market Weakness

India wasn’t alone in this decline. Asian and Western markets were also hit hard by the new U.S. tariffs and general global macro concerns. As global investors turned cautious, sentiment turned sour in Indian equities too.

🔻 5. Bearish Technical Indicators

From a technical standpoint:

- Nifty 50 slipped below key moving averages

- Indicators suggested a trend reversal

- Many traders adopted a “sell-on-rise” strategy

This further fueled the correction, particularly among short-term participants.

Despite some positive domestic news — like strong auto sales data and progress on an India-U.K. trade agreement — these were overshadowed by the dominant negative triggers.

👉 The Stock Market Weekly Report clearly reflects that macroeconomic uncertainties and global factors weighed heavily on investor sentiment this week.

Economic Calendar & Dividend Tracker: Key Events to Watch Next Week

In this Stock Market Weekly Report, we not only look back but also look forward to what could shape the markets in the coming week. From macroeconomic data to central bank decisions, here are the key events to track:

Key Economic Data (August 5 – August 6)

| Date | Time | Indicator | Actual | Forecast | Prior |

|---|---|---|---|---|---|

| Tuesday, Aug 5 | 10:30 AM | HSBC Composite PMI Final | 61 | – | – |

| 10:30 AM | HSBC Services PMI Final | 60 | – | 60.4 | |

| Wednesday, Aug 6 | 10:00 AM | Cash Reserve Ratio (CRR) | 3% | – | – |

| 10:00 AM | RBI Interest Rate Decision | 5.5% | 5.5% | 5.5% | |

| 5:00 PM | M3 Money Supply YoY | 9.5% | – | – |

What’s Good?

- Stable RBI Policy: No surprise moves from the Reserve Bank of India (RBI). A steady 5.5% repo rate signals continued support for growth without triggering inflation.

- Strong Services PMI: The Services PMI came in at 60, suggesting robust expansion in the services sector — a positive sign for domestic demand.

What’s Concerning?

- Moderating Momentum: PMI slightly cooled from 60.4 to 60, hinting that while expansion continues, the pace might be softening.

- Broad Money Supply at 9.5%: Although still healthy, rising M3 could warrant a closer look if inflation picks up.

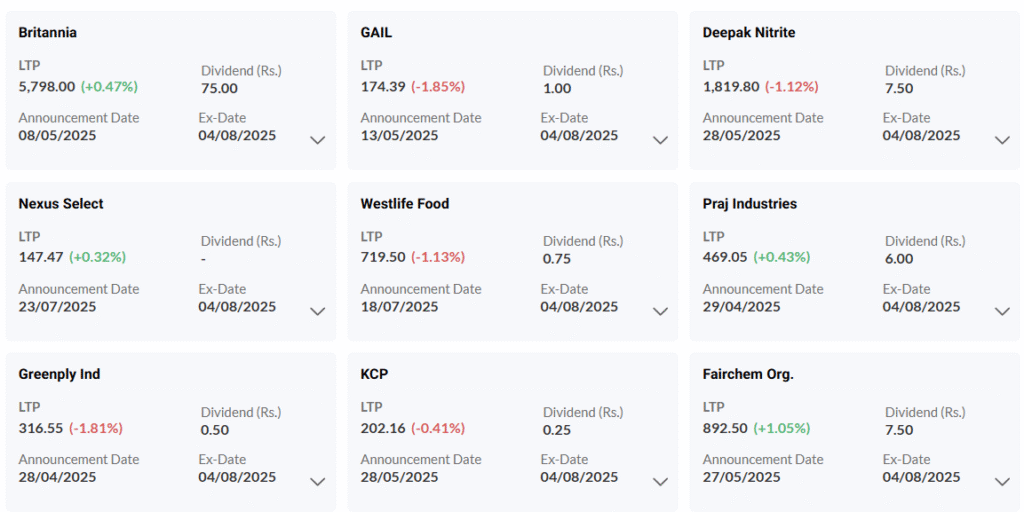

Upcoming Dividend

Here are some key dividend Ex-Date to watch out for next week:

Stay tuned — dividends can offer clues about management confidence and cash flow strength in uncertain times.

Conclusion: A Mixed Week with Pockets of Strength — What’s Next?

This Stock Market Weekly Report reflects a week of heightened volatility and negative sentiment across global and domestic markets. Benchmark indices like the Nifty 50 and Sensex saw a sharp drop, weighed down by external shocks like the 25% U.S. tariff on Indian goods, weak Q1 earnings from key sectors, and continued FII outflows.

Yet, amidst the pessimism, there were a few bright spots. Defensive sectors like FMCG and Fertilizers showed resilience, and stocks like GE T&D and Kaynes Technology stood out with strong gains on the back of margin growth and robust results. The RBI’s steady policy stance, along with upbeat PMI figures, adds a layer of stability heading into the next week.

However, risks remain: global trade tensions, muted demand in IT and finance, and bearish technical indicators could keep the markets choppy.

🔍 What to Watch Next Week:

- Corporate earnings season continues.

- Market reaction to macro data like inflation and trade figures.

- Global geopolitical developments and foreign investor activity.

As we head into August, investors are advised to stay nimble, focus on quality stocks, and watch both macro and micro signals closely. The market may be uncertain — but within every dip lies opportunity.

Related Articles

India’s $40 Billion Spending Wave: What’s Powering the Next Consumption Boom?

Battery Energy Storage in India: The $32 Billion Opportunity Powering the Green Shift

Power Sector Boom in India: Stocks to Watch and Why It’s Just Beginning

Vehicle-to-Grid (V2G) Technology: How India Is Gearing Up and 5 Stocks to Watch