Introduction

The stock market today, 4 July 2025, reflected a tale of two halves. While benchmark indices held steady with modest gains, several individual stocks saw wild swings due to news-driven action, regulatory shocks, and earnings expectations.

The Sensex closed up 0.23% at 83,432.89, and the Nifty 50 eked out a narrow gain, supported by heavyweight IT and energy names. However, the broader market witnessed mixed reactions, particularly in financial services and broking firms.

In this post, we take a closer look at how the market performed, the top stocks that made headlines, and what factors drove the day’s action.

Stock Market Today: 4 July 2025 Overview

On the macro front, investor sentiment was underpinned by expectations of monetary easing by the RBI, backed by stable inflation data. Positive commentary from global central banks and cooling crude oil prices also contributed to the mildly bullish tone.

The IT sector led the gains, as companies like Infosys and Mastek attracted strong buying on the back of robust quarterly updates and optimistic earnings guidance. Meanwhile, PSU energy stocks like Bharat Petroleum saw renewed interest due to a rebound in oil marketing margins.

However, not all sectors fared equally well. Regulatory tightening by SEBI around certain derivatives trading practices put pressure on broking-related stocks and exchanges, dragging names like BSE and Angel One lower.

Top Gainers in the Stock Market Today

🔺 Top Gainers

- Mastek – ₹2,548.60 | ▲ 5.2%

A strong performance in the mid-cap IT space pushed Mastek higher. Backed by high volume buying, the stock benefited from the broader rally in tech and investor rotation into digital transformation themes. - Sapphire Foods – ₹336.75 | ▲ 5.05%

The QSR chain surged on rumors of potential merger talks with a global F&B brand. Investors cheered the strategic possibilities, triggering strong price momentum. - Raymond Realty – ₹926.20 | ▲ 5%

Shares rebounded after hitting 10-year lows earlier in the week. Bargain hunters stepped in as sentiment improved around the real estate sector following recent project approvals. - Bharat Petroleum (BPCL) – ₹346.20 | ▲ 4.43%

The PSU oil major advanced as oil prices stabilized and retail fuel margins expanded. Reports of improved refinery utilization and increased export capacity also added to investor optimism.

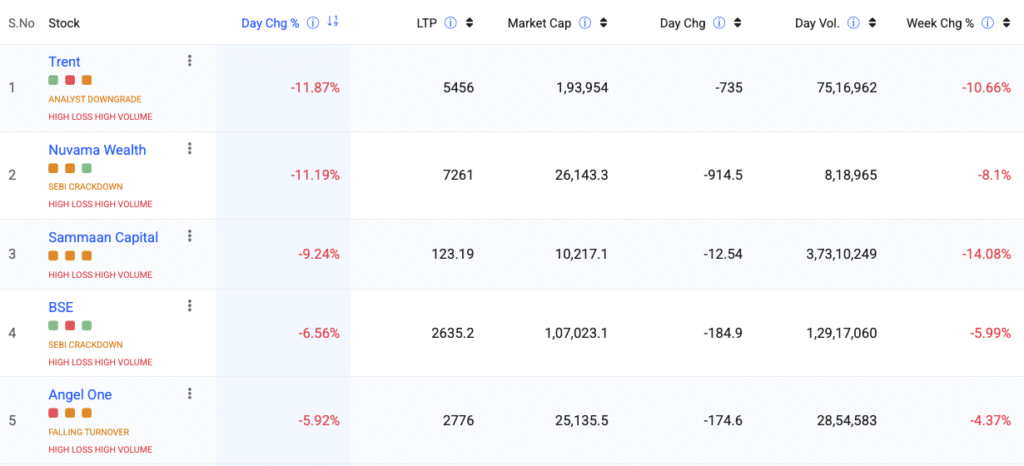

🔻 Top Losers

- Trent – ₹5,456.00 | ▼ 11.87%

The Tata Group retail stock fell sharply following an analyst downgrade that flagged slowing store-level growth and margin compression in the coming quarters. - Nuvama Wealth – ₹7,261.00 | ▼ 11.19%

The wealth management and broking firm suffered after being named in a SEBI investigation into derivatives market practices, triggering fears of regulatory penalties and FII outflows. - Sammaan Capital – ₹123.19 | ▼ 9.24%

Heavy volume-based selling gripped the lesser-known financial player. No major trigger was disclosed, but investor sentiment remained weak amid sector-wide scrutiny. - BSE Ltd – ₹2,635.20 | ▼ 6.56%

India’s oldest stock exchange came under pressure as SEBI’s actions indirectly impacted derivative turnover. Volatility in exchange-related counters pulled BSE sharply lower. - Angel One – ₹2,776.00 | ▼ 5.92%

Falling trading volumes and regulatory headwinds in the options market weighed heavily on the online broker. Lower participation in derivatives impacted its revenue outlook.

Why the Market Moved Today

Despite volatility in select sectors, the stock market today, 4 July 2025, showed resilience at the index level.

Here’s what moved the needle:

Positive Domestic Cues

- RBI is expected to maintain an accommodative stance, and there’s growing speculation around rate cuts by September.

- Inflation data remains benign, giving policymakers room to support growth.

Strong IT and Energy Stocks

- Mid-cap IT names and large-cap players like Infosys and TCS were in demand, pushing the tech index higher.

- PSU energy stocks benefited from improved margins and lower crude volatility.

SEBI Crackdown Weighed on Brokers

- Regulatory action against derivatives desk manipulations hit broking firms hard. Names like Angel One, Nuvama, and BSE suffered heavy losses as traders exited risky positions.

Global Markets Cautiously Optimistic

- While global equity indices were largely flat, a slightly dovish tone from the Fed kept risk sentiment intact. No major global shock allowed Indian markets to breathe easier.

Conclusion: What to Learn from the Stock Market Today

The stock market today, 4 July 2025, delivered a mixed bag for investors. While index levels stayed positive, stock-specific reactions dominated the narrative. Gains in IT, energy, and consumer names were offset by steep losses in broking and wealth firms amid regulatory pressure.

The day’s action reinforces a key investing lesson: focus on quality, watch for regulatory signals, and don’t ignore sector rotations.

As we move deeper into earnings season and policy events, investors should brace for more stock-specific volatility—even as the index trend remains constructive.

Related Articles

DDPI Explained: How It Works, Why You Need It & How to Activate

Apollo Hospitals Demerger 2025: Unlocking Value Through Apollo Healthtech

How to Track All Mutual Fund Investments Using PAN – Step-by-Step Guide