Weekly Stock Market Update

Stock Market This Week presented a mixed picture, with benchmark indices moving in different directions as investors reacted to global signals, earnings updates, and sector-specific developments.

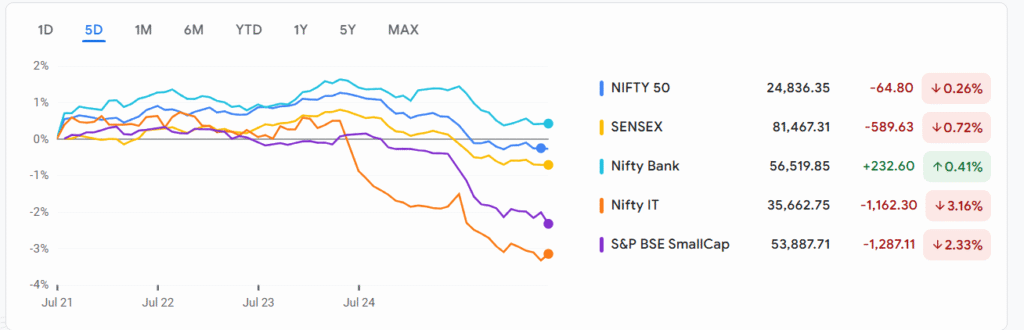

The NIFTY 50 ended the week marginally lower at 24,836.35, down 0.26%, while the SENSEX slipped 589.63 points, or 0.72%, to settle at 81,467.31. Broader markets followed suit — the S&P BSE SmallCap index saw a sharper decline of 2.33%, ending the week at 53,887.71, reflecting pressure in the mid- and small-cap space.

Amid the volatility, the Nifty Bank index stood out with a 0.41% gain, closing at 56,519.85, indicating relative strength in the banking and financial space.

On the downside, technology stocks dragged overall sentiment. The Nifty IT index dropped 3.16%, finishing at 35,662.75, as global tech cues turned negative and commentary from key players added to investor caution.

In summary, Stock Market This Week reflected cautious optimism in select sectors while broader market weakness and IT pressure capped gains.

Sector Highlights

Top Performing Sectors This Week

Despite a broadly cautious tone, a few sectors managed to shine in the Stock Market This Week, driven by strong demand trends and sector-specific catalysts.

| S.No | Sector | Weekly Change (%) |

|---|---|---|

| 1 | Retailing | +3.69% |

| 2 | Forest Materials | +2.87% |

| 3 | Fertilizers | +1.67% |

| 4 | Diversified Consumer Services | +0.65% |

| 5 | Metals & Mining | +0.38% |

The Retailing sector emerged as the top gainer, backed by healthy consumer sentiment and robust earnings momentum. Forest Materials and Fertilizers also posted solid gains, benefiting from commodity tailwinds and seasonal factors like the monsoon.

Worst Performing Sectors This Week

Meanwhile, several key sectors came under selling pressure in the Stock Market This Week, particularly in the technology and energy spaces.

| S.No | Sector | Weekly Change (%) |

|---|---|---|

| 1 | Hardware Technology & Equipment | -7.30% |

| 2 | Telecommunications Equipment | -5.52% |

| 3 | Oil & Gas | -4.72% |

| 4 | Realty | -4.17% |

| 5 | FMCG | -4.15% |

Technology-linked sectors like Hardware Technology & Equipment and Telecom Equipment led the declines, amid weak global cues and concerns over demand slowdown. The Oil & Gas and Realty sectors also saw notable pullbacks due to macro pressures and rising bond yields.

Weekly Stock Market Update: Top Gainers & Losers

Top Gainers of the Week

In the Stock Market This Week, select mid-cap and growth-oriented names delivered strong returns, supported by positive earnings surprises, bullish sentiment, and technical breakouts.

| S.No | Stock | Week Chg (%) | LTP (₹) | Notes |

|---|---|---|---|---|

| 1 | Eternal | +20.74% | 310.55 | |

| 2 | Olectra Greentech | +15.36% | 1,480.90 | |

| 3 | Gravita | +9.51% | 1,886.60 | Results-driven rally |

| 4 | Home First Finance | +8.31% | 1,479.00 | 10-Year High |

| 5 | One97 Communications | +6.60% | 1,067.75 | Estimates beat |

Eternal led the gainers this week with a massive 20.74% surge, followed closely by Olectra Greentech. Positive earnings from Gravita and a multi-year high for Home First Finance further boosted investor sentiment. One97 Communications (Paytm) rallied on the back of an earnings beat, helping regain some lost ground.

Top Losers of the Week

On the flip side, Stock Market This Week witnessed steep declines in a few stocks impacted by regulatory actions, earnings disappointments, and broader market weakness.

| S.No | Stock | Week Chg (%) | LTP (₹) | Notes |

|---|---|---|---|---|

| 1 | Indian Energy Exchange | -28.61% | 145.02 | Regulatory impact |

| 2 | Zee Entertainment | -12.63% | 123.70 | High gain, high volume |

| 3 | Jaiprakash Power | -11.99% | 20.12 | |

| 4 | Chennai Petroleum | -11.78% | 687.60 | Earnings miss |

| 5 | Ceat | -11.75% | 3,377.70 |

Indian Energy Exchange (IEX) took a heavy hit, falling nearly 29% amid regulatory headwinds. Zee Entertainment and Jaiprakash Power also faced strong selling pressure, while disappointing results weighed on Chennai Petroleum and Ceat.

Why Did the Market Fall This Week?

Key Triggers Behind the Dip

Stock Market This Week saw a noticeable decline after a strong start, with the NIFTY and SENSEX both ending in the red. A confluence of domestic and global factors led to a sharp shift in sentiment, pushing investors into risk-off mode by midweek. Here’s what weighed on the markets:

1. Financial Stocks Dragged Down the Index

The biggest pressure point in the Stock Market This Week came from financial stocks. Key players like Bajaj Finance and Bajaj Finserv tumbled 5.5% and 4.5%, respectively, as concerns around asset quality in the MSME loan segment overshadowed their strong Q1 results.

Adding to the stress were major banks like Axis Bank, HDFC Bank, and Kotak Bank, all of which faced selling pressure. With finance being a heavyweight sector, its weakness significantly dragged down overall market performance.

2. Uncertainty Over US-India Trade Deal

Geopolitical uncertainty returned to the spotlight as investors reacted nervously to the lack of progress in the US-India trade talks. The failure to secure an interim agreement before the looming August 1 deadline, especially around tariffs on agricultural and dairy products, dented market confidence.

The return of the Indian trade delegation from Washington without a breakthrough only added to the unease.

3. Persistent FII Selling

Another major contributor to the weakness in Stock Market This Week was sustained selling by Foreign Institutional Investors (FIIs). Over the last four trading sessions, FIIs offloaded more than ₹11,572 crore worth of Indian equities.

Concerns over stretched valuations and global uncertainty have led to consistent outflows, raising red flags about short-term market stability.

4. Weak Global Cues and Cautious Sentiment

Broader global cues also weighed heavily. Asian markets mirrored a risk-averse mood, with investors positioning cautiously ahead of major global events, including:

- The upcoming US Federal Reserve policy meeting

- Crucial US payrolls data

- Earnings from tech giants like Apple, Amazon, Meta, and Microsoft

This global caution fed directly into Indian markets, dampening risk appetite further.

5. Mixed Q1 Earnings Season

Although banks like ICICI Bank and HDFC Bank delivered decent earnings early in the week, the broader Q1 earnings season has been largely underwhelming.

Reliance Industries, despite reporting record profits, disappointed the Street due to slower core business growth. Overall, a lack of strong earnings momentum failed to support the bulls.

6. Valuation Concerns Remain

Valuation discomfort continues to lurk in the background. Indian equities remain richly priced compared to global peers, making the market more prone to corrections amid uncertainty. Elevated P/E and P/B ratios have left little room for error, amplifying negative reactions to any adverse news flow.

In summary, Stock Market This Week faced a perfect storm of weak financials, geopolitical uncertainty, foreign selling, uninspiring earnings, and cautious global sentiment — all of which converged to trigger a broad-based correction.

Economic Calendar & Dividend Tracker

Key Events to Watch Next Week

With macroeconomic trends under close watch, investors will be eyeing fresh data and income opportunities that may influence sentiment in the Stock Market This Week.

🔍 Economic Data – Monday, July 28

Two key indicators will be released at 4:00 PM on Monday:

1. Industrial Production (YoY) – Forecast: 2.4% | Prior: 1.2%

This measures the annual growth in industrial output, including sectors like mining, electricity, and manufacturing.

- What’s Good: A rise to 2.4% (from 1.2%) would signal improved economic activity and industrial demand, which can boost confidence in cyclical sectors such as capital goods, infrastructure, and manufacturing.

- What’s Bad: If the actual number falls below the forecast, it could raise concerns about sluggish demand recovery and manufacturing slowdown.

2. Manufacturing Production (YoY) – Prior: 2.6%

This subset focuses only on the manufacturing sector.

- What’s Good: Any upside from the prior 2.6% figure would suggest strong factory output, potentially benefiting stocks in engineering, auto, and industrial automation.

- What’s Bad: A slowdown here may reinforce fears of weakening momentum in the real economy.

Impact on Stock Market This Week:

Stronger-than-expected data could stabilize sentiment and support market recovery after recent declines. On the flip side, weaker figures might fuel more cautious positioning, especially amid global uncertainties.

Dividend Tracker – Upcoming Ex-Dividend Dates (Post July 25)

Income-focused investors will have several opportunities this week, as many companies go ex-dividend. Here’s a simplified view:

| Company | Dividend (₹/Share) | Ex-Date |

|---|---|---|

| CRISIL Ltd | ₹9.00 | 28-Jul-2025 |

| DLF Ltd | ₹6.00 | 28-Jul-2025 |

| Wipro Ltd | ₹5.00 | 28-Jul-2025 |

| KPIT Technologies | ₹6.00 | 28-Jul-2025 |

| Cosmo First Ltd | ₹4.00 | 28-Jul-2025 |

| EIH Associated Hotels Ltd | ₹3.50 | 28-Jul-2025 |

| Bosch Ltd | ₹512.00 | 29-Jul-2025 |

| VRL Logistics Ltd | ₹10.00 | 30-Jul-2025 |

| BASF India Ltd | ₹20.00 | 30-Jul-2025 |

| MM Forgings Ltd | ₹4.00 | 30-Jul-2025 |

| JB Chemicals & Pharma | ₹7.00 | 30-Jul-2025 |

| Sinclairs Hotels Ltd | ₹0.80 | 30-Jul-2025 |

| TD Power Systems Ltd | ₹0.65 | 30-Jul-2025 |

| Aurionpro Solutions Ltd | ₹1.00 | 30-Jul-2025 |

| NOCIL Ltd | ₹2.00 | 30-Jul-2025 |

| TTK Prestige Ltd | ₹6.00 | 31-Jul-2025 |

| BPCL | ₹5.00 | 31-Jul-2025 |

| JK Tyre & Industries Ltd | ₹3.00 | 31-Jul-2025 |

| Godrej Agrovet Ltd | ₹11.00 | 31-Jul-2025 |

| Usha Martin Ltd | ₹3.00 | 31-Jul-2025 |

| Rama Phosphates Ltd | ₹0.25 | 31-Jul-2025 |

| Chembond Materials | ₹1.75 | 31-Jul-2025 |

| Cheviot Company Ltd | ₹5.00 | 31-Jul-2025 |

These developments — both economic and income-related — could play a key role in shaping investor mood in the Stock Market This Week, especially as markets search for direction amid volatility.

Conclusion: A Mixed Week with Pockets of Strength — What’s Next?

Stock Market This Week showcased a tug-of-war between bullish and bearish forces. While benchmark indices like NIFTY and SENSEX posted modest declines, there were areas of resilience — particularly in retail, fertilizers, and select banking names. At the same time, sharp corrections in tech, FMCG, and energy sectors pulled overall sentiment lower.

Earnings season continues to deliver a mixed bag, and global uncertainty — from trade talks to Fed commentary — has kept investors on edge. Add to that sustained FII outflows and valuation worries, and it’s clear why the market struggled to find its footing.

Looking ahead, attention will shift to macroeconomic data, dividend activity, and critical earnings from major companies. Positive surprises on the industrial output front or clarity on the US-India trade deal could offer some near-term support.

In short, the Stock Market This Week reminded investors to stay selective, stay informed, and stay agile. While the broader trend remains cautious, sectoral rotation and stock-specific momentum continue to create opportunities — but with heightened sensitivity to news flow and global cues.

Related Articles

Ongoing and Upcoming IPO Details, Review and Best Strategy

Patanjali Foods Bonus Issue 2025: Sweet Deal or Temporary Hype?

HDFC Bank Bonus Issue: Is This the Right Time to Enter the Stock?