Indian Stock Market

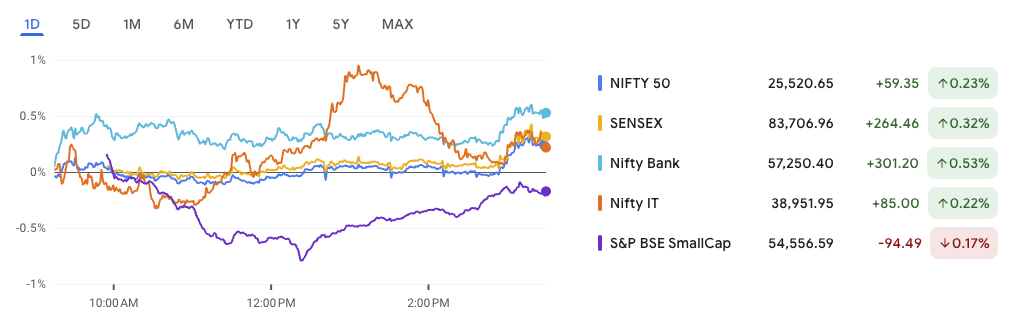

The Indian stock market extended its uptrend on Tuesday, with Nifty 50 closing at 25,520.65, up by 59 points. Sensex added 264 points to end at 83,706.96. Nifty Bank gained over 300 points, leading sectoral momentum, while Nifty IT showed modest strength. However, the BSE SmallCap index slipped slightly, hinting at cautious undertones in broader participation.

In the Indian stock market outlook today, we cover everything you need to prepare for the trading session:

- A detailed technical outlook on Nifty 50 with key levels and breakout zones

- Important news updates that could move specific stocks today

- One stock from our technical screener showing a fresh short-term breakout setup

- A new smallcap pick with high-risk, high-reward potential

- Latest IPO activity, listing dates, and GMP trends to track

This edition brings you a focused view on price action, tradeable setups, and event-based opportunities to watch as markets open.

Nifty 50 – Next Move Analysis

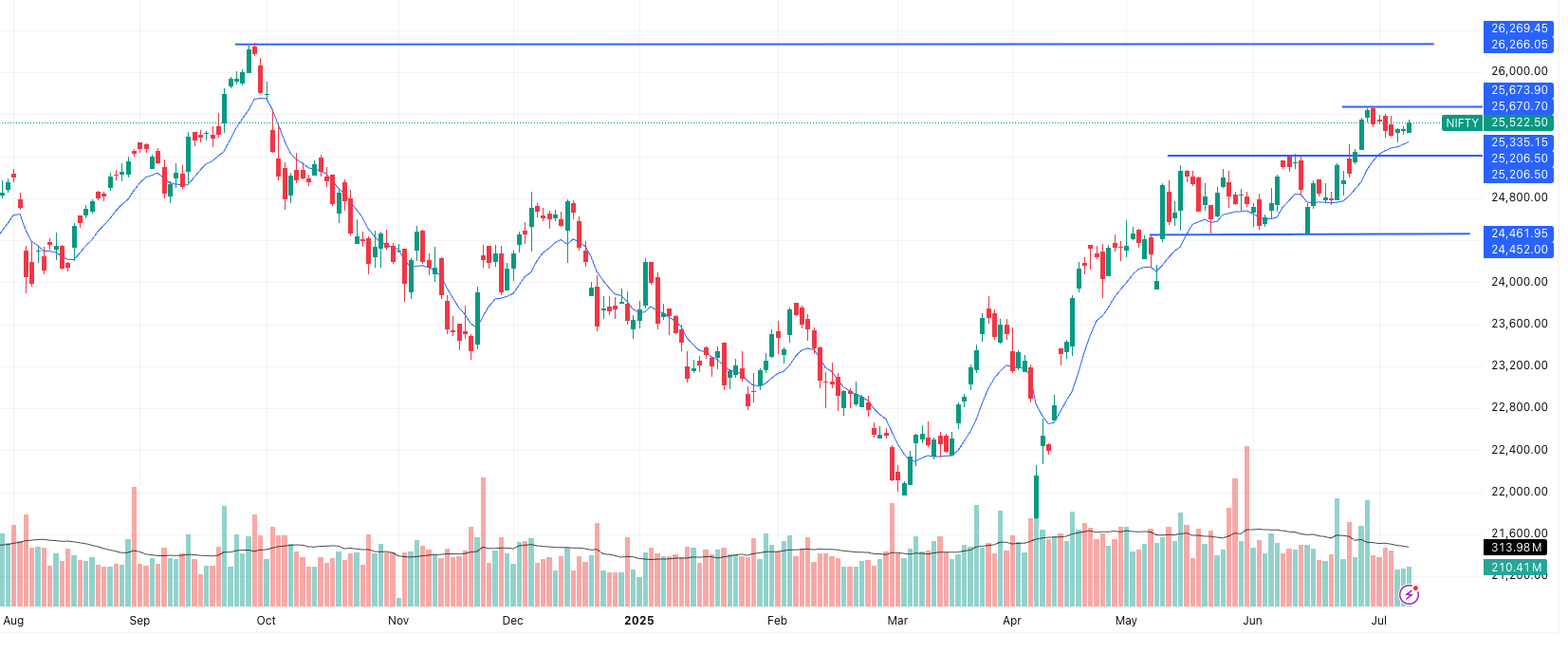

In the Indian stock market outlook today, Nifty 50 remains in a tight consolidation just below its previous all-time high. The index closed at 25,520.65 and is holding firm above its 9-day EMA, signaling underlying strength even as momentum takes a breather.

Technical Snapshot

Nifty is currently forming a classic bullish flag or range consolidation pattern just under resistance at 25,675. This setup often precedes a breakout continuation. Price action remains above the rising 9 EMA, indicating that dips are being absorbed by buyers.

Volume has remained muted over the last few sessions, which is typical during consolidation phases and usually precedes a directional move. The volatility compression points to a breakout zone building.

Key Price Levels to Watch

| Level Type | Price Range (₹) | Comment |

|---|---|---|

| Immediate Resistance | 25,673–25,680 | Recent swing high, breakout trigger |

| Dynamic Support (EMA) | 25,335 | 9 EMA zone, short-term cushion |

| Structure Support | 25,206 | Last base before the current move |

| Major Resistance | 26,266–26,269 | Previous ATH zone from Sept–Oct 2024 |

Immediate Scenarios

- Bullish Breakout (Likely):

A close above 25,675 on strong volume may trigger a rally toward 26,200+, retesting the all-time high zone around 26,266. - Short-Term Rejection:

If the index fails to break 25,675 and slips below 25,335, we could see a dip toward 25,200–25,100. The trend would still be healthy unless 25,000 is breached, which may weaken the short-term setup.

Volume & Momentum

- Volume has been lower, indicating a lack of aggressive buying or selling.

- A breakout supported by volume expansion will be the real confirmation.

- RSI is likely trending near 60–65, still in the bullish zone with room to climb.

Trading Strategy Setup

| Strategy | Trigger Point | Stop-Loss | Target Range |

|---|---|---|---|

| Breakout Long | Close above 25,675 | 25,500 | 26,000 → 26,250 |

| Buy on Dip | Entry near 25,335 | 25,200 | 25,600 → 25,800 |

| Short-Term Caution | Breakdown below 25,200 | 25,400 (SL) | 25,000 → 24,800 |

Summary View

The bias remains mildly bullish with the broader structure still intact. If Nifty breaks above 25,675 with confirmation, a test of the all-time high around 26,266 could be the next milestone. A failed breakout and dip below 25,335, however, may shift the momentum temporarily to the downside.

In the Indian stock market outlook today, all eyes are on whether this tight consolidation gives way to a strong directional move.

News & Impacted Stocks

Here are the top news events likely to influence the market today, along with stocks that could react in trade:

1. Trump’s Tariff Shock: 14 Nations Hit

US President Donald Trump has announced a new round of tariffs on 14 countries, including India’s key trade peers such as Japan, South Korea, Malaysia, Indonesia, and Bangladesh. Tariff rates range from 25% to 40% and will come into effect from August 1, although Trump has left room for negotiation.

Impact View:

- Could weigh on global trade sentiment and risk appetite in EMs.

- Indian exporters, especially in textiles, chemicals, and auto ancillaries with exposure to ASEAN markets, may face sectoral pressure.

2. MHADA–Adani Mega Redevelopment Deal

Adani Group has signed a redevelopment agreement with MHADA to transform Mumbai’s Motilal Nagar into India’s largest rehab housing project. The project will span 142 acres and deliver 1,600 sq. ft. flats to existing residents under a 7-year timeline.

Stocks to Watch:

- Adani Realty (Adani Enterprises) – Likely sentiment positive from project scale.

- Construction/Infra EPC players could benefit from subcontracting opportunities.

3. Edelweiss NCD Issue at 10.5% Yield

Edelweiss Financial Services has launched a ₹300 crore NCD offering, with yields up to 10.49%, aiming to refinance existing debt and fund corporate needs.

Stocks to Watch:

- Edelweiss Financial – May attract investor interest from yield-focused segments.

- NBFC stocks in general could react to debt market liquidity sentiment.

4. Indore Expansion by Omaxe Ltd

Omaxe has announced a new integrated township project in Indore’s Super Corridor region. This marks the company’s strategic push in Tier-II urban ecosystems, with funding supported through internal accruals.

Stocks to Watch:

- Omaxe Ltd – Positive for long-term fundamentals and regional brand expansion.

- Real estate ancillary firms may benefit as the project rolls out (cement, pipes, tiles).

5. Gen Z & Investing – Regulatory Caution

With the rise of gamified investing platforms and meme-led financial content, regulators are increasingly concerned about misinformation and risk underestimation among Gen Z investors.

Stocks to Watch:

- Fintech platforms, financial content aggregators, and social investing apps could come under increased scrutiny.

- Regulatory tone may shape sector sentiment over the medium term.

6. India Bonds Unmoved by US Yield Spike

Despite rising US Treasury yields, Indian bond yields remained range-bound, with the 10-year at 6.29%. Markets await RBI liquidity cues.

Stocks to Watch:

- Rate-sensitive sectors like banks and NBFCs may stay muted unless RBI shifts liquidity stance.

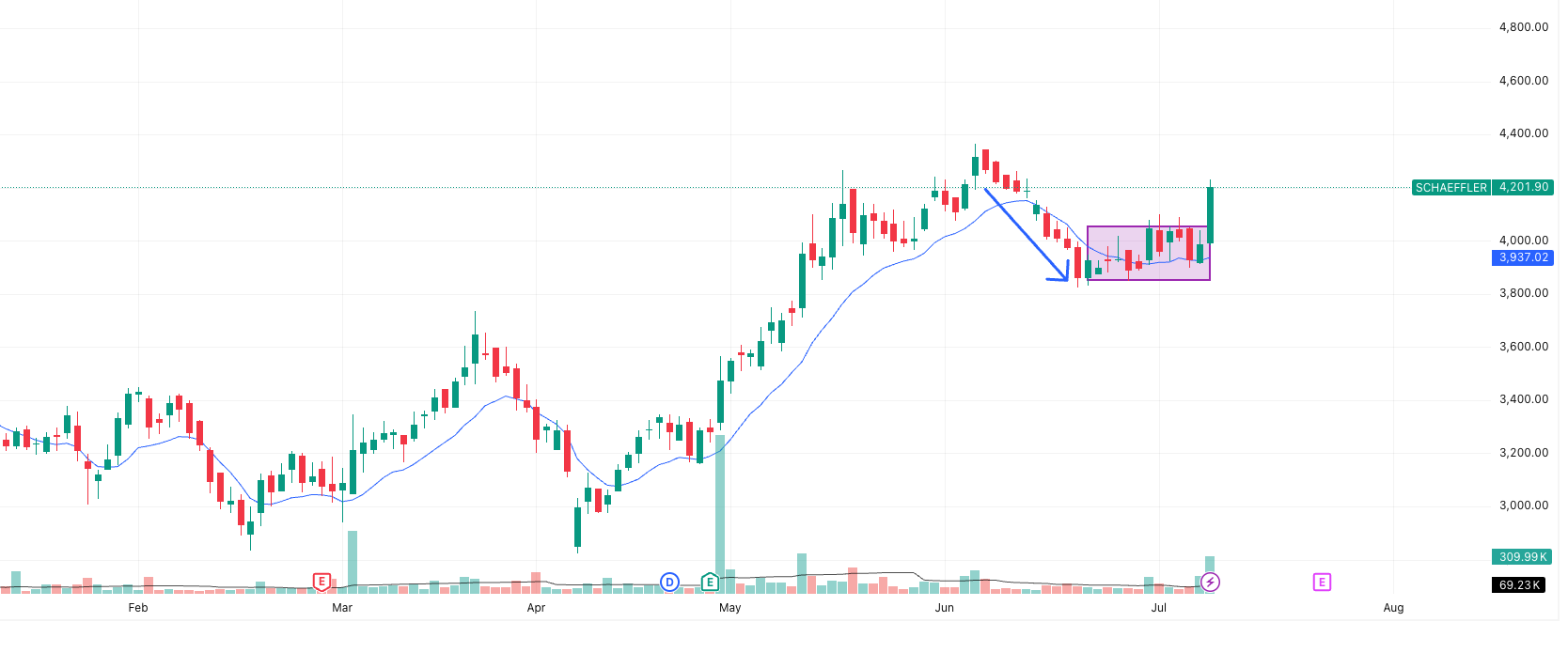

Breakout Stock of the Day: Schaeffler India

Why it matters:

Schaeffler India has broken out from a multi-week consolidation zone, delivering a 5.37% rally today on strong volume. The setup points to potential short-term upside if momentum sustains.

Technical Snapshot

- Breakout Zone: ₹3,880–₹4,020

- Volume Spike: Highest in nearly 3 weeks

- EMA Support: Price bounced from the 9 EMA at ₹3,937

- Structure: Classic Bullish Flag → Base → Breakout

Short-Term Upside Targets (3–7 Days)

- T1: ₹4,320 (minor resistance zone)

- T2: ₹4,450 (swing high from June)

- T3: ₹4,600 (potential all-time high zone)

Support Levels to Watch

- ₹4,020 (breakout retest zone)

- ₹3,937 (dynamic EMA support)

- ₹3,880 (pattern invalidation)

Swing Trade Setup

| Trade Type | Entry Range | Stop-Loss | Targets | R:R Ratio |

|---|---|---|---|---|

| Breakout Buy | ₹4,050–₹4,100 | ₹3,880 | ₹4,320 → ₹4,450 | ~1:2 |

| Add-on Buy (Aggressive) | Above ₹4,320 | ₹4,100 | ₹4,600+ | ~1:2.5 |

Summary

- Trend: Bullish

- Momentum: Building with volume confirmation

- Bias: Positive as long as price stays above ₹4,020

- Invalidation: Break below ₹3,880 may negate the setup

IPO Updates – Key Listings to Watch

Mainboard IPOs

| Name | Open | Close | Listing | GMP (Gain) |

|---|---|---|---|---|

| Smartworks Coworking | 10-Jul | 14-Jul | 17-Jul | ₹27 (6.63%) |

| Travel Food Services | 7-Jul | 9-Jul | 14-Jul | ₹12 (1.09%) |

| Crizac IPO | 2-Jul | 4-Jul | 9-Jul | ₹31 (12.65%) |

SME IPOs

| Name | Open | Close | Listing | GMP (Gain) |

|---|---|---|---|---|

| Spunweb Nonwoven | 14-Jul | 16-Jul | 21-Jul | ₹– (0%) |

| Asston Pharmaceuticals | 9-Jul | 11-Jul | 16-Jul | ₹10 (8.13%) |

| CFF Fluid Control | 9-Jul | 11-Jul | 16-Jul | ₹– (0%) |

| GLEN Industries | 8-Jul | 10-Jul | 15-Jul | ₹30 (30.93%) |

| Smarten Power Systems | 7-Jul | 9-Jul | 14-Jul | ₹– (0%) |

| Chemkart India | 7-Jul | 9-Jul | 14-Jul | ₹– (0%) |

| Meta Infotech | 4-Jul | 8-Jul | 11-Jul | ₹43 (26.71%) |

| White Force | 3-Jul | 7-Jul | 10-Jul | ₹5 (6.58%) |

| Cryogenic OGS | 3-Jul | 7-Jul | 10-Jul | ₹32 (68.09%) |

Small Cap of the Day – BLS International Services Ltd

CMP: ₹379 | Market Cap: ₹15,603 Cr | Sector: IT Services / Outsourcing

About the Company

BLS International is a global leader in visa processing and G2C services, operating in over 66 countries with 46+ government clients. Over the years, it has expanded into digital citizen services and is now evolving into a tech-driven, diversified services provider.

Business Highlights

1. Visa & Consular Services (83% of Revenue)

- One of the world’s top outsourced visa processors (36 Cr+ visas so far).

- Operates for multiple governments with services like e-visa, biometrics, passport renewals, etc.

- Shift to self-managed centers has improved margins.

- Revenue per application rose from ₹1,638 in FY22 to ₹2,653 in Q1 FY25.

2. Digital & Assisted Services (14% of Revenue)

- Business Correspondent (BC) and G2C services across rural India.

- Over 1.1 lakh service points and 1,000+ stores.

- Served 13.3 Cr transactions in FY24, up 250% from FY22.

- Recent tie-up with Axis Bank; ₹1,000 Cr+ loan leads in Q1 FY25 alone.

Recent Acquisitions & Expansion

- iDATA (Turkey): Acquired in July 2024 for ₹720 Cr to strengthen EU footprint.

- Aadifidelis (India): 55% stake to tap into loan processing (~₹190 Cr deal).

- Citizenship Invest (UAE): Acquired for ₹260 Cr, expands into global residency services.

- BLS E-Services IPO: ₹300 Cr raised to fund tech upgrades and expansion.

Global & Domestic Presence

- Middle East: 39% of revenue

- North America: 26%

- India: 23% (fast-growing digital services arm)

- Expanding into underserved visa markets and rural digital delivery

Key Financial Metrics

| Metric | Value |

|---|---|

| ROE | 34.6% |

| ROCE | 32.9% |

| Net Profit Margin | 19.4% |

| Debt-to-Equity | 0.21 |

| Cash & Equivalents | ₹741 Cr |

| PE Ratio | 30.7 |

| Sales (FY24) | ₹2,193 Cr |

| Operating Profit Margin | 28.7% |

Valuation Snapshot

- Intrinsic Value: ₹278

- Current Price: ₹379

- Price-to-Book: 9.02

- Industry PE: 34.9

The stock trades at a premium but is backed by strong growth, asset-light business, and rising global demand for outsourced services.

Why BLS International?

- Near-monopoly in visa outsourcing with massive global footprint

- Digital G2C business growing rapidly in rural India

- Strong profitability, high ROE, minimal debt

- Acquisitions unlocking new growth verticals

- Potential to evolve into a tech-enabled diversified service leader

Risk Note:

- High dependence on geopolitical factors and visa travel cycles

- Growth-sensitive to international regulations and G2C contract renewals

- Premium valuation implies limited margin for error

Conclusion: What to Take Away from Today’s Newsletter

As the markets consolidate near record highs, the short-term outlook for Nifty 50 remains cautiously bullish, with a breakout above 25,675 being the key trigger to watch. In the stock-specific space, Schaeffler India show strong technical setups for short-term gains, while BLS International stands out in the small-cap segment with a high-growth, asset-light global business model and robust fundamentals.

On the IPO front, listings continue to gather investor attention, with Smartworks and Glen Industries showing promising GMP trends. Keep an eye on these for potential listing pop opportunities.

Internationally, policy moves like Trump’s new tariff wave could ripple across global trade markets and are worth monitoring for macro cues.

In short, today’s newsletter gives you:

- A focused Nifty 50 analysis with actionable trade levels

- Breakout trading ideas in Schaeffler

- A high-growth small cap spotlight (BLS International)

- Fresh IPO insights and GMP trends

- Key global headlines shaping market sentiment

Stay sharp, manage your risk, and position smartly.

Related Articles:

China’s Fertilizer Export Halt to India: Stocks Set to Gain from the Supply Shock

DRDO’s Emergency Weapon Orders: Defence Stocks Set to Gain

Insider Buying in Indian Stocks: Hidden Signals You Shouldn’t Ignore

More Articles

How to Transfer Shares from Groww to Zerodha – Full Guide (2025)

Why Fundamentals Are Failing—and Market Cycles Are Getting Shorter

How a Tea Seller Used the Power of Compound Interest to Build ₹45 Lakh