Introduction: A Star-Studded Real Estate IPO Hits the Market

The spotlight is on Mumbai’s booming luxury real estate scene—and this time, it comes with a generous dose of Bollywood glam. The Sri Lotus Developers IPO is creating waves, not just for its size or timing, but for the galaxy of celebrities backing it. From Shah Rukh Khan—popularly known as “Pathan”—to Amitabh Bachchan, the industry’s revered “Shahenshah,” a host of big names from the film fraternity have invested in this luxury-focused developer ahead of its public listing.

Set to open for subscription on July 30, 2025, the IPO aims to raise ₹792 crore through a fresh issue, primarily to fund high-end residential projects across Mumbai’s premium western suburbs. Before filing its DRHP, Sri Lotus Developers and Realty Ltd. had already raised ₹399.20 crore via private placement from a high-profile list of 118 individuals and entities—including Bollywood royalty and marquee market investors.

What’s driving this buzz? It’s a heady mix of star power, luxury real estate, and strong financial performance. Backed by Anand Pandit, a film producer turned real estate mogul, the company is positioning itself at the intersection of celebrity brand value and booming luxury housing demand in India’s most expensive city.

In this blog, we’ll break down the Sri Lotus Developers IPO in detail—from who’s investing and why, to the company’s financials, growth strategy, and whether it’s worth your investment radar.

Spotlight on the Bollywood Backers

The Sri Lotus Developers IPO is more than a typical real estate public issue—it’s a star-studded affair, thanks to a long list of Bollywood celebrities who’ve thrown their weight (and wallets) behind the company. And the names involved aren’t minor players—they’re some of the most influential and recognizable faces in Indian cinema.

Who Invested?

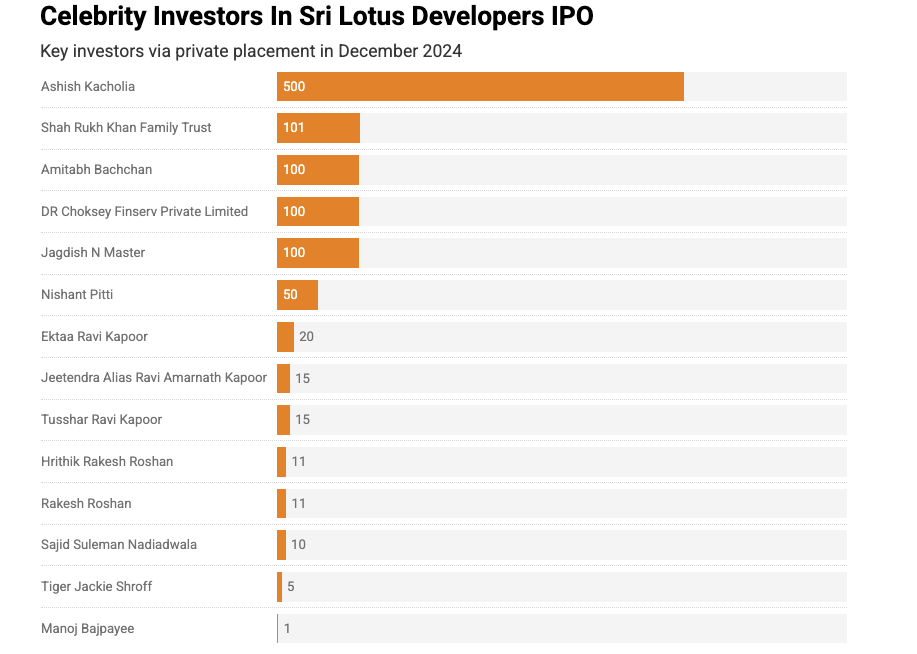

According to the company’s Red Herring Prospectus, the pre-IPO round in December 2024 saw participation from:

Shah Rukh Khan – ₹1.01 crore, Amitabh Bachchan – ₹1.00 crore, Hrithik Roshan, Rakesh Roshan, Ektaa Ravi Kapoor, Tusshar Kapoor, Jeetendra Kapoor Each of these investments was made at ₹150 per share, indicating a shared belief in the long-term value and vision of Sri Lotus Developers.

Why Is Bollywood Backing This IPO?

One key reason for this star-studded investor list lies in the company’s promoter—Anand Kamalnayan Pandit, a veteran Bollywood film producer and distributor, known for projects like The Big Bull and Well Done Baby. His dual identity as a real estate entrepreneur and film industry insider likely helped build trust and visibility for Sri Lotus Developers among top-tier celebrities.

In an industry where reputation and relationships matter, Anand Pandit’s credibility has clearly worked to the company’s advantage—drawing in some of the country’s biggest names as early believers.

Market Sentiment Boost

This kind of celebrity endorsement does more than just create buzz. It also adds a layer of intangible brand equity to the IPO—enhancing visibility, boosting investor confidence, and tapping into aspirational value. When Shah Rukh Khan and Amitabh Bachchan put their money into a luxury real estate play, retail and institutional investors are bound to pay attention.

Company Overview: Inside Sri Lotus Developers IPO

Founded in February 2015, Sri Lotus Developers and Realty Ltd. has carved out a niche in Mumbai’s highly competitive real estate landscape by focusing on luxury and ultra-luxury redevelopment projects in the city’s western suburbs. Headquartered in Mumbai, the company has quickly grown from a boutique realty venture into a premium brand known for high-end residential and commercial developments.

Core Focus Areas

Sri Lotus Developers primarily engages in:

- Redevelopment projects in established residential zones

- Luxury residential properties priced between ₹3 crore to ₹7 crore (2BHK–3BHK units)

- Ultra-luxury apartments and penthouses priced above ₹7 crore (3BHK–4BHK+)

- Commercial office spaces, strategically located in premium zones

Its emphasis is on low-density, high-value developments that cater to Mumbai’s upper-middle and HNI (high net-worth individual) segments.

Project Pipeline

As of June 30, 2025, the company has:

- 4 Completed Projects

- 5 Ongoing Projects — estimated saleable area: 0.30 million sq. ft.

- 11 Upcoming Projects — estimated saleable area: 1.64 million sq. ft.

- Total Developable Area: 0.93 million sq. ft.

This growing pipeline reflects a well-balanced mix of near-term revenue visibility and long-term expansion.

Business Strategy: Asset-Light, Brand-Heavy

Sri Lotus operates on an asset-light model, entering into development agreements instead of acquiring land outright. This not only reduces capital outflow but also allows the company to maintain healthy cash flows and scalability without over-leveraging.

Additionally, the brand positions itself to sell properties throughout the construction phase, enabling faster cash generation and better margin control.

Financial Performance: A Strong Growth Story

Behind the glitz of celebrity investors lies a solid financial foundation. Sri Lotus Developers & Realty Ltd. has delivered consistent revenue growth, expanding profit margins, and a clean balance sheet—making it more than just a glamour-backed IPO.

Topline & Bottomline Growth

| Metric | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Revenue (₹ Cr) | 169.95 | 466.19 | 569.28 |

| EBITDA (₹ Cr) | 20.84 | 158.55 | 288.97 |

| Profit After Tax (₹ Cr) | 16.80 | 119.14 | 227.89 |

Over two years:

- Revenue grew by over 235%

- PAT jumped over 13x

- EBITDA margin rose to an impressive 52.57%

- PAT margin climbed to 41.46%

These margins are exceptional, especially in the real estate sector, indicating high pricing power and operational efficiency.

Balance Sheet Strength

| Metric (as of Mar 31, 2025) | Value (₹ Cr) |

|---|---|

| Total Assets | 1,218.60 |

| Net Worth | 932.44 |

| Reserves & Surplus | 888.93 |

| Total Borrowings | 122.13 |

| Debt/Equity Ratio | 0.13 |

This low Debt-to-Equity ratio suggests prudent capital management—especially impressive considering the capital-intensive nature of real estate.

Key Performance Indicators (FY25)

- ROE: 24.39%

- ROCE: 27.22%

- EBITDA Margin: 52.57%

- PAT Margin: 41.46%

- RoNW: 24.39%

These metrics reflect not just profitability, but efficient capital utilization, strong cash flow generation, and management discipline.

In summary, Sri Lotus Developers is not only growing fast—it’s growing profitably and responsibly, which sets a strong base ahead of its public listing.

IPO Details: Key Dates & Offer Structure

With a strong celebrity backing and solid fundamentals, the Sri Lotus Developers IPO is now set to hit the public markets. Here’s everything you need to know about the issue structure, key dates, and how the company plans to use the funds raised.

IPO Size & Structure

- Total Issue Size: ₹792 crore (Fresh Issue Only)

- Face Value: ₹1 per equity share

- Price Band: ₹140 to ₹150 per share

- Lot Size: 100 Shares

- Issue Type: Book Building

- Listing On: BSE and NSE

IPO Timeline (Tentative)

| Event | Date |

|---|---|

| Anchor Investor Round | July 29, 2025 |

| IPO Open Date | July 30, 2025 (Wednesday) |

| IPO Close Date | August 1, 2025 (Friday) |

| Cut-off Time for UPI Mandate | August 1, 2025 – 5:00 PM |

| Allotment Finalization | August 4, 2025 (Monday) |

| Refund Initiation | August 5, 2025 (Tuesday) |

| Shares Credited to Demat | August 5, 2025 (Tuesday) |

| Listing Date | August 6, 2025 (Wednesday) |

Investor Quota Allocation

| Category | Reservation |

|---|---|

| QIB (Qualified Institutional Buyers) | Up to 50% of Net Issue |

| NII (Non-Institutional Investors) | At least 15% of Net Issue |

| Retail Individual Investors | At least 35% of Net Issue |

This structure ensures robust participation from all investor classes, with a retail-friendly allocation that allows small investors to participate meaningfully.

Use of IPO Proceeds: Where the ₹792 Cr Will Go

The company plans to deploy a significant portion of the IPO proceeds to fund its flagship luxury projects via its subsidiaries:

| S. No. | Objective | Amount (₹ Cr) |

|---|---|---|

| 1 | Investment into subsidiaries for funding ongoing luxury real estate projects (Amalfi, The Arcadian, Varun) | 550.00 |

| 2 | General corporate purposes & working capital | Balance |

This capital infusion will directly support the company’s core strategy: high-end housing in high-demand micro-markets of Mumbai.

Competitive Strengths vs. Risks: A Balanced Look at Sri Lotus Developers IPO

While the Sri Lotus Developers IPO comes with strong tailwinds—celebrity backing, strong financials, and sectoral growth—it’s also important to weigh the potential risks. Here’s a clear side-by-side comparison of what works in the company’s favor and what investors should stay alert to:

| Competitive Strengths | Risks and Challenges |

|---|---|

| 1. Luxury Market Leadership Positioned in Mumbai’s ultra-luxury and luxury segment with ₹3–7 Cr+ residential products. | 1. Geographic Concentration Heavily dependent on Mumbai’s western suburbs; no diversification beyond MMR. |

| 2. Asset-Light Business Model Focus on development agreements reduces land-buying cost and improves capital efficiency. | 2. Execution Risk Delays in high-end projects or regulatory approvals can impact revenue recognition and cash flows. |

| 3. High Brand Equity Backed by celebrities and promoter Anand Pandit’s film industry reputation, which aids marketing and premium pricing. | 3. Market Cyclicality Luxury housing demand can slow during downturns; not as resilient as affordable housing. |

| 4. Strong Financial Metrics EBITDA margin of 52.57%, PAT margin of 41.46%, ROCE of 27.22%, low debt-to-equity at 0.13. | 4. Limited Operating History Relatively new company (est. 2015) with limited track record of listed operations. |

| 5. Robust Project Pipeline 20 total projects (4 completed, 5 ongoing, 11 upcoming), offering strong future revenue visibility. | 5. IPO Pricing Unknown As price band is yet to be announced, valuation comfort for investors is still uncertain. |

| 6. End-to-End Execution In-house project design, development, sales, and execution capabilities. | 6. Celebrity Effect = Sentiment? Celebrity investments boost attention, but don’t necessarily reflect long-term fundamentals. |

Investor Insight:

Sri Lotus Developers is clearly positioned for scale and margin-led growth in the luxury housing space. However, investors should assess whether the rich valuations (once announced) justify the business concentration and early-stage risks. It’s a bet on premium urban housing—and sentiment may play a big role in early price action.

Industry Context: Riding the Wave of Mumbai’s Luxury Housing Boom

The timing of the Sri Lotus Developers IPO couldn’t be more strategic. India’s luxury housing market—especially in Mumbai’s western suburbs—is experiencing a powerful surge in both demand and pricing. This isn’t just a post-pandemic rebound; it’s a structural shift driven by aspirational upgrades, supply constraints, and growing HNI interest in branded, amenity-rich developments.

Mumbai: India’s Most Lucrative Real Estate Market

- Western suburbs like Juhu, Andheri, Bandra, Santacruz, and Versova have emerged as epicenters of luxury real estate activity.

- Projects priced in the ₹3–₹7 crore and ₹7 crore+ range are witnessing faster sales velocity than ever before—particularly when paired with brand assurance and premium amenities.

- The trend is fueled by:

- Upgrading urban professionals

- Bollywood and entertainment industry buyers

- NRI and HNI demand for trophy assets

Read More: Luxury Housing Boom: Real Estate Stocks to Watch in 2025Tailwinds for Premium Developers

- Limited Land Supply in prime locations is driving up prices.

- Redevelopment Projects are increasingly replacing old housing societies with luxury towers—a specialty of Sri Lotus.

- GST & RERA Compliance favors larger, professional developers over small-time builders.

- Shift in Consumer Preferences toward bigger homes with balconies, work-from-home spaces, and concierge-level services.

📌 According to Knight Frank India, luxury housing sales in Mumbai jumped over 35% in H1 2025 compared to the same period in 2024, with Western suburbs accounting for nearly 50% of the value share.

Peer Landscape

While Sri Lotus Developers is yet to be listed, it will eventually compete with established real estate majors like:

| Company | Market Focus | Listed? |

|---|---|---|

| Oberoi Realty | Premium & luxury residential in Mumbai | ✅ |

| Godrej Properties | Pan-India with a luxury tilt | ✅ |

| Lodha (Macrotech Developers) | Mass and premium luxury across India | ✅ |

However, Sri Lotus sets itself apart with:

- A 100% luxury residential focus in high-demand micro-markets

- Celebrity branding

- An asset-light business model with stronger margins

Should You Subscribe to the Sri Lotus Developers IPO?

With celebrity firepower, luxury real estate exposure, and enviable margins, the Sri Lotus Developers IPO is clearly built to turn heads. But the big question is—does it deserve your money?

Here’s a breakdown to help you decide.

Why You Might Want to Subscribe

| Reason | What It Means for You |

|---|---|

| Strong Financials | 91% YoY PAT growth, 52%+ EBITDA margin, low debt—rare for a real estate company. |

| Luxury Housing Focus | Premium Mumbai projects offer better pricing power and margin resilience. |

| Asset-Light Model | Development agreements reduce upfront costs and improve return on capital. |

| Brand Boost from Bollywood | SRK, Big B, Hrithik, and others add aspirational value and trust to the brand. |

| Clear Use of Proceeds | ₹550 Cr earmarked for real projects with revenue visibility (Amalfi, Arcadian, Varun). |

| Well-Timed Market Entry | Riding the current luxury real estate boom with a strong pipeline and high visibility. |

Why You Might Want to Wait or Avoid

| Concern | Impact on Investment |

|---|---|

| Concentrated Geography | Entire portfolio tied to Mumbai’s western suburbs—no geographic diversification. |

| Short Operating History | Founded in 2015, still building track record—unlike more established peers. |

| Luxury Segment Risk | Highly sensitive to macroeconomic conditions and buyer sentiment shifts. |

| Celebrity Hype ≠ Business Fundamentals | Glamour may drive listing buzz, but long-term growth depends on execution. |

Our Take: A Momentum + Growth Play for Risk-Aware Investors

If you’re:

- Bullish on Mumbai’s luxury housing market,

- Comfortable with mid-cap IPO risk,

- And willing to ride short-term listing momentum,

…then Sri Lotus Developers IPO could be an attractive opportunity. However, if you’re looking for stable, diversified real estate exposure with lower risk, you might prefer established names like Oberoi Realty or Godrej Properties.

Bottom line: This IPO blends financial strength and celebrity sentiment—but your decision should be rooted in fundamentals, not fame.

Conclusion: A Glamorous IPO with Real Fundamentals

The Sri Lotus Developers IPO is more than just a glitzy debut backed by Bollywood stars—it’s a showcase of what a modern real estate company can look like: focused, lean, profitable, and aspirational.

While the presence of names like Shah Rukh Khan, Amitabh Bachchan, and Hrithik Roshan has certainly added glamour and media attention, the company’s core strengths lie in its:

- Ultra-luxury real estate strategy,

- Strong financial performance, and

- Asset-light, capital-efficient development model.

With a ₹792 crore issue aimed at expanding a solid pipeline of luxury projects across Mumbai, the IPO aligns well with the ongoing luxury housing boom in India’s financial capital. Still, as with all investments, caution and valuation discipline are key—especially in a sector as cyclical as real estate.

Investor Tip: Treat the celebrity angle as a bonus—not the basis—for investment. The real story is Sri Lotus Developers’ rising profitability, scalable project base, and solid management pedigree.

Whether you’re a retail investor hunting for IPO listing gains, or a long-term player eyeing the luxury housing growth story, Sri Lotus Developers IPO definitely deserves a spot on your watchlist.

Frequently Asked Questions (FAQs)

1. What is the IPO date for Sri Lotus Developers?

The IPO opens on July 30, 2025, and closes on August 1, 2025.

2. How much is Sri Lotus Developers planning to raise?

The company aims to raise ₹792 crore through a fresh issue of shares.

3. Who are the celebrity investors in the company?

Notable Bollywood investors include Shah Rukh Khan, Amitabh Bachchan, Hrithik Roshan, Ektaa Kapoor, and Jeetendra.

4. What does the company do?

Sri Lotus Developers focuses on luxury and ultra-luxury real estate projects in Mumbai’s western suburbs.

5. What are the key financials for FY25?

Revenue: ₹569.28 Cr, PAT: ₹227.89 Cr, EBITDA margin: 52.57%, Debt/Equity: 0.13.

6. Where will the shares be listed?

The shares will be listed on both BSE and NSE.

7. What is the anchor investor date?

The anchor round opens on July 29, 2025.

8. How will the IPO proceeds be used?

₹550 crore will fund three ongoing luxury projects through its subsidiaries.

9. Is this a fresh issue or offer for sale?

The IPO is 100% a fresh issue—no shares are being sold by existing shareholders.

10. What sets Sri Lotus apart from other real estate companies?

Its focus on luxury, strong margins, celebrity brand power, and an asset-light development model.

Related Articles

How to Analyze an IPO Before Investing: A Step-by-Step Guide

One Demat vs Multiple Demat – Which is Better for IPO Allotment?