Introduction:

The Smartworks Coworking IPO opens on July 10, 2025. The issue size is ₹582.56 crore, with ₹445 crore as a fresh issue and ₹137.56 crore as an offer for sale. The company aims to use the funds for expansion and debt repayment.

The IPO is priced between ₹387 and ₹407 per share. Allotment is expected on July 15, and listing is likely on July 17 on both NSE and BSE.

Smartworks offers tech-enabled, fully managed office spaces tailored for enterprises. With an EBITDA margin of over 62%, the company shows strong operational efficiency—even though it’s not yet profitable.

In this blog, we break down the business, growth prospects, financials, and risks to help you decide if the Smartworks Coworking IPO is worth applying for.

Details & Dates Of Smartworks Coworking IPO

The Smartworks Coworking IPO is a Book-Built Issue with a total size of ₹582.56 crore. It includes a fresh issue of ₹445 crore and an offer for sale worth ₹137.56 crore. The issue aims to fund business expansion, reduce debt, and improve working capital flexibility.

Here are the key details and important timelines for investors:

IPO Snapshot

| Detail | Information |

|---|---|

| IPO Open Date | July 10, 2025 |

| IPO Close Date | July 14, 2025 |

| Issue Price Band | ₹387 to ₹407 per share |

| Face Value | ₹10 per share |

| Lot Size | 36 shares |

| Minimum Investment (Retail) | ₹14,652 (1 lot) |

| Listing Exchange | BSE, NSE |

| Listing Date (Tentative) | July 17, 2025 |

| Employee Discount | ₹37 per share |

| Total Issue Size | ₹582.56 crore |

| Fresh Issue | ₹445 crore |

| Offer for Sale (OFS) | ₹137.56 crore |

| Book Running Lead Manager | JM Financial |

| Registrar | Link Intime (MUFG Intime India Pvt Ltd) |

Important Dates (Tentative)

| Event | Date |

|---|---|

| Anchor Investor Bidding | July 9, 2025 |

| IPO Opens | July 10, 2025 |

| IPO Closes | July 14, 2025 |

| Allotment Finalisation | July 15, 2025 |

| Refund Initiation | July 16, 2025 |

| Demat Credit | July 16, 2025 |

| Listing Date | July 17, 2025 |

| UPI Mandate Cut-off | 5 PM, July 14 |

The IPO also includes a special employee quota of 1,01,351 shares at a ₹37 discount to the issue price.

Smartworks Coworking IPO Objectives: Where Will Smartworks Use the Funds?

Smartworks Coworking plans to raise ₹582.56 crore through this IPO. Out of this, ₹445 crore comes from a fresh issue, while the rest is an offer for sale. The fresh capital will primarily support business expansion and reduce existing liabilities. Let’s break down the usage:

1. Debt Repayment and Prepayment

The company plans to use ₹114 crore to repay or prepay certain borrowings. By reducing debt, Smartworks aims to strengthen its balance sheet and improve financial flexibility going forward.

2. Fit-Out Costs and Security Deposits for New Centers

Next, ₹225.84 crore will go toward capital expenditure. This includes furnishing new Smartworks centers and paying security deposits for new leases. These funds will enable the company to scale quickly in premium urban hubs.

3. General Corporate Purposes

Finally, a portion of the proceeds will support general business needs. This may include marketing, hiring, and tech upgrades to enhance operational efficiency and customer experience.

By allocating funds to these three focused areas, Smartworks is gearing up for aggressive expansion while keeping financial risk in check.

Company Overview & Business Model

Smartworks Coworking Spaces is not your typical office space company. Think of them as the Airbnb of workspaces—but instead of offering homes, they turn plain office buildings into fully-managed, beautifully designed campuses for big companies.

Let’s say you’re a landlord who owns a large office building but don’t want the trouble of managing it. Smartworks steps in, leases your building, renovates it, installs tech, designs the layout, and turns it into a premium co-working campus. Then, they rent it out to big companies.

This way, landlords earn steady rent, companies get fully-managed office campuses, and Smartworks earns a margin from managing and renting the space. It’s a win-win-win.

What They Do

Smartworks doesn’t just rent out desks. They take large empty offices, set them up with everything an employee needs—like cafeterias, gyms, crèches, medical rooms, and even game zones—and offer these ready-to-move-in campuses to companies.

So if a company like Infosys or a multinational wants a stylish, fully set-up workspace in Bengaluru or Mumbai, Smartworks can give them exactly that—without the hassle of building it from scratch.

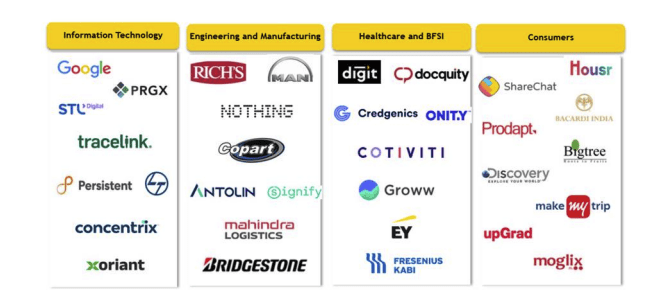

Who They Serve

Their focus is mostly on mid-sized to large businesses. These are companies that want hundreds or even thousands of seats in one go. As of March 2025, they had 738 clients using over 150,000 seats. By June 2025, their seats had grown to over 190,000, with an occupancy rate of 89%—which shows how in-demand their spaces are.

Where They Operate

Smartworks is present in 15 major Indian cities, including Bengaluru, Pune, Mumbai, Hyderabad, and Chennai. They manage 50 centers with a total workspace area of 8.99 million sq. ft., and this number is growing fast.

They’ve also stepped outside India and have two office centers in Singapore, tapping into a growing international demand.

A Look at Their Scale

Their average center size is massive—about 1.8 lakh sq. ft., and they even operate India’s largest managed office center at Vaishnavi Tech Park in Bengaluru, which alone is 7 lakh sq. ft. That’s like 10 football fields of workspace under one roof!

Financial Overview of martworks Coworking IPO

Smartworks is growing quickly and building scale, but like many expanding businesses, it’s still in the investment phase with net losses. However, strong revenue growth and high EBITDA margins show solid operational performance.

Key Financials (₹ in Crore)

| Metric | FY23 | FY24 | FY25 |

|---|---|---|---|

| Revenue | 744.07 | 1,113.11 | 1,409.67 |

| EBITDA | 424.00 | 659.67 | 857.26 |

| EBITDA Margin (%) | 57.0% | 59.3% | 62.4% |

| Profit After Tax (PAT) | -101.05 | -49.96 | -63.18 |

| Net Worth | 31.47 | 50.01 | 107.51 |

| Total Borrowings | 515.39 | 427.35 | 397.77 |

| Reserves & Surplus | -46.23 | 29.01 | 4.69 |

Key Ratios (FY25)

| Ratio | Value |

|---|---|

| Return on Capital Employed (ROCE) | 42.3% |

| Return on Net Worth (RoNW) | -58.76% |

| Debt-to-Equity Ratio | 2.90 |

| Price-to-Book Value (P/BV) | 38.58 |

| Post IPO EPS (₹) | -5.54 |

What This Means:

- Strong growth: Revenue nearly doubled in 2 years, showing rising demand and scale.

- Efficient operations: EBITDA margins are above 60%, indicating a solid core model.

- Losses continue: Net losses are narrowing overall, but increased slightly in FY25 due to expansion costs.

- Debt manageable: Debt is coming down gradually; IPO funds will help further reduce this.

Valuation & Peer Comparison

Now that the IPO price band is available (₹387–₹407), we can estimate Smartworks’ valuation against its closest peer, Awfis Space Solutions.

Key Financial Metrics (as of March 31, 2025)

| Company | EPS (₹) | NAV (₹) | Upper Price (₹) | P/E (x) | RoNW (%) | P/BV Ratio |

|---|---|---|---|---|---|---|

| Smartworks Coworking Spaces Ltd | -6.18 | 1,078.81 | ₹407 | ❌ Loss-making | -58.76% | 0.38 (Est.) |

| Awfis Space Solutions Ltd | 9.75 | 4,592.19 | ₹616.4 (as on June) | 63.18 | 14.78% | 0.13 |

Key Insights of Smartworks Coworking IPO

- Smartworks is loss-making, so a meaningful P/E can’t be derived yet.

- However, with a NAV of ₹1,078.81 per share and IPO upper band at ₹407, its Price-to-Book (P/BV) is estimated around 0.38, which suggests undervaluation compared to asset base.

- Awfis, being profitable, commands a higher P/E and trades at a lower P/BV ratio — likely reflecting investor caution despite profitability.

- Investors might view Smartworks as a long-term asset-rich growth bet, while Awfis currently presents more near-term earnings visibility.

GMP for Smartworks Coworking IPO

As of July 7, 2025, the grey market premium (GMP) for the Smartworks Coworking IPO stands at:

- GMP: ₹0

- IPO Price (Upper Band): ₹407

- Estimated Listing Price: ₹407

- Estimated Profit on Listing: ₹0 (0.00%)

Day-wise GMP Trend

| Date | IPO Price (₹) | GMP (₹) | Estimated Listing Price (₹) | Estimated Profit (₹) |

|---|---|---|---|---|

| July 7, 2025 | 407 | ₹0 | ₹407 | ₹0 |

What Does This Mean?

Currently, no premium or discount is seen in the grey market, suggesting muted demand or a wait-and-watch approach by retail investors. However, GMP is speculative and not a guaranteed indicator of listing performance.

Conclusion: Should You Apply for the Smartworks Coworking IPO?

The Smartworks Coworking IPO offers investors a chance to bet on India’s fast-growing managed office space sector. While the company has shown strong growth in revenue and scale, its consistent losses and high debt raise caution for conservative investors.

Short-Term Strategy

For listing gains, this IPO may not be the ideal pick. With the GMP currently at ₹0, there’s no premium in the grey market, which suggests weak listing buzz. Short-term investors should wait for subscription data from QIBs before deciding.

Long-Term Strategy

For long-term investors with high-risk appetite, Smartworks could be a growth story in the making. If the company manages to turn profitable and leverage its large-scale infrastructure and client base effectively, it might deliver strong returns over time. However, keep a close watch on its debt levels and occupancy metrics.

Allotment Strategy

- Apply using multiple retail applications (from family demat accounts) to improve chances.

- Avoid large HNI bids unless QIB response is strong.

- If you’re an employee, don’t miss out on the ₹37 discount — it’s a good safety cushion.

In summary, the Smartworks Coworking IPO is best suited for long-term investors willing to ride out short-term volatility for potential future growth.

Want to increase your chances of IPO allotment?

Open a free demat account with Angel One today and apply smart! Open Your Account with Angel One Now →

FAQs on Smartworks Coworking IPO

1. What is the Smartworks Coworking IPO opening and closing date?

The Smartworks Coworking IPO opens on July 10, 2025, and closes on July 14, 2025.

2. What is the price band for Smartworks Coworking IPO?

The IPO price band is fixed at ₹387 to ₹407 per share.

3. What is the lot size and minimum investment required?

The minimum lot size is 36 shares, requiring a minimum investment of ₹14,652 at the upper price band.

4. What is the total issue size of the IPO?

The total issue size is ₹582.56 crore, consisting of a fresh issue of ₹445 crore and an offer for sale of ₹137.56 crore.

5. What is the employee discount in the Smartworks Coworking IPO?

Eligible employees can apply at a discount of ₹37 per share from the final issue price.

6. When will the allotment for Smartworks IPO be finalized?

The basis of allotment is expected to be finalized on July 15, 2025.

7. What is the expected listing date of Smartworks Coworking IPO?

The stock is likely to list on July 17, 2025, on both BSE and NSE.

8. Is there any GMP (Grey Market Premium) for Smartworks IPO?

As of now, the GMP is reported to be ₹0, indicating neutral market sentiment toward the IPO.

9. Is Smartworks a profitable company?

No, the company is not yet profitable. It posted a loss of ₹63.18 crore in FY25, though revenues have shown steady growth.

10. Who are the promoters of Smartworks Coworking Spaces Limited?

The promoters include Neetish Sarda, Harsh Binani, Saumya Binani, NS Niketan LLP, and others.

Related Articles

India Becomes the Cheapest Manufacturing Hub: Stocks Set to Win Big

HDB Financial Services IPO: GMP, Review, Date, Price & Should You Apply?

More Articles

DRDO’s Emergency Weapon Orders: Defence Stocks Set to Gain

Discounted Cash Flow (DCF): The King of Stock Valuation Methods

Strategic Shifts to High-Margin Segments: Future Multibagger Stocks to Watch