Introduction: A New Way to Invest Smarter

“Know the rules well, so you can break them effectively.” — Dalai Lama.

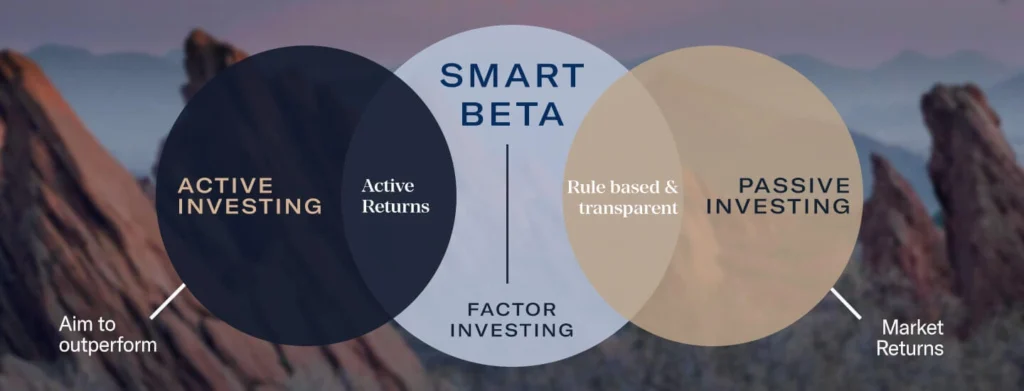

For decades, investors have relied on two primary strategies: passive investing, where funds track an index, and active investing, where fund managers attempt to outperform the market. But what if there were a middle ground—a strategy that combines the best of both worlds? Enter Smart Beta Investing. In this guide, we’ll dive into what Smart Beta is, how it works, and why it’s becoming a game-changer for modern investors.

What is Smart Beta Investing?

Smart Beta Investing is a strategy that blends the simplicity of passive investing with the strategic approach of active investing. Instead of blindly tracking a market-cap-weighted index, Smart Beta funds follow alternative weighting strategies based on specific factors like value, momentum, quality, or volatility.

| Traditional Indexing | Smart Beta Investing |

|---|---|

| Tracks indices like Nifty 50 | Focuses on factors like low volatility, growth, or high dividend yield. |

| Weighted by market capitalization | Weighted by strategic factors or rules. |

| Minimal customization | Offers tailored exposure to desired market attributes. |

Key Features of Smart Beta Investing

1. Factor-Based Approach

Smart Beta strategies target specific factors to enhance returns or reduce risk. Common factors include:

- Value: Focus on undervalued stocks.

- Momentum: Stocks showing strong recent performance.

- Low Volatility: Stable stocks with less price fluctuation.

- Quality: Companies with strong fundamentals, such as high ROE or low debt.

- Dividend Yield: Stocks with attractive and consistent dividends.

2. Rules-Based Selection

Unlike actively managed funds, Smart Beta relies on pre-set rules to construct the portfolio. This eliminates human biases and ensures transparency.

3. Cost-Effective Alternative

While slightly more expensive than traditional ETFs, Smart Beta funds are far cheaper than actively managed mutual funds. Investors get targeted exposure without the high fees.

Benefits of Smart Beta Investing

1. Enhanced Returns

By focusing on specific factors, Smart Beta strategies can deliver higher returns than traditional passive funds.

2. Diversification

Smart Beta funds offer a more balanced approach, reducing over-concentration in large-cap stocks. For instance, a low-volatility ETF might include a mix of mid-cap and small-cap stocks for better risk management.

3. Tailored Portfolios

Investors can align Smart Beta funds with their financial goals. If stability is your goal, a low-volatility ETF may be ideal. For income generation, dividend-focused ETFs can be a better fit.

Example: A Smart Beta strategy focusing on low volatility might outperform during market downturns, offering stability when traditional indices decline.

Popular Smart Beta ETFs in India

| Fund Name | Factor Focused | Expense Ratio | Benchmark |

| Nippon India Low Volatility ETF | Low Volatility | 0.25% | Nifty 100 Low Volatility Index |

| ICICI Prudential Alpha Low Vol 30 ETF | Alpha and Low Volatility | 0.29% | Custom Multi-Factor Index |

| SBI Dividend Yield ETF | Dividend Yield | 0.20% | Nifty Dividend Opportunities 50 |

| UTI Quality 50 ETF | Quality | 0.18% | Nifty Quality 50 Index |

Case Study: Low Volatility Outperformance

During the market correction in 2020, low-volatility ETFs outperformed traditional market indices by minimizing exposure to highly volatile stocks, proving their value in managing risk.

Risks of Smart Beta Investing

1. Factor Cyclicality

Factors don’t perform consistently across all market cycles. For instance, momentum strategies may underperform during market corrections.

2. Higher Costs than Traditional ETFs

While cheaper than active funds, Smart Beta funds still come with higher expense ratios than standard ETFs.

3. Complexity

The strategies behind Smart Beta can be complex, making it harder for beginner investors to understand and evaluate.

Who Should Consider Smart Beta Funds?

- Intermediate and Advanced Investors: Those who understand market dynamics and are comfortable with factor-based strategies.

- Long-Term Investors: Smart Beta works best for those who can stay invested for at least 5-10 years.

- Goal-Oriented Investors: Perfect for individuals looking to target specific outcomes like stability, income, or growth.

How to Start Investing in Smart Beta Funds

- Understand Your Goals: Identify whether your priority is growth, stability, or income generation.

- Research Factors: Study the historical performance and risks of different factors.

- Choose a Fund: Compare expense ratios, underlying benchmarks, and fund performance.

- Monitor Regularly: Keep track of factor performance and market trends to ensure alignment with your goals.

Conclusion: Is Smart Beta the Future of Investing?

Smart Beta bridges the gap between passive and active investing, offering a unique opportunity to enhance returns and manage risks. While it’s not a one-size-fits-all solution, its ability to target specific factors makes it a valuable tool for investors seeking tailored portfolios.

As markets evolve and technology makes investing more accessible, Smart Beta funds are poised to play a significant role in shaping investment strategies for years to come. So, whether you’re looking to add stability, capture growth, or generate income, Smart Beta offers a smart way to redefine your portfolio.

FAQs

- Are Smart Beta funds better than traditional ETFs?

They offer targeted exposure and the potential for higher returns but come with higher costs and risks. - Can beginners invest in Smart Beta ETFs?

Beginners should first understand how factors work before diving into Smart Beta funds. - What is the ideal holding period for Smart Beta funds?

These funds perform best over the long term, ideally 5-10 years. - Are Smart Beta funds risk-free?

No, they are subject to market risks and the cyclicality of factors.